The company recently informed investors that the raw materials have been stuck at Chennai port for extended period of time due to Covid-19 related disruptions. If these raw material imports are being sourced from China, there could be severe supply chain disruptions going forward.

Read about recent developments in Pondy here

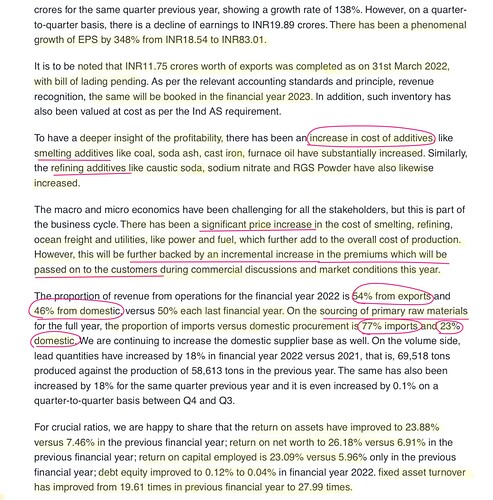

First concall

PONDY OXIDES - Q3 2022 .pdf (4.7 MB)

Wrote a detailed research blog about the company. Please feel free to review it.

One of Pondy Oxides top clients:

Exide Inds gets into Lithium ion batteries::

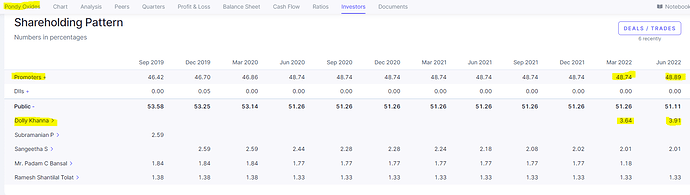

Pondy looking at that vertical as well as per last concall:

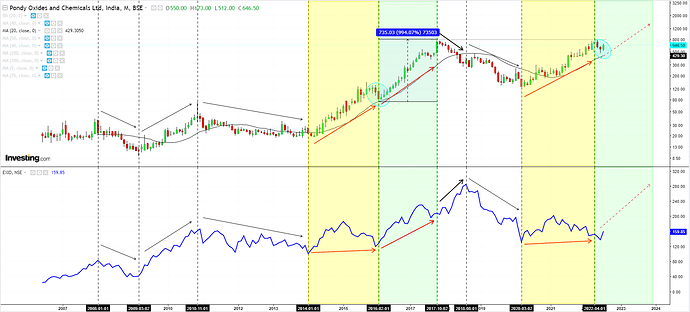

The Case of Positive correlation between PondyOxide and ExideInds:

A Technical Analysis Perspective:

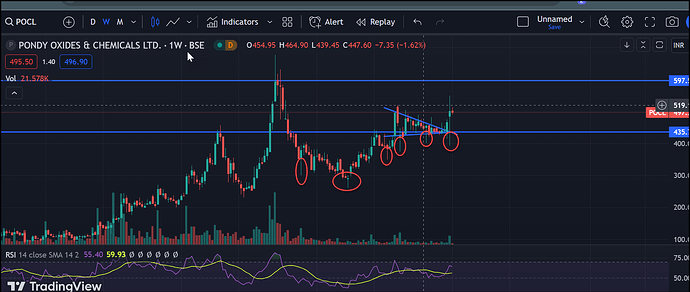

The period 2014-16 (yellow) played out very similarly in 2020-22, 20ma respected (blue circle) as well, following which led to a 1 year upmove (green) in 2016-17.

In case of softening of commodity prices where virgin materials will be much cheaper than recycle product , what will be relevance of recycle, lets assume Govt mandates 10-20% product from recycle still it makes the pond smaller, also the margin will not be much as cost of realization will be higher, Globally there is a trigger for ESG but in India’s domestic mkt what relevance it has, just a opinion, as ur tracking deeply plz do reply

If the commodity prices fall below a certain point, then it become uneconomical for the smelters to run. The first ones to shut will be the ones in more expensive locations and so on. Thats the self correcting mechanism of commodity prices. Irrespective of the price of primary metal, and depending on the metal, the recycled cost will always be cheaper. For example, Aluminium is very energy extensive and geography specific to produce. Hence recycling is always a better alternative.

