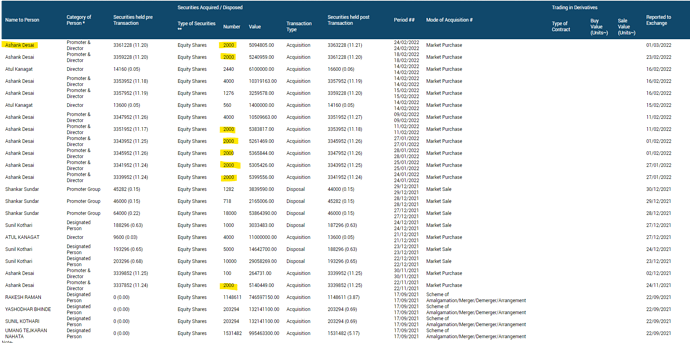

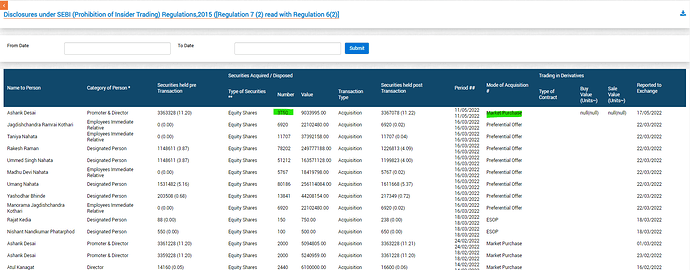

SIP by promoter ![]()

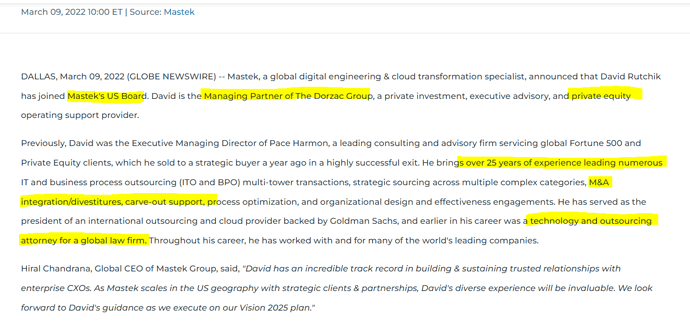

Mastek is hitting the right cord in term hiring talent in the US.

They have hired this guy who has extensive experience in US Tech sector including M&A. Looks like they are preparing for quite a few acquisition(s) in the the US.

Another deal win in UK

From article- Mastek will deliver 24x7 Level 2 and Level 3 Live Service Support for half a dozen business services platforms (made up of 32 key micro-services). We understand that Mastek already provided some of the services but that the scope has now been increased and the contract moved from an interim arrangement to a professional managed service agreement

It’s a good example of ad-hoc services ( staffing), converting to larger and managed services constract. Adds to visibility and provides levers for margin improvements ( offshore in mix, service level based agreements helps optimize resource utilization ).

With UK - Post brexit and recent geo politics - a lot more govt programs would need a revamp and upgrades, Mastek has won above deal despite Development done by a consortium of IT heavyweights( IBM, Capgemini, Cognizant etc) and each of them having capabilities to deliver same set of services. Speaks about Mastek stronghold.

Mastek to hold investor day on 20th April (after Fy22 results scheduled on 19th April).

This is Mastek’s first investor day in probably in last two decades.

