PG Electroplast Limited (NSE:PGEL) is one of India’s leading players in the Electronic Manufacturing Services, Plastic Injection Moulding and Printed Circuit Boards and Plastic Manufacturing space. The company offers solutions as an Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) both.

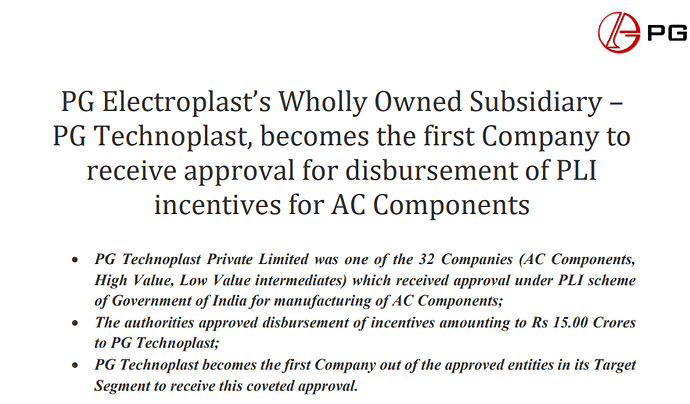

The company is beneficiary of Government PLI scheme : https://dpiit.gov.in/sites/default/files/PLIWG-Notification-16042021_10May2021.pdf (FOR WHITE GOODS (AIR CONDITIONERS AND LED LIGHTS) MANUFACTURERS IN INDIA) where it will be eligible to receive approximately 200 Cr. of 320 Cr. capex planned for AC components manufacturing in next 5 years provided it can generate revenue of 1500Cr. through it.

Among the beneficiaries of scheme(listed here: https://static.pib.gov.in/WriteReadData/specificdocs/documents/2021/nov/doc202111321.pdf ) ,PGEL price appreciation by market is way higher then other listed players like Voltas, Amber etc.

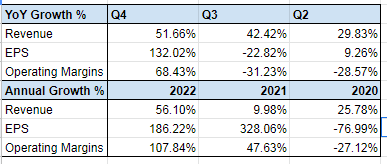

It is posting good growth in 3 Ratios:

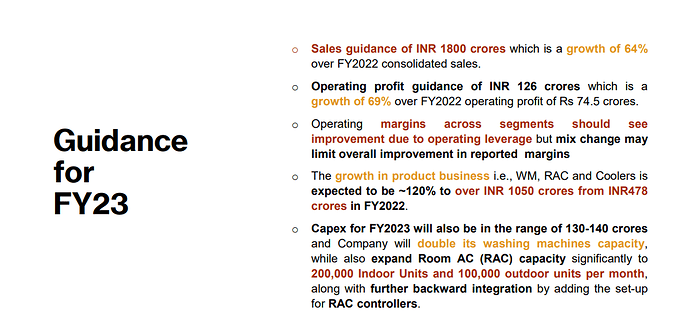

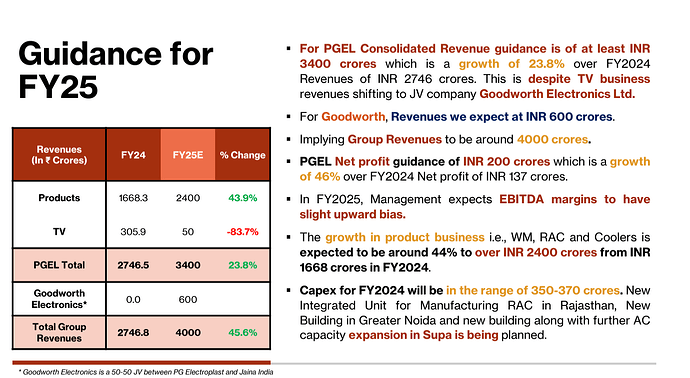

and management seems extremely optimistic on the outlook:

