Quant has launched Quantamental fund. It sounds so similar to what you do. And its doing great. Kindly share some thoughts on what strategy the fund uses. Is it AI/ML based algo or quant portfolio with periodic rebalancing ?

@amishra I have no clue what the Quant Mutual Fund does ![]()

Usually, no one will share what exactly they do because that is what provides the edge.

@amishra

The fund is very secretive. Their CEO also talks general things in interview. They are surely hiding some very elegant algo code. Instead of trying to find what recipe they are cooking, i just invested in Quant small cap and quant active fund. When you cant beat them, join them

I’m doing SIP with Quant absolute and Quant active funds since Jan 2022. So far they have given category leading returns. Will have to see how they perform in longer term.

Won’t it be better to invest in quant based mutual fund due to no tax on capital gains?

@Yesraaj

Mutual funds have this major advantage over individual investors in that you only pay tax when you sell units and all internal portfolio churn does not attract any tax. So, yes, if you find a good mutual fund, it makes a lot of sense to buy into it rather than doing it yourself.

The advantage of doing it yourself is that you can tweak your own strategy or holding. The biggest challenge in mutual funds, especially when they grow in size is that they tend to over-diversify. For example, the Quant Active Fund has 58 stocks as per moneycontrol. At some point, the size of the fund will become a headwind, especially if it continues to outperform.

One of the biggest challenges of momentum-oriented quant strategies is their ability to absorb large capital. It is not able to perform as well with higher amounts of capital as with lower ones due to changes in liquid stock universe and impact cost.

This is a recent interview with Sandeep Tandon of Quant MF. He has articulated beautifully what I keep trying to say. We need to look at the markets from the viewpoint of data. We should be married to a particular stock or sector. We need to update our portfolio as and when the data changes. Most of the time when we do discretionary investing, we tend to fall in love with our own ideas, our stocks and our own analysis.

no short and long term capital gains!!

quant funds are also equity based. so selling and making profit should attract gains tax.

what am I missing on these funds? can you please elaborate.

@navneetsinghvi

Unlike individual investors, mutual funds do not need to pay capital gains tax when they sell shares. It is a special provision for mutual funds as they are a collective investment vehicle for retail investors. This helps them in case there is very heavy churn. The taxes need to be paid by the investor only when he or she sells his funds.

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Bharti Airtel Limited | Stylam Industries Limited | Stylam Industries Limited | ICICI Bank Limited | ITC Ltd. | ITC Ltd. | ITC Ltd. | Vedanta Limited | ITC Ltd. | State Bank of India | Vedanta Limited | ITC Ltd. |

| 2 | Fortis Healthcare Ltd | Bharti Airtel Limited | Fortis Healthcare Ltd | Fortis Healthcare Ltd | Fortis Healthcare Ltd | Fortis Healthcare Ltd | Fortis Healthcare Ltd | State Bank of India | Reliance Industries Ltd. | ITC Ltd. | ITC Ltd. | State Bank of India |

| 3 | Oracle Financial Services Software Ltd | Tech Mahindra Limited | Tech Mahindra Limited | Hindustan Copper Limited | State Bank of India | ICICI Bank Limited | ICICI Bank Limited | Reliance Industries Ltd. | State Bank of India | Reliance Industries Ltd. | Escorts Ltd | Reliance Industries Ltd. |

| 4 | Stylam Industries Limited | Fortis Healthcare Ltd | Oracle Financial Services Software Ltd | Stylam Industries Limited | ICICI Bank Limited | State Bank of India | State Bank of India | Fortis Healthcare Ltd | Vedanta Limited | Vedanta Limited | State Bank of India | Fortis Healthcare Ltd |

| 5 | Tech Mahindra Limited | Oracle Financial Services Software Ltd | Infosys Ltd. | Tech Mahindra Limited | Stylam Industries Limited | Coal India Ltd | Oracle Financial Services Software Ltd | ITC Ltd. | Fortis Healthcare Ltd | Fortis Healthcare Ltd | Reliance Industries Ltd. | Escorts Ltd |

