Its Fake news…Adani’s spokeperson denies report of buying into paytm.> Adani Group Denies Media Reports Of Buying Stake In Paytm

and the name is still on UC, i think people just bought the fake news and making beeline ! ![]()

You never know it could be the reaction of decoding the earning call transcript which was released just yesterday.

Management seems confident in their guidance in their transcript.

fa3c56a6-a32b-40e0-bf43-3412e6a2104b.pdf (876.0 KB)

Paytm not denying a possibility of ticketing business sale/partnership with Zomato or any other possible buyer(investor)

I don’t know how to react. From being all in one app to focused business. Actually I like their ticketing business. Let’s see how it pans out.

Actually I liked their ticketing business also from customers/consumers stand point.

I don’t use paytm much for other services.

However, I am hopeful about their venture into insurance distribution, a step they have lately said they will focus on.

Policy bazar market cap is more than paytm at the moment.

So if they address the insurance arm rightly, my sense is it could be a game changer for them.

They may get good valuations if they succeed in insurance arm, that will be added benifit plus there is core business of financial services.

Let’s see, too soon to call anything.

Not sure what’s the valuations they are selling ticketing business at , I heard somewhere it’s deal size of 2000 cr.

If that’s the valuations they are eying, I think that’s not a great sell, if they sell that business at such value.

“The company for me is like a daughter…we were getting mature, going towards full profitability, making free cash and so on. I saw it as a daughter on the way for an important entrance test, but met with an accident, and is in ICU right now,” Sharma said from a personal point of view.

“At a professional level, I would rather say we should have done better, there is no secret about it. We should have understood better…and we had responsibilities, we should have fulfilled, much better way…we learnt the lesson,” he said.

Q1 FY25 Earnings release: https://www.bseindia.com/xml-data/corpfiling/AttachLive/d4065d63-af00-49a0-b3b7-b4b8921a10b1.pdf

We are awaiting approval for starting onboarding of new UPI consumers

This is news to me that Paytm is yet to have permission to onboard new UPI consumers.

It is due to RBI regulation on Feb 23 that restricts onboarding of new customers until migration of existing customers to new handles is complete and you have to take customer consent before giving them new upi handle. Basically since the psp bank is going to be changed from PPBL to other banks RBI is looking at it as if it is a case of fresh UPI registration. Don’t know how long this saga will continue before allowing them to onboard new customers. What’s interesting is that existing customers started getting messages since yesterday like this “ Paytm is now powered by 4 banks!

We are creating new UPI ID with these banks to ensure seamless payments. If you wish to opt out, tap https://m.paytm.me/UPInew“. Whether the regulator had permitted them to do this or not is unknown. If it is a no, they will again be in the crosshairs. Uff. But killing it you will end up having a foreign controlled duopoly in the countries payment system. Interesting times in payment space!!!

What a wealth destroyer PAYTM has been. From a listed price of 1800 to 450 now, a 75% evaporation. The dangers of buying a stock based on narratives.

-

Having said that, I think the worst seems to be over for now in terms of firefighthing: monthly transacting users have stabilised in the range of 7-8 crores and merchant subscription at 1 crore.

-

How the company is going to generate value going forward is a metric to be seen but is it not the case with all the new age companies ; Nykaa at 50k crore valuation; Zomato at 1.93L crore valuation with thr estimation of profitable cash flow assumptions stretching in to 15-20 years to make sense of these valuations.

-

The value of a payment business is not in transactional revenue but in the data and the insights it generates. Imagine an insurance company cross checking your declaration that you’re not a smoker by requesting the data from payment companies for a fee(a daily debit of Rs.18/-). Paytm still holds 8-9% market share in UPI transactions and with the regulator wanting to cap the market share of each TPAP at 30%, it can only be beneficial to Paytm if it manages the risks outlined in pt.1 well enough.

Disc: Not invested. Interested and studying further.

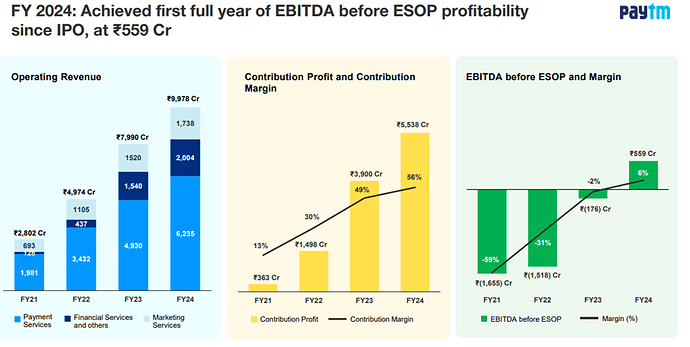

Need some clarification . In 4th quarter is it mentioned in Presentation that this is first year of EBDTIA profitability since IPO excluding ESOP and Margin. Are they really profitable (may be EBDTIA only ) ? does the ESOP and Margin costing so high that it going negative on overall profit ? I checked PAT for all qtrs they shows negative.

Paytm has done a good sale here imo. Selling a business which was only adding 29 crores to EBITDA for 2048 crores is not bad.

Any idea why stock is up by 11% today… ?

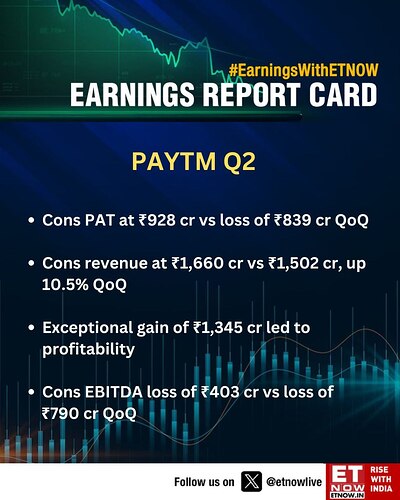

Paytm Q2

- Cons PAT at ₹928 cr vs loss of ₹839 cr QoQ

- This quarter’s results include an exceptional item. The sale of movie ticketing and events business (PayTM Insider) contributed to a positive PAT. However one should see that as a one-time, non-recurring transaction

This doesn’t look good.

Paytm shifts lending strategy, enters into first FLDG agreement to boost merchant loans

I’m happy that paytm became a quick multibagger for most of us. But can anyone share any positive news thats leading to these up moves. Or is it just a change of perception!!

I wouldn’t say thats necessarily true. They have received the approval to onboard new UPI customers, have changed their model from payment bank led to TPAP, and created a large cash balance for themselves from selling the insiders business to Zomato. I think its more about what kind of growth they can do from here but having arrested the fall from an extinction level event deserves some applause

Today got an update from Paytm payments bank to update my KYC.Seems they have not totally written off the business and making efforts to revive it.Big question is will they be able to convince RBI after such a public fiasco

@Sanjeev_95 Agree.

I entered when the market cap was around 25K, with 8-10K cash in BS. It was purely a valuation play and a bet on VSS. At that time, I planned to exit when the market cap reached around 40K. However, I played the momentum and am still holding. Now, my mind says a 60K market cap isn’t very high.

This situation arises when you don’t fully understand the fundamentals—something rare for me but happening in the case of Paytm. I’m looking for a VP friend to share fundamental views time to time.