About the Company

MIDHANI (Mishra Datum Nigam Ltd) is majorly owned by the government and manufactures a variety of super alloys, titanium and titanium alloys, special-purpose steels, controlled-expansion alloys, soft magnetic alloys, electrical-resistance alloys, molybdenum products, and other special products made according to customer specifications. The company also offers metallurgical testing, evaluation, and consultancy services. Its quality control is recognised by the National Accreditation Board of Laboratories. MIDHANI is under the administrative control of the Ministry of Defence’s Department of Defence Production

Mile stones

• 1983-1984 First commercial production started

• 1987-1988 Entered into the field of fabrication of special armour panels

• 2000-2001 Development of bio implants from Titanium alloys

• 2001-2002 Development Niobium alloy required for critical space applications

• 2002-2003 Supply of indigenized special fasteners commenced

• 2005-2006 Development of large forgings of Chromium -Molybdenum steel in the form of weld neck flanges, blind flanges etc.

• 2006-2007 Development of gun barrel forgings.

• 2008-2009 Achieved Mini Ratna category-1 status from MoD

• 2009-2010 Commencement of commercial production of 6.5 metric tonnes vacuum induction melting furnace

• 2010-2011 Commissioning of critical equipment like 10 tonnes vacuum arc re-melting furnace

• 2011-2012 Implementation of the e-Procurement portal for publishing and processing tenders online. Signatory to UN Global Compact Initiative

• 2014-2015 Commissioning of 6000 tonnes forge press and electron beam melting furnace

• 2015-2016 Commissioning of in-house designed 20 tonnes electro slag refining furnace and 10 tonnes vacuum arc re-melting furnace Awarded “Excellent” rating with a score of 97.06%, which is the best amongst all the defence PSUs and ranks among top 5% of all companies signing such MoUs with the Department of Defence Production

• 2016-2017 Commissioning of 20 tonnes electric arc furnace

Plant locations

• Hyderabad

• Nellore

• Rohtak

Products

• High Value Specialty Steel

• Super-alloys

• Titanium Based Alloys

Ultra High Strength Steel: Ultra High Strength Steel has yield strength between 1400 and 2400 MPa with high strength, excellent toughness and weldability without losing their malleable nature, and it belongs to the ultra-high strength materials category.

Armor Grade Steel Plates: Armor grade steel plates are used for bullet proof application to ensure the safety of individuals and/or contents transported from one place to another. It possesses excellent hardness and toughness along with high velocity projectile protection for vehicles in combat situation. The key end user application includes both defence vehicles and commercial vehicles. Generally the walls, doors, and the ceiling of these vehicles use armour grade steel to increase the ballistic resistance of the vehicle. The functional components of the vehicles such as engine components are made of superior quality to withstand load and excess weight.

Ferritic Stainless Steel: Ferritic steel contains high content of chromium, magnetic stainless steel with less than 0.12% carbon content. Ferritic steel have good resistance to corrosion along with excellent surface finish and stress corrosion cracking. This material finds application with thinner material and reduced weight with strength.

Martensitic Stainless Steel: Martensitic steel has carbon content of upto 0.75%, with chromium from 12.5% to 18%. Tempered martensite steel provides increased hardness and high toughness. Improved group of martensitic stainless steels are the super martensitic stainless steels that provide high strength with low-temperature toughness having acceptable corrosion resistance.

Austenitic Stainless Steel: Austenitic steel are non-magnetic stainless steel grade with high level of chromium (upto 28%) and nickel (36%) along with low level of carbon. Austenitic steel grades have enhanced corrosion resistance with modified structure from ferritic to austenitic. These types of grades are categorized with 200, 300 series and are most commonly used type among other types of stainless steel.

Precipitation Hardening Steel: Precipitation hardening steel is classified as martensitic or semi austenitic steel grade that can be strengthened and hardened by heat treatment. This material is ideal for applications that requires high strength-to-weight ratio such as aerospace.

