Rising silver prices is clearly short term negative for PNGS. But this will provide opportunity for long term investors to accumulate.

Disclosure - Invested and hence biased. Transactions in last one month

PNGS Gargi has intimated the exchanges that they are raising funds through preferential allotment for which the meeting of board of directors is convened on 10 th July 2024 . I think this news might be the reason why the stock has zoomed in the last one week or 10 days

Pls review latest result

I am not able to buy the stock. What might be the reason? Is it low liquidity? And are there any workarounds?

Is there any answer from company regarding reduced export of natural diamonds and growth of lab grown diamonds?

Good news for organized sector companies in silver jewellary like PNGS Gargi

Their con call is on 5th Feb , here is my list of questions , may I please request everyone to provide their list also

- Sales mix and GM from own stores , own web site , SIS PNG , SIS non PNG and Amazon

- Total no of own stores , SIS PNG and SIS non PNG added in the current quarter and plan by mar 25 and by mar 26

- What is their market share in organised segment from fashion jewellery ; who do they consider as competitors in organised space ?

- How do they see trend and growth in the industry and and what’s their growth and margin guidance for FY 26 and 3 year guidance

- What is the SSG growth in Q3 and 9m FY 25 and guidance for FY 26

- What is the sustainable ebitda and Pat margin going forward , last quarter their ebitda margin is 32 pc and Pat of 25 pc

Concall is on 5th Feb

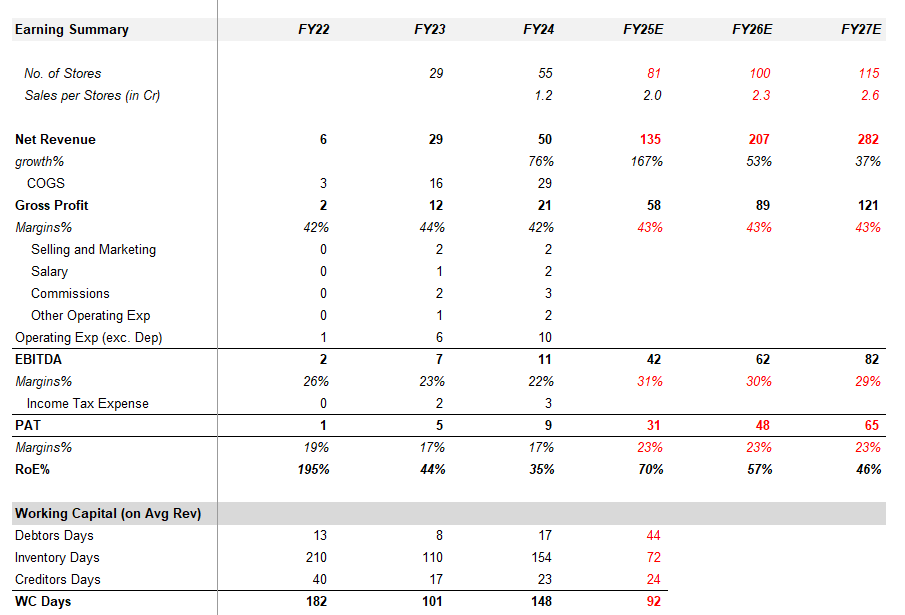

Here are my projections for PNGS. Incremental store addition will be low as they have maxxed out on existing parent stores - 30 new stores over FY25-27. Industry is growing at 25%, and I expect them to grow at 35-40% over the next 2-3 years. With marginally higher marketing cost (due to competition) and operating leverage, I expect margins to remain range-bound.

Thus PAT is expected to increase from current Run Rate of 30cr to 65cr over FY24-27; Currently the stock is valued at 10x P/S. If I look at the last valuation of unlisted fashion jewellers this are: Giva ~9x; Kushal Fashio Jewel ~8x; Sukkhi ~3x; But Gargi & Kushal is the only PAT profitable company with other companies doing -ve 20% EBITDA; So PNGS should command an higher multiple as FY25 P/E Ratio of 40-45x seems justified given the decent growth & profitability

Disclaimer: Invested 2yr back at much lower levels; I might sell in few months

Going by the past track record of management , they have been under promising and over delivering ; If industry growth is 25-30 pc , they should grow cagr of 50 pc for next 3-4 years which will take them to appx 400 cr of sales by FY 29 and PAT of around 80-90 cr

They have been introducing good products such as the one introduced 14c studded diamond jewellery . This forms almost 50 pc of their sales ; This product was a great product innovation

Would be interesting if they are able to leverage sales from shopper stop sis in future ; as of now this contributes only 5-6 pc of their sales .

