Except for first line, there is nothing much ![]()

![]()

Presentation and announcement

https://www.bseindia.com/xml-data/corpfiling/AttachLive/2f482e3e-f6d3-4bf2-ad8d-6f33302eff0c.pdf

Great results.

Ball has started rolling

73% GM and this business will add 200 crs at the top line…and EBIT accretive…

PI may attain 8000cr topline this FY…and also the presentation, data is full of disclosures… 60% improvement in cash flow !!

Incident PI Industries Jambusar plant

Company’s reply on it…" the situation is entirely under control and there is no

cause for concern".

PI Industries and Koppert forge a strategic alliance to work on a

sustainable Agriculture Agenda.

Notes from Q1 FY24 Earnings Conference Call Transcript

India is already the 4th largest producer of Agchem, and now No. 2 in the world

Still Growing:

Given a target of between 18% to 20% revenue growth in the

current fiscal year

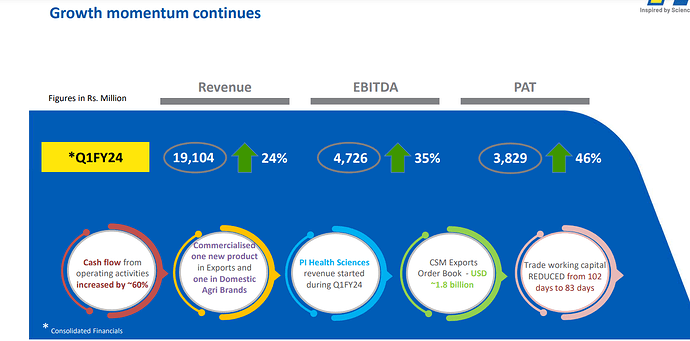

PI overall year-on-year basis during Q1,

- a 24% revenue growth and

- a 35% increase in EBITDA and

- a profit after tax recorded a 46%

- exports with a 33% growth year-on-year

Subdued domestic growth due to monsoons

Five innovative products are planned for this fiscal year

In Q1, we have launched

EKETSU. EKETSU is India’s first three-way herbicide mixture to provide maximum

weed control and efficacy for total control in rice herbicides

- Commercialized one new molecule and remained well on track for

- commercializing 4 to 5 new molecules every year as guided earlier.

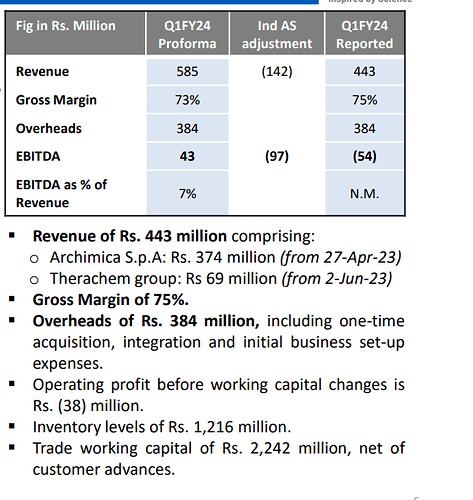

Integration on target as per KPI’s

14%-15% margin target during transition and 20% - 24% after stabilisation

Destocking is happening at the channel level and not at the consumption level

Work is on to diversify the revenue streams:

Non Agchem products including electronic chemicals, specialty polymers etc

Exports Data: ( Source Redboxglobal Twitter)

Chemical Exports for Aug’23

PI Industries

- PI Industries exports increased by 35% yoy to Rs 5,390mn in Aug’23 while YTD exports increased by 22% yoy to Rs 24,819mn.

- Pyroxasulfone volumes increased by 50% yoy in Aug’23 while YTD export volumes increased by 51% yoy.

- Pyroxasulfone sales increased by 48% yoy to Rs 3,647mn and stood at 68% of overall revenue in Aug’23 while YTD Pyroxasulfone sales increased by 59% yoy to Rs 15,515mn and stood at 63% of overall revenues.

- Ex-Pyroxasulfone revenues increased by 15% yoy to Rs 1,743mn in Aug’23 while YTD Ex-Pyroxasulfone revenues declined by 7% yoy to Rs 9,296mn

Can anyone Explain why outsourcing CSM in India is better to the innovator companies as compared to the other countries?

