AR23 notes:

Management change

- Kumar Jay Modi (son of Managing Director G.L Modi) became Jt Managing director

- Rakesh Singh (non-executive director) and Manish Srivastava (joint MD) resigned

- Murlidhar Narayan Nikam was appointed as CEO (very impressive profile; ex CG Power and Crompton Greaves)

Miscellaneous

-

Losses on forex hedging: 2.56 cr. (vs 3.54 cr. in FY22)

-

Inventory was 78.52 cr. in FY23

-

# of employees : 261 (vs 257 in FY22)

-

Increase in management salary: 12.57% (vs 10.78% in FY22). This was despite drop in profits by 27%

-

Increase in other salary (except management): 11.17% (vs 8.39% in FY22)

-

Share price : 49.55 (low), 81.15 (high)

-

# shareholders : 15’736 (vs 17’182 in FY22). Dheeraj Kumar Lohia held 0.61% and is a new entrant in top 10 shareholder list

-

Audit fees : 8.8 lakhs (vs 6.35 in FY22)

-

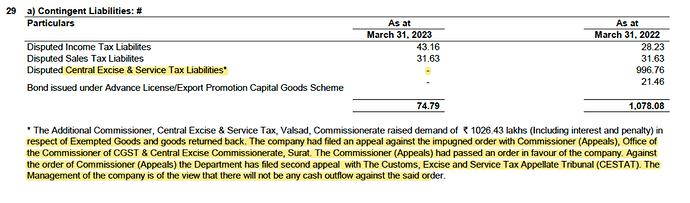

Total tax disputes : 75 lakhs (vs 10.25 cr. in FY22). Seems 10 cr. tax dispute is close to being solved

-

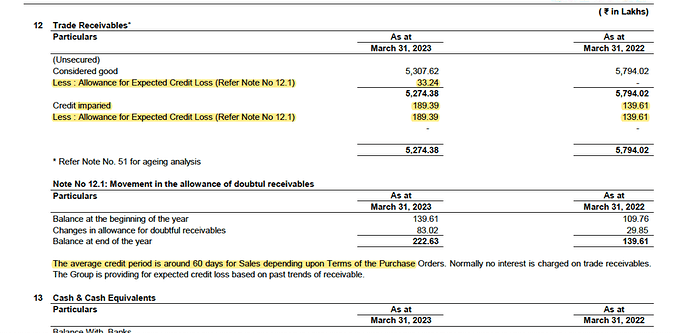

Doubtful receivables : 1.89 cr. (vs 1.4 cr. in FY22)

-

Advances from customers: 7.72 cr. (vs 4.1 cr. in FY22)

-

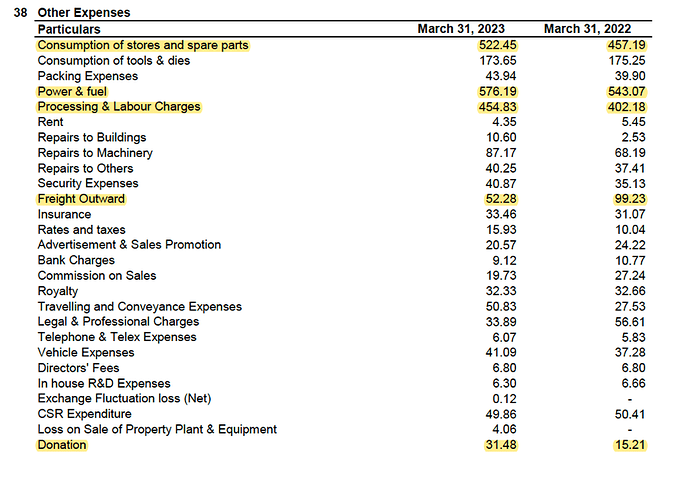

Other expenses breakup:

-

Received Certificate of Appreciation from Siemens Energy and ABB- Supplier Summit Award 2022

-

Our new flat organization structure enables streamlined decision-making and lowers transactional costs. We have also implemented a Reward & Recognition scheme to create an environment of Performance Excellence, which has started showing desired results and is expected to add significant value to our organization

-

Since FY22 project of construction of Modison Government College is under progress

