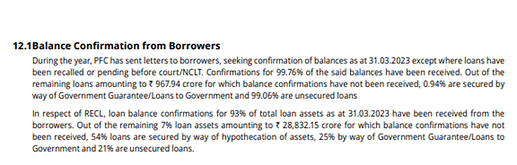

Why balance conformation is so low for REC?

While I used to avoid PSU stocks as risky due to reasons which all of us talk about such as inconsistent growth in revenue and profit, frequent Govt policy changes etc,

However, over a period of time in the market, i realised that stock investment itself is risky whether it is PSU or non- PSU stock.

Even best of the reputed pvt corporates (Non-PSU stocks) with very high P/E also had Corporate Governance issues , tax raids , CFO / Auditor resigning all of a sudden , Inconsistent growth in revenue and profit qoq/yoy and such events were leading to steep fall in share prices. There are many such examples- not taking names here.

Moreover , in spite of excellent growth in revenue and profit , dividend yield of such corporates are extremely low. And some of them were not at all paying dividend over several years

So , i realised there is no reason to be happy with a sound balance sheet.

keeping this in mind I started investing in select PSU stocks with high dividend yield since Covid days of 2020.

Apart from dividend yield , I was trying to identify PSU stocks which have potential for capital appreciation.

During this process , identified some PSU stocks made 3 baskets- one for Defence , another for Railway and the 3rd one for Renewables ( my renewables include PFC & REC)

Happy to share that the entire PSU basket which consists of 30% of my portfolio has given me 3X return ( capital appreciation only - dividend additional) over last two and half years which I am trying to prune now.

In my view , If the Govt continues with it’s current policy of Capex spends for infrastructure building , sticks to made in India theme, the PSU stocks may continue to do well. However , the valuations may not sustain if the Govt makes a u turn in its policy.

Disclaimer: Not a buy or sell recommendation. please do your own assessment before investing.

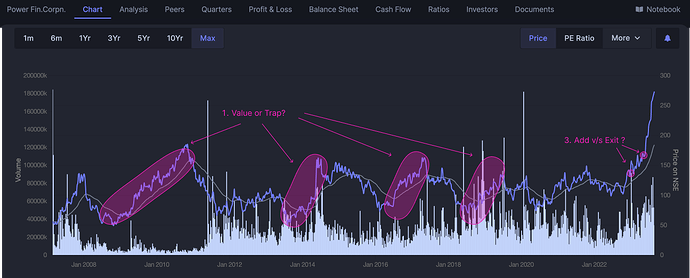

How is that a value trap? And it was also growing fundamentally

These are very subjective statements and completely depend upon the investment thesis and duration.

I entered REC when the price was 100 and exited sometime back. So I think I can freely comment here.

Why I exited REC and haven’t came back yet

Every investment comes with the cost of going wrong. In certain PSUs, this cost is a very good reason to look somewhere else. And, it’s not like investors cannot make money somewhere else - even in the same sector.

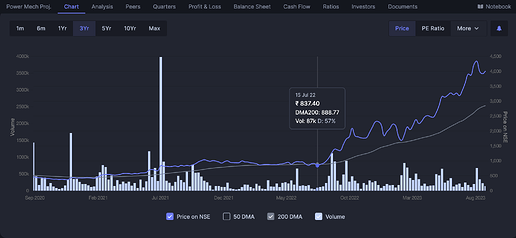

Example: Power Mech Projects, has gone 4-6 times in the last 2-3 years. I entered and exited in between.

(In my experience, once people realize that one can still make money even after missing PSUs, the debate ends)

-

What is a value trap: Stocks are value stocks UNTIL they become a trap. By looking at the present, one can always debate if xyz is a value or a trap. But it will be a never-ending debate - unless we look at the past.

-

What past tells us: Whenever a government owns or controls a sector too much, the industry/business is often inconsistent, and thus, predicting the business outlook (topline, margin, capex, policies etc) is very difficult. This often is reflected via the low valuation multiples. Whether it was gov owned IRCTC or a sector such as gaming (say Delta Corp), what seemed value/growth overnight became a pain.

