So, whats the verdict on results? Any red flags?

Also short term borrowings and receivables have gone up sharply. Will the be a concall?

Yes, thats correct

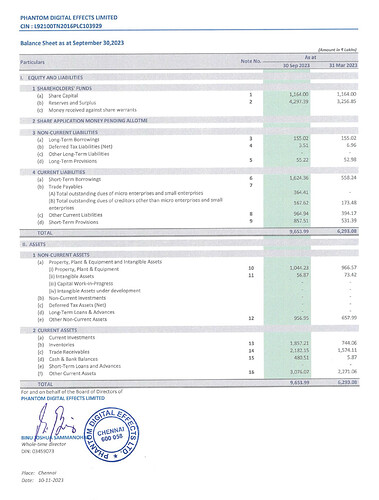

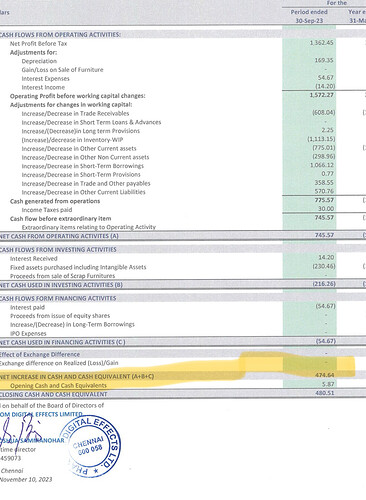

There is however healthy cash generation during the period despite increase in working capital

During last year’s Q2 results also, they have compared H1 vs H1. Infact, reporting and disclosures have improved this year with 1) more comparison vs prior like for like periods. 2) good to see balance sheet comparison now with fiscal end.

Anyone has an idea if they are hosting analyst/investor meeting?

What is short term borrowing? From some bank? NBFC? If so, why are they reporting it under operating activities instead of financing activities?

When you put this together with their recent efforts to raise further money; I suspect they are facing a reasonable cash flow issue.

2 surprising elements for me from results.

Appreciate if experts tracking the company can help me understand:

-

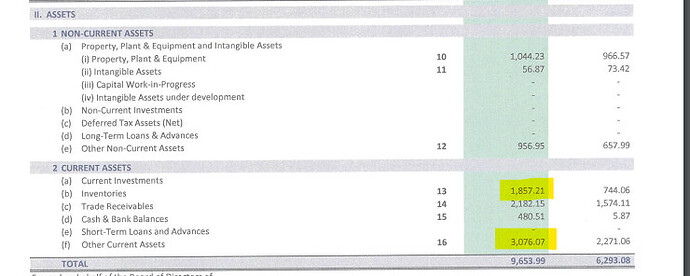

Inventories: Why a sharp increase of Rs11cr in Inventories (cash outflow)? Why would there be a big Inventory on Balance Sheet for Phantom, wondering what would that constitute for VFX player?

-

ST loans: Seems this inventory is funded by short term borrowings, and therefore a similar increase in ST borrowings. This is worth clarifying with management, if they haven’t mentioned this before. Also, is it loans/advances from third parties?

Again, as mentioned in your post, ST loans should be a financing activity and not operating cash flow. However, when I checked their Annual Report, they always treated this ST borrowings as operating cash which is surprising.

They left note references on balance sheet items in their release, however do not have actual notes ![]()

Short term borrowing (STB) is from Bank in the form of Over draft (OD). It is backed with Account Receivables as Collateral (Src:AR)

As some portion of Trade Receivables (TRs) is already used / received indirectly in the form of Short term borrowings, the same needs to be adjusted from the overall TRs…that’s the reason it is shown under Operating Activities → Adjustments for Changes in Working Capital so that this STB amount is deducted from the TRs

For example, if the total TRs is 100/- and from that company has already used 40/- in the form of STBs / OD …then the balance TRs has to be 100-40 = 60/- and can’t be still shown as 100/-

Thanks for your clear explanation. Do you know reason for increase in inventory?

Inventories:

This is the actual amount of VFX work done by PhantomFX against client’s order. Since Invoices for this work is not yet raised, the same is shown as Inventory / Work In Progress line item.

Billing in VFX industry is usually done on reaching a milestone like some 40%, 70%, 100% of work completion or on completion of a particular phase and the corresponding documents / exe file pertaining to that phase are delivered.

All projects which starts and ended in a particular quarter will be billed in the same quarter.

Any projects where considerable work pertaining to that milestone/ phase has been done, but is not yet 100% complete will be treated as WIP item and shown under Inventory

Usually this happens when the work has recently started in the last month of that quarter and the milestone is not yet reached or in case of some big projects where completion of each milestone itself could take more than a quarter time…like for Ayalaan movie which has 4500+ VFX shots

We can’t expect every project starts and ends within a quarter and every quarter they would be starting with a fresh set of projects…this is a common scenario for every VFX company, but for some reason other VFX companies don’t show it … probably it’s not big enough for them to show or for some other reason

For PhantomFX, this number is usually in the range of 1-3 Crs in previous quarters. But this quarter this has raised to around 11.3 Crs indicating that they could be working on some big projects.

Since this work is only on client’s order, we can safely assume that major portion of it would be billed in next quarter for sure… meaning we would see a big jump in Revenue in next Qtr

ST loans:

Please check my previous post on ST borrowings.

Note that as the company is growing, adding new clients and working on bigger projects, their WC needs also would be going up with increase in TRs and Inventories…I feel OD is good enough as this is a short term need and also keeping in mind that this amount keeps fluctuating either way on a QoQ basis or rather on a Weekly basis.