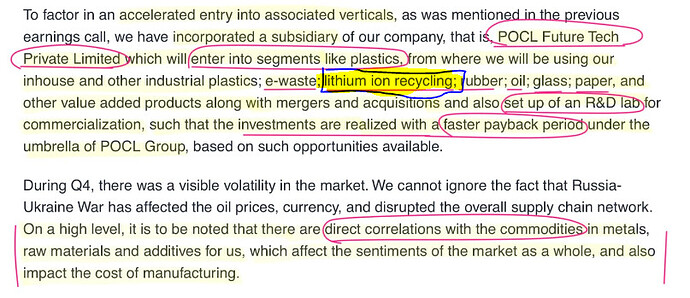

Company is diversifying recycling into aluminium and Plastics, as per earning call around 60 cores revenue may come from plastic segment in FY24 and product mix may change to 70-30 mix over next 2 years ( currently 90% lead and ( copper, alumunium, plastic generate 10% of revenue). Margin may improve with introduction of plastic segment.

Let me try and exhume this company story based on the recent development:

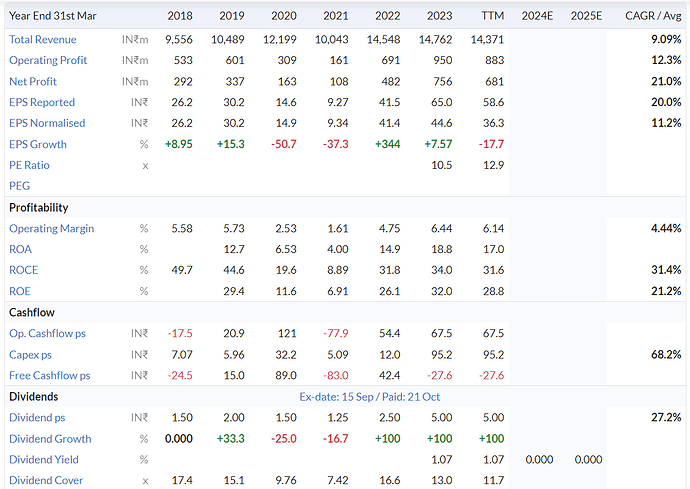

Lets start with the financials:

Last 5 year CAGR growth:

Revenue: 9%

Net Profit 21%

ROCE growing at 31.46%

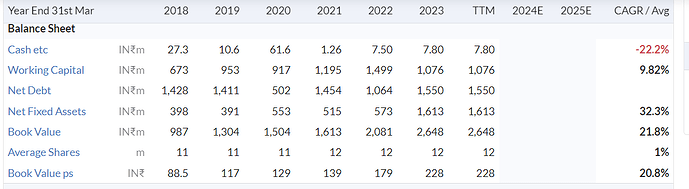

Balance Sheet:

Present PE: 12.6

Present ROCE and ROE:20.9 and 21.4 respectively

POCL has embarked on a diversification plan with focus on Aluminum (commercial production already started) and Plastics. Significant revenue contribution is expected from these verticals. The diversification and ramp up in these verticals will be a key monitorable

Financial risk profile has been comfortable, with networth of Rs 198 crore and debt of Rs 107 crore, resulting in gearing of under 0.6 time as on March 31, 2022. Financial risk profile should remain healthy supported by stable profitability in fiscal 2023, acquisition of Harsha Exito Engineering Pvt Ltd admitted in National Company Law Tribunal route and the absence of any large, debt-funded capital expenditure (capex)

SWOT Analysis

Strengths

- Established technology with a long history of use

- Reliability and robustness of lead-acid batteries

- Cost-effectiveness compared to alternative battery technologies

Strong business risk profile

POCL enjoys a strong business risk profile, which is supported by its well-entrenched relationships with key customers, diversified procurement and supply base, moderate entry barriers and established manufacturing capabilities. Clientele comprises reputed players such as Amara Raja Batteries Ltd, Sebang Global Battery Company Ltd and Glencore International AG. Relations with these customers span over 10-15 years, ensuring steady inflow of orders.

The company also has a well-diversified supplier and procurement base, with over 270 suppliers and procurement from over 90 countries. The import of lead scrap in India is subject to licensing from the Ministry of Environment and Forest, while setting up of lead recycling plants require permissions from central and state pollution boards, which results in entry barriers for new entrants.

