Sir, is this through Debt MFs or direct buying? If Direct, could you suggest some platforms to explore. Thanks

@Rational_Investor over 90% of my bonds is direct buying. I have shared the platforms here in the same thread: My portfolio updates and investment journey - #39 by joinjp2003

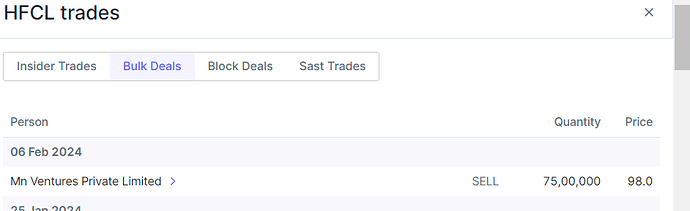

Hi @LarryWink I sold HFCL as promoter sold shares.

Source: screener.in

Company in Sep 2023 had raised QIP. I did not understand why promoter should exit while they raise QIP (find new investors).

@joinjp2003 Whats your take on Ami after results ? its more flattish

what is your experience with the liquidity of bonds bought directly?

I have not bought so far as I am concerned if I will be able to sell those quickly when I need.

for me - debt portfolio primary criteria is stability and liquidity, returns are important but comes next in priority.

@cometolearn I have no change in my view after the results. Earning story as expected shall pick up from Q2FY25. Positive - was increase of Ankleshwar capex from 190cr to 300cr. In long-term (beyond 2 to 3 years) they will also have a new electolyte solution business line.

Hi @aadi_007 liquidity is an issue. For me I will hardly sell as it funds my monthly expenses. If bond prices rise drastically then I might look to sell, I can sell in small tranches for many days.

Bond MF provide good liquidity however post management expenses we hardly get 7%. My bond portfolio is designed at 10%. Bid-ask spread is very high ranging from 25 to 75bps. So if I want to sell in hurry then i might have to sell at discount of 3 to 5 rupees on 100 rs par bond. In many cases there is no liquidtity so may end up holding till maturity. So I have staggered my maturity from 1 to 17 years. I am hoping as country grows bond market deepens.

If you can share, what are some bonds that you have purchased that have a higher yield (10-12%)? I have always been concerned that interest payments may be delayed on these higher yield bonds (for whatever reasons) even if I am not looking to sell. In your experience, have you ever faced that issue or is that not a risk to worry about?

@asarun please note that bonds also has risk as you said. I never had any issues in payment.

I have invested in AA rated bonds of Muthoot, IIFL Finance, Edelwiess and Nuvama. 6 months back credit access was around 11% yield and has now come down below 10%. Few of Poonawalla also available.

Please note of liquidity risk also.

Disclaimer: I am not a financial advisor and nor a SEBI registered Analyst. The content shared here is only for learning purpose. All the names mentioned here are for example purpose. I may buy more, exit or partly sell the stock/bonds without any prior intimation.

Got it, thanks. Yes, the liquidity risk I understand. But I am not looking to sell before maturity (or at least I hope I don’t have to). Had historically stayed away from higher-yield bonds more due to concerns of payment delays. So it’s good to know you haven’t faced that issue so far. I suppose I will nibble a bit though I prefer safety much more on my debt portfolio even if the yield is lower. I am trying to arrange a quarterly income stream, somewhat like you have done.

Appreciate the disclaimer ![]()

Thank you… Always good to know your point of view and stocks you are investing

^^

Thanks for your response.

I too have a ICICIDirect account, and have been thinking about buying bonds directly.

Considering I am in my mid 40’s and contemplating early retirement, a steady income stream is needed apart from equity. You are right that debt funds typically will give 6-8% returns which barely covers for inflation.

Can you please tell me if I need to do anything when the bond matures?

Does the amount get automatically credited in the bank account along with interest?

I will probably buy a small amount to get comfortable with the overall process before putting in large sum of money.

@asarun I note that there might be some confusion. Also for other readers its good to clarify.

Higher-yield is not generic market term. However, High-yield is the generic market term.

So what is high-yield? High yield in global market paralance will be bonds rated below BBB- by S&P and Fitch and below Baa3 by Moody’s. As India is rated BBB- by global rating agencies so from global standard perspective if we want to invest in investment grade (non-high-yield) then mostly the government and very few institutions (SBI, large private banks, and PSUs) might only be the option. While the rating I am talking about AA for IIFL, credit access, etc is domestic ratings.

