There has been a significant jump in revenue share of CMS segment from 33% in Q2 FY23 to 55% IN Q2 FY24. The company has attributed to surge in profits to shift from low margin Prime segment to high margin Speciality and CMS segments. Sustainability of margin will depend on speed of progress from P-3 & Pre-Reg./Reg. to Commercial production.

On the valuation side, the stock still looks cheap at PE of 24.8. However the big operators may cause the price to dip in short or medium term.

Neuland gets CADIFA approval for Mirtazapine API. Don’t know how much it will contribute but should add some crores in topline and exposure to Brazil market.

who is the innovator? or market size for the same?

https://x.com/vivekchadha1996/status/1726829846310093308?s=46

Neuland Labs is working on KarXT along with regis technologies

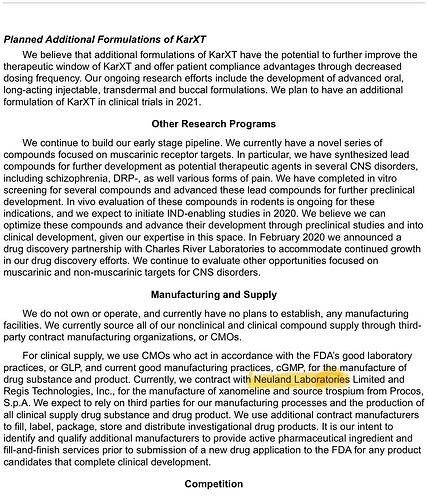

2022- Annual Report-Karuna-Updated on Feb,2023

From Neuland Q2 FY24 Investor presentation,

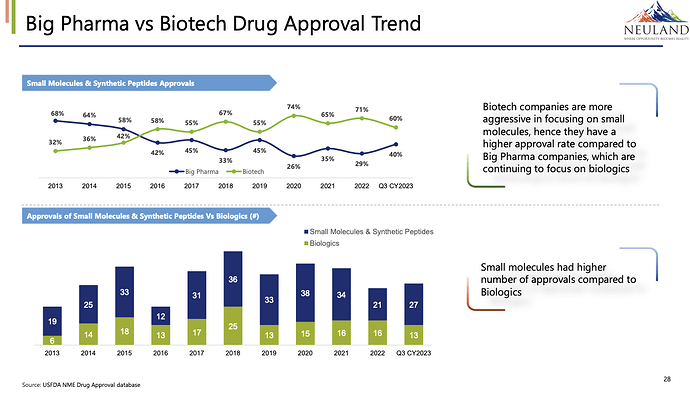

Biotech companies are more aggressive in focusing on small molecules, hence they have a higher approval rate compared to Big Pharma companies, which are continuing to focus on biologics.

I used to assume that the biotech companies focuses more on biologics as they have bio in its name.

If they focuses more on small molecules, why did they have bio in its name?

Interesting development- USFDA has accepted KarXT for review under New Drug Application (NDA) submission for Karuna’s investigational treatment in schizophrenia.

Finally, Neuland comes up with a pretty detailed post on their partnership with Karuna Therapeutics;

Hyderabad, India, December 8, 2023 – Neuland Laboratories Limited (NLL) (NSE: NEULANDLAB;

BSE:524558), a pharmaceutical manufacturer providing active pharmaceutical ingredients (APIs), complex intermediates and custom manufacturing solutions services to customers located in around 80 countries, has been informed that Dr. Davuluri Rama Mohan Rao, Founder & Promoter and Executive Chairman of

Neuland Laboratories Limited (the Company) has sold 4,00,000 equity shares of the Company (i.e. 3.12 % stake) today through open market at an average price of Rs. 5,012.45. Dr. Rao has informed that he intends to use the funds generated from this sale for personal purposes.

Davuluri family does not plan to sell any further shares in the foreseeable future and are fully committed and invested in the future of Neuland Laboratories Limited.

How will the market perceive stake sell by main promoter.

Rs 200 Cr is a big amount…

Disclosure: Invested form long term perspective.

Would be interesting to see who bought this huge quantity. Its done through bulk deal and stock closed in green so it can’t be retail. More than 3% of stake sold in bulk deal but BSE is not showing any buyer in bulk deals/or block deals data.

Looks like multiple HNI/DII/FII have entered, names will only be know in next SHP data.

I am not able to figure out who has bought up in the bulk deals.![]()

200 cr rupees of sale and stock closed in green!

It clearly indicates that some big hands entered it and before hand the management has arranged the buyer for this deal.

Today that the U.S. Food and Drug Administration has approved an updated LDL-cholesterol lowering indication for NEXLETOL and NEXLIZET to include the treatment of primary hyperlipidemia as a qualifier for existing approved populations.

