I agree with you but we have to understand that Piccadily not going to make profit on 4360 rupees…

The selling price of Piccadily should have been much lower than the 4360. There is around 30% excise duty on liquor… and there will 10-20% profit for vendors . A 4200 rupees bottle might be having selling price of around 2000 to 2500 rupees for Piccadily… accordingly we may calculate the profit and sale of Piccadily.

Camikara 12Y old is available in the UK for £80 - £90.

since i am from same industry i would like share some key inputs . Premium Branded IMFL segmented is dominated by MNC i.e Pernod Ricard , Diageo , Suntory , William Grants , Bacardi . Pernod Ricard dominates premium segment above Blenders pride segment and there is virtual duopoly with Pernod and Diageo enjoying huge shares .Only brand which has been able to make some dent in premium segment is Rockford from Modi Distilleries rest all companies have tried to break monooly of Pernod but none succeeded . Coming to Bottled in India scotches Diageo enjoys better shares with brands like Black Dog , Black & White , Vat 69 . Pernod with 100 Pipers, Passport , Oken Glow is close second . Suntory with Teachers also has good share. Bacardi with Dewar’s white label ,William Lawson is also doing good .Pernod is now bottling Ballentine in India William Grant is also bottling Grants in India . In BIO blended whisky segment Diageo, Pernod enjoy huge shares i.e Diageo with Johnnie Walker Range of Whiskies , huge range of single malts , coal ila , Glenkinchhie , etc Pernod with Chivas , Ballentine , Royal Salutes Glenlivet . Grants with Glenfiddich Grants also has huge range and all MNC has good portfolio of BII and BIO brands and market for premium brands is growing more than 20%.

It will be good if you share some feedback on Indri and Camikara

Thanks for your insights .Whats your take of Indri -i mean any consumer insights you have ? they are getting shares from what kind of TG ,brands ?

Will share an overview on Indian Single malts soon .

Premium Rum is tough category to crack. Indian Dark rum is primarily regular segment . I.e Old Monk , McDowell’s Celebration Contessa etc . Bacardi is trying to premiumize rum category for long but they have received limited success. India still remains a whiskey market so Indri ,its special editions will keep on doing well . But almost all Indian liquor companies are now trying jump into single malt band wagon. So competition will certainly increase .l

I have tried Rampur. Its very bad (tastes like acid and is poor quality). Dont know how they manage to get the price they sell at. Amrut is decent. Yet to try Indri. Everyone who has had Indri says its very nice.

Same master blender Surendra Kumar at Indri who was at Amrut for long time and now with Piccadily agro. No wonder Indri quality wud be as good as Amrut the big success story specially in exports

Pretty impressive reach for a relatively new brand I’d say. I did try Indri at one of the cafes mentioned in Delhi. But was just impressed at the unending list!

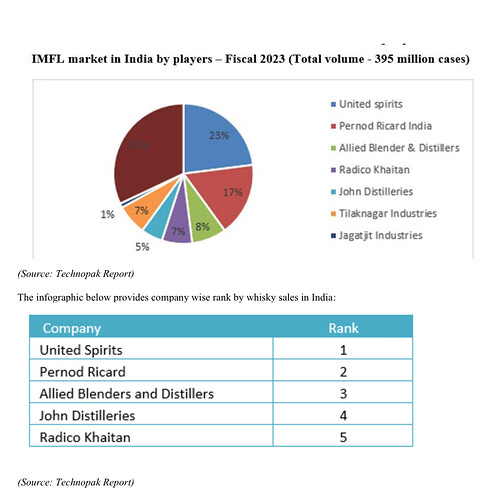

A new IPO has hit the market - Allied Blenders & Distillers Limited.

The company is being valued at ~7600cr and has an EBITDA of about 200-250cr, with an EBITDA margin of ~7% and growth rate of ~10-12%. (source: ABDL’s RHP Pg 355)

Compared to this, Piccadily Agro, based on Q4 numbers, has an annualized EBITDA of 250cr, EBITDA margin >30%, growth rate >40%. Yet, its current marketcap is 7000cr - less than ABDL!!

Clearly, Piccadily Agro is extremely undervalued on market comparables basis.

In a bull market, everything tends to be valued with higher expectations. It’s important not to compare an IPO price, which is decided by management and merchant bankers, with the stock price, which is determined by the market. If Piccadilly can maintain a growth rate that meets market expectations, it is not richly valued. However, if the growth rate declines, it may be overvalued.

So, as per you, whatever price the management and the merchant bankers decide is OK. There is no need for market investors in IPO !!! If anything, merchant bankers base their decision based on what market will accept. And majority investors in IPO/QIB are institutions who are the ultimate arbitiers of true value of a stock.

Institutions can fail at valuations too, just like retail, WeWork is an example. And, they may not know the qualitative aspects of the business and management, which can impact the price after a business gets listed. So, there is merit in the argument that valuations can be inflated before IPOs.

No investment in Piccadily.

Very intriguing piece of information, taken from DRHP of Allied Blenders and Distillers Ltd.

Piccadily is not even mentioned.

Disc- invested from lower levels

Found this video very much insightful!

They are creating a visitor building with a golf course trying to emulate Sula

So what is the point? Undiscovered or there is no standing of it in industry?

With the little knowledge I have of capital markets, I find it little difficult to compare as Allied Blenders focuses more on volume growth with their entry level IMFL segment whiskey (OPM 7%) as compared to Piccadily which is more into the premium segment with more focus on margin growth as compared to volume with OPM of 25%. Still volume wise, Piccadily still has a long way to go. Hopefully the ongoing capacity expansion which gets completed next year will help with volume growth. Also, since the number of investors in Piccadily has gone up from 21k to 70k in past 3 years, whether the stock is still undiscovered is anyone’s guess.

Request senior VP members to correct my mistakes