Business

We can watch this video to understand what ramming mass is used for.

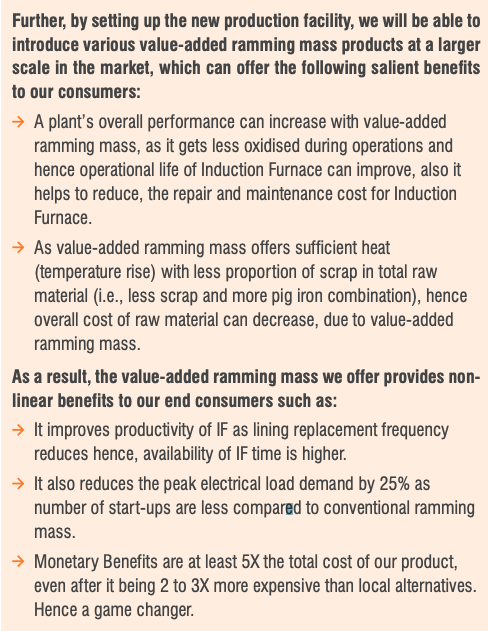

Ragav makes quartz & silica based ramming mass which is a refractory used to line induction furnace type steel reactors. Why do steel producers use ramming mass? It enhances the life of the induction furnace, reduces the electricity costs, & reduces the raw material costs by enabling steel producers to work with a facorable mix of pig iron & scrap steel. The ramming mass reduces the energy requirements for the steel making process & thus result in cost savings for the steel producer (To be understood what physical property of quartz or silica ramming mass results in lower heat requirements).Raghav Productivity Enhancers Limited (RPEL) is the largest ramming mass producer in the world. Quartz powder with a silica purity of 96-98% is called ramming mass and is widely used in the steel industry as a refractory material in lining of the inner surface of coreless induction furnaces for melting scrap, sponge and pig iron. Quartz powder with higher silica purity is used in glass and ceramics industries, while quartz powder with highest purity is used in the manufacture of ophthalmic lens and solar industry.

Competitive Advantages

While i was reading the VP thread, annual reports, AGM presentation of Raghav. Only one thought was going on in my mind, what a beautiful lollapalooza of multiple S curves of adoption.

(i) Ramming mass is essentially quartz or silica powder mixed with binding chemicals. The quality of the ramming mass is directly influenced by the quality/purity of the quartz source.

This is where raghav shines. Raghav’s plants are located near Quartz mines in Rajasthan & thus raghav has access to one world’s purest quartz.

(ii) Ramming mass is generally perceived to be a bulk commodity. This is why, transportation costs add significantly to the end user price. If you produce ramming mass worth 100 & spend 60 rupees transporting it, why would end user buy it at 160 rather than buy local ramming mass worth even 110? What Raghav did here is to study 100+ steel plants, their specific requirements, & using data analytics & their understanding of how induction furnaces work (they do have an in house induction furnace for R&D) they developed value added versions of ramming mass which customers are happy to pay extra for. Why? Because cost savings more than compensate.

Okay, so rather than buying a 100 rupees costed local low quality ramming mass, the end user is buying 200-300 rupee costed raghav ramming mass because the cost savings are at least 1000 rupees! Just see the ROI for the end user. We use only 30 KG of ramming mass every 1000 KG of steel produced. Stainless steel price is 48000 Rs / MT. Raghav ramming mass realization is 4800 Rs / MT. This means, that ramming mass is only 0.3% of steel production costs! This means that by putting up a 0.3% costing, steel producers can save 1.5% of revenue in costs! No wonder why steel producers are happy to buy this critical application product even at 2x -3x the costs. The ROI is totally worth it.

(iii) The bedrock of any technology business is R&D. Raghav set up an in-house R&D Centre, which tapped into the intellectual inputs of their collaborators, JWK, Sweden, and one of India’s most famous public engineering institutes. Their R&D Centre gained them the recognition of the Department of Scientific and Industrial Research (DSIR), under the Ministry of Science and Technology of the Government of India. Even today, Raghav are the only company in the industry that can claim this distinction. R&D leader having own induction furnace, Data driven, tie-up with IIT Bombay, Advisory Board with global domain experts

(iv)

Opportunity size & Tailwinds

Raghav has only 10% of market share by volume. However, it has to be understood that raghav is a value added ramming mass maker. Thus, when raghav captures volume market share, it actually expands the value market share. Raghav products sell at least a 25-30% (in some cases 200-300%) premium to local competitors. Thus, when folks talk about 1000cr ramming mass market, it is actually expanded to at least 1200-2000 cr (depending on product mix raghav can accomplish) if we consider only raghav’s products. In Value terms of the potential maket, raghav’s market share might be significantly lower at 5-8% indicating larger opportunity size.

Ramming masses are only used in Induction furnace reactors. However, induction furnace reactors are gaining market share in developing markets. THis implies a tailwind for raghav’s products.

New planned steel capexes are :

JSW steel: 14.8M tons

Tata Steel: 5M Tons

JSPL: 6M Tons

NMDC: 3M Tons

This is almost a 27% increment in installed capacities (refer to total steel capacities pic above).

THis is also in line with ministry of steel targets to grow steel production at 8% PA.

Growth/capex

Layering of S curves of adoption/growth bridge:

- Steel CAGR at 8%

- Shift to Induction furnace at 5% CAGR.

- Raghav Gaining volume market share: 7% CAGR

- Raghav Value added being higher than customer current refractory: 5%

I would not be surprised if raghav grows at 25% CAGR over next few years.

