sir i am holding presstonic, thaai casting, shri techtex & planning to buy accent microcell, sbvcl, basilic, krishca strapping

can you share your views

I am invested in Presstonic and Basilic and am very hopeful of great results in H2 and future too. Let us see, rest have not sutdied so cant say.

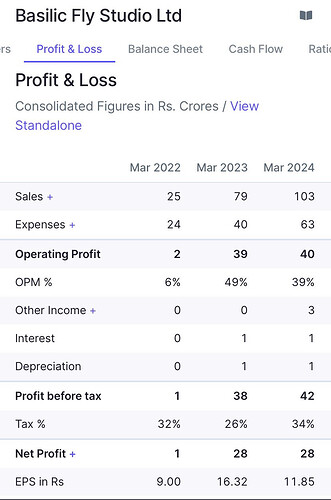

Hi @Rajesh_Singh ji, Basilic’s performance has been poor. Any change in your view now on Basilic after their result?

Aside, half yearly result is very poor owing to Employee Benefit Expenses. Thoughts?

I have 2 contrasting thoughts:

-

Increase in Employee Expenses may be because of the hiring spree for future projects, and that the topline/bottom line has been impacted due to the writers strike in December leading to business going away from established markets like North America.

-

If Basillic’s competitors (like Digikore Studios) pose better results, the stock can go down by a significant amount.

Wondering what would be yours ![]()

I will exit it as its question of trust, they had said 80 percent CAGR in IPO meet. Its not about performance, but failing to meet guidance. It may work too as msny are saying but for me its a ckear rejection will move funds to Presstonic andTechknow green.

Presstonic seems a good play, can you please share Revenue growth projections by company or any other analyst ? Lik Basilic had given of 70-80% CAGR , any similar given by Presstonic ? Need to calculate forward projections and Valuations

TIA

I will provide update on all portfolio by June first week, its order book was more than 70 crore at time of IPO, more imp given Rail capex has immense potential. Management can be more transparent in communication thoug

Mr Singh,

Did you get the opportunity to see the Kamat Hotels results? Any view on it?

It is as per their guidance

Expansion will complete by Dec 24, by may Next year should cross 1000 Rs - 90 crore PAT with 40 PE can be higher too

Can you please throw some more light on Techknow green like Revenue guidance, Promotor integrity, competitors, etc?

Their investor presentation is very promising with addressable market, promoter interview on YouTube alpha sme last year also provided excellent foresight.

Regards

whats your view on presstonic results?

It’s below average but i will hold as they had not given any guidance and had said that will interact in a year… Rail capex is huge expecting a few big orders

As always ! u r very helpful and stunning ! ![]()

Do your own due diligence – this is sharing of my learnings.

This half yearly review and blog is for my son who has just turned 16 and intends to be an investor. There is so much half baked opinion and noise that vital to be self aware - what we know and more importantly what we don’t know - it shouldn’t be Chauffeur knowledge but Planck knowledge (Legendary Charlie Munger on https://fs.blog/two-types-of-knowledge/) It is not about knowledge alone as we see so many FURUS too. So called alchemist of dalal street with much vaunted 4 AM strategy entered and took thousands gullible in Bright com where revenue recognition, number of employees, cash flow all were red flag- reminds of Buddha - be your own light!