Source:Company Presentation

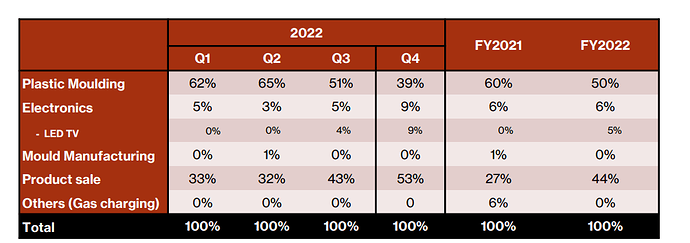

The company is aiming to increase share of Product Business(where it sells completely built AC and WM units to its customers) as part of overall growth:

Source:Company Presentation

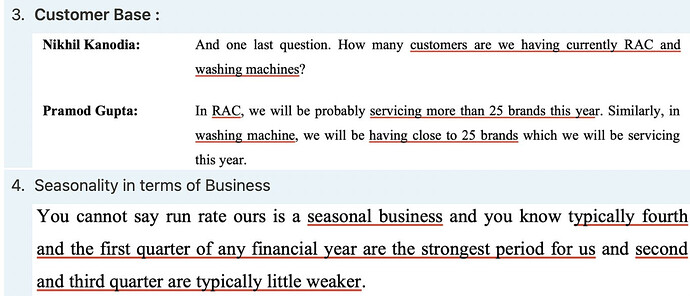

AC and washing machine both divisions are growing strong, The Washing Machine (WM) and AC IDU Business has seen robust growth, WM business grew 119%, and AC business grew 185% in 12M FY2022. There’s TV and air cooler segment too.

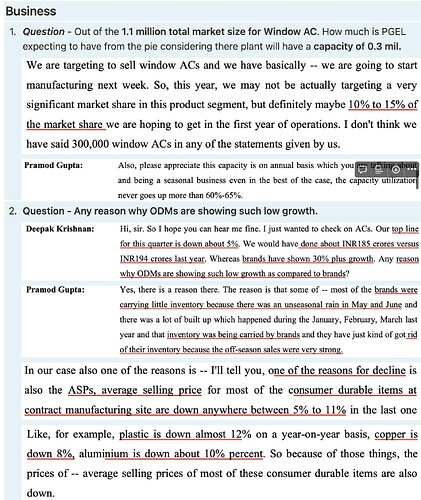

Few pointers from FY22Q4 earnings conf call:

-

The Washing machine business is 100% ODM while 75% of business in AC business comes from ODM, I assume this is highly beneficial for a company as it gives advantage over competition which are only in OEM space(Please correct me if my assumption is wrong).

-

Product wise revenue breakup:

Yearly : 62% AC,35% Washing machine, coolers 3%.

Quarterly breakup:77% AC,WM:19.3%,cooler:3.5% -

Quarterly breakup of AC In Door Unit vs Outdoor Unit: IDU 80%, ODU:20%

-

The kind of components company is manufacturing for AC, it’s approximately 50% of sale value of AC as whole, hence Topline sale of 3000 Cr. of AC revenue will translate to 1500 Cr. of ac components

Request members to please post their insights and provide inputs on below questions:

-

As an answer for question about Debt/Equity ratio has risen more than 1 recently, company saying it’s due to plant commissioning in this quarter. Can you please explain it and how to interpret it?

-

Management mentioned that there’s provision in PLI if they can’t achieve targeted 1500 Cr. revenue in AC, there’s non AC components sales also which can be included. I did not find anything related to it in PLI document. Appreciate if anyone has idea about and what is the maximum limit which one can include as non-AC component revenue in this case? and will it affect the benefits received as a result?

-

Management mentioned that smaller base revenue of just 84 Cr. is beneficial for PLI, what is the rationale behind it?

-

If the company anyways is focusing efforts on increasing their Product Business(where it sells completely built AC and WM to its customers and receiving good acceptance of their products), why not sell directly B2C creating a brand of their own instead of just being a platform.

-

Appreciate the competition analysis and more insights on it.