| 6 | Tata Steel Long Products Limited | Infosys Ltd. | Deepak Ferts & Petrochemicals Corp Ltd | Oracle Financial Services Software Ltd | Bharti Airtel Limited | Bharti Airtel Limited | Indiabulls Real Estate Ltd | ICICI Bank Limited | ICICI Bank Limited | ICICI Bank Limited | Fortis Healthcare Ltd | ICICI Bank Limited |

| 7 | Sun Pharmaceuticals Industries Ltd | Tata Steel Long Products Limited | Tata Steel Long Products Limited | Tata Steel Long Products Limited | Hindustan Copper Limited | Vedanta Limited | Stylam Industries Limited | Oracle Financial Services Software Ltd | Linde India Ltd. | Larsen and Toubro Ltd. | ICICI Bank Limited | Linde India Ltd. |

| 8 | Bharat Rasayan Limited | NMDC Ltd | J B Chemicals & Pharmaceuticals Ltd. | Deepak Ferts & Petrochemicals Corp Ltd | ICICI Securities Limited | ICICI Securities Limited | Vedanta Limited | Linde India Ltd. | Oracle Financial Services Software Ltd | Oracle Financial Services Software Ltd | Linde India Ltd. | Indiabulls Housing Finance Ltd |

| 9 | Infosys Ltd. | General Insurance Corporation of India | Tata Consultancy Services Ltd. | Vedanta Limited | Sun Pharmaceuticals Industries Ltd | Sun Pharmaceuticals Industries Ltd | ICICI Securities Limited | HDFC Bank Limited | HDFC Bank Limited | Linde India Ltd. | Indiabulls Real Estate Ltd | Adani Enterprises Ltd |

| 10 | Vinati Organics Ltd | Cadila Healthcare Ltd | General Insurance Corporation of India | Infosys Ltd. | Vedanta Limited | Stylam Industries Limited | Coal India Ltd | Indiabulls Real Estate Ltd | Indiabulls Real Estate Ltd | HDFC Bank Limited | Adani Enterprises Ltd | Indiabulls Real Estate Ltd |

| 11 | Alembic Pharmaceuticals Limited | Bharat Rasayan Limited | Bharat Petroleum Corp Ltd | Sun Pharmaceuticals Industries Ltd | Oracle Financial Services Software Ltd | Indiabulls Real Estate Ltd | Sun Pharmaceuticals Industries Ltd | ICICI Securities Limited | ICICI Securities Limited | Indiabulls Real Estate Ltd | Adani Ports & Special Economic Zone Ltd | IRB Infrastructure Developers Limited |

| 12 | Jubilant Life Sciences Ltd | Petronet LNG Ltd. | Bharti Airtel Limited | J B Chemicals & Pharmaceuticals Ltd. | Tech Mahindra Limited | Jindal Steel & Power Ltd | Hindustan Copper Limited | Stylam Industries Limited | Sunteck Realty Limited | ICICI Securities Limited | ICICI Securities Limited | Adani Ports & Special Economic Zone Ltd |

| 13 | Divis Laboratories Ltd. | Deepak Ferts & Petrochemicals Corp Ltd | Linde India Ltd. | Cadila Healthcare Ltd | Bharat Forge Limited | Hindustan Copper Limited | EID Parry (India) Ltd | Macrotech Developers Limited | Stylam Industries Limited | Sunteck Realty Limited | Stylam Industries Limited | Larsen and Toubro Ltd. |

| 14 | Ineos Styrolution India Ltd | Tata Consultancy Services Ltd. | Cadila Healthcare Ltd | Steel Authority of India Ltd | Just Dial Limited | EID Parry (India) Ltd | Macrotech Developers Limited | EID Parry (India) Ltd | Adani Ports & Special Economic Zone Ltd | Stylam Industries Limited | Sunteck Realty Limited | ICICI Securities Limited |