Thanks and Regards,

Naman

I assume its mostly low cost and good talent available in india.

Also a few questions regarding the company.

- What kind of molecule does the company perform CSM on?

- Does the company need to do separate capex on every new molecule they do CSM on?

- What is the order book recognition period for ~1.8 billion USD?

Thanks & regards,

Naman

Also few ques regarding to company

- Pharma CSM competitor to PIIND?

- Speciality chemical is also on the deversification list of PIIND ?

Thankyou

regards

Sanket

There was a very good interview on agropages recently, I am capturing the summary below

02.11.2023 Agropages

-

Competitive advantage lies in technological edge

-

Recently operationalized “Flow chemistry” and “Azide chemistry” at commercial scale

-

Developed facility for high pressure oxidation involving toxic fluorinated compound and vapor phase fluorination synthesis

-

-

15 MPPs

-

R&D

-

Early-stage patented molecules, complex chemistries

-

FY23 R&D: 186 cr. (3% of sales)

-

Only integrated single-site centre encompassing chemical synthesis to biological evaluation to process development to scale-up

-

800+ employees including 500+ scientists, 185+ PhDs

-

50+ projects encompassing agrochemistry, electronic chemicals, and product lifecycle management

-

-

Non-agchem products: electronic chemicals, imaging chemicals, specialty chemicals

-

Making manufacturing sites zero discharge

-

Introduced a captive solar power project of capacity 637 KWp

-

Growth driven by exports underpinned by presence in knowledge space and not generics and commodities

-

Prominent brands: NOMINEE GOLD, AWKIRA, ROKET, OSHEEN, DINOACE, BIOVITA, KEEFUN, and HUMESOL

-

Reach: 3+ mn farmers in India

Disclosure: Invested (position size here, no transactions in last-30 days)

Here is the news

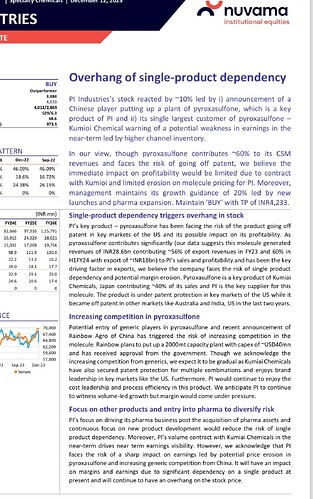

The dependence of Pyroxasulfone on revenues of PI is significant, as available all over the internet. Management declining to provide the revenue share of this molecule was not good:

(1) Huge Headroom For Growth In Pyroxasulfone Market, Expect 18-20% Growth In FY24 : PI Industries - YouTube

However, we have to accept their assessment that the market is large enough to not impact PI on face value. We have to watch this for sure.

He declined to comment on this due to confidentiality agreement.

Then it is a valid reason. However, this information is available. One such source:

PI_company_update.pdf (jmflresearch.com)

some important points from it and CNBC interview management gave.

- China already has some capacity.

- Patent expiring in 2025 and beyond in different countries at different time. China patent has already expired.

- Rainbow Agro is third largest pesticide company in China. It should take some time to put up plant and stabilize it.

- PI has very diversified portfolio. (broker report seems to suggest that it is still has sizable position)

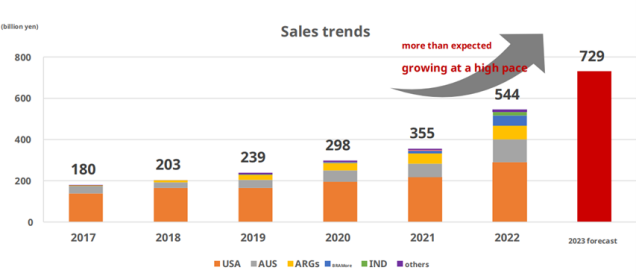

As per PI Ind and other broker reports Pyroxasulfone still in growth phase, even chart suggest that.

there must be many partners making it for Kumiai?

Disclosure: invested