I did similar exercise, and my finding are similar to yours. I am building up position hence may be biased and planning to tender the share.

Disc: Invested at current level

Kindly share the further details on buyback if any one have.

Regards,

Murari Shah

The Draft notice of the Buyback has been released on 25th, record date was 27th. The specific buyback open and close dates will be known shortly.

On the acceptance ratio, I am not sure if the retail quota means retail will only get allocated from that 15 %, as this would go against them with a much lower potential acceptance. I think they could get allocation from the overall quota also on a proportional basis. Can someone point to the official methodology used for calculating the acceptance ratios ?

Without splitting into retail/non retail, at a high level these are the numbers I ran.

Hi Parag,

Let’s guess if AR is 50% what’s the plan for remaining share is it good to hold for a long term ?

Company next quater performance need to see as last two quater top line and bottom line both declined due to talent retaintion and Ransomware effect.

If they will come on past performance track than this is a good investment as whatever % of shares goes in buy back, stock will become cheaper by that much % on valuation.

Regards,

Murari Shah

Retail ER - 15%, As per calculation potential retailers is around 23Lacs, Looks like Max 30% AR

After deduction of promoters number General Category comes around 67 Lacs, So bare minimum 30% will go in buyback if all general category participate else looks like 40% AR.

Thanks for the calculation Shah.

Overall against 22 to be bought back, 30 offered. Can the non-retail acceptance ratio be more than retail?

Buyback – 22,67,400

Application shares Received – 30,75,732

Minimum 75 % for both category

In General category Expecting 100% AR = Finger crossed…

Can you please indicate the source of the data on the number of

shares tendered in the buyback please.

Had taken a snapshot from NSE site on 14th. It should reflect in past issues later

https://www.nseindia.com/market-data/all-upcoming-issues-ipo

Yes. That is possible.

Happened in case of Bharat Rasayan.

Retail was 36% and General was 59%

The business still has a lot of potential. Problem is management is too conservative.

I will watch the business performance for a bit before deciding to invest or not. OFSS has shown very tepid results, let us see what Intellect reports as well. As the general tech euphoria fizzles off, we may get the company at reasonable valuations for the near future.

OFSS attrition for the quarter was 29% versus ~15% usual. IT companies have to massively step up entry level recruitment. They take minimum 6-12 months to start contributing. Some margin pressure maybe witnessed.

81% AR in General for me. 49% for Retail.

Nucleus Results for Q2’23show some improvement, revenues are up slightly, so are margins.

- Consolidated revenues Rs. 130.09 Cr ( vs 114.12 Q2’fy22)

- PAT Rs. 11.03 Cr (vs 8.58 Cr Q’fy22)

- EPS Rs. 4.12 ( vs 2.95 Q2’fy22)

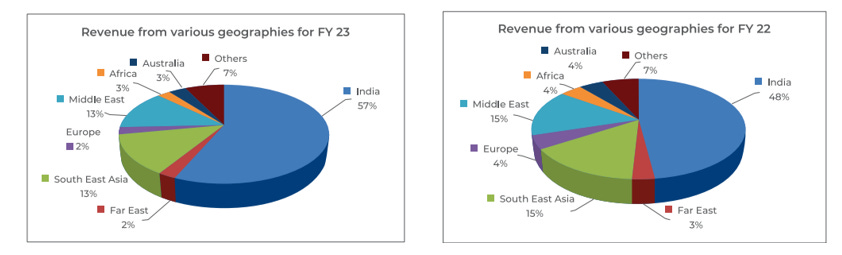

Segments - India business has shown some growth, but none of the international segments (potentially higher margin business) have shown growth.

- The best two potential markets Europe and Australia have declined both YoY and QoQ. Taking H1 totals, both markets are flat

- Press release mentions attrition is down, but no specific number provided, will see when inv call transcript is available.

- Nucleus financial performance on both revenue and margins is still way below the performance 2 years ago, new CEO has not shown much change in the business.

