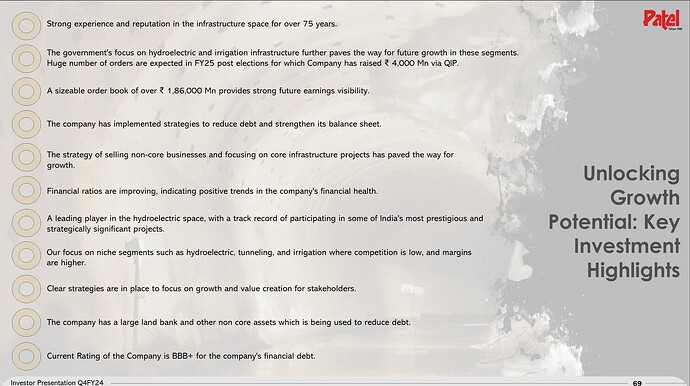

Patel Engineering Limited, founded in 1949 and headquartered in Mumbai, is a prominent player in the civil engineering construction segment. With over seven decades of experience, the company has successfully constructed various heavy civil engineering works such as dams, bridges, tunnels, roads, piling, and industrial structures.

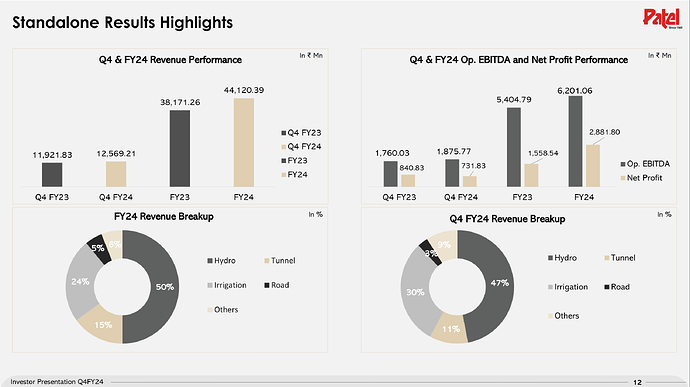

The company is strong in high-margin, technology-intensive areas like hydro, tunneling, irrigation, water supply, urban infrastructure, and transport. Its outstanding execution of projects has resulted in the successful completion of over 250 projects.

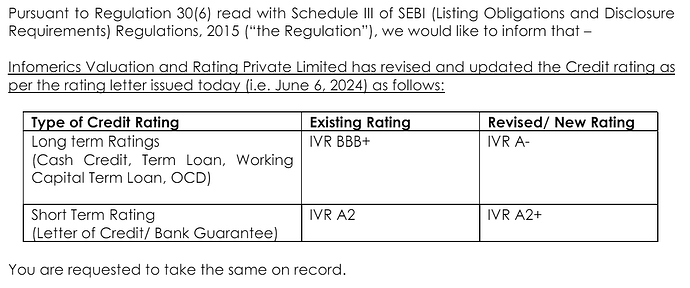

Patel Engineering Limited commands a robust position in the hydropower and tunneling segments and has played a vital role in some of India’s most prestigious and strategically significant projects. Its shares are listed on the Indian Stock Exchanges (BSE/NSE), and the

company has valuable non-core assets.

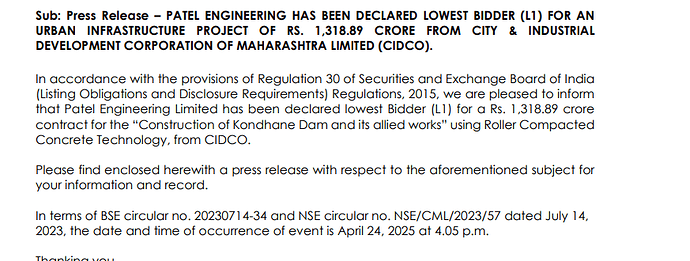

Currently, the company’s order book stands at about ₹ 2,00,142 Mn (Including L1 Orders)

| Narration | Mar-14 | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Trailing | Best Case | Worst Case |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales | 3,701.13 | 3,415.39 | 4,040.87 | 3,883.84 | 2,274.55 | 2,362.21 | 2,617.21 | 1,994.79 | 3,380.31 | 4,201.97 | 4,253.70 | 5,223.35 | 4,225.79 |