Process :

Company’s manufacturing facilities includes primary and secondary melting furnaces such as electric arc furnace with ladlle refining furnace, vacuum degassing/ vacuum oxygen decarburisation, vacuum induction melting, vacuum induction refining, vacuum arc re-melting, electro slag re-melting and electron beam melting. Subsequent operations are carried out with 6000T/1500T forge press, ring rolling mill, hot rolling and cold rolling, bar and wire drawing based on the output sizes required. The auxiliary supporting services like conditioning, heat treatment, machining, pickling, quality control also form part of our manufacturing processes.

The primary raw materials used by Company for manufacturing our products are: (a) nickel metal to various specifications; (b) cobalt metal to various specifications; (c) various master alloys; (d) pure iron; (e) titanium sponge of various grades; (f) chromium metal to various specifications; (g) mild steel scrap/stainless steel scrap; (h) high carbon/low carbon ferro chrome; (i) aluminium metal in various forms; (j) manganese metals; and (k) different ferroalloys

It is good to mention that the by-products produced during the production process are not hazardous to the environment. Different forms of by-products generated during the process of manufacturing are reused by the Company at different stages of the manufacturing process.

People / management / Skill enhancement:

• The value added per employee in the last five years has seen a growth from ₹ 3.7 million in Fiscal 2013 to ₹ 7.2 million in Fiscal 2017.Compnay have undertaken following steps to motivate talent : Dr. Tamhankar’s trophy for young managers below 35 years for encouraging new ideas. They have Employee suggestion scheme along with Best employee of the year award in each category executive, non-unionised supervisor, worker and woman.

• As of January 31, 2018, company have 852 employees, comprising 268 executives, 71 non-unionised supervisors and 513 nonexecutives. Of these non-executives, 271 are skilled workers, 201 are semi-skilled and the balance of the employees consists of unskilled labour and administrative staff.

for management brief back ground one may look at Mangment of MIDANI.docx (14.3 KB)

Intellectual Property :

business under the name and brand of MIDHANI. Our logo has been registered in the name of Company as a word mark and label under class 6 and 35.Company have been issued the trademark registration certificate on May 18, 2017 in respect of advertising, business, administration, office, functions, demonstration of goods, dissemination of advertising matter publicity services, promotional services, all being in relation to special metals and alloys. Company have been issued the trademark registration certificate on May 26, 2017 in respect of common metals and their alloys, design, development and equipment made out of special metals and alloy sheets. Company use the brands MDN, SUPERNI, SUPERFER, SUPERCO and TITAN which are not registered.

Niche Space:

Competitive advantages:

Most advanced and unique facilities

- Company is the only facility in India to carry out vacuum based melting and refining through world class vacuum melting furnace such as vacuum induction melting, vacuum arc remelting, vacuum degassing/ vacuum oxygen decarburisation, electro slag remelting and electron- beam melting. It enables our Company to venture new markets with innovative and advanced products.

- Company has successfully produced Hafnium metal having vital application in the space sector for the first time in the country using state of the art electron beam melting furnace. Also, we have manufactured large nickel super-alloy based casting through air induction melting route.

- Thus the wide spectrum of advanced melting facilities enables company with the flexibility to provide it’s customers with high quality products which meet their stringent quality requirements.

Capability to manufacture wide range of advanced products

MIDHANI is a manufacturer of special steels and stainless steels, Superalloys (nickel base, iron base and cobalt base), commercially pure titanium and titanium alloys, soft magnetic alloys, controlled expansion alloys, heat resistance alloys, special purpose alloys, refractory metals and other alloys in different shapes, properties and sizes.

MIDHANI have process capabilities across the product manufacturing value chain, including melting, forging, rolling, wire drawing, investment casting, machining and quality testing. We are a modern and integrated metallurgical plant for manufacturing a wide spectrum of critical alloys in variety of forms such as ingots, forged bars, rings hot rolled sheets and bars, cold rolled sheets, strips and foils, wires, castings, fasteners and tubes using state of the art production facilities for defence, space, aeronautics, power and thermal power, electronics, tele-communications and engineering industries and other sectors in India. Compnay monitor all its processes, right from the receipt of raw materials, manufacturing to packaging of products. In addition, we also use high quality/pure form of raw materials to manufacture alloys. This helps MIDHANI to ensure high quality of it’s manufactured products and control our production costs. MIDHANI’s variety based capacities also allow it to service customer requirements in a timely and efficient process with the flexibility to produce different ranges of customised products to our customers. MIDHANI is in a unique position to leverage both economies of scale and scope as we are capable of processing different alloys. Some of the alloys that MIDHANI manufacture have properties higher than international standards to meet specific requirements of our customers.