POCL is focusing on aluminum and plastic verticals enabling diversification. It has already started commercial production for aluminum. POCL is expected to garner revenue from aluminum and plastic verticals fiscal 2024 onwards. Also, POCL is also exploring scaling up copper vertical. The diversification and revenue contribution from these verticals will be a key monitorable.

POCL has well-established manufacturing facilities providing it logistical advantage. Its Sriperumbudur plant in Tamil Nadu is close to the Chennai port while its Chittoor plant in Andhra Pradesh is close to the Amara Raja unit. POCL has emerged as a successful bidder for Harsha Exito Engineering Pvt Ltd admitted in National Company Law Tribunal (NCLT). This provides the company with developed asset base for expansion in terms of land bank, factory building and sheds etc.

Weaknesses

- Limited energy density compared to lithium-ion batteries

- Environmental concerns related to lead content and recycling

- Relatively shorter lifespan compared to some alternative battery technologies

Stiff competition from both unorganized and organized players and susceptibility to fluctuations in raw material prices

Risks associated with change in government policies related to tightened environmental norms

Opportunities:

- Growing demand for energy storage solutions

- Increasing adoption of electric vehicles and renewable energy sources

- Government initiatives and policies promoting sustainable energy

Threats

- Competition from alternative battery technologies such as lithium-ion batteries

- Strict environmental regulations and disposal requirements

- Volatility in raw material prices

Huge demand for lead acid batteries due to growth in telecom and datacenter growth (USD 59.6 Billion by the year 2032 with a CAGR of 6.9%, globally).

Demand for rear earth material including Lithium.

Growing importance for circular economy.

OUTLOOK (based on CRISIL)

Liquidity: Adequate

Outlook Stable

POCL will continue to benefit from its established position in the lead metal, lead alloys, and other nonferrous metals businesses along with longstanding relationships with reputed customers

Year 2023 Highlight

The Company successfully established and commenced operations of an Aluminium Recycling/Melting facility at its factory in Sriperumbudur,Tamil Nadu.

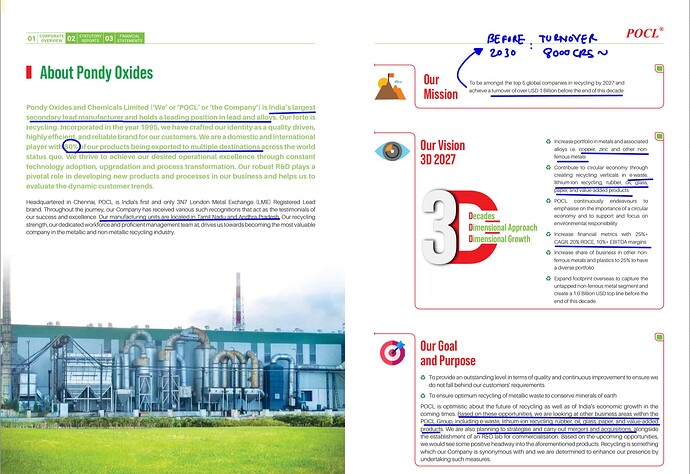

In AR the company says: “To achieve our ambitious goal of reaching a Billion dollar top line by 2030, we are exploring various verticals, with some projects in the feasibility stage and others in prefeasibility stage”.

So, the company has set a goal to increase the revenue to ~8000 crore by 2030 from current 1400 crore which is aprox 27%-28% CAGR for next 7 years which is very ambitious, same thing was conformed by the management in the Q1FY23 concall, when customer asked how confident are you to achieve this based on the current growth rate of 6% to 7% for which the company responded saying they are very very confident of achieving this based on the new portfolio additions and demand of circular economy they will ensure the walk the talk!.

Observation:

Looks like the company is poised to take the advantage of power sector growth as most of it’s products such as lead (batteries), aluminum (with 50 to 55% ), copper (EVs, consumer products, solar etc), required by the power sector

I’m the person who asked that question to the management ![]() And in my honest review, I would wait for them to deliver before passing any judgments.

And in my honest review, I would wait for them to deliver before passing any judgments.

You see, in that same 2024Q1 concall, the management earlier guided that their lead business will be growing in single digits, which is currently 90-95% of the overall sales. Also, they added that in the coming years, they expect the new products (aluminium & plastic) would be contributing at most 25% of the overall pie. So, you can expect a Lead-ValueAdd break up, as let’s assume in the next 2-3 years would be 75%-25%.