-

Certifications: ISO9001:2015, ISO14001:2015, and 45001-2017

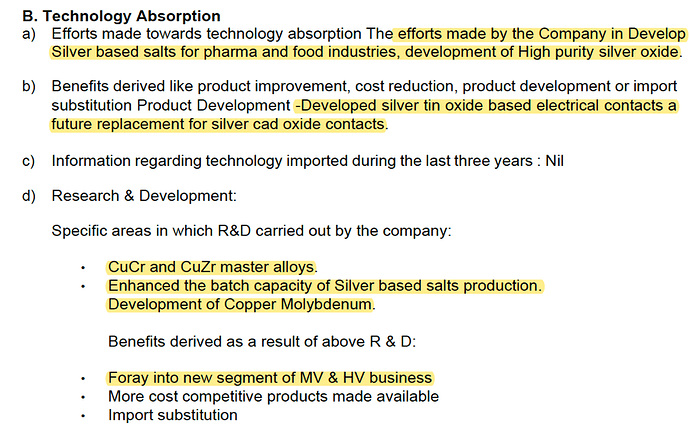

R&D projects

- R&D spends: 75.71 lakhs (vs 80.49 lakhs in FY22) capitalized, 43.23 lakhs (vs 55.3 lakhs in FY22) recurring (total: 1.19 cr. vs 1.36 cr. in FY22 )

Related party transaction with Modison Copper:

-

Purchase: 26.25 cr. (vs 27.09 cr. in FY22)

-

Sale: 1.69 cr. (vs 4.66 cr. in FY22)

-

Took approval for transactions upto 50 cr.