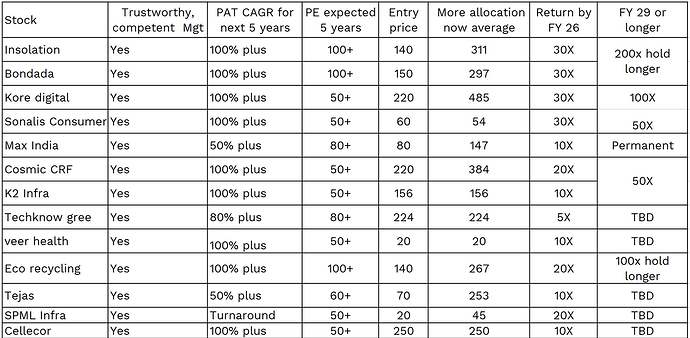

One of my friends quipped - in some time I will be able to move companies invested. None should be under this illusion - What moves share prices and sustains it in mid to long term -sustained high earnings and competent (superior performance- For me for next 5 years it 100% + earning CAGR then what happens year 1-2x, Year 2 - 4x, Year 3- 8x, Year 4- 16x, Year 5- 32X and when earning is 30x share price can be as high as 100x to 200x also with bonus and split with PE rerating candidates - many nano , micro cap / SMEs will deliver number more than this also such is the growth ). Yearly basis Cosmic, Eco recycling, Kore digital, Bondada, Insolation all on same path and now sonalis, K2infragen too. One hears too much noise - elections, economy, geo politics however these are needless distractions. Investing requires a very long period of inactivity but deep perspective for robust earnings ahead so have to invest only where there is excellent potential. A few decadal holds are going to be - Max India, Techknow green, Bondada, Insolation, Eco recycling as megatrend will continue along with immense growth - A few quarters of disappointment is fine too. Mohnish Pabrai’s insightful talk on circle the wagon as the most important thing for investor. https://youtu.be/SP6kKi2nMz4?si=DlDdT5dAom_jpEqM Right now most of companies are growing at explosive rate however in long term even if they grow at 20% CAGR 300 bagger in 25 years though I believe this may happen very early too given the sweet spot many of these companies are in along with decades ahead being INDIA MOMENT. This is what I was teaching my son that Alpha return comes in the end. At the end of 20 year it is 100x and next three year it doubles and again doubles in next three years so 300 times came in the last six years of 26 years.

Half yearly review

There were surprises on upward and downward performance both. On upside, Sonalis consumer as I felt promoters were genuine though risky given its small size. At any point there will be a few stocks where I will swing at the fences as my risk appetite is high and can afford it. It got order five times more than annual revenue to be delivered in an year moves to long term portfolio with potential earning of 50x in five years as company raises preferential with very high aspirations. I have put tentative x return with assumption implicit of bonus, split. Holding duration is longer where management both are excellent. TBD (to be decided cases) are there for two years and they are yet to earn full trust. Max India is trend for many decades so will gift it to third generation by the time I hit the bucket.

Entries - Veer Health because of 100 crore topline in four year which is 7x of current , rights issue and expansion as updated in Bharat connect conference by Arihant capital. K2 infragen , excellent order book planning 1000 crore order book this year with 150% growth in earning expected this year and large addressable market and huge aspiration. Tehcknow green for competent management, large runway ahead, Cellecor for 100% + earning growth guidance

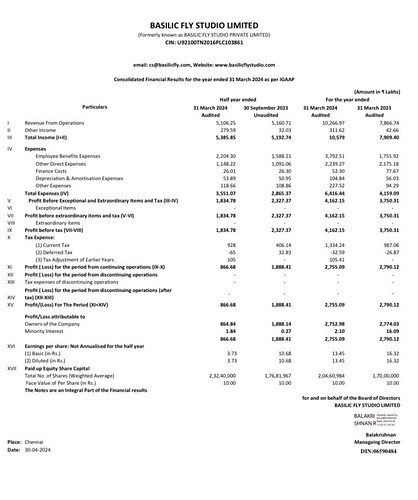

Exits Basilic fly missed guidance, blunder in sharing financial statement leading to restatement of P&L - despite all noise they had made of 80% CAGR in pre IPO meet, exited same day when they posted revised results. Addictive learning also flat H2 despite all high hopes they had made and investor presentation. Docmode too, poor result and no communication. Presstonic poor results, promoters silent too, wrote mail post result to CS , called office no response then exited - rail sector has huge tailwind but cant have anyone whose trust is a serious issue. Aurangabad declining topline and tax rate shows the PAT which is artificial but more importantly lack of communication and trust so goes out. Out of 15 plus 5 exits is manageable but have to get better in rejecting so one time earnings or flowering picture by management is backed by execution.

Out of this world results - Tejas which had been waiting for years- aspiration to be among top 5 telecom OEM globally with Tata brand.

Bondada, Insolation both have exceeded sky high expectations and better guidance and and hee too am expecting better performance than projection.

Process of identifying stocks - Trust worthy promoter (this can’t be foolproof despite our best efforts as Basilic and Addictive fiasco proved, Presstonic, Docomode were a clear miss of my own process as promoter reputation was not known), High CAGR 100% and above through order book, capacity expansion with huge tailwinds. More than RHP/DRHP, I read youtube interviews of promoters and media interaction to know about their thinking process. While I follow many twitter handles with focus on SMEs/ microcaps, read Sovrenn times (it provides huge information and is free on Monday for those who want to explore however after doing all this I reject more than 90% stocks, have to get better at it still . Stock price going down is an opportunity as long as I trust promoter and business hypothesis. I did this in Kore digital (down 40% from top) and Sonalis (60% from top).

I also subscribe to free news letters from Brain Feroldi, Alpha ideas, the deep view, Mckinsey, BCG perspectives and read three news papers daily to know the ecosystem. More importantly thinking about scalable opportunity and strength of business model which are scalable and capital efficient with large run way ahead.

