FY23Q4 concall notes

- 26% FY23 export growth: 11% volume + 15% price, currency and product mix

- 12% FY23 domestic growth: 8% volume + 4% price, currency and product mix

- Huge reduction in working capital (from 103 days in FY22 to 79 days in FY23). There won’t be further improvement

- Not witnessing any significant change in demand of innovative products

- Expect 18-20% growth going forward (all driven by volume growth) and improvement in margins in FY24

- Revenue recognition is a mix of revenue booking at time of shipping and revenue booking when customer gets the shipment

- 2% lower gross margin (vs Q3) was due to change in product mix

- Agchem capex: 300 cr. carried forward from FY23 + 600 cr. Expect 900 cr. of capex going forward (time frame not specified). In FY23, did capex of 339 cr. (vs 500 cr. guidance in FY22Q4)

- CSM: 17-18% revenue from products launched in last 4-5 years. This was 16-17% in FY22

- Pharma will contribute 550-600 cr. revenues in FY24 at 15-18% EBITDA margins (depending on when transactions get closed and nos get consolidated with PI)

- Pharma capex: Expect $10-12mn (not yet finalized)

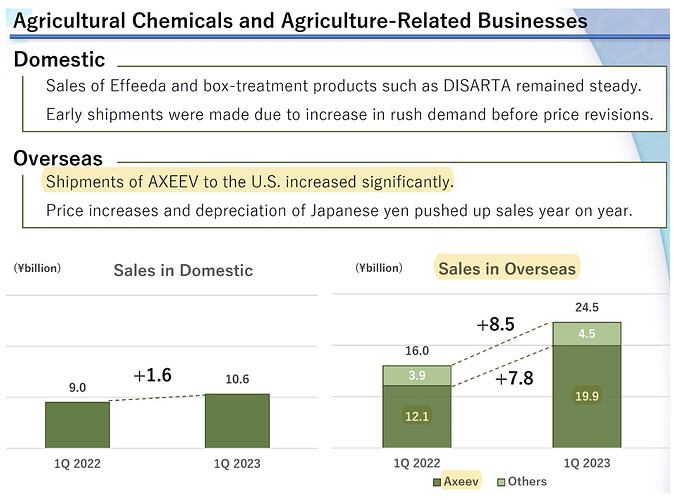

- Kumiai achieved 64% growth in Axeev (pyroxasulfone) in last quarter

Disclosure: Invested (position size here, no transactions in last-30 days)