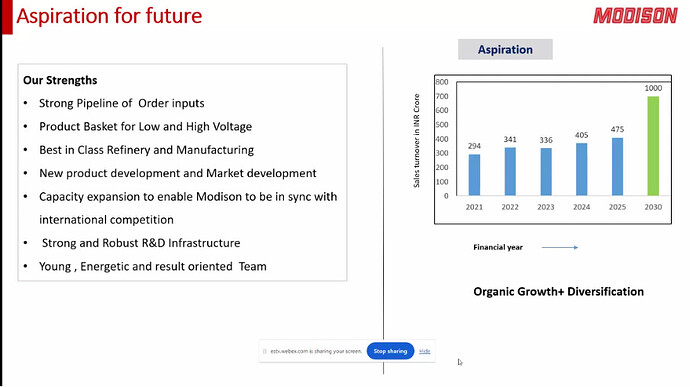

Broad outlook

-

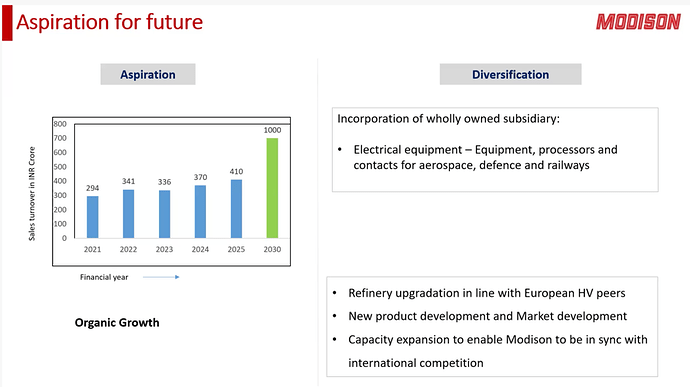

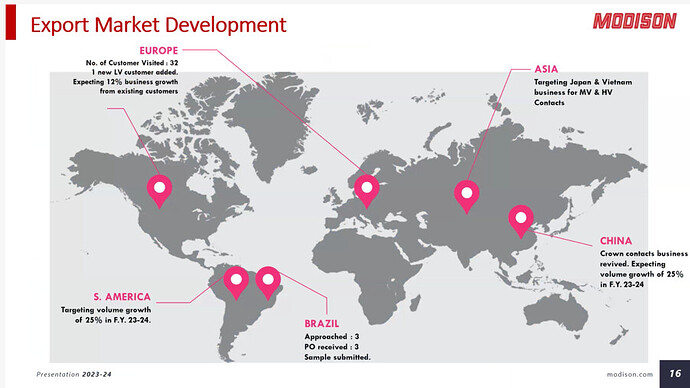

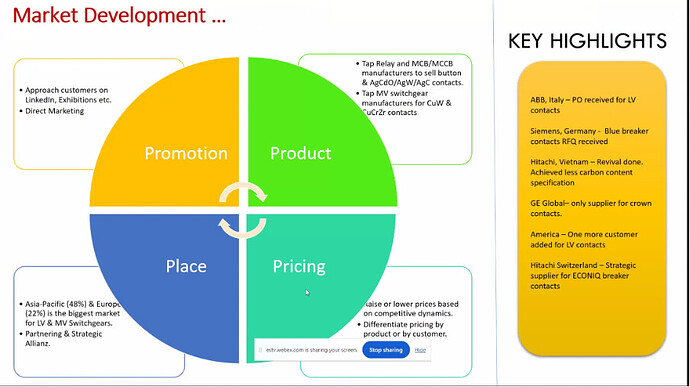

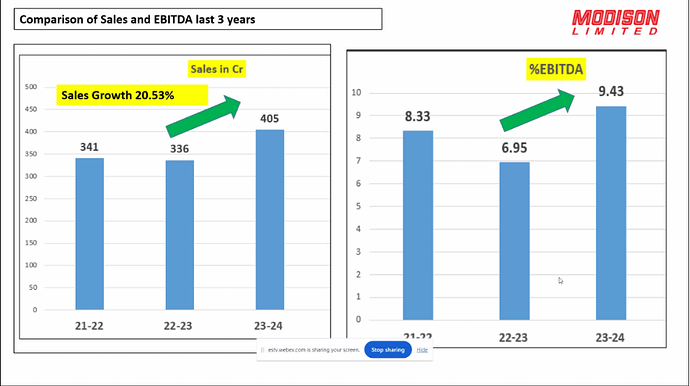

During FY23, managed its growth in high voltage & continued momentum in terms of volume for low voltage.

-

Adverse input cost movement including silver impacted profitability in short terms.

-

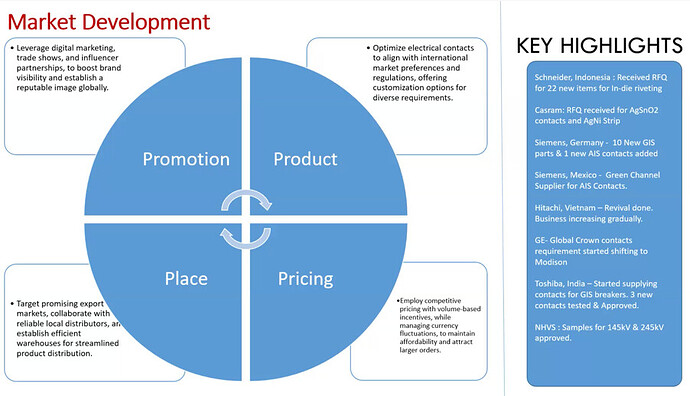

FY24 focus will be on cost optimization & innovation that include new product development, automation, new market development

-

Witnessing supplier consolidation and China+1 from key clients thereby having higher wallet share

-

Engineering Goods sector constitutes >27%, accounting for largest share of India’s total exports. Growth in engineering goods exports in recent years has largely been due to the zero duty Export Promotion Capital Goods (EPCG) scheme

-

India Switchgear market is expected to grow with a CAGR of more than 5% from FY23 to FY28. Low Voltage Switchgear market is formed by commercial, residential buildings, real estate industry, and construction sector.

-

Medium and High Voltage Switchgear is expected to have stagnant growth during the forecast period 2023.

-

Company’s HV competitors are from Europe it is imperative that Company remain in sync with the global manufacturing norms

-

Has 2 plants in Western India (Vapi and Silvassa), employing more than 500 people

Capex plans

- Spent 12.5 cr. with most addition being seen in CWIP

- We have started our capex plan for upgradation of our existing facilities by infra expansion, both green and brown field, procuring automated machinery and robots etc. Started construction of new factory at existing premises and at new plot near existing factory. These will be commercialized in FY24.

Disclosure: Invested (position size here, no transactions in last-30 days)