Against that backdrop, the legacy business (which will still remain a major contributor to the topline even in the future) is just growing at 6-9%, giving a 27% CAGR guidance for the remaining part of the decade in this case is more of an aspiration vs. a properly planned strategic mission.

Nevertheless, It’s still an evolving story with good base case valuations, and of course, I’m a hopeful and optimistic investor but my rationale would still not allow me to buy that argument at this point in time. This is also why I wanted to double-check what they said by asking… “I’m hopeful the management will walk the talk going ahead”! ![]()

Disc. Fully Invested

Nov24 concall summary. Any further views @i_mustafa ?

Financial Performance:

-

H1 FY24:

- Revenue: INR 392 crores, a 22% increase from Q2 FY23

- EBITDA: INR 52 crores, a 28% increase from Q2 FY23

- PAT: INR 19.89 crores, a 20% increase from Q2 FY23

Management’s Projections:

Revenue:

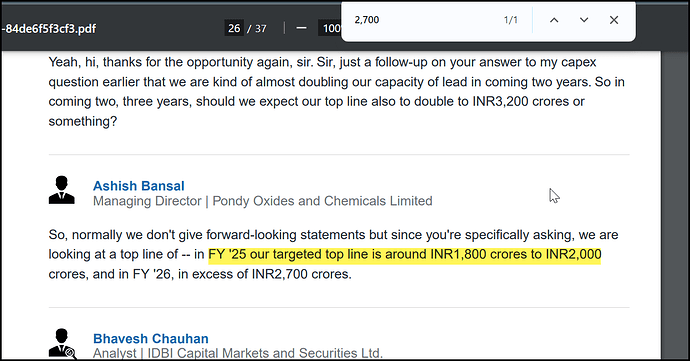

- FY24: Target range of INR 1,800 crores to INR 2,000 crores

- FY25: Expected to grow by 22% to 28% compared to FY24, reaching INR 2,204 crores to INR 2,560 crores

- FY26: Projected to exceed INR 2,700 crores, indicating a growth of 35% to 50% compared to FY25

Expansion Plans:

-

Doubling lead capacity:

- Key focus area for the next two years

- Construction of the new Harsha plant underway

- Expected to contribute significantly to increased lead production

-

Geographic expansion:

- Targeting new markets in Middle East, Europe, and Southeast Asia

- Leveraging existing expertise and established partnerships

- Aiming to become a global leader in lead recycling

-

New Verticals:

- Exploring opportunities in lithium-ion and rubber recycling

- Investing in research and development to develop new technologies

- Diversifying business portfolio and unlocking new revenue streams

Concall transcripts

Pondy Oxides & Chemicals Ltd

ROCE:- 24%

Market Cap:- Market Cap₹ 511 Cr.

P/E :- 14.1

Stock Price:- 439 Rupees

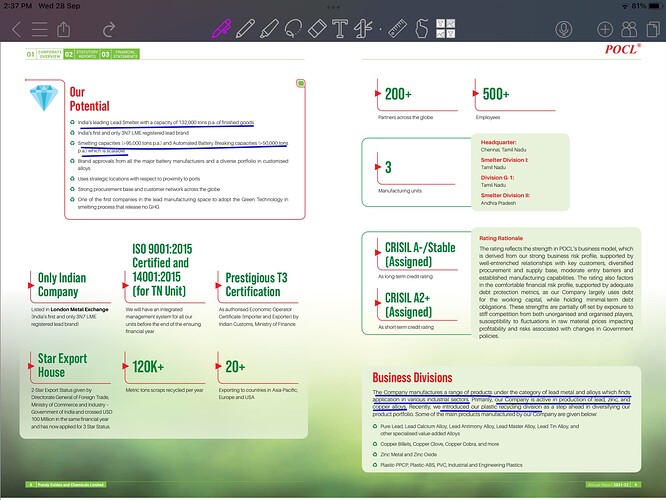

POCL is a leading manufacturer and recycler of Lead, Aluminium, Copper Alloys, and Plastics.

History

Pondy Oxides and Chemicals Ltd Incorporated as a public limited Company in Tamil Nadu and listed on the Madras and Coimbatore Stock Exchanges (Regional) at 1995.

Then They Set up Litharge, Red Lead and Zinc Oxide production plant in Pondicherry in 1996. In 2003, They Set up new unit in Tamil Nadu for lead acid batteries.