The growth is being led by continuous capex.

Installed capacities are growing 2x over the next few years. Newer capacities are also expected to have significant breakthrough in quality of quartz/silica used & also level of automation. I would not be surprised if newer capacities increase % of value added ramming mass even more.

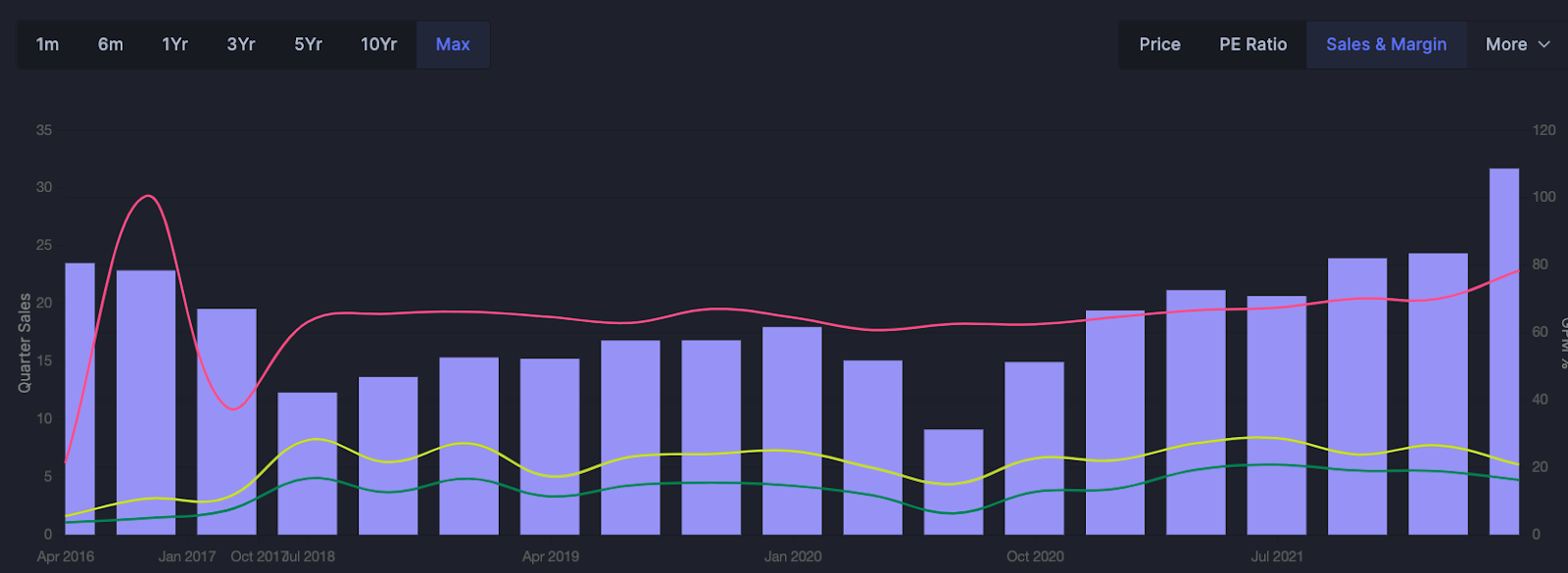

Profitability

This favourable industry structure is visible in margins. Both gross & operating margins. The favorable product mix is visible in gross margins as well. Which expanded from 65% to 80% over last few years. A 80% gross margin player in a commodity industry? This shows true value add.

Fact that operating margins have not expanded as much shows elements of current supply chain disruption. I fully expect operating margin to go up in normalized scenario.

Optionalities

Many other industries use Processed Quartz such as glass, ceramics, engineered stone, semi -conductors, optical glass, solar -panels, rubber etc. Semiconductor & Solar panel are the key industry I would want to deep dive into. Clear secular growth trend in india. Can we find where ramming mass is used in these industries & how? Gives us a great idea about TAM. Question to management would be HOW they plan to capture these value chains.

Risks

GOvernment has recently imposed duties on steel exports. Steel Industry Hit As Govt Imposes Export Duty To Check Elevated Prices: Icra | Mint

However, it is clear that government has done so to “reign in steel prices”. Thus, i see this only as a temporary risk which only improves the valuation at which we are able to own a great co.

Valuation

Given the industry structure, the growth bridge, the criticality of the product the gross margins, the operating margins, the historic growth (20%+ CAGR for sales in last 1/2/5/10 years this is despite stopping low value activities like trading of ramming mass in the middle) visibility of future growth & competitive advantages, growth period (can easily growth 25% for next 5-10 years if it executes well), I find 27 times earnings a reasonable valuation if not cheap.

However, there is a catch. Look at the Q4 P&L. Specifically look at “Other expenses”.

These have gone up from 10cr to 17 cr. Typically in past these have growth in line with the topline. My suspicion is that the growth has been due to supply chain disruptions (freight, travel costs).

To confirm that I looked at FY21 Annual report:

And indeed, the largest header is freight & packaging materials & charges. I fully suspect that this abnormal growth in other expenses is due to supply chain disruptions & is a relative one-off (not present in steady state). Thus in terms of normalized earning power, i expect the profits to have been 8 cr. This gives us an earnings power of 32 cr. Thus, basis earning power RPEL is available at 16-17 times Which is too cheap. Reality is most likely somewhere in between 16 times & 27 times. Valuation is all about marrying numbers & narratives These are my numbers & my narratives. Do your own due diligence, find your own numbers & narratives.

Disclaimer: Bought today, invested & biased.