Results PPT: https://www.primeinfobase.in/z_Nucleus/files/financials/Nucleus_AuditReport_Q2Results_2022-23_30092022.zip

Disc: Holding the qty left after tendering in the buyback. Current valuation is reasonable, promoters are ethical, and underlying product has potential, but the business is not showing any improvement, not looking at adding or selling yet.

Can we continue the thread here, unreal back to back quarters for Nucleus. Management has a generic statement in place when asked about the fact whether current margins would sustain.

.

Reading between the lines it looks like it should sustain. Any investor/analyst would like to share their views? much appreciated

They repriced their contracts which are sticky and high-retention. Product based IP operating leverage of their banking/lending software product (which is gartner rated) is coming through as it all drops to the bottom line. The stock has almost doubled after the last trading update by management. They have likely completed the key re-pricing activities with their major customers at end of the FY. The bet now is simply what additional upside on pricing will happen and what is their growth runway (old question but still relevant).

2023 Annual Report Summary

About the company:

Nucleus Software is the leading provider of lending and transaction banking products to the global financial services industry. Its software powers the operations of more than 200 customers in 50+ countries, supporting retail banking, corporate banking, cash management, internet banking, automotive finance and other business areas.

Nucleus Software operates through integrated and well-networked subsidiaries in India, Japan, the Netherlands, Singapore, the USA, Australia and South Africa. In India, 40 lakh crores worth of retail assets are managed on their software.

Business offerings:

FinnOne Neo:

This suite is a product which offers an end-to-end solution for lending businesses. The product has the following:

- Customer Acquisition System: It covers the entire customer onboarding evaluation process for retail and corporate customers, with a multi-channel front end and a solid credit process back end.

- Loan Management Systems: It takes care of the entire servicing life cycle of a loan including accounting, repayment, special transaction, non – performing asset management and self–service through multiple channels.

- Collections: This module optimally manages defaulters and possible defaulters efficiently managing NPAs.

- Enterprise Content Management: This provides image-based processing capabilities to store and retrieve various contents like document images, letters, communications, etc.

- Collaterals Management System: It takes care of the entire collateral life cycle management. The sales assist is a specialized loan sourcing channel for sales staff empowering them for super quick and easy loan sourcing.

- Mobility Apps: It is a portfolio of mobility solutions aimed at creating end customer empowerment while digitalizing various lending business processes. The apps include mCAS, mApply, mCollect, mServe, and mFin.

- API Center: In the increasingly digitized world, the integrability and compatibility of a software solution with other software solutions are becoming very difficult. The product in discussion has been a front runner in this regard as this carries an incredible number of APIs – 470+ APIs that facilitate robust, secure, easy, quick and agile integrations. The product supports both cloud, hybrid and on-premise deployments and can be deployed quickly in partnership with leading cloud providers.

FinnAxia:

This suite is another product of the company. It is an integrated global transaction banking solution built on the latest Java J2EE technology and Service Oriented Architecture (SOA) platform. With this product suite, banks can break down traditional product silos, launch personalized products/services over multiple channels and create winning corporate customer propositions. The key product components of FinnAxia:

- Global Receivables: It enables banks to provide comprehensive accounts receivable management solutions for managing inflows efficiently. Receivables can be paper-based (Cheque / Draft / PDC), electronic (direct debit) or cash. Bank may provide faster fund availability with the option of guaranteed credit against the cheque based on the arrangement between the bank and corporate.Banks can offer tracking of corporate receivables by capturing invoices and reconciliation of the same with all the payments received, both paper and electronic. FinnAxiaTM Bill Collection solution enables banks to collect on behalf of corporates by integrating with their ERP for fetching bill details.

- Global Payments: It is a value-enhancing payments solution to enable banks to handle low and high-value inter and intra-bank payments of their corporate customers, supporting instantaneous settlement that can be processed 24x7.The solution is designed to help corporates streamline automation, improve operational efficiencies, gain greater cash visibility, comply with regional and global regulations, and reduce operational risk and cost during payment processing.Banks can process cross-currency payments using multiple rate types and maintain tight control of the rate at which these payments are processed.