MIDHANI’s wide range of products and ability to meet the specific customer needs enable us to successfully service core strategic sectors such as defence, nuclear/ power and aerospace.

- Strong long term customer relationships

- Company have a strong and an established relationship with it’s customers. Company have partnered with many of it’s key customers in the product development process, enabling it’s products to meet the exact specifications provided by the customers and to ensure repeat orders. MIDHANI’s relationships with it’s major customers, especially in core strategic sectors, have existed for more than three decades. MIDHANI undertakes an in house survey for customer satisfaction. The results of customer satisfaction index during 2012 to 2015 is more than 3.5 on the scale of 1 to 5.

- Going forward, it’s believed that there is likely to be an increase in demand for special metals and alloys on account of government initiatives such as Make in India that will boost defence production and heavy equipment manufacturing in India, which will indirectly lead to an increase in demand of it’s products. Company intended to continue to leverage these long standing relationships and continue to grow it’s business operations in line with these expectations.

- MIDHANI’s quality is exemplified through the ISO 9001:2008, AS 9100C and NABL certifications that it have obtained with respect to it’s manufacturing processes. Company is committed to enhancement of customer satisfaction by continually improving the effectiveness of quality management system to drive organisational performance. Company intend to strive to exceed client expectations during every stage of the project life cycle. This, coupled with it’s flexibility in setting prices for it’s products, is a significant advantage to our business. The trust of it’s customers is manifested through customer funded capital investments at the Company. As on September 30, 2017, customer funded assets constitute ₹ 660 million out of the total gross block of our Company of ₹ 3,653.94 million.

- Research and development based technology development

MIDHANI keep abreast with the latest developments in related fields of science and technology. To be at par with the global technological progress, it place strong emphasis on technology of products, technology of process and technology of equipment. In it’s in-house research and development team works towards improvement of product quality and processes innovation. e.g it has reused titanium scrap to make ferro titanium for Indian market . It has manufactured the adour engine disc through isothermal forging process for aerospace sector under Make in India programme .

Company has team comprising of 14 officers who have in-depth knowledge of the design and engineering of special metals and alloys. In 2016, we have established a new melt shop with electric arc furnace, ladle refining furnace, vacuum degassing facility, new ring rolling mill and higher capacity forge press apart from echo system of making value added products like tubes, fasteners, etc. MIDHANI has in-house metallurgical laboratories to cater to the testing required for it’s products. Given the strategic and sensitive nature of our customers’ operations, it is vital for company to ensure delivery of high quality products to customers…

Highly Qualified and Experienced Management and Management Systems

Risks :

- Significant dependence on single or few customers

- Significant economic changes that materially affect or are likely to affect income from continuing operations.

- Portion of business relating to our import of raw materials and other capital equipment are in other currencies. Our exchange rate risk primarily arises from our foreign currency revenues, costs and other foreign currency assets and liabilities to the extent that there is no natural hedge. We may be affected by significant fluctuations in the exchange rates between the Indian Rupee and other currencies.

- The proposed 100% foreign direct investment in defence services with full technology transfer may result in private companies manufacturing superalloys

Indian Industry Out look:

Overview of the Defence Sector

India’s defence industry continues to strive to become a cutting edge, technology-savvy, self-sufficient, and world-leading industry. According to data published by the Department of Industrial Policy and Planning, India’s defence industry had attracted ₹ 130,000 million in Foreign Direct Investment (“FDI”) in Fiscal 2015. The proposed 100% FDI with full technology transfer aims at addressing the need of capital investment and improved technology transfer. Ordnance factories (“OF”) and Defence Public Sector Undertakings (“DPSUs”) are engaged in the manufacturing of weapon systems for the armed forces. The private sector has been mainly involved in supplying raw material, semi-finished products, and components to DPSUs, OF, army base workshops, air force base repair depots, and navy dockyards.

