What is the record date for the right issue??

It’s just a draft letter. Not live.

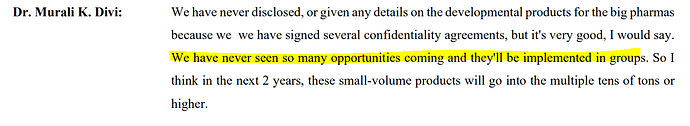

@paragbharambe , great job in squeezing out important and interesting details from large document like Draft letter for rights issue. I am disappointed by 0.75% brand royalty. Is it not mandatory for company to disclose this signing of brand licensing agreement as I don’t recall company disclosing it earlier to the stock exchanges. Seems like a lapse in corporate governance… ![]() Also it means PEL also may be paying this to Piramal Corporate Services…who knows…

Also it means PEL also may be paying this to Piramal Corporate Services…who knows…

I am surprised by the figure too. it was hiding under the carpet but rights issue brought this forward. I am sure PEL will be paying this too. On a revenue of 7000 cr (PPL), Piramal are getting 50 cr every year, which is growing YOY irrespective of company performance.

Very disappointing. They have not talked about this Royalty item any time any where in the past 2 years publicly. Even if they don’t want to charge it and do not charge it (Like Muthooth Finance company) still, letting minority investors know about this royalty agreement is ethical.

PPL’s client got one product approval, which PPL has been helping since research to commercialisation phase as per this article.

There are similar products in the market “And they’re all blockbusters — Jardiance notched sales of $4.3 billion, Farxiga $3 billion and Invokana $563 million in 2021.”

TheracosBio seems small compared to other companies, so their sales won’t match other competitors but it shall help PPL get few millions of sales for API/FD next years as TheracosBio is hoping to launch the product by June 2023 .

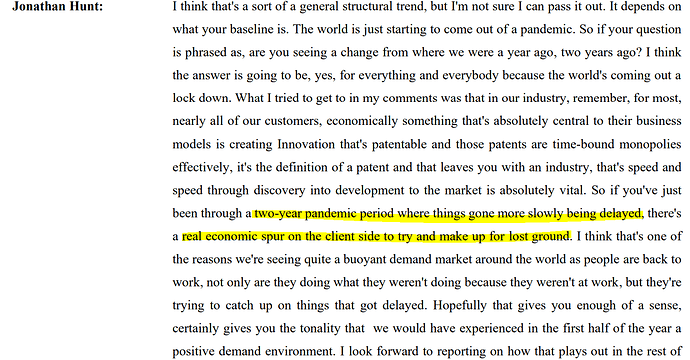

BQ Prime has done very good interview with Dr Chava about CDMO space in general.

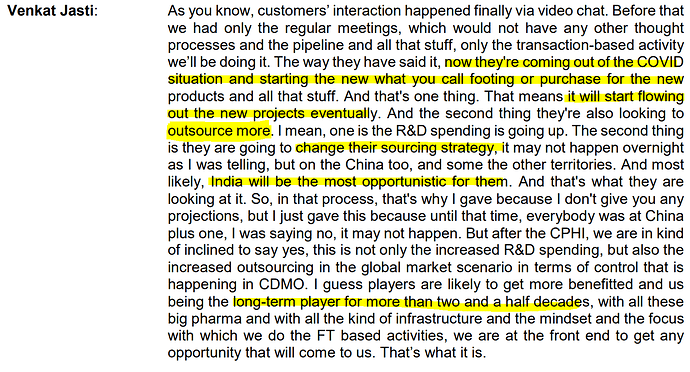

Pharma companies are freezing their partnerships in the next two months. If that is the case, pharma companies would like to partner with companies with high governance and quality track records and invest ahead of time to build the required capacities. PPL tick all the boxes, so this shall bode well for them.

PPL also hinted that they see increasing customer action for their phase 3 molecule.

Divis also said the same thing.

Syngene made a huge investment in its biologics manufacturing facilities first. Once they were ready, then Zoetis signed ten years deal with $500 million with them.

Suven also said the same thing. Syngene said the same something a few quarters back after work started recovering from Covid.

Dr Chava suggested that pharma companies would like to partner with companies with spare capacities. Earlier, having a spare capacity was difficult as companies tried to make the most of their capacities. In the CDMO world, spare capacity is an advantage. Also, CDMO players need to build capacities as well as enhance capabilities to stay relevant in the market. From planning to getting becoming a commercial takes anything between 3 to 5 years. Companies which have their molecule in phase 3 want to have spare capacities as they do not want to end up in a position to relook at the supply chain.

PPL’s current Capex seems to the in line with this IMO. The capacities they are building will become operational and QA validations after 2/3 years down the line, possibly more for some areas. However, the willingness to invest even when they are going through a tough phase will give clients lots of confidence when selecting PPL for CDMO players.