| 15 | ITC Ltd. | Linde India Ltd. | Grasim Industries Ltd | Thyrocare Technologies Limited | Oil and Natural Gas Corporation Ltd. | Godrej Agrovet Limited | Godrej Agrovet Limited | Godrej Agrovet Limited | Macrotech Developers Limited | Adani Ports & Special Economic Zone Ltd | IRB Infrastructure Developers Limited | Sunteck Realty Limited |

| 16 | Deepak Ferts & Petrochemicals Corp Ltd | Alembic Pharmaceuticals Limited | Bharat Rasayan Limited | Grasim Industries Ltd | Tata Steel Long Products Limited | Oracle Financial Services Software Ltd | Reliance Industries Ltd. | Hindustan Copper Limited | Prestige Estates Projects Ltd | Macrotech Developers Limited | EID Parry (India) Ltd | United Spirits Limited |

| 17 | Reliance Industries Ltd. | Ineos Styrolution India Ltd | ITC Ltd. | General Insurance Corporation of India | Jindal Steel & Power Ltd | Just Dial Limited | Dhani Services Limited | Prestige Estates Projects Ltd | EID Parry (India) Ltd | Escorts Ltd | Arvind Limited | Stylam Industries Limited |

| 18 | PTC India Financial Services Ltd | Canara Bank | Hindustan Petroleum Corporation Ltd | ICICI Securities Limited | General Insurance Corporation of India | Bharat Forge Limited | HFCL Limited | Sumitomo Chemical India Limited | Glenmark Life Sciences Limited | Arvind Limited | SUN TV Network Limited | CRISIL Limited |

| 19 | Dabur India Ltd | ITC Ltd. | Alembic Pharmaceuticals Limited | Bharti Airtel Limited | Grasim Industries Ltd | HFCL Limited | Havells India Ltd | Canara Bank | Godrej Agrovet Limited | EID Parry (India) Ltd | United Spirits Limited | Prestige Estates Projects Ltd |

| 20 | Cadila Healthcare Ltd | Jubilant Life Sciences Ltd | Petronet LNG Ltd. | Bharat Petroleum Corp Ltd | Thyrocare Technologies Limited | Sumitomo Chemical India Limited | Just Dial Limited | Larsen and Toubro Ltd. | Hindustan Copper Limited | Prestige Estates Projects Ltd | Prestige Estates Projects Ltd | Arvind Limited |

This is the Top 20 stocks per month of the Quant MF in 2021 as per their factsheet. If you see the churn, you will realise that if a normal individual investor was to replicate this, they would be hit by STCG, which could potentially reduce the returns by 3-5%. So, as a structure, a mutual fund will always be at an advantage in terms of taxation.

If anyone wants to fund a new MF, please let me know ![]()

What i also observed is, there is a high overlapping in different schemes, be it quant small cap, quant active fund. One major reason may be there are 3-4fund managers to each scheme and most fund managers are common to many schemes.

This means if we invest in 1 or 2 schemes, it will replicate most other schemes.

Also if one scheme starts failing, other schemes will also start failing.

And any dividends recieved from holding stocks are tax free (??) or at least not at the peak tax rate as in case of individuals.

How’s the capital gains taxed for individuals and MFs for buyback?

(I heard it’s non taxable for both but I’m not sure)

Although even if there is an overlap, even if the funds are managed by the same manager, the reason for investing in same stocks could be different.

If we take the example of ITC, a fund based on a system will only buy it after it has started moving or looks like it will move, on the other hand, a fund based on pure fundamentals may have got chosen for the business and not for the price alone, so the system fund may exit after the up move is over and is consolidating, and the fundamentals fund may remain invested for longer periods.

And if all of this is explained in the funds’ documents, then investors will have the clarity.

Here is an explanation of such a system.

@basumallick - Really enriching experience to read this thread. Difference perspective to investing I must say.

Also, have observed that some old timers (20-30+ years in market) who started PMS seem to follow/use Quant/Algorithms etc. - i.e. mechanical aspect sans human thoughts/emotions. and seem to be doing quite well. Same I came to know about Quant mutual funds from this thread.