-

Risks: There was a reason why xyz business had a low valuation a few years back. In a bull market, it’s easy to look beyond the past track record. But is it justified? Only investors can decide. In my experience, it gets difficult to decide whether to ADD or EXIT after a 10-15% correction. If the thesis goes wrong not only does one lose the earnings but also puts the invested capital at risk.

-

Risk v/s reward: One can still generate returns while reducing one risk (i.e. cost of going wrong). There are examples other than Power Mech. An investor has to decide his own risk v/s reward appetite.

Disclaimer: Certain stocks may be in my portfolio and I may change my views anytime. Anything I say is NOT a BUY/SELL recommendation. Please do your own research and do not go by my words. I am not responsible for anyone’s gains or loss. Also, I have edited my answer a few times, because the words were coming right - as I wanted them.

were can I find name of the companies PFC lend to?

price now reflects too much optimism - pfc/rec lend to predominantly to state enterprises - now they are going to infra financing…they have been on adowntrend on NPAs but will reverse soon.

i had a exceptional run with great yield and price appreciation (2.5X over 3 years) but have to trim substantially…but a big investor like prashanth jain are buying in his new PMS

PFC had very good bull run … but seems for last couple of days failing to cross its new high… i m nt expecting it to cross ![]() just saying… the problem with Govt companies is that due to constant change of policies govt stocks were unable to perform in long term… and investors unable to hold for long terms… so the question is - now that its almost certain that election results are not going to make much difference… and hoping govt policies will be same/constant… will PFC going to grow for next few years… until the term end… any views…

just saying… the problem with Govt companies is that due to constant change of policies govt stocks were unable to perform in long term… and investors unable to hold for long terms… so the question is - now that its almost certain that election results are not going to make much difference… and hoping govt policies will be same/constant… will PFC going to grow for next few years… until the term end… any views…

Disc : invested long back for dividend… still holding…

MFs increase stake PFC in Feb month… but the way its going down in past few sessions not sure how many MF’s exited…

The days of explosive growth in terms of Share price is over.

But at around 300-350 Rs and 6-6.5 PE with approximately 10% EPS growth( i am considering on high base) can PFC/REC provide a consistent overall return over next 5 years with lets say 10% - 15% CAGR + 3-5% DY.

Rather than running around buying hydrogen/smart meter/transformer small caps at 80-100 PE.

In NBFC, i hold only bajaj finance and chola finance…no psu NBFCs

I felt Power Finance was a good buy especially as compared to IREDA. My stand was, when both are in the same sector,i.e., fianancing power companies, why rate IREDA so high.

Power Finance is however in a downward tailspin, having fallen from ₹469 in Feb to ₹363 yesterday.

Anybody tracking it? The fall is because, like all the PSUs, it had gone up rather fast, and is saner now, or some fundamental reasons?

Disclaimer: Booked some loss yesterday, watching.

PFC was looking overvalued in February / January 2024 with P/B > 1.5, which is much higher as compared to its 3-5-10 year Median P/B of about 0.75.

I think, such overvaluations in PSU NBFC was looking stretched hence the necessary correction seems to have happened. There is no fundamental reason as its Gross NPA are under control as reported in Q3 FY24.

Market was in a hurry to factor further improvement in its Gross NPA and hence the overvaluation was there, which seems to have been rationalized now.

It has compounded its Net Profits at 30% CAGR where as Share Price has has gone up at over 55% CAGR in past 3 years, indicating that Market has re-rated it due to Gross NPA reduction but it seems that now some rationalization is happening in its share price.

Disclosure: I was holding it from low levels but decided to book profits in Feb 2024.

PFC Q4 2024

A good set of Q4 results from PFC … Dividend declared.