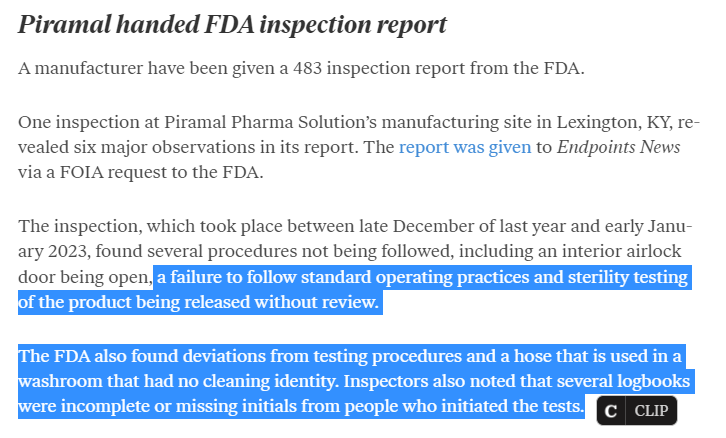

This is VAI not OAI and is now closed as well - https://www.fiercepharma.com/manufacturing/piramal-gets-form-483-kentucky-begins-api-production-michigan

Was listening to Piramal Pharma’s Q4 concall.

Broad brush takeaways -

Piramal Pharma can potentially clock 1200 cr plus EBITDA for FY 24

Profitability at PAT levels also likely to improve significantly next year

Most improvements to accelerate in H2 FY 24

Beauty is the the eye of beholder

Everyone can judge for themselves wrt current Mkt Cap

Disc: biased, holding a tracking position

Last year too they claim H2 will be better than H1 but Q3 turned out to be loss and during Q3 concall they denied having said this.

I think we should wait and see if the management is doing walk the talk. Also they have rights issue planned so they have to paint a rosy picture

Can someone please confirm has Piramal pharma issued Warrants ?? I could not find any communication initiated by the company to the exchange.

Rough Calculation on Piramal Pharma Valuation: (All based on my assumptions)

Piramal Pharma ( SOTP Valuation) - Fair Value: 130

CDMO: 4000cr (55% Generic)

GENERIC: 600cr= O value ( worst)

CMO: 1600 *1 = 1600cr ( Lumpy business)

Innovator CDMO: 1800 *10 = price to Sales = 5 to 8 price to Sales = 1.5 Billion dollars ( best business)

Complex Generic:2200cr= *3-4 = 1billion ( Good profit)

Consumer Healthcare:800cr* 5 = 4000CR ( not profitable)

CMP: 100

No of shares: 119

Raising 1000cr : expected 12cr extra shares

Current EV : 17.5k crores after dilution (Net debt)

Total share: 130cr shares

Capex: Fy23 major Capex done Growth (1000cr)

Capex: Fy24 ( rough 700cr )

Valuation based on Ev/Ebitda - Blended basis 15

1200cr - 15multiple. - 18k company

1200cr - 20 multiple - 25k company

Avoiding EPS Calculation: It will go on toss. (Depreciation very high + equity shares loaded)

Will update once we get exact dilution numbers.

What should be retail investors strategy in this stock ?

My understanding is Stock price of PPL would be pumped up so that Rights issue can be priced at higher level. As Rights issue is generally lower than market price.

Once Rights issue is announced Price of PPL will fall.

Rights issue announced. @rs 81. Entitlement 5 for every 46 shares held

How does one pay for it? I got an email stating my rights allotted shares will be in my demat account as I have PP shares. Now what do I do to buy those at the allotted rates?

Is there any prior posts that explain the steps ?

per the email received, i think rights issue is going to open on Aug 8.

I just googled “how to apply + your broker name” and got a small video.

please try that.

I received this email, and today I got shares in my demat account. But please, someone can explain to me in simple terms what is that means. , Piramal Pharma Ltd. has announced a Rights Issue of 5 (Five) Equity Shares of Rs.10/- each for cash at a premium of Rs.71/- per Share on Rights Basis for every 46 (Forty Six) Equity Shares held as of the record date of August 2, 2023

The company will issue Right Entitlements (RE’s) to anyone who holds its shares on the record date. These RE’s will be temporarily traded on the stock exchanges and will then be extinguished. You can either use the RE’s to apply for the rights shares of the company or you can sell them in the market.

It means that for every 46 shares you owned pre rights issue, you will get 5 additional shares of the Co at a price of 81Rs each. These will be granted as REs which can be bought and sold in the market like shares till such time as the REs are converted into actual stocks of PPL. If you choose to convert the REs to PPL shares, you will get additional PPL shares at 81 Rs per share. Or if you want to cash them, you can sell them in the open market at the market trading price.

And how is that done? I go to the bank site and apply for rights issue or go to the linktimes site and enter my demat details and such?

The bank site application confuses me as I dont want to apply afresh, just pay for the existing shares newly in my demat