The Indian power sector is made up of power generators, distributors (also called discoms), power transmitters and exchanges. In this entire value chain, discoms have been suffering losses by giving extraordinary discount to end customers due to political compulsion (example). Because of suffering discoms, the long term purchase agreements with power generators is not met, resulting in large receivables for power generators leading to their deteriorating fundamentals (eg: Tata power threatening to shutdown their Mundra power plant). Power exchange such as IEX has lowered electricity prices because of more efficient match of demand and supply resulting in more discoms purchasing from exchanges (in short term market). This has come at the cost of discoms voiding long term power purchase agreements with generators. In this whole value chain, only two players are still making good profits (Power grid and IEX).

Power grid connects the power generation companies to power distribution companies by building towers which forms a part of the grid network. This sector was opened to private entities in 2011, but power grid still maintains its monopoly status commanding 85% market share of inter-state transmission network and 45% market share of overall domestic transmission network.

Business fundamentals: Power grid invests in building grid network, maintains it and charges a fee for its services. It is governed by CERC and gets regulated ROEs of 15.5% (for the period of 2019-2024). This ROE is decided by CERC and gets revised every 5 years (in the previous 5-year period, ROE was also at 15.5%). For building a new asset, power grid uses 70% debt and 30% equity. Their mandate is to maintain this ratio.

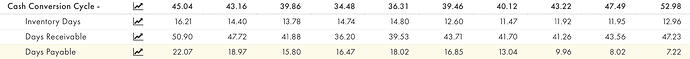

Past financials: Tangible book value has grown from ~16’000 cr. in FY10 to ~64’000 cr. in FY20 (15% book value growth). D/E was ~2.16 in FY10 and has grown to ~2.35 in FY20. Debt grows when a new project is getting constructed (CAPEX phase) and is paid down when it gets commissioned. Sales, profits and CFO have grown at 18%, 18.4% and 16.7% over the last decade. Company has spent close to 1.05 lakh cr. in the last 5 years, and cumulatively has spent more than 2 lakh cr. since 2004.

Operational efficiency: Power grid is an efficient transmission company, making a gross margin of ~90% and a net profit margin of ~30%. For context, Power grid Bangladesh makes a gross margin of ~40% and a net profit margin of ~15%. PAT margins of Power grid have varied between 28-32% over the last 2 decades.

Growth drivers:

- The company planned to do invest 1.6 lakh crore from FY17-FY22 adding ~43% of new transmission lines within their network. Out of this, they have done CAPEX of ~85’000 cr. in the past 3 years. This was partly funded by debt (~30’000 cr.) and rest from internal accruals. Over the last decade, power grid has generated CFO of ~1.75 lakh cr.

- Railway electrification project: Railways are trying to achieve 100% electrification by FY22 at a cost of ~35’000 cr.

- Cross border transmission with neigboring countries (Bhutan, Nepal and Bangladesh)

- Telecom services: Powertel is rapidly expanding its optical fibre network, their plan is to connect 2.5 lakh gram panchayats.

Risks:

- TBCB route of bidding: In this route, companies have to bid for projects and tariff is not cost-plus but based on the best bidder. This is a huge risk as a large part of incremental projects are coming from this route. If players become too aggressive, it can destroy profitability.

- Government interference: Power grid had to give a rebate of ~1000 cr. to discoms during the Q1FY21. This will always be something to be watchful about.

- Receivables have increased recently from 4’900 cr. in March 2020 to 7’500 cr. in July 2020 due to deteriorating fundamentals of discoms. Collections have improved recently but this is a key monitorable.

Key monitorables:

- CAPEX vs commissioning: When the project commissioning is higher, it leads to greater free cashflow generation, which can be distributed to shareholders. In FY20, CAPEX came down from 25’000 cr. to 15’000 cr. As a result, free cashflow increased to ~19’500 cr. leading to higher dividend distribution. Going forward, management has guided for lower CAPEX (10’500 cr. in FY21) and will generate higher free cashflows. Dividend has increased at ~20% over the last decade.

- Government recently announced launch a $1bn Invit from Powergrid (link). If this is successful, future projects can be directly funded by this structure instead of additional debt.

Valuations:

- Its trading at 5.8% dividend yield (which is sustainable because the dividend payout ratio is only 50%), ~8x P/E and 1.4x P/B. For a business growing at 10-12% with a ROE of 15%, valuations are not demanding.

Disclosure: Invested (portfolio size here)