Hi Harsh

Thanks for writing back.

Coming to your question :

Does this mean that in the last 7-years, you have bought 5 businesses (Kotak, Suprajit, Ajanta, Granules and Talkwalkars)? Answer is Yes

Coming to next question - are these the only 5 businesses available that meet your criteria? Let me elaborate that little more because there are multiple thoughts behind that, I hope, I can explain well

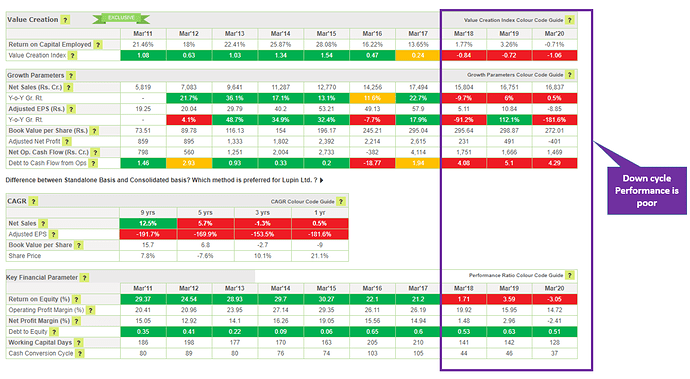

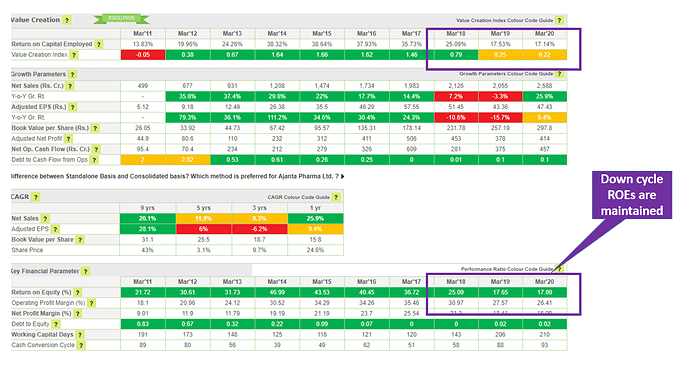

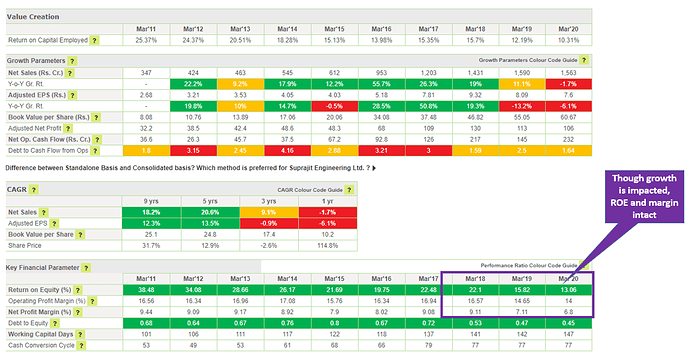

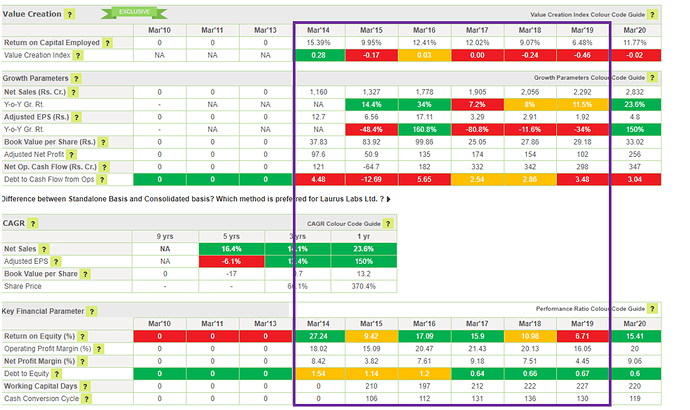

I usually check past 10 years track record first before even start reading about company. When I say track record some of the quantitative parameters are – (1) Last 10 years ROCE (2) Last 10 years Sales and EPS growth (3) Last 10 years Margin trends (4) and Last 10 years cash conversion cycle. Apart from that qualitative parameters like management quality which I have explained in earlier post