Some doubts as a beginner in understanding Quant system -

-

I see that you follow multiple hats as you mentioned - Quant, fundamental/core long term and positional trades etc. and maximum CAGR seems to be coming from Quant out of these three. In this context, would like to know what do you feel is the strength & weakness for each of these styles (specially long term core vs Quant since you still seem to believe in long term core as well) and why did you not transform into a full Quant style? Is that the ultimate goal to transform to Quant as much as possible as that provides maximum CAGR?

-

Is Quant investing being followed in west, specifically US, since long time? Like how passive investing is old in US and picking up in India…is that a similar thing happening for Quant? If yes, we can understand globally how Quant based funds/investors have fared over cycles instead of backtesting? Just a thought…

-

Apart from quality of data & refinement of one’s own style, what do you feel is the biggest drawback of Quant investing?

-

If Quant provides massive CAGR upsides compared to other styles, why most big investors, FII, Mutual funds not full blown into Quant? They must have access to best quality data…Is it because of inability to develop a suitable Quant style so far or some other reason?

Thanks again for presenting this really intriguing & different aspect of investing. More than that really liked the way you have followed through and keep adding immense value & growth in this thread.

too much churn. which fund was this? if possible, please tell the name.

Trying to answer your questions below:

As you have rightly said, I try to do many things. One reason is perhaps that I am not very good in any one ![]()

But it is erroneous to assume that quant gives the best CAGR. Returns are dependent on multiple factors including underlying market dynamics. What I have found is that a combination of strategies works the best and has the potential to give the most consistent returns, which is what I am looking for, not necessarily the best returns.

The holy grail for me is to be able to have multiple quant-oriented strategies across timeframes and styles. So, a monthly momentum strategy and also a half-yearly mean reversion type strategy.

In the US and other developed markets, quants have been around for much longer. Firms like OSAM, Renaissance, Two Sigma have delivered stellar returns for many years. Individuals like Ed Thorp have become legends doing this. I would argue that even a value investor like Walter Schloss is essentially quant.

If you read through this thread you will know that quant is not a homogenous strategy. There can be as many strategies as investors. Quant can be value based, growth based, momentum based etc etc. So, returns over cycles will depend more on the type of fund strategy than whether it is quant or discretionary.

The main drawback of quant is fact that we don’t have data that is long enough and that the accounting system and market system has changed a lot over the last two decades. But the major benefit of having rules based systems that prevent psychological biases from creeping in is the biggest benefit.

Again, quants do NOT provide massive upside. If you make a bad strategy you will lose money. Apart from that the biggest reason why there are less very successful quants is because it lies at the intersection os two different skills - investing & computational skills. Usually fund managers come from the finance background and are clueless about computational skills. and those who have computational skills don’t have the requisite finanal knowledge. (Makes it a good moat for someone like me, I think!!! ![]() )

)

When quant has more churn than the traditional investing processes, and is based on selecting stocks on a quantifiable model, where does investing come from? We are not investing based on a quant model not even for a few quarters.

You yourself have said about relative momentum, which if is incorporated in all quant systems, then we move from one stock to another, despite the first stock being in upward motion, so where is the need of investing acumen here? These are not long term holdings.

Are you talking about technofunda here?

Why should quant have more churn? Why will it only hold stocks for less than a few quarters?

Both these assumptions are completely wrong.

The rate of churn, the duration of holding, the parameters used for stock selection are all based on the individual strategy employed.

For example, Joel Greenblatt’s magic formula is a quantitative strategy that invests once a year and uses only fundamental parameters.

Right.

So quant here has a broad meaning although technically correct. I said that in a more stringent and general sense. So any model where qualitative inferences have no place, and the selection is based on some quantitative factor is quant, and there exist many such quant models, some of which, also fall under the category of fundamental investing, if Schloss and Greenblatt are considered.