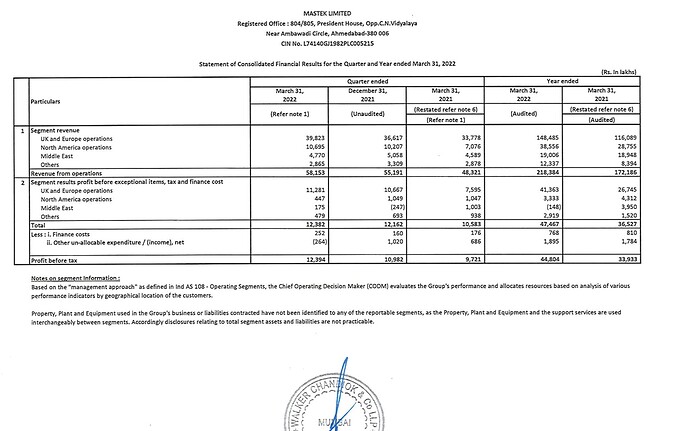

Decent numbers. Sequential growth of 5.4% is a bit lower than market expectation (7-10%) but in the current scenario looking at other companies’ numbers, it is satisfactory. A small dip in EBITDA which is ok for me. Revenue growth in the USA market is still to catch but decent orders won in that region. Looking forward to Concall and investor’s day presentation to understand the future direction. Disclosure: Invested and may add more in dips.

investor presentation is in the results file itself. Link attached above.

Edit : Investor’s day presentation may be different. The link has investor ppt for Dec 21 result.

Q4 results

Good parts

- LTM Attrition stable at Q3 levels( 28%), high but good when most reported higher nos, again partly attributable to relatively higher on-site mix

- Main engine - UK biz - good growth QoQ, YoY and wins, like it or not this part stays needle mover in near future

- Margins steady at 20%+ ( courtsey UK biz PBIT margins near 30%)

- Middle east from negative to positive margins

- at 103 EPS, 20%+ type growth for mid term, valuations are fair - doesn’t look like mkt has high expectations either

- Cash balance of 700 cr+ to help in acquisition- current sector stress may help get a fair value acquisition in US.

Not so good parts

- US biz margins detoriation QoQ and YoY, likely for new projects ramp up and senior folks hiring , not much action sequential on revenue as well

- Middle east drag continues on consol margins

- QoQ hiring - lead indicators - 5% type growth

- No updates on acquisition

- RoW is flattish too on QoQ

Whole sector is under stress on margins, some derating, Mastek seems fairly valued.

Regional performance

At this point UK is holding the fort but that biz alone can’t drive re rating being Govt orders driven, US it is visible that they can’t win biz without diluting margins atleast for near term and there too low base may only help to some exteng

CEO Hiral has been on-board for 2 Qtr+ now, given UK biz is self sustained and has local leadership, if we were to look at US geo - nothing exciting in numbers or newsflow. If UK margins ( currently near 30% below image, FY 21 was below 25%) were to normalize to mean levels, risk on margins visible unless US is ready to do heavy lifting - no signs yet. Let’s see what mgmt commentary holds.

Edit: CFO interview - nothing concrete on guidance, acquisition etc.

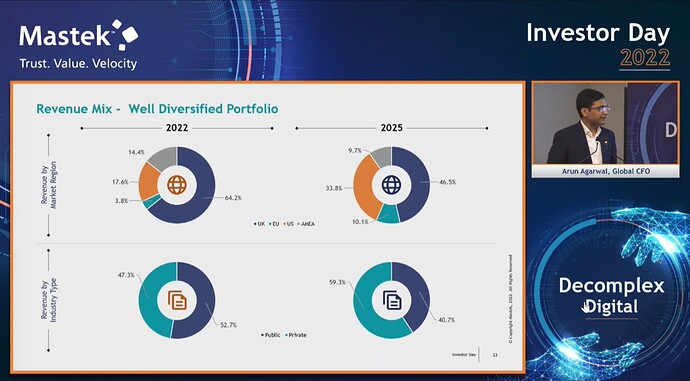

Quick observations from Alalyst day

- $1B Aspirations by Fy 25-26, interesting that they have it mapped out to decimal points

on 5 Year out revenue break up but couldn’t answer / didn’t have any deeper insights on how to get there besides organic+ inorganic, better to leave it in air for now

on 5 Year out revenue break up but couldn’t answer / didn’t have any deeper insights on how to get there besides organic+ inorganic, better to leave it in air for now

Though what looked doable was UK biz currently at 400 cr per qtr, could deliver 20% CAGR growth and get to 900 cr per qtr mark in 5 years - thus $120 M and at 45% of target mix at 2025+. Rest all which is 150 cr now per qtr need to get to 1000 cr per qtr type runrate to get $250 M per qtr runrate.