- Global Liquidity Management : It gives banks the power to manage the cash positions of their corporate customers on an international basis resulting in better utilisation of available funds and reduced interest costs through short-term bank borrowings. It automates all transactions, interest & tax calculations and manages a registry of intercompany lending/ borrowing history and limits for the corporate entity.

- Financial Supply Chain Management : It offers an integrated way of managing invoice presentation and transaction processing across a corporate’s supply chain, covering its suppliers and dealers. FinnAxiaTM e-FSCM provides a 360-degree view of the financial supply chain ecosystem with an end-to-end credit line and transaction tracking.

- FinnAxia Business Internet Banking: It is the Internet front end for the bank’s corporate customers to access various cash management features over the Internet. It facilitates the customers to initiate, authorize, release for processing, track, and view reports etc. for all transactions across all modules and features offered to customers by the bank. This product helps banks to create new revenue streams through a wide range of segmented and personalized offerings.

- E-Trade Finance: It provides the corporate customers of banks the flexibility to digitize their trade finance service requests via trade products like letters of credit, bank guarantees, import-export financing, standby letter of credit, shipping guarantee and import-export bills for collection.

- Advance Virtual Treasury Management : It enables banks to offer transaction processing and manage corporate liquidity using virtual accounts. It can help corporates rationalize their operating accounts landscape by reducing the number of required physical accounts and optimizing cash flows. It enables banks to set up on-behalf-of structures (POBO/ ROBO) for their corporate customers. It provides self-service options to its customers allowing faster deployment and more convenient control of virtual accounts

- FinnAxia 8.5: It enables corporates to make informed decisions on their cash position via an integration solution. It enables cash forecasting capabilities for the banks’ corporate customers and provides enriched MIS.

PaySe:

The world’s first online & offline digital payment solution was created with the aim to democratize money.

Nucleus Solutions Services:

The services division of Necleus Software plays a crucial role in the digital transformation of organizations by delivering seamless customer experiences, operational and cost efficiencies and actionable insights.

This division leverages a broad spectrum of disruptive digital services like Cloud services, Application Modernization, Data Engineering/ Virtualization and Analytics, Robotic Press Automation, Infra Services and more.

This service wing has operations in India, South-East Asia, Japan, the Middle East & Europe.

Achieved 86.5% operational efficiency by implementing, Robotics Process Automation for a top Japanese NBFC for their identity and access management processes.

Accomplished Process Automation of the Risk Evaluation Management System for a large regional bank in Europe.

Facilitated the digital transformation of a large Asian bank by developing open banking APIs as per the central bank guidelines.

Nucleus was hit by a cyber breach attack in FY 21- 22:

Comprehensive actions have been taken which include the below:

§ Enhanced security for VPN

§ Next Generation Firewall

§ Focus on Network Security

§ Multi-Factor Authentication across the enterprise

§ Comprehensive AV Guard

§ End Point Detection and Response (EDR) solution

§ Setting up of 24X7 Security Operations Centre

§ Enterprise mobility and Microsoft 365 Security

§ Engaged Retainer Services of the world’s leading Cyber Security Expert Organization

§ Comprehensive background verification is carried out for their associates.

§ Continuous awareness sessions are arranged for our associates advising them about the fast-evolving challenges and risks related to Cyber and Info Security. This is also backed by comprehensive and continuously enhanced processes and practices, tools, and platforms.

Intellectual Property:

The company has been given 2 patents recently for their Offline and Online Financial Inclusion Platforms. It was developed as a financial inclusion enabler to address the significant challenges that banks and financial institutions face in providing financial services to the people at the bottom of the pyramid.

This solution is capable of carrying out transactions in completely offline mode and addresses all the challenges faced by consumers in rural areas, such as financial literacy, lack of internet connectivity, lack of mobile phones, and commute to bank branches.

