We have been working on www.ratestar.in for quite some time now and have developed a usable beta version of the same. Using RateStar, you can find and research about the fundamental data of any company. Feedback from forum members is highly appreciated. This is just the starting point and we plan to keep adding new features as we progress…

quick glance through suggests very helpful… One suggestion - please have export to excel option

While copying the data to excel for further number crunching it does not maintain the screen layout. Would be very helpful if this issue is resolved.

Otherwise looks quite good. Thanks.

Looks good at first glance…

What is the source of data?

What is the critrea for rating?

Excellent work. It is going to be good extension to screener.

It’s a good effort, but what’s the difference from Screener?

@borapratik03 Export to excel feature should be coming soon.

@hiral Source of data is Accord Fintech, makers of Ace Equity software. Ratings are based on fundamental and technical analysis which includes industry trends.

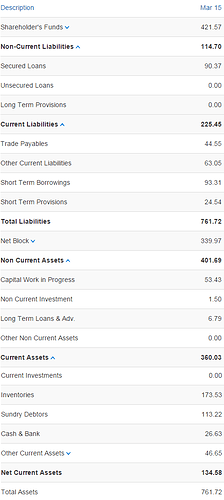

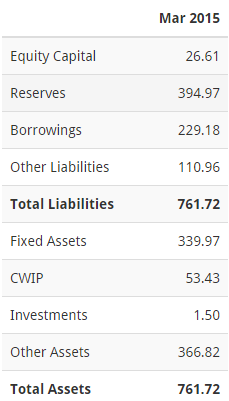

This is just a starting point. Plan to add many more features. Have incorporated line item breakups into P&L, Balance sheet, Cash flow, basically stuff like variance which we use regularly for our analysis. Also subtle changes like giving data in a descending order for better viewing on mobile & saving the number of swipes.

Nice Site. Can you add sectoral filters? e.g Banking, Transportation etc

Great work., Mihir

The first look says the work is neatly done.

It becomes easy for an investor to see long term comprehensive data in a single screen.

I almost like all the features, except the Rating feature. The rating feature provides an unnecessary bias.

The feature I liked the most is the Financial ratio comparison for a period of 10 years. It gives a clear picture of where the company is heading.

Best Regards,

Mukesh Tolani

rating by crisil or other agency missing, projected price and is it good price to buy this 3 should also be added.

screener of big investors also be added to make better then screener.in

Great Work!!. I have 2 suggestions for you if possible. Since you have access to data if possible can you put the market cap of subsidiaries. Like for instance Vedanta holds Hind Zinc and Cairn India and can you incorporate the finished good and raw material screener.

sector wise list of stocks should be mentioned. now we hv to search stock. if beginner then it should be easy . u can follow money 4 works it is good concept.

Sorry to ask my doubt here.

I always confuse with the format of Balance sheet. Please some one clarify how figures are arrived. I was comparing screener and ratestar

One correction on site please - It shows PAT before adjusting for minority interest.

Example : for Pennar industries FY2015 PAT before minority interest is Rs. 43 crs. and PAT after minority interest is Rs. 35 crs.

But Rate Star shows PAT as Rs. 43 crs. only.

I want to know on what basis the “Star Rating” is coming? What factors are the system considering?

Good initiative

The star ratings just do not make sense to me. Seems very random and is a unnecessary distraction

Love the details provided in every segment and also the ratios

Would be great to see some sector wise segregation of stocks

Cheers

Akshay

Is it possible to display FCF on the screen?

how are the rating being given…could you please elaborate

also pledged shares could be shown