My rationale on Sandhar Technology (3% allocation, 8% profit): My first buy was in July 2023 at 357 rs. My last transaction (buy) was in August 2023 at ~400 rs.

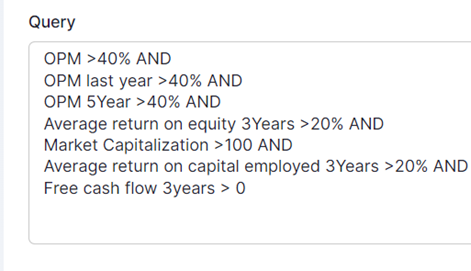

First time I came across Sandhar was an year back on scientific investing and the logical investor collaborative video on YouTube https://www.youtube.com/watch?v=irrl7f1jeWE&t=1312s. However, I ignored it as I am generally not big on auto ancillaries. Then this company came back on my radar when I was watching a recent SOIC’s (Ishmohit’s) video https://www.youtube.com/watch?v=PneVPf1L-y4 (14th minute). One thing which really clicked this time was when he mentioned the operating cash flows of the company over 300 crores for FY 23, while market capitalization was around ~2000 crores. So I bought my first tranche by end of July 2023. In Q1 2024, the cash flows were 98 crore. So if I annualize that it gives ~400 crores of cash flow. That is ~17% operating cash flow yield. So, I added aggressively in the August month.

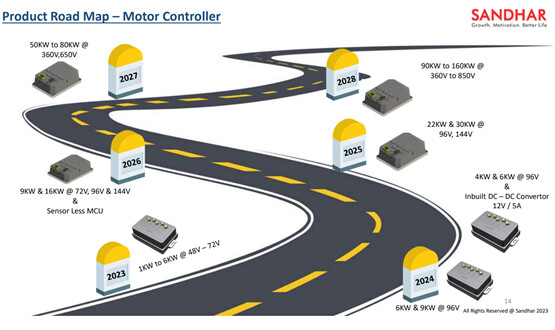

Generally, valuation is not only parameter for me. My further readings changed my mind of this being a traditional auto ancillary. I went through company conference calls, presentation, and annual reports. I liked its products; smart locks, motor controller unit (MCU), DC converter, off board chargers etc. Please note that I don’t have deep knowledge of these products. Only thing is when I was talking to one of my friends on BLDC fans, he talked about MCU as one of the components. Also, little bit of my research on off-board charger shows that it makes EVs lighter, reduces space requirements and much more efficient in charging battery.

Company works with a vision and plan. This is visible in their presentation. One of the snapshots below show the road map on MCU:

Source: Sandhar Investor Presentation for June ended quarter.

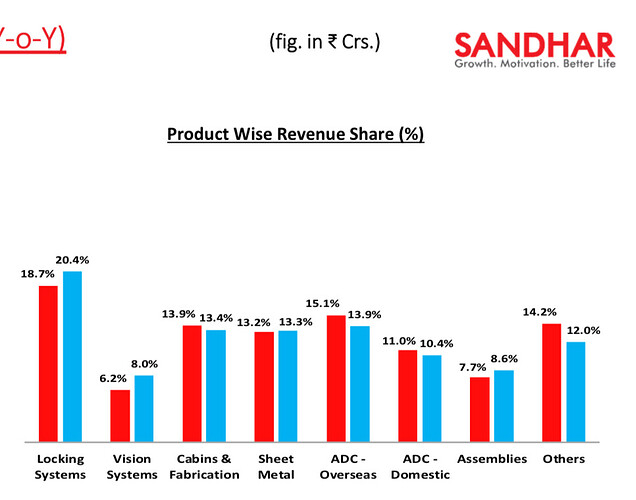

Going forward, past two-three years capex is coming in frution and future capex requirements will be very low. Hence, free cash flows will increase subtantially. Two wheeler industry going forward will move from manual locks for 300 to 400 rs to Sandhar’s smart locks of over 2000 rs per vehicle.

Source: Sandhar conference call Q4 FY2023

Though company’s products are EV agnostic, their EV pipeline of products could result in 15k to 30k revenue per vehicle for two wheelers while 50k to 60k for 4-wheelers.

Source: Sandhar conference call Q4 FY2023

Their JVs, which were in losses are breaking even or coming in profits. 2-wheeler industry growth is 2-3% but company grows in 20-25% range. This shows that value of its products per vehicle is increasing. Products seems futuristics as well.

Is management sounding too bullish? lets track and manage…

I Invite the people to comment who have the knowledge on MCU, DC-convertors and Off-board chargers to share their knowledge on Sandhar Tech’s thread - Sandhar Technologies - An emerging market leader - #18 by Souresh_Pal

Disclaimer: I am not a financial advisor and nor a SEBI registered Analyst. The content shared here is only for learning purpose. All the names mentioned here are for example and learning purpose. I may buy more, exit or partly sell the stock/bonds without any prior intimation.