In 2015, They Set up new SMD-II plant in Andhra Pradesh.

In 2023, The Company successfully established and commenced operations of an Aluminium Recycling/Melting facility at its factory in Sriperumbudur, Tamil Nadu.

Business:-

They manufacture Lead, Tin, Aluminium, Copper Alloys, and Plastics.

Lead:-

Lead has been one of the oldest metal known to have widespread uses commonly due of its properties like easy extraction and to work with, highly malleable, corrosion resistant and so on.

Their Products :-

Lead alloys :- Pure lead, lead calcium alloy, lead antimony alloy, lead master alloy, lead tin alloy, and other specialised value-added alloys.

In lead, about 50% to 55% is the general pure lead and 45% to 50% is the alloys.

Uses:- The largest use of lead is in the lead acid battery industry. It is also used for radiation shielding, ammunitions, roofing sheets, extruded products, solders in the electronic, plumbing and automotive industry. Some other uses like cable sheathing, pigments, glass and others also contribute to the consumption of lead.

In cable industry where lead is used as a sheathing mechanism which is also growing and also there is radiation industry, x-ray machines and nuclear power plants.

Process:-

Procurement:-

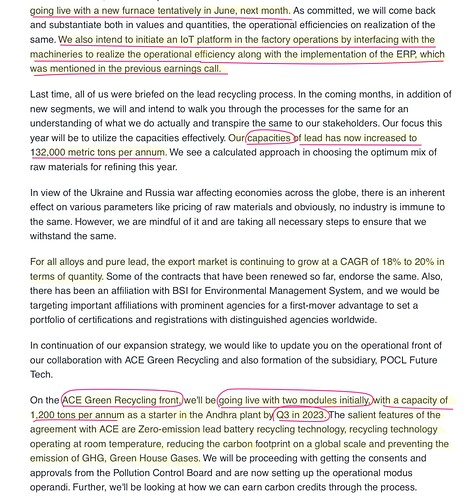

In terms of procurement, They have a mix of 75% imports and 25% domestic sourcing.

They do tie up with OEMs either battery manufacturing OEMs or car manufacturing OEMs and they collect batteries from their workshops.

For retail batteries that are being used by E rickshaw and especially in countries like India, they come from retail network.

The lead content in a Lead Battery is around 60 to 65%. It also contains some plastic, rubber etc.

Price is around around 50% - 60% of the L.M.E.(London Metal Exchange) Prices for 60%-65% of the Lead in the Battery.

Plants:-

SMD I - In Tamilnadu

SMD II - In Andhra Pradesh

SMD I has a capacity of 96,000 MTPA, in Tamilnadu.

SMD II has a capacity of 36,000 MTPA, in Andhra Pradesh.

Scrap Batteries Goes Into A First Auto Cutting Machine ( Acid Collection) - Belt Conveyor - Primary Shredder - Screw Conveyor - Secondary Crusher - Vibrating Separator ( Separates Lead And Other Materials ) - By Using Water Flow, Plastics are Separated ( As the density of the Plastic is low ) - Collection Of Lead Metal And Lead Powder - Then Melted in the Rotary Furnance

Customers:- Clientele comprises reputed players such as Amara Raja Batteries Ltd, Sebang Global Battery Company Ltd and Glencore International AG.

Their sales composition consists of 60% exports and 40% domestic proportion.

Aluminium :-

Products:-

Aluminium alloys, Aluminium and Aluminium Alloys.

Procurement:-

85% to 90% imported and the balance will be domestic.

Customers:- They are new in the business. They are getting orders from O.E.M.s.

They have plant in Tamilnadu with a Capacity of 14,750 MTPA.

Plastics:-

Products:- PPCP, Plastic-ABS, PVC, industrial and engineering plastics

Procurement:- currently 70% is procured domestically and 30% is from various other sources.

Customers:- The primary industry could be battery industry, furniture manufacturing, flooring sheets, paint manufacturers – paint boxes, and all these box packaging industry etc.

They have of capacity of 9,000 M.T.P.A.

93% Of The Revenue Comes from lead division.

And the rest 7% Comes From Plastic and Alumium Division and Copper Division.

Industry:-

The Global Recycling Industry was valued at USD 60.41 Billion by the end of 2022 and is projected to reach USD 88.01 Billion by 2030.