| Expenses | 3,234.27 | 2,919.00 | 3,641.66 | 3,462.83 | 1,743.34 | 1,985.26 | 2,431.73 | 1,750.41 | 2,850.13 | 3,577.04 | 3,619.69 | 4,444.82 | 3,658.78 |

| Operating Profit | 466.86 | 496.39 | 399.21 | 421.01 | 531.21 | 376.95 | 185.48 | 244.38 | 530.18 | 624.93 | 634.01 | 778.54 | 567.01 |

| Other Income | 98.97 | 131.25 | 40.97 | 165.14 | 106.00 | 247.43 | 201.69 | -114.78 | 83.27 | 119.48 | 95.99 | - | - |

| Depreciation | 81.98 | 79.78 | 54.98 | 78.04 | 54.27 | 50.20 | 66.18 | 72.03 | 81.90 | 93.30 | 89.96 | 89.96 | 89.96 |

| Interest | 437.86 | 516.17 | 601.61 | 579.21 | 489.42 | 370.27 | 266.27 | 401.39 | 419.53 | 418.42 | 404.50 | 404.50 | 404.50 |

| Profit before tax | 45.99 | 31.69 | -216.41 | -71.10 | 93.52 | 203.91 | 54.72 | -343.82 | 112.02 | 232.69 | 235.54 | 284.08 | 72.55 |

| Tax | 21.28 | 22.02 | -20.22 | 31.79 | -11.27 | 44.49 | 23.42 | -70.88 | 43.14 | 53.89 | 59.61 | 25% | 25% |

| Net profit | 16.37 | 8.47 | -196.19 | -102.89 | 104.79 | 154.15 | 11.13 | -290.75 | 72.10 | 183.48 | 182.62 | 212.18 | 54.19 |

| EPS | 0.60 | 0.31 | -7.10 | -1.82 | 1.85 | 2.61 | 0.18 | -4.16 | 1.00 | 2.37 | 2.36 | 2.74 | 0.70 |

| Price to earning | 69.03 | 172.69 | -5.43 | -29.94 | 22.53 | 6.76 | 45.06 | -2.56 | 22.46 | 6.30 | 19.85 | 19.85 | 16.20 |

| Price | 41.15 | 52.90 | 38.52 | 54.50 | 41.78 | 17.61 | 8.19 | 10.65 | 22.53 | 14.95 | 46.85 | 54.43 | 11.35 |

| RATIOS: | |||||||||||||

| Dividend Payout | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |||

| OPM | 12.61% | 14.53% | 9.88% | 10.84% | 23.35% | 15.96% | 7.09% | 12.25% | 15.68% | 14.87% | 14.90% | ||

| TRENDS: | 10 YEARS | 7 YEARS | 5 YEARS | 3 YEARS | RECENT | BEST | WORST | ||||||

| Sales Growth | 1.42% | 0.56% | 13.06% | 17.09% | 24.31% | 24.31% | 0.56% | ||||||

| OPM | 13.42% | 14.07% | 13.48% | 14.61% | 14.90% | 14.90% | 13.42% | ||||||

| Price to Earning | 45.58 | 20.49 | 20.08 | 16.20 | 19.85 | 19.85 | 16.20 |

Risks and concerns.

Internal Risk Factors:

Our business heavily relies on government contracts, making us

vulnerable to potential policy changes. This introduces uncertainty

and challenges that need careful management. Additionally, delays,

modifications, or cancellations of projects can have a significant

impact on our business, affecting our order book and future projects.

These factors have the potential to materially and adversely affect

our results of operations and financial condition.

External Risk Factors:

Prevailing economic, political, and market conditions can lead

to a slowdown in the Indian economy, negatively impacting our

business, financial performance, and operations. Communicable

diseases like COVID-19 and natural calamities pose a significant risk

to the Indian economy, which in turn can have adverse effects on

our business. Moreover, a potential downgrade in India’s debt rating

by rating agencies can have adverse implications for our business

operations and financial performance.

Disclosure - Invested