And if Schloss and Greenblatt are quants, then Jim Simons is the absolute quant.

I have come to acknowledge, appreciate and understand the beauty of such quant models, hence the asking.

One of my main interests over the last five years has been in quantitative investing. The main trigger for it came to be because I could feel that a lot of investment outcomes are dependent on the whimsical nature of human psychology, so a better way to address this problem is to be able to codify some rules for investing. This approach has helped me immensely in my discretionary long-term investing as well.

So, starting this month we are going to publish a quant newsletter. We will try to make it monthly (at least that is what we have thought for now). It will be only and only focused on quantitative investing concepts, stuff that we are reading and the state of the markets.

State of the Markets

Note: Why do we need to understand the state of the markets?

The state of the markets is like the “pitch” in a test match. The captain needs to read the pitch and then decide on the playing eleven. For example, if it is a turning wicket, you may wish to play an additional spinner. Similarly, based on the state of the market, you might wish to change your allocations or stock selection.

One of the ways in which market health can be measured objectively is by monitoring the market breadth. It is purely data-based, unbiased and objective. Like any other indicator, it needs to be evaluated in sync with many other factors together and never in isolation. However, it is a good metric to keep track of. As of now market breadth is strong.

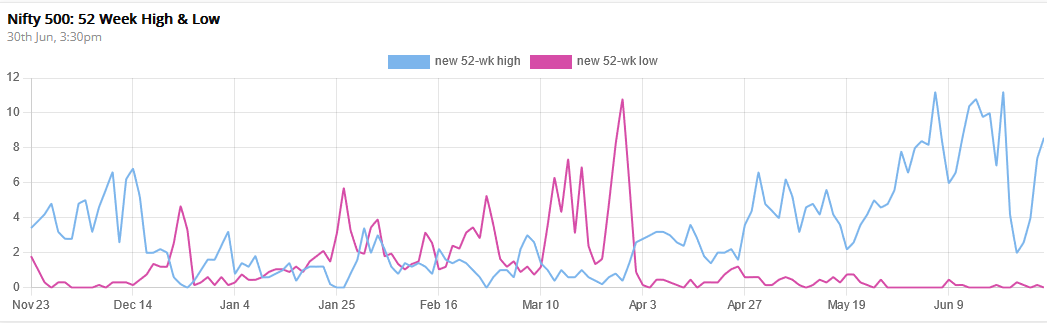

No of stocks hitting new 52 weeks highs is much higher than no of stocks hitting new 52-week lows (Universe Nifty 500).

Therefore the net new 52 highs and lows are strongly positive. (Universe Nifty 500).

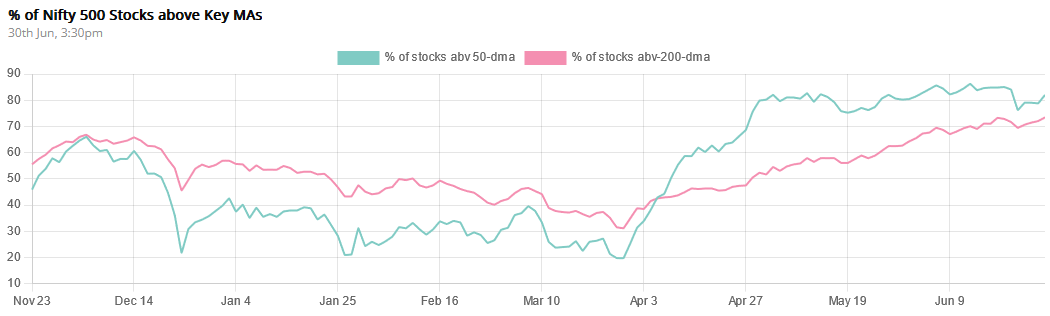

% of Nifty 500 stocks above key long-term moving averages is also signifying strength.