Industry Structure and Development

- The technology industry has played a pivotal role in shaping the global and Indian business landscape. It has not only enabled companies to maintain operations but also facilitated their adaptation to dynamic market forces and evolving customer needs.

- In FY 2023, India’s technology industry experienced remarkable growth, as evidenced by its record-breaking 15.5% increase, reaching $227 billion in revenue, according to NASSCOM’s India Annual Technology Performance Report.

- This growth can be attributed to the successful amalgamation of digitalization and innovation, with platformization and XaaS serving as key drivers in accelerating technology adoption. Moreover, the report highlights the significant contribution of start-ups in scaling up their operations and further propelling industry growth.

- Another milestone for the industry was the addition of 445,000 professionals to the workforce, pushing the total direct workforce past the 5 million benchmarks. This achievement is a testament to the industry’s people-first, employee-centric approach, which facilitated a seamless transition to hybrid work models and the expansion of digital capacity-building programs.

- India’s position as a global digital talent hub is further underscored by the fact that one in three employees possesses digital skills. This demonstrates the country’s prowess in nurturing a skilled workforce that aligns with the demands of the digital era.

- With digital revenue accounting for 30-32% of the nation’s total revenue, India continues to solidify its position as a leader in the global sourcing market, commanding a 59% share. These achievements not only validate India’s new technology value proposition but also highlight the industry’s role in shaping the broader business landscape.

Opportunities:

- Emerging technologies such as artificial intelligence and machine learning offer opportunities to enhance credit risk assessments and improve the efficiency and accuracy of financial services.

- According to NASSCOM Insights, the COVID-19 crisis has amplified the existing challenges faced by traditional banking business models . Factors such as revenue pressure, low profitability due to low-interest rates and high capital levels, stricter regulations following the previous financial crisis, and increasing competition from shadow banks and new digital entrants have become more pronounced. This will help in more banks focussing on digital growth.

- As more consumers and banks shift towards digital platforms, there is a growing demand for innovative and user-friendly software solutions that were previously unavailable. Nucleus Software can capitalize on this trend by providing advanced software platforms that support digital banking and lending services while ensuring the highest levels of security and compliance.

Threats:

- While the Fintech industry is poised for growth, it also faces certain threats that need to be addressed. The industry is becoming increasingly crowded, with more competition for customer acquisition in 2023. Traditional banks and financial institutions are also entering the digital space, creating a competitive landscape for Fintech companies. To mitigate this threat, Nucleus Software needs to continue differentiating itself by delivering superior software solutions and maintaining its reputation for excellence and innovation.

- Another potential threat is the risk of cybersecurity breaches . With more financial transactions taking place online, Fintech companies need to invest in robust security measures to protect customer data and maintain their trust.

- Moreover, the Fintech industry is subject to regulatory scrutiny as it disrupts the traditional financial sector. Navigating complex regulatory frameworks and complying with evolving regulations require ongoing efforts and resources.

- Additionally, Fintech companies could face challenges in an economic downturn, as consumers and businesses become more cautious with their spending. This may lead to a decrease in demand for financial services. To mitigate this threat, Nucleus Software should focus on enhancing its product offerings, exploring new markets, and strengthening customer relationships to weather potential economic challenges.

Management:

Managing Director: Vishnu R Dusad

Vishnu R. Dusad is one of the main founders of Nucleus Software Exports Ltd. and has served as a director since the inception of the Company. Dusad completed his Bachelor’s Degree in Technology from the Indian Institute of Technology (IIT), Delhi and has been associated with the development of the software industry in India since 1983 as an entrepreneur. He was appointed Managing Director of the Company in January 1997.

Dusad has enriched Nucleus with his technology background and over three decades of valuable professional experience in the space of Information Technology Solutions for the BFSI sector. His experience encompasses areas of software development, creation of strategic alliances, business development, and strategic planning.

CEO and Executive Director: Parag Bhise

In his most recent role as EVP, Product Engineering, he has been responsible for ensuring the flagship products of Nucleus – FinnOne Neo and FinnAxia – are developed using the latest technologies and techniques.