PAT up by 23.3% at 7556 crore from 6128 23 ( consolidated)

Revenue up by 20.3% at 24142 Crore from 20061 Crore (consolidated)

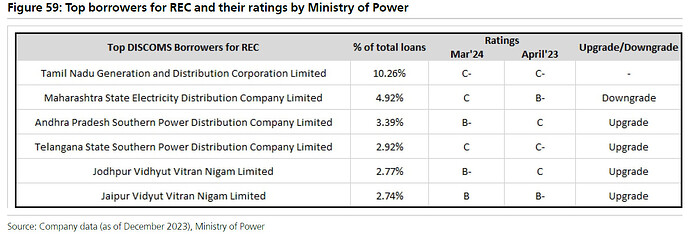

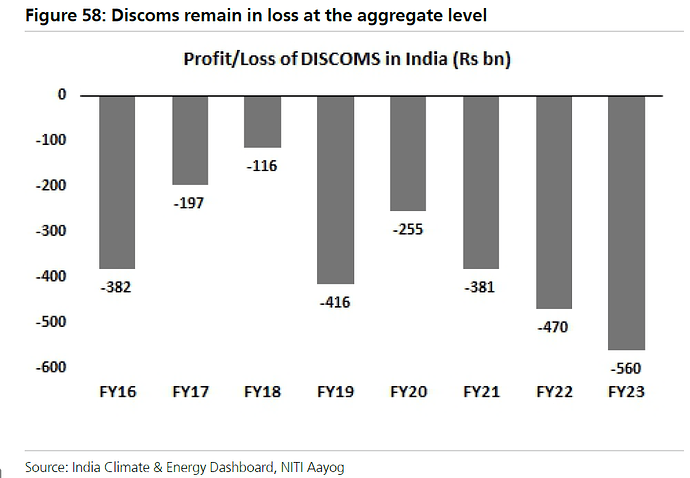

Most major borrowers for both PFC and REC continue to be major state distribution

companies.

Discoms’ operating metrics have improved but remain in loss despite Govt schemes like Revamped Distribution Sector Scheme (RDSS).

Is this a risk for Power Financiers like PFC and REC?

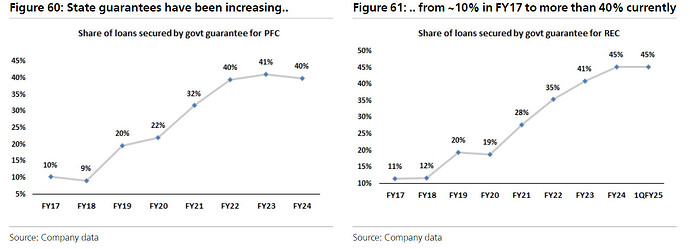

I understand that more and more loans are now guaranteed by state governments as

subsequent schemes by the centre has included conditions to provide cover for these

loans. But this is still just 45% currently.

Sources: UBS Report 28.08.2024

As long as governments are running deficits by giving freebies to electorate, the future of psu power nbfcs is secured . Power being a sensitive subject, they cant rise prices and hence they should keep taking more loans from power nbfcs. Now with the new trend of free power schemes , power finance psus need is even more…. If discipline comes in governments , and if they start acting rationally, then invits shall grab all these stable return assets and growth of power nbfcs shall be effected… Govts inefficiency is the moat for these power psu nbfcs….

And if India’s international credit rating is improved, it shall further reduce the borrowing cost of these power psu nbfcs and make their rates more competitive…… And due to this craze of renewables, these psu nbfcs are lapping up stable return yielding thermal power financing which shall play well for these in longer terms…

PFC Secures Landmark $1.265 Billion Foreign Currency Loan to Drive Green Energy Transition

- PFC secures largest-ever foreign currency term loan by an Indian PSU, valued at $1.265 billion.

- Loan will finance assets outside of thermal generation projects, supporting PFC’s commitment to decarbonization and green energy transition.

- Multi-currency loan includes USD, EUR, and JPY, helping PFC diversify its funding sources and expand operations.

- Loan has a 5-year tenor and is linked to external benchmark rates such as SOFR (USD), EURIBOR (EUR), and TONA (JPY).

- The loan’s average interest rate is 4.21% per annum.

- SBI, IDBI, Axis, MUFG, Deutsche Bank, and SMBC served as bankers, with SBI acting as the largest lender and facility agent.

- The transaction was executed through IFSC GIFT City, Gandhinagar, strengthening PFC’s market presence.