@Venky_Thiriveedhi

nice explanation,

Let me give my take so what happiness is my understanding is the real cash received is in the beginning and the end of the project and in between is all revenue recognition or very small payments.

Like i get 20% as advance now as and when I complete a %of project I am supposed to recognize revenue but I have a understanding that in reality you actually dont get a lot of money in between.

and the best part is in the end till the time I dont get the payment I dont deliver the product, just think about this way that the entire movie gets delayed or is put on hold so it creates a risk for the entire small ecosystem, in this case both parties always try to come up with best solution which benefits both like in ayalaan movie phantom has the distributing rights. (so the possibility of receivables being downsized is also low)

Another thing is suppose I can recognize revenue at 20% completion of a project but by the quatre end I could only do 18% then in this case I am supposed to recognize revenue in next quarter, so by next quarte If I complete 40% I get to recognize entire thing.

another possibility to highlight is since % of work completed is subjective phantom might say I have done 20% of work and recognize revenue but client might not agree and pay in this case the entire thing becomes unpaid revenue but this effect should normalize in the subsequent quatre

BASILIC

In phantom case you work in preproduction so what %of work is done is itself a subjective matter for the company hence the revenue recognition is a bit tricky but in basilic case who work in post production has 15cr of receivable and 15cr of other asset on 53cr balance sheet 56%

PHANTOM

In phantom case 78cr of balance sheet out of 96cr which is 80% is in other current asset, receivable, inventory this is because the delay of ayalaan movie if I adjust that then their receivable+ inventory are just 40% of balance sheet

This 30cr of other current asset and 18cr of inventory will be recognized as revenue (please correct me if I am wrong here) once ayaalan movie releases (30cr of other current asset) and millstone/product is delivered (18cr inventory) so 49cr is what we are taking about.

Of course the balance sheet has been deteriorated + ayalaan successful/timely release is must, so we have to monitor things closely, expecting H2 to be better.

Basilic does not show this berceuse they work on small projects(post production) in phantom case they take like 6motnhs to 9months for a particular project (pre production)

Disc- I would exit this stock if I get to know about any significant developments without a intimating plz invest at your own risk, invested

Hello everybody, this has been a very insightful thread that has greatly helped me in understanding the business of Phantom.

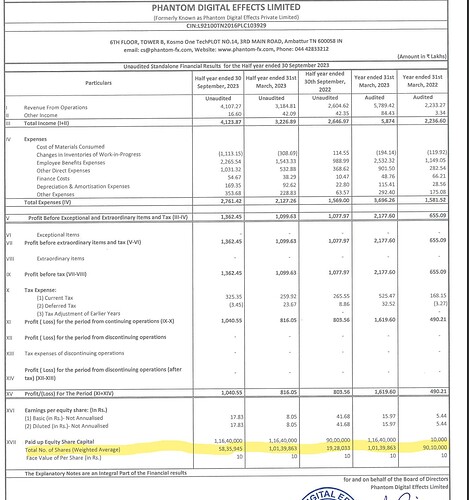

While going through the recent results, it came to my attention that the total number of shares had drastically come down.

Would be really helpul if someone could take the time out and explain what exactly might be the reason for this, and whether it is something to be weary of.

Thank you in advance.

Investor/ Analyst meet on 21st Nov

https://nsearchives.nseindia.com/corporate/PHANTOMFX_17112023155446_PDELInvestorMeetIntNov23F.pdf

So table is a bit shitty but the shares have NOT gone down.

1,16,40,000 is the total shares. 58 lakhs shares are weighted average number of shares over a period of time. What period of time? For some reason it is from 31st March 2022 when the shares were 10k.

If you add 10k to 1.164 Cr and divide by 2; you will get the 58L number.

Thank you so much for explaining this.

Much appeciated!

https://ccreservations.com/recordings/select_recordings.php

Recording Id : CVE0220231121150430

Thanks Krishna Bahirwani for posting this on Twitter.

https://twitter.com/BahirwaniKrish/status/1726911342383452661?t=3QwMYxiFqbEoBgSvWNT-6A&s=19

Felt there were no clear answers given on the situation in Ayalaan. 23 Cr is recorded as receivables, investments in the project are also 23 Cr. No clear benefit mentioned for co-producing it, I’d rather say the ans left me confused.

Also, one participant asked the question on how the QIP money would be used, felt that the answer was not satisfactory. Same story of automation and reducing the man hours was repeated.

Since there is always some reading between the lines and backstory to answers, appreciate if someone would explain the 2 points clearly. Thanks

They paid 17 Cr for the rights and have 23 crores pending from Ayalaan. This is a 40 crore investment for Phantom Digital. And they are trying to raise 60 Cr…

But in other news; looks like ayalaan international rights (the one Phantom owned) has been sold to Hamsini Entertainment! So the money SHOULD start coming in

Looks like people are loving the Ayalaan teaser

Why not dub the movie into Hindi.

In their concall they mentioned that they worked for Kaalapani TV series as well. If anyone has already watched it, please do share your opinion on Kaalapani series.

Phantom digital effects

Present revenue: 77 Cr,

Profit: 19 cr,

NPM: 25%

Guidance for FY 25 in the recent concall

Revenue: 135-150 Cr,

NPM: 25-30%

Profit: 34 Cr - 45 cr.

Mcap: 465 cr

TTM P/E 24.5

FY25 P/E 10.3 to 13.5 (as per guidance)

Since the company is in VFX and digital effects space which is a high growth industry, 10.3-13.5 P/E is reasonable.

H1FY24 Conference Call recording link

Have you factored in the impact of AI?