The Indian waste management market size is estimated at USD 32.09 Billion in 2023, and is expected to reach USD 35.87 Billion by 2028, registering a CAGR of 2.25% during the forecast period (FY 2023-28).

Lead

The lead market is projected to register a CAGR around 7% during the forecast period. The following graph shows the global lead acid battery market from the year 2022 till 2032 (value in USD Billion).

The global recycled lead market size is projected to hit around USD 20.4 billion by 2030 with a registered growth rate of 3.5% over 2020-2026 (Source: Precedence Research and GM Insights).

Indian Lead Market Outlook

Aluminium

The global aluminum market size was estimated around USD 179 Billion at end of the year 2022 and is expected to hit around USD 278 Billion by 2030, growing at a compound annual growth rate (CAGR) of 5.61% from 2022 to 2030.

Indian Aluminium Market Outlook

Total aluminium (primary and secondary) demand in India in fiscal 2022 is estimated at 3.9 million tonnes, logging a CAGR of 4-5% over fiscals 2015 to fiscal 2022.

Demand for secondary aluminium revived by 21-22% on-year and the industry increased at a CAGR of 10% to 1.66 million tonnes in fiscal 2022.

Thus, total secondary aluminium demand is expected to increase at a CAGR of 6-7% to reach 2.2-2.3 million tonnes by fiscal 2027, from current demand of 1.66 million tonnes in fiscal 2022.

The demand for secondary aluminium in India zoomed at a CAGR of 9-11% from fiscal 2015 and 2022, while primary aluminium demand registered a CAGR of 1-2% only.

The global market for copper estimated at USD170.9 Billion in the year 2022, is projected to reach a revised size of USD 242.8 Billion by 2027, registering a CAGR of 6.2% over the analysis period FY 2022-27.

India’s copper imports, are anticipated to grow 3.4% yearly to reach USD 6.9 Billion by 2026. In India, copper is an essential metal that has been widely used in various industries for centuries due its superior properties such as electrical conductivity, thermal conductivity, ductility, malleability, corrosion resistance and toughness among others.

the use of copper in India is to see an annual growth rate of 8% or more enabled by rising demand from traditional sectors such electrical applications, building and construction and white goods such as air-conditioners, refrigerators and washing machines and also from growing official focus on decarbonising the economy. Growing demand of copper will also be seen say for a creation of 1 mw of solar cell capacity, there will be requirement of 6 tonnes of copper.

Plastic

The global Plastic Recycling market size was valued at USD 44,290 million in 2022 and is forecast to a readjusted size of USD 65,050 million by 2029 with a CAGR of 5.6% during 2022-2029.

Indian Market For Recycled Plastics is anticipated to increase at a compound annual growth rate (CAGR) of 11.30% from FY 2023 to FY 2028, reaching 18.50 million tonnes (Source: Market Research and IMARC).

Management:-

Mr. Anil Kumar Bansal, B.Sc., holds the position of Executive Chairman and Whole-time Promoter Director. He has more than 25 years of experience in this industry.

Mr. Ashish Bansal holds an MBA degree and joined POCL in 2009. Elevated to the position of Managing Director in 2015.

Peers:-

Gravita India Ltd

Market Cap :- ₹ 7,179 Cr.

O.P.M :- 9%

FY 23 Revenue:- 2,801 Crores

R.O.C.E. :- 31.6%

Nile Ltd

Market Cap :- ₹ 268 Cr.

OPM :- 5%

FY 23 Revenue :- 806 Cr.

ROCE :- 15.0 %

Growth :-

- Capacity Expansion

They are operating at about 70%, 75% and They are targeting to double their capacities in the next two years.

Harsha Exito Engineering Private Ltd land is where the company is looking at adding the new verticals and also the current expansion on the lead capacity will be done at this specific site and which is ongoing at the moment.

- They have a target to achieve USD 1 Billion revenue before this decade.

- Battery Waste Management Rules 2022

The Government of India has recently introduced new rules on Extended Producer Responsibility (EPR) through Battery Waste Management Rules (2022) for battery waste management. These rules apply to battery manufacturers and importers, and are designed to ensure that they take responsibility for the collection, recycling, and disposal of their products.

- Unorganized To Organized

For Lead,

Only 30% - 35% Market is organized.

For Plastic,

10% would be in the organized sector and more than 90% would be in the unorganized sector.