Perspective to look at long term earnings - Given Indian economy trajectory of 30 billion dollar plus in decades ahead and improving institutional and private sector competence, SMEs / microcaps will create eye popping wealth. Utpal seth (CEO RARE enterprises) in his famous talk keeps using terminal value investor with megatrends and scalable opportunities to think about mega multibaggers. It is not about money but same approach in life too, how many reliable, competent and caring people we have in life or for that matter are we ourselves one? One gets very few scalable opportunities with competent and reliable management hence perspective is very important to look at the scale of opportunity. We are lucky to be in India of today where there are so many opportunities but have to narrow down to a few great ones! I enjoy investing most after pursuing many careers across public sector, government, entrepreneurship (burnt all money and became zero 7 years back ![]() and private sector as it provides the life I value most - autonomy, money, time - can’t get troika elsewhere! Intellectual satisfaction is the bonus and I have started enjoying the process more.

and private sector as it provides the life I value most - autonomy, money, time - can’t get troika elsewhere! Intellectual satisfaction is the bonus and I have started enjoying the process more.

Patience - As veteran investor Ramesh Damani says Alpha comes at the end. In the era with reducing attention span and reducing average holding period if one looks at quarterly or yearly return then mediocre return will follow. In instead of looking within and making selecting framework rigorous most most people blame others. Peter Lynch – Best returns comes at least in 3 to 4 years. RJ used to say investment is for min 3 to 5 years and forever as long as hypothesis remains in tact.

Probabilistic - We have to be lucky too like anything great in life cant happen without favourable luck. When there was fire incident leading to a few deaths in Max India a few quarters back , one realised that how difficult risk management is and there are so many factors which have to work together to make a business and as a result investing great success. Another fire incident in Eco recycling, One large order at Sonalis. There will be mistakes and omissions which will keep me humbled too. Would like to remember Jim Simons, mathematical genius with CAGR of 66% over 30 year and who donated most of the money like Warren Buffet before his death. He said on luck: "People underestimate its importance except when things go badly. Then they’re very happy to ascribe it to bad luck, which it may be, of course. One has to recognize that luck plays a meaningful role in everyone’s lives. You get born to decent parents in a good part of the world, and you’re way ahead of the game. And that certainly doesn’t have much to do with skill or hard work. In my case, I was lucky to collaborate with some very good people when I was doing Mathematics. I was also lucky in my choice of partners at Renaissance.

Inspiring writeup. Kudos to your choice of stocks and patience with already multibaggers .

One thing which I would add ,and it’s related to being lucky, we must be aware of what’s is currently market’s favourite sector (currently it’s Renewable and related). If we align ourselves to market’s favourite as early as we do, we may say we were lucky .

I wish you great luck with your stocks ![]()

Keep sharing knowledge ![]()

Thanks @Rajesh_Singh for Sharing ur knowledge so generously . Regarding the excel of ur holdings shared above, what about some of the other positions u have spoken about in past or on this thread ? Such as , Shelter Pharma , Auroimpex, Kamath Hotel . Do u have those in ur portfolio too currently or the above xcel is comprehensive view of ur holding ?

I had tracking position in Auro and Shelter exited them. One learningbis to invest only where tyrtebis reasonable certainty of 100 percent growth either through order book, capacity expansion and management is holding discussion with investors as a norm post result. Kamat guidance is 130 crore EBITDA for this year and I continue to hold as it remains 1000 plus price candidate this year. As it’s short term bet so will exit once target is realised

@Rajesh_Singh Sir, can you share your view point for Max India? what made you put into a decadal trend? Per my view yes they are build homes with a focus on senior care but

- as a slight -ve (with other residential builder) i thing they are a residential builder with a senior theme

- +ve well as health care grows and medical costing still at good prices for people coming from foreign countries this could a good rental place to live in.

I see they have launched Max Antara and a friend of mine is a channel partnre for the same. The starting price is 4cr in Gurugram and they have already delivered one project in Dehradun

They have changed model to make it asset light and houses will be built by partners and they will focus on services, it is integrated player with products including digital products. They are just fulfilling 5% of demand pls refer to their presentation and from 2 to 5 and will go to all million plus cities in decades ahead. Longevity and aging with need of sr citizen health care is never ending trend hence it is permanent trend as they scale then profitability will shoot up , still two years away but will have operational leverage kicking in esp for digital and product side.

hi Rajesh, you seem to be a humble and helping personality. I came through kore digital few days ago and remembered varanium cloud ltd. which came in news for fraud a month ago. But before the news broke out I was going through the company, I saw sales and pat growth was crazy. but when I looked at balance sheet, specially trade receivables I knew some thing was fishy. And exactly same came to news. so do you think there is even a slight chance of management reporting forged numbers because growth is very good here, and they have given guidance of 1000CR top line for FY26 which is even crazy. and I was going through their annual report FY 23 and they have only 9 employees on payroll.