Some key features of the Indian defence industry include:

Fourth largest armed forces worldwide, in the 2017 Military Ranking by the Global Firepower list

One of the largest arms importer, accounting for 12.8% of global arms imports (between 2012 and 2016) Ranks fifth in the global military budget (2016)

The industry however, suffers from several legacy issues. Almost half of India’s military equipment is approaching obsolescence. Additionally, India overwhelmingly relies on imports for its defence equipment. Almost 70% of its defence requirements are imported.

India’s military seems reluctant to procure weapons from Indian firms, citing low or no track record in defence manufacturing. Additionally, Indian firms have refused bidding for government tenders worth approximately ₹ 975,000 million since 2013, quoting unrealistic quality demands, opaque processes, and slow decision making.

By 2027 the government plans to achieve approximately 70% indigenization in defence purchase, and the government has taken steps by budgeting ₹ 915,800 million for defence capital expenditure in Fiscal 2018, which is 25% of the nation’s overall defence budget. To take this to the next level, India expects to export defence equipment worth ₹ 128,000 million by 2019 to countries such as Vietnam, Mauritius and the UAE.

Between 2015 and 2020, the defence cumulative spending is estimated to be ₹ 22,931,500 million, of which new armaments spending is estimated to be ₹ 8,630,500 million. Procurement of new equipment from domestic sources is estimated to increase between 2015 and 2030 from 44% to 55%. By Fiscal 2025-2030, the defence spending is estimated to hit ₹ 41,934,700 million.

New procurement policies would likely result in indigenous development and increased production in the long term. The Indian defence establishment will move from off-the-shelf purchases to co-development and partnership. Critical equipment shortfall in certain sectors would mandate high-value, off-the-shelf purchases in the short and medium terms to maintain the combat readiness of the Indian Armed Forces.

Contribution of the Defence Sector to the Indian Economy

There is a positive direct link between the defence budget growth and economic growth. Defence spending has macroeconomic implications, since security threats have an adverse impact on trade and business. Gross Capital Formation (“GCF”), (investment, at current prices) estimate for Fiscal 2016 was 30.4% of GDP, the lowest since Fiscal 2012. However, India stood well above the global average of 24.2% in 2015, which is a healthy sign. The way forward is to boost investments through increased private-public partnerships.

Defence allocation is likely to remain constant for the next three to four years, in order for the government to focus on offsetting the economic impact of demonetization. The MoD currently need an increase of roughly 10% to deal with inflation and the vast sums required to modernize India’s aging military hardware.

Speciality material – high value speciality Steel, Superalloys and titanium alloy products – are a vital segment to the defence industry, and is found on almost every application platform. For instance, fighter jets use high performance specialty steels and Superalloys. Light armoured vehicles use significant tonnage of steel plate per vehicle. Steel plates are also used by the navy in the fleets of bodies and propulsion systems. The control cables found in the defence industry are produced from steel wire rope. A subsequent increase in the defence budget will have a direct positive impact on the demand of speciality material in India. Given the cost advantage and highly skilled engineering talent base, India could harness its potential to produce superior material indigenously and also increase its presence in the global supply chain.

The market growth for high value speciality steel, Super-alloy and titanium alloy products is largely dependent on new project investment and expansion plans of the defence, air force, navy, space segments. The Army’s plans involve indigenization of key components and spares of tanks and other weapons systems. This is in synchronization with the aim of the MoD to reduce import bill and promote domestic production of military equipment. The Indian Air Force (“IAF”) has outlined its 10-year modernization plan (2016-2026) that identifies services and technologies which it requires, and aims to share this information with the private sector. About 15% of the projected acquisitions of ₹ 30 lakh million are likely to be sourced from local manufacturers. Also, half of the Indian fighters are due to retire between 2015 and 2024. A government to government (“G2G”) contract for off-the-shelf purchases of 36 aircrafts is currently under negotiation. The remaining 90 fighters will be developed under Make in India. In its expansion plans, ISRO has announced various projects that will increase demand for specialty materials. For instance, Chandrayaan 2, GSLV MK-III, SAARC Satellite, GSAT-9, and Aditya L1 are some of ISRO’s upcoming space missions.

