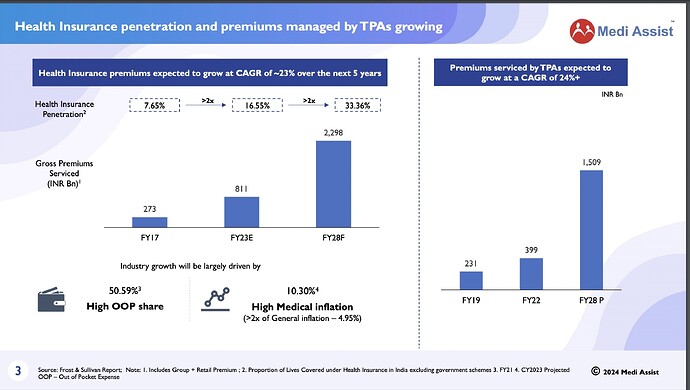

I was excited when Medi Assist filed its IPO papers. I thought it could be a good proxy for growth in the health insurance space in India, and within that space, TPAs provide a mission-critical service. However, as I read more and spoke to more people in the industry, it seems that perhaps TPAs are not the most exciting long-term bet in the healthcare space. I am summarizing my thoughts below in the note. It’s a small write-up focusing on the qualitative aspects – first covering the basics of the TPA business and then reasons why I will not invest in the sector.

What does a TPA do?

A TPA, in simple terms, processes insurance claims filed by policyholders (retail policyholders – like you and me – or corporate policyholders – who buy a group insurance policy for its employees) on behalf of insurance companies (likes of ICICI, Religare, etc.). In return, it receives a fee (which serves as revenues for TPA companies) from insurance companies.

Who is involved in the value chain?

There are largely five parties involved in the insurance claim processing process – (1) insurer - public and private insurance companies which pays out the amount charged by hospitals, clinics, etc.; (2) payor - people who pay the insurance premiums – retail customers, corporate customers or government for insuring low-income group people; (3) intermediaries – TPA, insurance brokers, etc.; (4) care providers such as hospitals, clinics, diagnostic centers, nursing homes, etc.; (5) beneficiary – people who eventually receive the care such as you and me, our family members, group members, etc.

How does the business work?

TPAs receive money from insurance companies for processing the claims i.e. when a patient avails any healthcare services from a hospital, TPAs help to organize a cashless treatment, collects bills from the hospital, checks the bills for accuracy, sends the same to insurance companies. In return for providing the abovementioned services, it receives fees from the insurance companies. It has people on its payroll, who help in carrying out the abovementioned functions.

How do TPAs add value?

Claim processing (checking the bills, ensuring they are not fake, matching these bills against the policy) is a commoditized service. TPAs add value to different stakeholders in the value chain by (1) insurance companies by providing analytical services such as trends in medical expenses claims by an individual policyholder, detecting fraud bills, etc. and by negotiating with hospitals for preferred rates for various treatments (2) Hospitals - flow of patients and (3) patients - cashless services to the payor of the policy.

So, with the basics out of our way, I will summarize the reasons why I will not invest in Medi Assist:

-

The changing nature of the TPA industry – when TPAs started in 2001/02, they used to provide a suite of services such as negotiating with hospitals on behalf of the insurance companies for preferred (read discounted) treatment rates (key value add by TPAs – healthcare inflation in India is ~8-9% while TPAs controlled healthcare inflation is 4-5%), collecting bills from hospitals, ensuring the accuracy and even making the payment on behalf of insurance companies. However, over a period of time, regulators have restricted the role of TPAs, and as such now insurance companies are directly negotiating with hospitals and making payments to hospitals (two of the main important functions of the TPAs). Currently, TPAs are only taking care of processing the claims and making sure they are correct. As a result, the fees for TPAs, which used to be as high as 5.5% in past have gradually come down to 2-3% of premiums.

-

Tech advancement – slightly longer term, but tech could automate the claim processing functions. As per one of the industry veterans, about 85% of the total claims are plain vanilla in nature and can be automated, and do not require intervention by TPAs. There are a few start-ups in the South East Asia market, which are developing tools and software to automate the same – Smarter Health, DocDoc, etc. Sooner or later, the same tech would come to India (if I am not wrong i3systems is already doing that) and if successful, it would reduce the role of TPAs significantly.

-

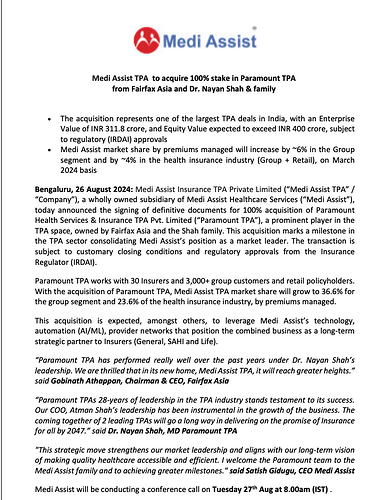

Incremental growth is from the private players – health insurance is served by two types of insurers – (1) public health insurance companies (40% share in FY20; 11% CAGR in premiums compared to the industry growth of 18% CAGR over CY17-CY20) and private insurance companies (60% share; 23% CAGR CY17-CY20). Private health insurance companies are taking the claim processing function in-house by setting up their in-house claim processing teams. It gives them more control over the claim data, helps them price the premium, and reduces the time to pay the hospitals. On the other hand, the public health insurance companies are currently using TPAs, but they have also set up the Health Insurance TPA of India (HITPA) for their claim processing. As the incremental growth will come from the private health insurance companies and HITPA would continue to scale, it would make lives difficult for the TPAs (which is kind of reflected in the numbers of Medi Assist – its revenues growth is declining on a y-o-y basis and EBITDA margins have also come down from ~30% in FY28 to 23% in 9MFY21).

These are the three primary macro reasons for me to be not very excited about Medi Assist IPO. I believe macro headwinds to the sector could be a bad recipe for good stock returns. Of course, I don’t believe that TPA business would come down to zero – there will always be a need for TPAs in the system especially in group insurance policies (55% of the total premiums) and government-sponsored insurance plans but those pockets are extremely competitive and TPAs primarily compete based on prices (heard that for Ayushman Bharat, TPAs bid as low as INR 2 per family) – but perhaps there are better opportunities in the healthcare sector than investing in TPAs.