I also think they would not expand too aggressively with their own stores on COCO model but would move on FOFO model which would be asset light .

I liked the management approach of growing without cash burn but as the sane time they should not turn over cautious and miss the industry tailwind

I feel in the last concall Q3FY2025, the guidance was muted, they mentioned about clocking 200 cr revenue by FY2028, that seems to be a slow pace growth given the fact that in last 9 months they have already clocked 100 Cr. Any thoughts from anyone tracking this.

They opened 2 shops recently. Management is promising. Only issue is with their guidance. Personally I was expecting 40% growth guidance (and outperforming that) because of favorable tax cuts, disposable money raised by QIP etc. I’ve concentrated bet on this company. Will see how it pans out.

I think few things stood out in concall for myself

- 250 Crore revenue possibility by FY28 as per Inventory turns (Rajesh question at the end)

- Tax cuts, disposable money is not factored in and can increase growth

- Lab Grown Diamond is not an issue for them and not preferred compared to Natural diamonds

They generally under promise and over deliver considering profitablility as key criteria

Invested since long

Its 2 year old SME company who is declaring quarterly results (when not mandated) and doing six monthly concalls. Post listing, company has performed exceptionally well as can be seen from stock price also. Its parent company (PNG & Sons) is 150+ years old and very well known in Maharashtra for its integrity, trust and conservative nature. Current director (Mr. Modak) of PNGS Gargi is CEO of PNG and Sons. Being new to the stock market (PNG & Sons is unlisted), I expect them to be conservative (sometime ultra conservative) while giving guidance on future performance. But as an investor, I would much prefer them to under promise and over deliver (which is what they are doing till now) than the other way round.

Conservative guidance disappoints the market in the short term but their actions (opening new stores, launching new designs, trying new material etc ) are quite aggressive. Going forward, I would not mind if they continue to guide 30% growth but double it (60%+) in actual results … ![]()

Disclosure - invested and forms large part of my PF. This is not a buy or sell recommendation.

4 consecutive lower circuits after concall. Market has not taken concall lightly and feels de-rating started somehow.

Don’t think so…its thinly traded SME stock…look at last few months…its either lower or upper circuit…(BTW it has hit upper circuit today ) thats the nature of the beast…ás long as fundamentals are great, price oscillations gives opportunity for long term investors to accumulate

I found it odd that they weren’t really tracking the sales from exclusive brand stores, their reasoning being it’s too new to track. Even if they are new the footfall/ revenue from these stores should give a good sense of brand pull ( which I feel is non existent).

Their growth till now was driven by PNG SIS, since the growth from SIS wouldn’t be as much as it was previously plus online not being a priority for them, it will be very important to understand the unit economics of their exclusive brand stores.

I checked out their SIS at Shopperstop, they sit right next to GIVA. The designs felt similar but GIVA has a better brand pull. Unfortunately none of their exclusive brand stores are near me. It would be great if someone can check those out.

Disclaimer: No positions. Tracking

I listened to the Gargi Concall and here are my observations.

NOTE : Do not treat this as a transcript of the call or management guidance, pls refer to the concall recording if you wish to know what the management has mentioned.

30% Revenue and Ebidta projections Based on industry Growth guided by management. This is the lower end of guidance numbers by management. They hinted at doing better than this. Though I am tempted to put in 40% ![]() I have considered 35% to be on safer side.