Key monitorable

- UK delivering 20%+ CAGR

- Acquisition entity revenue runrate ( $35M-$40M per Hiral, though smaller size will put pressure on Organic basket to do heavy lifting IMO)

- Organic ex UK Deal size and Client size

- Headcount growth ( 5000 folks for 2500 cr revenue, for 7500 cr will need 3X)

- Non Oracle pie success

- Oracle own growth rate

- US GTM success - Organic deal sizes - land ( driven by Evosys lead) and expand( by Hiral+ Mastek leads)

Risks

- Geo - UK concentration, though this is a cash cow as well and gives them some sort of strong hold,

- US GTM organic - in crude terms piggyback on Oracle/Evosys to open doors, eventually mine accounts for growth - Evosys on its own is primarily max $1M type deal construct, large accounts and larger deals are very difficult to come by given intense competition. Too late to party, unlike UK this is a uphill battle.

- US inorganic - key thesis and dark horse - if they get it right, get few customers + capabilities + ability to scale using larger Mastek platform.

- Any challenges with Oracle as a solution

Summary

$1B target Breakup ($250M or 1800 cr per Qtr) by 2025-26

- Current 400 cr per qtr UK+EU to grow 20%+CAGR and deliver 800-900Cr per qtr by 2025

- Current 200 Cr US + rest of world - Organic growth of 20%+ CAGR puts it at 400-450 cr per Qtr by 2025

- Need Acquisition to fill the remaining

Above are back of envelope and could be off, mkt is valuing at 3X+ sales currently at 20%+ margins, 7500 cr+ sales aspirations does makes it attractive from possibilities perspective, however some delivery needs to happen on ex UK front.

This is not true. What they have guided is sometime in the 2nd half of decade. Said this multiple times including hiral & the lower rung leaders. The question of how 150 cr goes to 1000 is a valid one, but the time frame is a bit open ended which gives them more breathing room.

Not true on 2 counts. They referenced this in passing but essentially they build assets which allows services growth. Same asset is already being monetized across multiple projects (eg: fraud detection & prevention)

Not true. In fact the entire presentation has bucket full of details on strategy. We just need to be perceptive towards it imo.

- Evosys & mastek go to customers are 2 entities right now. Will improve GTM with 1 mastek

- Instead of providing siloed implementation for part of customer requirements, will start providing implementations more wholistically for entire customer requirements. Capability building, aquisition, partnership done for that would be key

- This is one thing I noticed in intellect investor day as well as mastek. The focus is to fill gaps in the bid through combination of aquisition, Partnerships so that clients lives become easier & they need to deal with 1 partner

- Uk government spends are 13 B pounds. Mastek has only 10-15% wallet share in areas where they operate. (don’t operate in some areas) Already part of many large framework deals (800m pound healthcare deal with 13 vendors mastek has already won 80m euro of contracts)

- Deeply integrated in British army systems as well. One thing is fairly clear the British government system trusts mastek, is only providing 10-15% of wallet share with deeper capabilities & execution on 50m pound deals, likely to get larger wallet share of government. The opportunity size is at least 10x. I don’t consider uk geography a risk any more. It is an opportunity. The well established mastek has a moat in terms of customer relationships here.

- Cloud migration is only beginning of cloud journey of the client. Need to do work to upgrade & maintain cloud Integration every 3 months, add capabilities as business needs arise. Will focus more on this area. In fact will also start selling to clients which they did not bid for or lost on previous bids

- Middle East is like a training ground for recruited talent. The unsaid implication being that cost of mistakes is lower in middle East so can afford to let new comers train in middle East then move to Europe or usa.

- Have learned from past mistakes & doing thoughtful planning on how mastek can grow the new aquisition in usa do minimize the probability of mistake occuring.