Now coming back to domestic markets where domestic ratings start from AAA (generally government and large debt free institutions) the yield will be in 7 to 8% range max.

However, when we go down on credit quality we get slightly higher yield. However, you dont need to go down much. As we do it in finding stocks we need to evaluate each investement versus inherent risk.

Just to give an example: Nuvama is rated AA- currently. However, I know that business fundamentals are very good. Recently in there concall they highlighted they dont want to increase their credit business. Which means they will not borrow more. As credit investor I see an improving situation and MNC parentage. Also few quarters back Nuvama gave away the 3k crore credit line which was provided by parent. So company seems very confident. Now I look at what is the yield provided by Nuvama bonds in the market, they were available ~11% and now they have closer to 10%. As we keep PE in mind for stocks I understand that with such quality its credit ratings should improve and yield should fall below 10%. So it’s not about chasing higher-yield its about how we chase a balance of growth and valuations in the stocks. So fundamental direction vis a v yield.

In fact I will not invest in high-yield bonds as you alluded to risks. Also remember you need to do a good work, ILFS was rated AAA at some point of time, I think DHFL was also in AA category. So nothing is easy your financial analysis, your trust on company provided number, yield (price), all come in picture.

Hope this helps the reader.

Disclosure: invested in Nuvama bonds and stock.

Disclaimer: I am not a financial advisor and nor a SEBI registered Analyst. The content shared here is only for learning purpose. All the names mentioned here are for example purpose. I may buy more, exit or partly sell the stock/bonds without any prior intimation.

@aadi_007 Interest and maturity is credited directly to the linked bank account - this is my experience so far.

Please account for all the risks we discussed earlier and note I wrote few minutes back. and off-course my disclaimer:

Disclaimer: I am not a financial advisor and nor a SEBI registered Analyst. The content shared here is only for learning purpose. All the names mentioned here are for example purpose. I may buy more, exit or partly sell the stock/bonds without any prior intimation.

^^

Thanks, I have been investing for a long time and I understand how bonds or debt funds work, though my primary passion is equity investing.

So, whatever I will invest is at my own discretion only ![]()

Thanks for the additional clarifications and context. I understand high-yield has to do with the ratings. I was using the phrase higher yield loosely. However, like you mentioned, ratings are no guarantee of credit quality. Also, our assessment of companies in the high-yield category can vary. For instance, you are comfortable with Edelweiss whereas I am not. Not saying that there is anything wrong with them, just my own perception. So I will probably not purchase their bonds. That said, my key takeaway from this discussion is that it’s probably ok to put in a little bit of my money there. Caveat emptor, of course!

Base rate investing: a fultoss available to investors

Recently I came across an article and below excerpt was the highlight. Thanks to https://alphaideas.in/ who does the hard work so that I can read wonderful blog content, Indian capital market news.

Source: Base Rate Investing: The Smart Investor's Secret

Keeping “inside view” in context, when I am looking at a company’s valuation and historical financials I am not using broader context or history. I am not doing peer analysis and not seeing what history tells about such companies. If history or peers are not available in India then I look outside India.

One of the examples of inside and outside view I noted in my investing was for Nuvama: When the company got listed in September 2023, its market cap was 9000 crores with PE of about 20. I have seen other Jars and I know how many candies they had. In stock fundamentals language, I have seen how much PE is given to other wealth management companies: 360 One and Anand Rathi were trading in 25 to 50 PE range. So my valuation for Nuvama in my mind was about ~15,000 crores. So I bought it aggressively. As picture evolved, I continued to invest in it with improving earnings. I trusted the management as PAG is large Aisa focused investment firm. All the time simple patterns may not work also they might not be frequently available but when they come, they can be the easiest to play.

Disclosure: Invested in Nuvama and transacted in last 30 days. This is now my second largest position.

Disclaimer: I am not a financial advisor and nor a SEBI registered Analyst. The content shared here is only for learning purpose. All the names mentioned here are for example purpose. I may buy more, exit or partly sell the stock/bonds without any prior intimation

Sir whats your average price in Nuvama

My first buy was at 2485 on 27th September 2023, lowest price buy was at 2210 on 6th October, highest price buy is at 4410 on 23rd February 2024 and overall average is 2976.

I will delete this message in sometime as this is not a value add.

Sir company valuation 9000 at PE 20 but valuation will be goes 15000 in future. What is the process to calculate it?

Pls explain it in breif.