Neuland is already setting up the dedicated block for the same.

https://x.com/vivekchadha1996/status/1735174387090026971?s=46

https://twitter.com/rahuja671/status/1735264585119113640

Novo Nordisk best-selling weight-loss drug Wegovy (semaglutide) made nearly $3.1 billion in revenue in the first 9 months of 2023. Novo’s other semaglutide product Ozempic, for diabetes, continued to be the company’s top asset. https://biospace.com/article/novo-logs-over-700-percent-wegovy-sales-growth-in-q3-raises-2023-outlook-/… #neulandlabs #semaglutide

Keval Ashar: I had only one question so we have seen in our product pipeline Semaglutide is

there. So wanted to know what is the size of potential that we are seeing in

Semaglutide. Considering that Glucagon like peptides have shown a good growth

over the past few years.

Saharsh Davuluri: So GLP ones are actually very exciting, is Semaglutide and Liraglutide both Neuland

are working on. Semaglutide is the more advanced project for us because there is

opportunity to be the first source for the generic markets. Currently, we are still in the

early stages of the development we expect validation complete, maybe in end of

FY23. Having said that we are looking at markets worldwide that is a solid oral as

well as injectable formulation. And currently we are exploring, both exclusive as well

as non exclusive partnerships, but it is a complex project, but we do have very

capable teams working on it right now.

Peptide APls

Custom Peptides

FMOC/Z - Building Blocks

Peptides-Brochure.pdf (675.5 KB)

https://twitter.com/rahuja671/status/1704483487581876346

Neuland is setting up a dedicated production block for one of its client Esperion for production of it’s New Chemical Entity (NCE), bempedoic acid which is major API in NEXLETOL and NEXLIZET a cholesterol lowering drug.

Bristol Myers bought Karuna Therapeutics in $14 Billion deal for $330 per share

Some takeaways from acquisition of Karuna Therapeutics by Pharma Giant Bristol Myers from the perspective of Neuland:

-

With this big acquisition, looks like KarXT is seriously poised for regulatory approvals. If approved, KarXT is expected to launch in late 2024 in the U.S. as a treatment for schizophrenia.

-

As per analysts, KarXT could generate more than $6 billion in peak annual sales for BMS if it were to be approved for all indications for which it is in development.

-

Neuland is CDMO partner for Karuna for manufacture of API for their projects including that of KarXT. Karuna might have other products in pipeline at early stages, there is a good possibility that Neuland might be involved in scaling up these early stage molecules with the innovator Karuna Therapeutics.

-

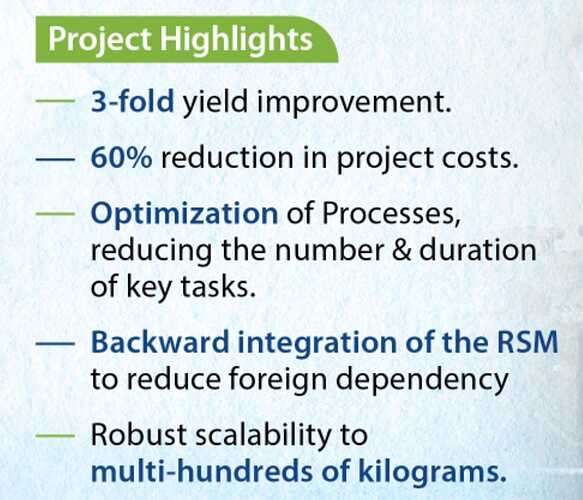

Karuna and Neuland started working on KarXT in mid-2019. Since then there has been various development on various fronts like scaling up, impurities reduction, signification yield improvements, registrations etc. Neuland is backward integrated for Regulatory Starting Material (RSM) . Neuland Labs has posted in good detail.

-

Neuland does’t seem to have any significant commercial relationship with Bristol Myers. Only connection I could found is that Dr. Christopher M. Cimarusti, Non-Executive Director of Neuland happens to have held executive leadership positions at Squibb Corporation and Bristol-Myers Squibb (BMS) in discovery and development. His last position with BMS was as Sr. Vice President, Pharmaceutical Development Centre of Excellence. But Neuland shares with very good relationship with Karuna Therapeutics.

-

Since the molecule is under development and not commercialised yet, I doubt this has been major contributor for the Neuland in terms of revenue thus far. However, management in the concalls indicated that development projects are exceeding their expectations but question is how much they can contribute. Management also saying that newly commercialised molecules have been the major contributors for increased CMS revenue.

-

Now the question is whether BMS would continue with Neuland for CMDO of KarXT. Patent has a limit and the way Neuland has greatly scaled up the molecule with integration of RSM and significant yield improvements despite CNS considered to be very Complex Chemistry and involves highly hazardous materials. Tech transfer and scaling up takes time. With my limited understanding I doubt BMS can totally ignore Neuland given the tight timelines for commercial launch if the molecule is approved.