I have considered 35% to be on safer side.

| Fiscal Year | Revenue (30% CAGR) | EBITDA (30%) | Revenue (35% CAGR) | EBITDA (30%) |

|---|---|---|---|---|

| FY25 | 100 | 30 | 100 | 30 |

| FY26 | 130 | 39 | 135 | 41 |

| FY27 | 169 | 51 | 182 | 55 |

| FY28 | 220 | 66 | 246 | 74 |

Current store count and its breakup as of today:

| Store Type | Count |

|---|---|

| EBO (Own Stores) | 5 |

| Franchisee Stores | 9 |

| PNG SIS Locations | 31 |

| Shopper Stop SIS | 38 |

| Museum Location | 1 |

| Total Locations | 84 |

Since there is no investor ppt created by management , I have tried to put down the numbers in a table as per the info in the call.

| Store Type | FY25 (Current) | FY26 (Target) | Net Addition |

|---|---|---|---|

| EBOs - Own Stores | 5 | ||

| EBOs - Franchisee Stores | 9 | 24 | +10 |

| PNG SIS Locations | 31 | 41 | +10 |

| Other Brand SIS | 0 | 10 | +10 |

| Shopper Stop SIS | 38 | 42-47 | +4 to +7 |

| Museum Location | 1 | 1 | 0 |

| Total Locations | 84 | 118 - 123 | +34 to +37 |

We can infer that The store additions for fy26 is around 40-45% as per the numbers discussed in the call.

Current Sales mix b2c:

| Channel | Revenue Contribution |

|---|---|

| PNG SIS | 80 % |

| Own Stores | 12 % |

| Online Sales | 4 % |

| Shopper Stop SIS | 4 % |

Current Margins :

| Metric | Value |

|---|---|

| Gross Margin | 43% |

| EBITDA Margin | 30% |

| PAT Margin | 25% |

Some more points mentioned in the call :

- Inventory is 20 crores and inventory days are 200.

- They have single set of design for entire India as a geography as its fashion jewellery.

- If gold prices go up , Gargi has a advantage of customers coming in more for fashion jewellery.

- Management mentioned Market share of 0.25% of the organized sector in the fashion jewellery , but I think its 0.25% of the whole organised + unorganised and around 4% or organised.

Sales mix as of q3 fy25:

| Category | Revenue Share |

|---|---|

| Silver Jewelry | 48% |

| Diamond Studded | 43% |

| Others | 9% |

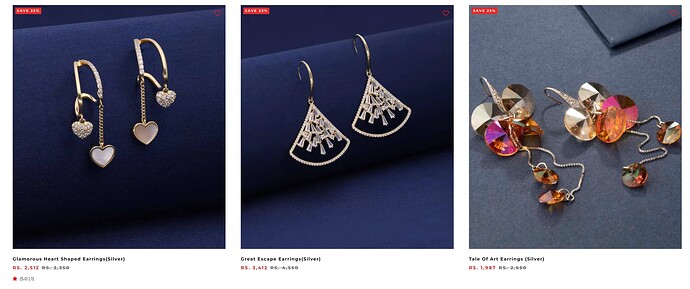

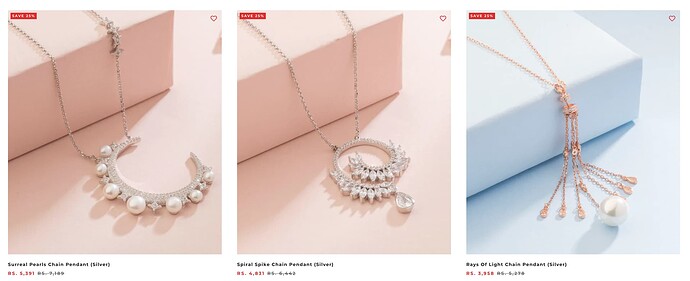

Some collections as seen today on their online store :

Buy Silver Necklace online at Gargi by PNG | Jewellery

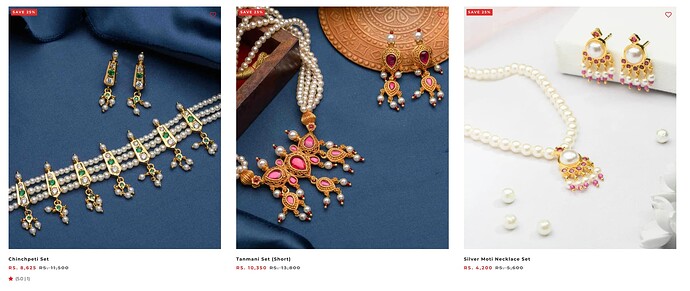

They launched new series and a new site which is wedding focused sub brand of Gargi

Some collections seen in Utsaav which was launched few days back :

Disclosure : Added in the last 30 days.