- The fact that they are doing a small aquisition is great actually, 20-50m$ runrate co is large enough that they have a proven business model but small enough that assimilating it will be less challenging.

- Possibly most exciting announcement for me was the fact that they will start platformization or assetization of capabilities they have already built. Will contribute 5% of sales in 3-4 years.

- Us / America’s will contribute 34% of sales double from 17%.

Disclaimer: invested, biased

Being on same side @sahil_vi :), we are here to make gains and good to have diverse opinions, happy to see if even parially what they said converts in execution, my only submission is aspirations need to meet numbers, ex UK must fire to make any of what they said to happen.

US GTM - 40 year old startup is what they referred themselves, intent is there but so is in most of companies, lets see if the can execute well on aspirations. Also products and platforms are not an easy path, one can look at HCL discount story - hope they stick to what they are good at and at best these are accelerators, tools, frameworks etc which they can monetize.

Have learned to take mgmt commentary with a pinch of salt, untill narrative meets number. But at the same time happy to give them few Qtrs to see how next few Qtrs story will unfold on ex UK front.

There is a reason they trade at discount to peers in mid IT, valuations being fair helps.

US is growing at 34% CAGR. I rest my case for “US firing evidence”

The discount to peers is because market does not find a narrative to be excited about. Valuations & stories around them are stories we tell ourselves (stories can be powerful).

We can try & rationalize valuations differrential by backfitting narratives or we can try & do deeper research to understand sources of competitive advantages. I would prefer to do the second ![]()

Mastek has actually demonstrated better ability than any peer in scaling revenues. You can check last 3 or 5 year revenue CAGR for any IT peer.

One thing I will concede. Intellect Design arena has a better biz model than mastek, and i am perplexed why it trades at similar valuation to mastek.

At end of day, multiple is in market’s hands & i would not spend too much effort contemplating on it except ensuring i am not paying too exorbitant a price.

Execution has been there. & hopefully will be there in future too. ![]()

I know we are off topic here but IMHO, for every exciting offering by IDA, there is an equivalent product from other major IT players. For all established and discovered service/semi-product companies, revenue per employee is what eventually matters. Yes one could go wrong with such simplistic model but unless number show some inorganic growth, it’s mere packaging.

Unfortunately core enterprise “business” products require massive system integration and customisation. Huge chuck of money comes from there (people business) and not as much from the actual product licensing. Companies tend to bundle them as one.

This is unlike “technology” products like say Oracle DB, or Google APIgee, your corporate communication platforms (mail, chat etc. ) or 3-click installations.

As we go up on the value stack from plain technology platform to tailored software, the term “product” slowly start becoming an illusion.

Two important things (one negative and one positive) that I will track are: 1.) Execution risk due to the merger of Mastek and Evosys 2.) Elevation of Umang Nahata to drive US and Middle East businesses.

1.) Execution risk: There is a high post-merger execution risk. Evosys has been a truly agile company that has grown aggressively since it was founded in 2006. Whereas, Mastek seems to have a relatively laid-back culture if we simply compare the organic growth of Mastek and Evosys for FY19-21 (not a precise criterion but gives you a fair bit of idea). Merger of the two may result in slowed growth if Mastek’s work culture overshadows growth-hungry Evosys (in my opinion).

2.) Elevation of Umang Nahata: For me, Umang simply stood out as a leader among the rest during the investor’s day. Read about Evosys history… he has been instrumental in driving Evosys growth — built a c.800 cr. topline company (almost similar to Mastek at the time of acquisition) in just 14 years. So his track record is solid. I consider him heading the US and the Middle East as a good thing for the company.

May be due to uk inflation & recession, which may trigger sloth growth which may disrupt renewal & fresh business as well, so with attrition & margin pressure mkt is discounting it in advance,

Also, GBP has fallen from 103 to 94 against INR since June 2021. That’s a near 9% fall in exchange rate in 9 months. USD on the other hand has strengthened in the same period.

Good pointer. This seems to be a key point