Emphasis is laid on the indigenous design, development, and manufacture of cutting-edge weapons and missiles

Global Industry Outlook :

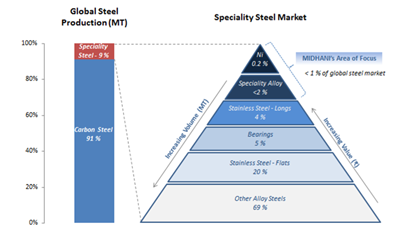

Market Overview for High Value Speciality Steel

High value speciality steels are premium alloy steel grades that are used across major industries such as automotive, industrial components, aerospace, defence, oil & gas etc., mainly as functional components that are subjected to high temperature, stress and corrosive environment. As per World’s Steel Association, the global finished steel consumption is estimated to be 1,515 million tonnes, of which commercial high value speciality steel products account to around 5% in 2016. High value speciality steel grades are broadly classified as Nickel alloy, armor grade steel and other speciality stainless steel grades.

Market Overview for Superalloys

Superalloys are speciality products that have superior resistance towards corrosion and oxidation at high temperature (around 600oC) with extended lifespan in higher stress conditions. Frost & Sullivan observed the global demand for superalloy products to be around 425,000 MT, with major consumption in countries such as US, Germany, France, Italy, UK, Russia and Spain.

Market Overview for Titanium Alloys

Titanium metal is known for its high strength to low weight ratio, making it an ideal material for aircrafts manufacturing, including fighter aircrafts. Other key end user segments where titanium finds application are bio medical implants, and exhaust systems in high end automobiles. Frost & Sullivan observed global production of titanium to be around 200,000 MT in 2016, with China and USA leading in global production. Titanium alloys occupying a healthy 13% of total aerospace raw material demand through the year 2020 globally, will fuel the demand growth for titanium alloy products during the next five years.

The United States is the largest supplier of high value speciality Steel, superalloy and titanium alloy products in the global market. The US has high defence budgets and large internal demand for aerospace and defence products. Majority of the global suppliers of high value speciality steel, superalloy and titanium alloy are based in the US due to large end users being based out of the country. These suppliers also have strong export orders. Other key countries for the supply of selected products are UK, Japan, Italy, Germany, France, Russia and China.

MOU / Alliance:

Recently Mishra Dhatu Nigam and TUBACEX, a multinational group with its headquarters in Alava, Spain and a global leader in the manufacture of stainless steel and high-alloyed tubular products signed a memorandum of understanding (MoU) to pursue a collaborative business model with the intention to develop and analyse potential joint business developments both for India and for other regions, based on their complementary manufacturing technologies for Power Generation and Oil & Gas applications.

Fundamentals

DIVIDEND POLICY

As per CPSE Capital Restructuring Guidelines, all central public sector enterprises are required to pay a minimum annual dividend of 30 % of profit after tax or 5 % of the net-worth, whichever is higher, subject to the maximum dividend permitted under the extant legal provisions and the conditions mentioned in the aforesaid memorandum.

Future:

Midhani seeks to enter the new markets of oil & gas, mining, power, railways, chemicals and fertilisers. The company is also positively looking at export opportunities.

Last but not least but very important point is that main expense of the company is cost of conversation is power / fuel

Fuel is taken from government public sector undertaking through competitive pricing and power is taken from state utility department. To reduce the cost of power, Company has invested in gas based power plant known as Andhra Pradesh Gas Power Corporation Limited and 4MW solar power plant and has applied for open access systems for starting the power trading to reduce the overall cost.

To ensure the reliable supply, company have a dedicated high power electricity line from Telangana State Transmission Company for it’s manufacturing facilities. It has installed 132/11 KV power transformers and one 132 KV switch yard for it’s manufacturing unit. It is also installing a second transmission line for high reliability.

However, for emergency, manufacturing facilities are also supported by four DG sets, one with a capacity 625 KV and three of capacities 500KV each, with the total aggregate capacity of 2,125 KV

Source : RHPROSPECTUS ( https://www.sebi.gov.in/sebi_data/attachdocs/mar-2018/1521178415613.pdf) and Company website and news articles

Disc: Not Invested Looking for lower valuations , I am not SEBI approved analyst .This is not any recommendation to buy or sell or hold

Regards