Hello Everyone,

I recently evaluated Raymond Lifestyle. The short version of my longer article is this :

![]() New Listing Alert: On Sept 5, 2024, Raymond Lifestyle Ltd. (RLL) debuted after a long-awaited spin-off from Raymond Ltd., signaling a fresh start for the brand.

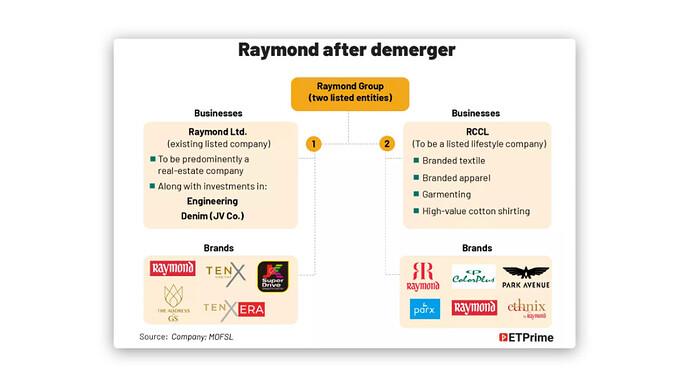

New Listing Alert: On Sept 5, 2024, Raymond Lifestyle Ltd. (RLL) debuted after a long-awaited spin-off from Raymond Ltd., signaling a fresh start for the brand.

![]() Internal Turmoil: Governance concerns have haunted Raymond Ltd. for over 8 years, fueled by a public father-son feud. There were other related party concerns also. But this could be an interesting opportunity for reasons described below.

Internal Turmoil: Governance concerns have haunted Raymond Ltd. for over 8 years, fueled by a public father-son feud. There were other related party concerns also. But this could be an interesting opportunity for reasons described below.

![]() Hidden Value? Despite CG issues, RLL’s stock has shown multiple instances of doubling or more over the past 14 years. This is important because I was under the impression that CG issues lead to poor stock performance, which is true, however, there were periods in the last 14 years where the stock did quite well. It made me question how to think about companies with CG issues.

Hidden Value? Despite CG issues, RLL’s stock has shown multiple instances of doubling or more over the past 14 years. This is important because I was under the impression that CG issues lead to poor stock performance, which is true, however, there were periods in the last 14 years where the stock did quite well. It made me question how to think about companies with CG issues.

![]() De-merger Dynamics Unpacked: The spin-off led to a wave of selling by index funds, sparking potential opportunities for investors.

De-merger Dynamics Unpacked: The spin-off led to a wave of selling by index funds, sparking potential opportunities for investors.

![]() Index Inclusion Watch: RLL may find its way into the Nifty Smallcap250 Index in early 2025, potentially triggering further fund flows—but that’s not enough. We need a fundamental improvement in the business to get a re-rating on the business.

Index Inclusion Watch: RLL may find its way into the Nifty Smallcap250 Index in early 2025, potentially triggering further fund flows—but that’s not enough. We need a fundamental improvement in the business to get a re-rating on the business.

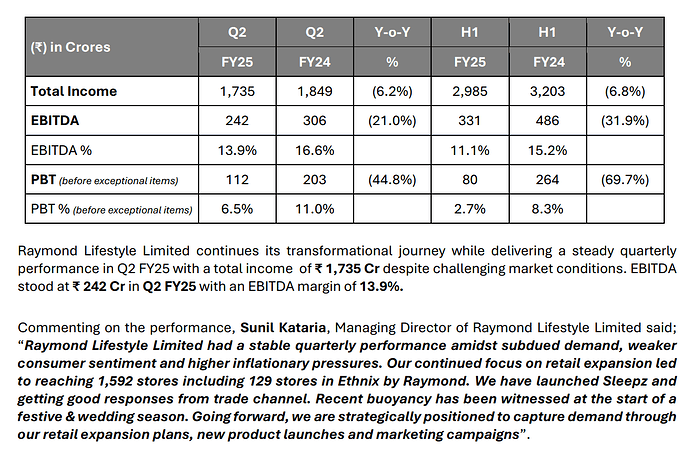

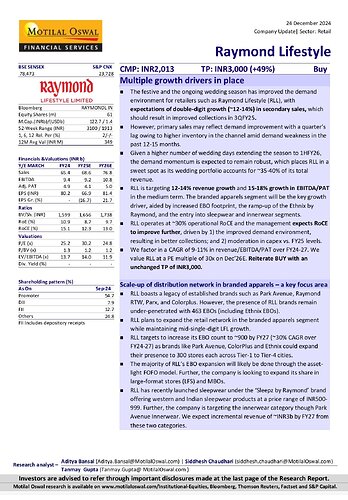

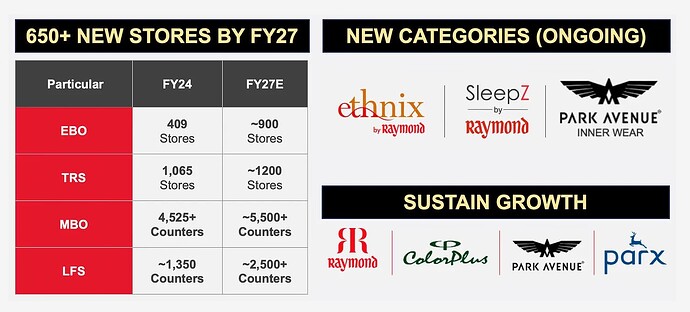

![]() A Fresh Approach: With a revamped management team and an asset-light franchise model (let’s see how that goes), RLL is optimizing costs, improving EBITDA margins, and focusing on core segments for growth.

A Fresh Approach: With a revamped management team and an asset-light franchise model (let’s see how that goes), RLL is optimizing costs, improving EBITDA margins, and focusing on core segments for growth.

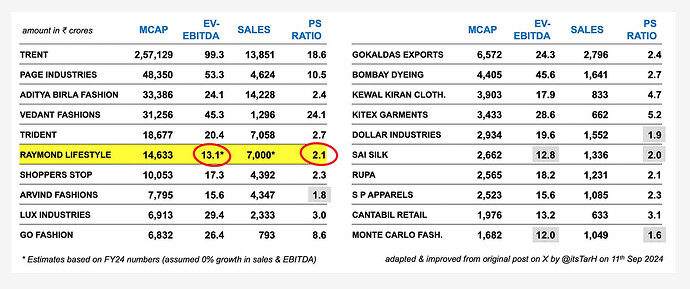

![]() Valuation Insights: Current valuations suggest a range of ₹10,000 Cr to ₹20,000 Cr, with a Market cap of 13,500 Cr, we believe it is trading at the lower end of the valuation band.

Valuation Insights: Current valuations suggest a range of ₹10,000 Cr to ₹20,000 Cr, with a Market cap of 13,500 Cr, we believe it is trading at the lower end of the valuation band.

![]() What’s Next? Is this a turnaround story or a classic bull-market flash? We need to track the business and how it progresses under the new management team.

What’s Next? Is this a turnaround story or a classic bull-market flash? We need to track the business and how it progresses under the new management team.

RISKS

- Sales growth of the core business has been slow and it competes with High Quality competitors in each of the 4 business segments.

- Error in estimating valuations. The company may NOT be as cheaply priced as we estimate.

- Competition

- Promoter decides to interfere and change strategy set by the new management team.

- Other Risks that pertain to all companies…