Agree. Except for the last quarter, I guess most peior quarters it had a >100% Combined Ratio. All insurance business is dependent on underwriting strength, but more s in General.

Interesting outlook. I havent checked on mcap of global insurance giants…will check it. Agree the current valuation of insurance companies are very high in India. And it has been high throughout since their listing and recent carnage (HDFC Life in particular). I am very bad at reasoning out on valuation with Mr Market. Maybe the market believes that HDFC Life will be a future global leader? Honesty I am surprised to know very few insurance company have 100 Bn $ valuation…could it be because GEICO, New York Life etc. are not listed?

True, to give a perspective to the statement…GEICO was once bankrupt, until it rose from its ashes under Berkshire…a great management and underwriting can create giants while vice versa can lead to huge losses (I fear General insurance as much as I fear NBFCs…however, we need to own them as they offer big growth, untill some of them collapse and I pray they are not the ones I own ![]() )

)

https://www.relbanks.com/top-insurance-companies/market-cap

I haven’t done any detailed analysis on trading comparables. Just some cursory checks. The above data is a bit dated, though.

I gut feeling is insurance is overvalued at this point and might be revealed at hind sight.

I have no data to back this but as things evolve and there is more certainty to life apart from natural calamities, the insurance premiums will stagnate or shrink. Unless there is mandatory / regulatory obligation such as in vehicles which require a 3rd insurance or so.

Thoughts are not coherent. Apologies for it.

I’d probably remove Yes bank (corp gov/mis reporting issues) and look at Motherson-Sumi. Do check that out, especially at current valuations

Thanks. I dont have much understanding of Motherson Sumi business. It seems This is a fairly large company with historical quality and current attractive valuation . However near term YoY, QoQ results are bad. Also stock has fallen 40% from high.In fact I get confused. 1 year bad financial performance results into price correction, which makes valuation attractive. Its like you gain some but lose some kind of situation.

If you can explain more "why recent financials are bad and can these improve in the long term", then I am sure this will be a very good stock to buy and hold. I guess, its effected due to overall slow down of automobile sales, rupee depreciation.

Let me know your inputs.

Losing market share, competition tightening, industry headwinds… Tough times.

Hmm, it’s a worrying sign. Let’s see how it goes in next couple of quarters. New Ertiga is being launched and am positive about it gaining traction.

By the way, as of Sep, 7 out of top 10 selling models are from Maruti.

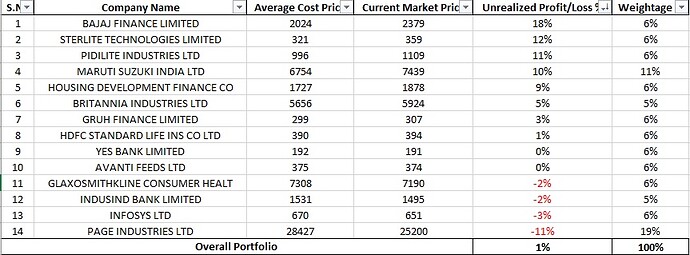

Reading through various posts realised- for beginner concentration can be risky and volatile. Increased to 14 stocks from 10. Added, GSK Consumer, IndusInd Bank, Infosys, Page Industries. Was impatient- entered Page too early, recent fall impacted portfolio big time.

GSK for recent good quarter performance, IndusInd has good past record and has corrected much. Also PSU to Pvt value migration happening, Infosys- not much idea, big name, Page- Most popular Stock.

Comments, feedback & reviews please !!!

Infosys has low promoter holding. I prefer TCS, which also has delivered better organic business growth, in the last couple of years.

In page, the momentum clearly is on the downside. Would suggest building the position gradually. Also, besides popularity, there has to be some other justification for commanding such a high PE. I would not invest without understanding that reason first.

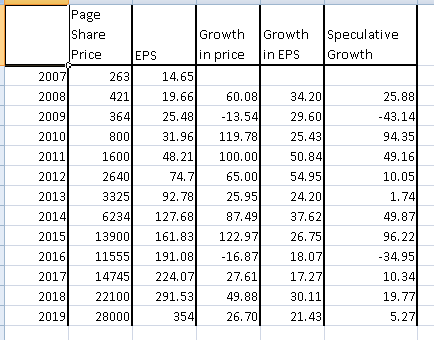

In regard with Page.

When in doubt about whether a growth stock is expensive, and at what level would I be comfortable buying, I fill this table. This gives one a picture of last ten years.

One tracks how much “Speculative Interest” is riled into the share price. When this number is low or negative, indicates that the price is not “heated”.

If the stock is growing at a scorching pace like Page is, then it is best to buy when this speculative Interest number is a low, or preferably negative. If its a large cap, I would interpret it little different.

PS: This is just a discussion, sharing of ideas. Pls take it with a pinch of salt. Many other factors are to be considered before taking investment decision.

Nice tool. Speculative interest!

@jamit05 can you tell me when was the right time to enter or buy on dips. I think its 2016,2013,2009…am I correct or am I missing something.

Difficult to say when was the right time. But, yes, this tool kind of guides you when you wish to add to an already existing position. It tracks when the stock has “cooled off”

This will help, if you wish to add in a cooled off setup. Some people wish to add when the stock is “hot” and has momentum.

If the portfolio you originally mentioned is what you hand picked yourself from your own research and screening then you have a lot of finance / insurance / banking in there and it is very skewed towards that area. It should not be even though it might the opportunistic time to invest in this generalized sector.

Timing is only known by God and no one else and hence you have to be humble about when you buy. If you are not an investor and going to dip into this arena every so often, then it must mean that you are new to investing and may not watch the market daily, carefully and almost all technical / fundamental aspects of it. This means you will become a passive investor very soon when a down turn comes (happens commonly to new investors). Being that it is a pattern of almost 50 years, you might want to:

- Pick a SIP approach to investing into individual stocks.

- Add the Nifty BeeS to your portfolio list as one of the stocks.

- Buy a good balance of sectors that you think are the best for the next 5 to 10 years - For example, Electric Vehicles, IT, Pharma and FMCG will do well (we all know that). Make sure you have Large Cap examples of these sectors in your list.

- Add stocks that have paid dividends with consistency in the last 3 to 10 years. 10 might be too long but worth looking into. You WANT to get paid while you wait and wait in a bear market.

- Also, you want to ensure that these companies are in a lowest debt environment. So, if you pick two similar companies in the same industry and want to pick 1, then pick the one with the lowest debt / equity ratio.

- Be ready for a haircut at any point since your horizon is not 5 years, but 5 years from your last purchase in that stock (rolling forward date).

- Be patient. Be disciplined. Wait and Wait to make wealth. Don’t try to make money.

Good luck.

KKP

good way to analyse the price in a simple manner

Nicely written, I had mad mistakes in my early investment years and suffered huge loss by not following/considering these points

Hi Amit,

What is source from where you get last 10 years EPS and price growth data?

Both from screener.in

Latest quarter results are very good. Revenue & profit increased yoy & qoq both. Also compared to other fmcg companies where pe is more than 40,50…gsk pe is 37 kind off. so essentially recent earnings and relative valuation are what i found good.