What we are reading: Lessons from Larry Hite

Larry Hite is regarded as one of the forefathers of systems trading. He grew up as a dyslexic, partially blind kid, facing failure and struggle at every corner. Despite such background, he went on to found and manage, Mint Investment Management Company which at its time became one of the most profitable and most significant quantitative hedge funds in the world. He authored a book “The Rule: How I beat the odds in the Markets and in Life-and How you can too”. It is a fascinating account of someone embracing his fears, frustrations, self-doubt and how this led him to accept markets as they are. In fact, his familiarity with failure helped him manage risks better and become successful in markets. There are some key lessons we can imbibe from his life and his market successes.

Create a system that you can put on autopilot:

At one time, due to an error of judgement made by his investing partner, Larry incurred serious losses and went into debt. He says “I looked at my debt and decided to go back and do what I really liked. I wanted to create an improved trading system that would remove human discretion entirely ”. In due course, he precisely did that, and he goes on to say “We all signed a written agreement that none of us could countermand the system. It was liberating to let go. I was driven not so much by greed as by laziness. I wanted money to work for me, not the reverse. My goal was to create a system I could put on autopilot so I didn’t have to anguish over the ups and downs of the market. This way I could sleep at night, and even better, make money while I was sleeping.”

Markets are not efficient and trend following will never really die

Larry says, “Trend following will never really die since there are very few people who are not afraid of losing.” Let that sink in. Much like Warren Buffett, Larry doesn’t believe in efficient markets and says “Efficient markets don’t exist and never will as long as humans are playing the game with greed and fear in a tug of war. What makes this business so fabulous is that, while you may not know what will happen tomorrow, you can have a very good idea what will happen over the long run. I don’t make money because I know anything. I only make money because I do what the market tells me to do.”

You have to be comfortable with small losses:

Quantitative Investing is a business. Losses are the cost of doing business. Larry says “All major fortunes are built on a lot of small losses, which pave the way to big wins and success. I failed so often and so badly that I learned to get comfortable with it as a variable. Because I’d been a poor athlete and bad student, it never surprised me that I would lose. I would quickly accept it, fold my cards, and move on to come back to play another day. I recommend you practice losing money. In the long run, that will help you win big. ” If you are not comfortable with accepting small losses frequently, you should not invest on your own, particularly in quantitative, trend-following strategies.

You have to manage risk all the time:

Larry’s system was based on controlling his risk to the downside so that he never loses all of his capital. He says “You can’t completely control outcomes. But you can control two things for sure. The odds of the bet you take, and the risk you take. If you keep placing good bets, over time the law of averages will work for you. If you keep placing bad bets, over time the law of averages will work against you. ”

His failure helped him win big. How? “I always expected to fail big. Solution? I engineered my actions so that a failure could not kill me. I won because I always expected to lose.” That may sound paradoxical but is the single most key ingredient to success in investing using any kind of method.

Backtesting is important:

“Now, obviously, just because you get something right in the past doesn’t mean you will get it right in the future—historical testing has its flaws. Just the same, these simulations were highly valuable because using real market conditions—even in the past—gave us far better information than hypothetical scenarios of us sitting around the office guessing. ”

Drawdowns are a feature and not a bug:

Based on Larry’s experience in running trend-following strategies successfully, he makes it clear, “Be prepared to lose roughly the size of your annual return. For example, a strategy with a 10 per cent return over time should be expected to suffer at least double the annual return in a 20 per cent drawdown—so a strategy with a 30 per cent return over time should be expected to suffer a 60 per cent drawdown.”

Larry Hite Quotes worth reflecting upon:

- Follow the crowd and go where the money goes.

- If you’re offered a seat on a rocket ship, don’t ask what seat. Just get on.

- Why will trend following never really die? There are very few people who are not afraid of losing.

- When you start following slick reports filled with predictions, you’re just finding out who has good copywriters.

- Global financial markets are not best explained or traded by stories but rather by numbers (which are the only facts).

- Markets are the ever-shifting accumulation of cold economic interests competing for superiority within regulated legal systems.

We will be back next month with the state of the markets review and update on what new we are learning in the field of quantitative investing.