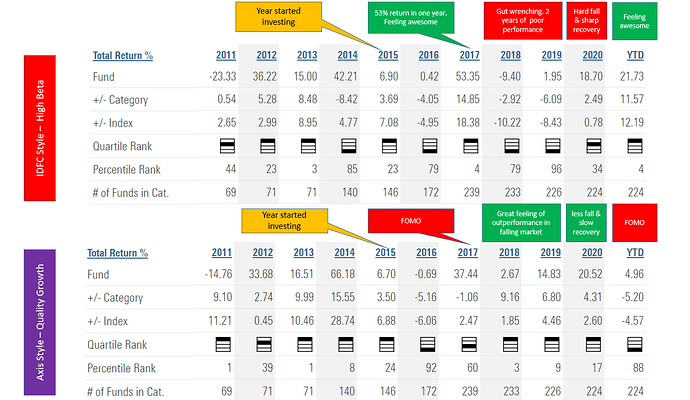

Now, there are off course many companies which pass that criteria. But it is also important how much conviction you are able to build on the company. Conviction according to me can be defined as how well you understand the competitive advantage of business. This conviction is very important because it is very rare (and only in excel sheets) you have very smooth sales and EPS growth. Business risk is very nonlinear and almost any business going through let’s say 1, 2 or 4 quarters of underperformance is a norm. You will hear lot of negative chatter when business is under performing. At that time if you don’t have conviction then you get suck in to the negative discussions and instead of adding stock (in the best time), you end up selling or trimming the position

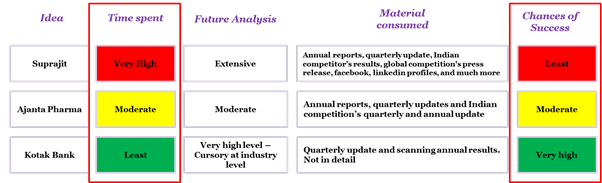

And building this conviction takes lot of effort IMO. You may have to read (and understand) conference calls, annual reports of the company then competitors (Indian and global). With my family and other life style I have finite time which I can dedicate for investing. It’s a question of how I use that time effectively.

Example – When a wonderful company like Bajaj Finance fell to 1600 levels last year, even I was one of the group who thought they are going to suffer because of personal un-secured loans portfolio. I did not have conviction. And I did not have conviction because I do not fully understand business

And next point is, even you believe you have conviction what is the quality of decision making. You can see 2 out of those 5 selections are wrong (Which I sold)

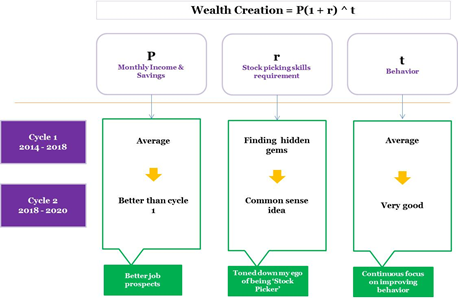

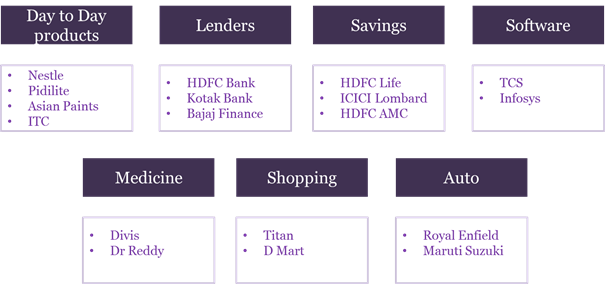

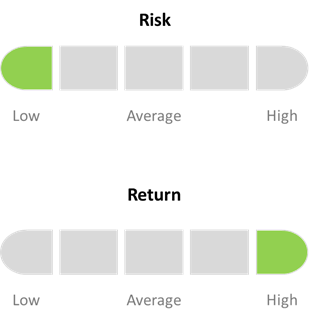

Making a diversified portfolio of quality businesses is the only answer to these questions. Because beyond a point I believe, diversification is the only way to hedge the risk. My technique of diversification is little different. I believe fund manager can construct better ‘’portfolio’’ than me and I can improve my decision making ability by focussing on few businesses where I can build ‘’conviction’’.

This I believe is an ‘’Art’’ part of investing and there is no one right answer. But I am a believer of diversification, how do you achieve diversification is your ‘’art’’

I hope I answered your question.