- Aluminium And Plastic Division

These Plants are working on 30% Capacity only. As they are new in this segment, so it will take atleast one year to improve the capacity utilization. For Aluminium,market should be somewhere around 7 to 8 lakhs per annum

- Margin Expansion

Lead Segment Margin Is 5% - 6%. But, In Aluminium And Plastic Segment, Margin Can Go Up To Nearly 8% - 9%.

- Exploring diverse business domains within the POCL Group, including e-waste, lithium-ion recycling, rubber, oil, glass, paper, and value-added products.

- FY '25 our targeted top line is around INR1,800 crores to INR2,000 crores, and in FY '26, in excess of INR2,700 crores.

- We are definitely concentrating on value-added products.

- Inorganic Opportunities.

Risks:-

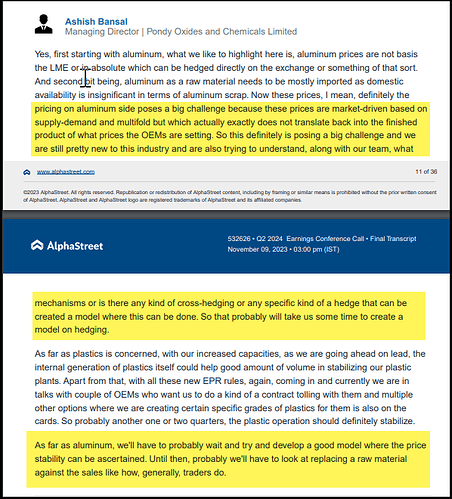

- Volatility in Commodity Prices. Aluminium prices are not the basis of the LME, So it cannot be hedged in the exchanges.

- Limited energy density compared to lithium-ion batteries - Environmental concerns related to lead content and recycling - Relatively shorter lifespan compared to some alternative battery technologies.

- Low Volume Growth On The Lead Segment. This segment has generated 93% Of their revenue.

- Their O.E.M. customers are trying to go backward integration in terms of getting compliant with the battery management handling rules.

- Slowdown in demand as the demand from China is very low.

- Difficulty in procuring batteries at cheaper prices.

Follow Me On X / Twitter :- sumantainvestor

No Reco

I don’t understand how you’re calculating EBITDA & PAT as 52 & 19.89 Cr respectively for Q2 FY23. Moreover, the topline projections are 1800-2000 Cr not for 2024FY, but I guess 2025FY.

If you ask me the key lookout is their execution in the Aluminum segment, as they are facing some challenges there, being new to the space and it is also affecting their gross and EBIT margins, which as per the prior discussions should have added positively to the margins but that is not the case currently. I understand this does not have significant contributions to the top line, but that itself is another lookout for the shareholders to increase the pie of these other value products and control over the Opex cost due to the recent acquisitions.

Valuations are still exciting but if you want to see some fireworks, they will have to show some good growth% at sales and EBITDA levels (which I expect to remain subdued for a quarter or two conservatively). Or expect Mr Market to price in those assumptions ahead of the fundamentals.

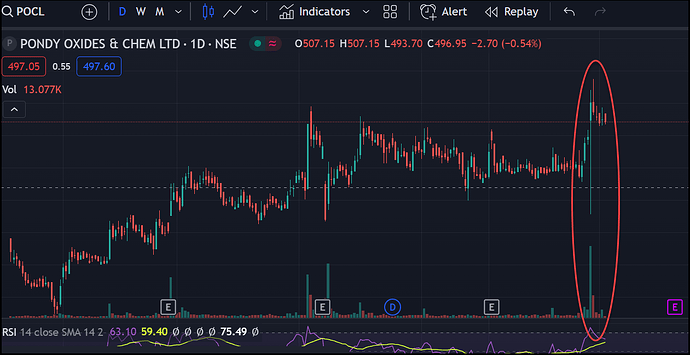

Technically, I see strong buying interest below 425 levels and the recent move in the share price validates these assumptions.

Daily

Weekly

Discl: Fully Invested

Pocl allot 10 lakh share

Pocl allott 10 lakh preferenceal share at 507 and issue convertable warrant for promtor equel to 7 lakh share is this not a red flag because current price was 853 per share why they not go with QIP I doubt management is going for personal profit someone reply please

I think management is greedy for money. Although this is according to sebi rule but this is not shareholders friendly decision.