For Neuland this could be big moment not only in terms of revenue but also to showcase their capabilities in case they are continued as CDMO of KarXT by BMS, be it 1st choice or 2nd choice, that can open many cross selling opportunities. Given many other projects in pipeline including peptides, valuations are still at discount to other CDMOs even without discounting KarXT thesis. This KarXT thing is turning out to be realistic optionality from binary outcome for Neuland.

Disclaimer: Invested, biased.

Very well analysed. This acquisition by BMS is going to put Neuland in a different orbit as a CDMO player.

Neuland team had good relationship with Karuna Team, however after the latest acquisition BMS will call the shots. BMS may have existing arrangement with other API manufactures also for the KARXT drug. Management can give some guidance in this regard in next concal. For Neuland, there is a new and bigger set of potential opportunities ahead from Bristol, provided that can smoothly channelise their exisitng relationship from Karuna to Bristol which is a giant in itself.

Any idea who is the formulator for KARXT

The recent transaction between Karuna and BMS has given clarity on two fronts:

Very High probability of commercialisation of KArxt drug.

The entire valuation of Karuna is mainly derived out of Karxt drug and hence the current valuation gives a reasonable clarity on the broad total addressable market of Karxt drug.

In view of above we now have more clarity on Commercialisation and TAM of the KArxt drug.

The same has also been immediately factored in share price of Karuna post BMS transaction wherein more than 50% appreciation was observed in a single trading session of 22/12/2023 to factor in the acquisition cost.

Now since we have clarity on above two variables we need to work our on the potential revenue for Neuland from the KArxt drug as an API supplier.

As per Annual Report of Karuna:

For clinical supply, we use CMOs who act in accordance with the FDA’s good laboratory practices, or GLP, and current good manufacturing practices, cGMP, for the manufacture of drug substance and product. Currently, we contract with Neuland Laboratories Limited and Esteve Quimica, S.A., for the manufacture of xanomeline and source trospium from Procos, S.p.A. and Midas Pharmaceuticals, Inc.

The KARXT drug is combination of 2 API (Xanomeline & Tropsium) and Karuna has 2 different sources for each of the API.

While searching for API manufactures for Tropsium, names of following Pharam Company was reflected.

However, I was not able to find any manufacturers for Xanomeline. (Experts can throw light on this).

The ratio of Xanomeline and Tropsium in the formulation is roughly in the ratio of 1:4 i.e for making 1 KG of KArxt you will require 200 Grams of Tropsium and 800 Gram of Xanomeline and hence more revenue potential for manufacturers of Xanomeline API (as a layman calculation).

Further, as per Annual report Karuna :

It is our intent to identify and qualify additional manufacturers to provide active pharmaceutical ingredient and fill-and-finish services prior to submission of a new drug application to the FDA for any product candidates that complete clinical development.

So Karuna will obviously look for other manufacturers also for sourcing the 2 APIs.

Now from the above table it is evident that for Tropsium, there are various other manufactures, however for Xanomeline I couldn’t find any one.

So is the API manufacturing process for Xanomeline complex ?? , if yes then there is a natural entry barrier and Neuland is in a safe position.

Further, we also need to analyse how sticky this business will be for Neuland or how sticky Neuland can make this business for itself. The following project highlight (for Xanomeline) published by Neuland reflects the capabilities of Neuland and also build a entry barrier for other manufactures even if the process is not complex. (similar to DIVIS Lab where they evolve their manufacturing process to become a lowest cost produce thereby creating a niche even in generic API)

So any new manufacturer which Karuna/ BMS will be looking for Xanomeline to replace Neuland will be required to have above capabilities along with proven track record. Further, the cost/compliance of shifting/ adding new API manufacturer(for Xanomeline) can also be a deterrent for Karuna/BMS.

https://www.chemanager-online.com/en/topics/pharma-biotech-processing/switching-api-sources

Karxt seems to be a blockbuster and a much awaited drug.

One can go through several reference article available on the internet to comprehend the requirement of this drug.

For reference one can also go through concal transcript of Karuna

KARUNA CONCAL.docx (70.0 KB)

Karuna Therapeutics, Inc. (NASDAQ:KRTX) Q3 2023 Earnings Call Transcript November 5, 2023

Neuland with the latest transaction seems to be elevated to a new orbit now.

Please help out for following questions:

Formulations/drug where Xanomeline is used as an API.

Manufactures of Xanomeline in India/World.

Is Manufacturing process of Xanomeline complex. ?

Disclosure : Invested and further added today and will further add in a SIP mode.