He has 3 decades of experience in technology. Throughout his career, he has been responsible for a range of areas – including software development, delivery and quality assurance as well as IT infrastructure management and internal systems. As a result, he ensures that their products are high quality, resilient and future-proofed.

He has recently completed MIT’s Professional Certificate in Innovation & Technology, which adds to his Master’s Degree in Computer Applications from BIT Mesra and his MBA from the Management Development Institute – Gurgaon.

Notes from recent Q2 FY 24 concall

Business:

Revenue

- Revenue from operations: Rs 205.3 crore up 58% YoY

- Revenue in the previous quarter: Rs. 206.81 crore

- Compared to QoQ revenue, India segment revenue went up by Rs 20 crore but overall revenue declined by Rs 1 crore. Additionally, most of the increase in India revenue came from AMC re-pricing. I need to understand if the AMC revenue is recurring or one-time.

- Revenue from “Product segment”: Rs. 174 crore up 68% YoY (contributes 85% to overall revenue)

- Revenue from “project and services”: Rs. 31.2 crore up 31% YoY

- Revenue contribution from the top 5 clients for the quarter is 28.8%

- Order book: Rs 705.1 crore including Rs 648.2 crore of the products business and Rs 56.9 crore of the projects and services business. Since TTM revenue was Rs 788 crore, the “book to bill” ratio is 705.1/788 = 0.89

- Order book in the previous quarter: Rs 758.6 crores including Rs 689.1 crore of product business and Rs 69.5 crore of project and services business

EBITDA margin

- EBITDA margin: 25% up from 9% YoY but in Q1 the same was 30%

Net Profit

- Net profit: Rs 44 crore up 305% YoY!

- Net Profit in the previous quarter: Rs. 53.6 crore

Cash position

- Total cash including investments in mutual funds, bank deposits, tax free bonds, etc. is Rs 718 crore.

- Considering current market cap of Rs 3778 crore, the cash balance constitutes to 19% of the market cap.

- In other words, since 2.68 crore shares are issued, Cash per share value is ~Rs 268

- Enterprise value = 3778 + 0 - 718 = Rs 3060 crore

- Management stated that there is no intention of investing cash via acquisition. Board to decide about dividend or buyback

Management

- Management initiated re-pricing of annual maintenance charges across all contracts a few quarters ago.

- Most domestic contracts have been revised with higher annual maintenance charges. Oversees contracts are in the process of renewal

- Management believes that the product offering is high quality and is priced low. Hence they are optimistic about re-pricing going smoothly with international customers as well. So far the customers have agreed to renew contracts at higher prices. Most of the revenue increase in Q2 FY24 came from renewing annual maintenance charges.

- It will take upto FY25 to complete the re-pricing exercise

- Bench strength is not applicable. After training employee starts on product or on project right away.

- The current employee strength of 1908 will go up by 300 in coming quarters. The addition will encompass all departments including engineering, sales, marketing, etc.

- Per management, business is lumpy but there is no seasonality. Need to understand better

- Spent 8 crores on marketing as management believes clients do not understand tremendous value addition. They declined to confirm that the marketing expense was to enter a new geography. However, they did say that the next leg of growth will come from international markets. The marketing expense will be a recurring expense.

- Want to focus on non-Indian customers. Expect growth from various geographies soon

- Expect an announcement of new deal wins in near future. Large deal for FinnAxia offering is still in pipeline

- Management is going to continue with marketing spend and hiring. However, since revenue is bumpy, the margin is also going to be bumpy

- Total addressable market as per management is $20 to $30 Bn since software cost for the lending business is between 0.5% to 1% of AUM

- Voluntary churn by customers is less than 5%

- There is going to be spillover of revenue in Q3 since certain orders in Q2 did not come through

Risk

- Due to the nature of the business, the revenue growth is bumpy - I need to understand better

- Data about customer churn, attrition and new product/feature development-related information is not shared by management

- 20% of market cap lies on the balance sheet in the form of cash with no visibility of how the management intends to use it