I have tried to give a detailed account of a global specialty insurance company (Markel Corporation). This might be useful for people who are trying to understand the evolution of insurance businesses and might give us some insights into how insurance might evolve in India. Looking forward to hearing from everyone ![]()

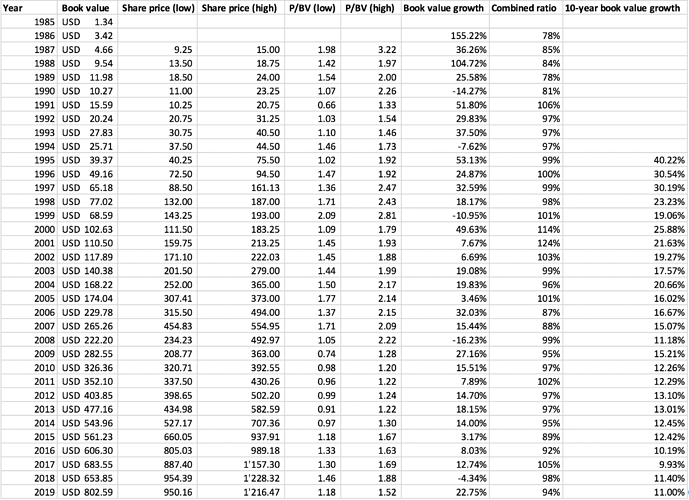

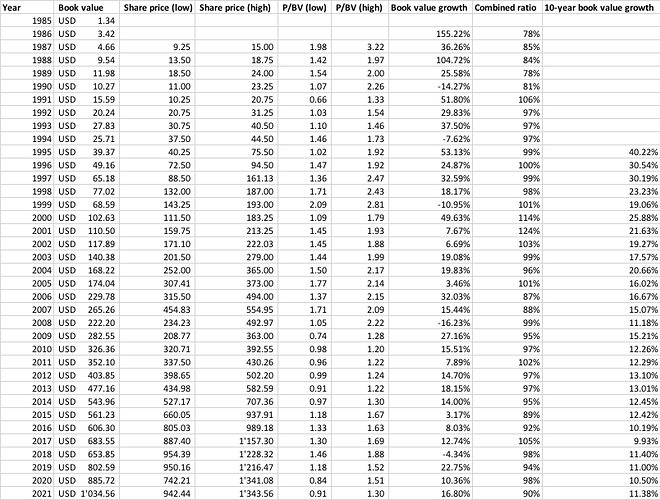

Markel Corporation is a holding company with operations in specialty property and casualty insurance headquartered in Richmond, Virginia (USA). It started operation in 1930 and was operated by the Markel family and was first listed in 1986. It has compounded its share price at a rate of 15% from a low of $9.25 in 1987 to the current price of $978 (as on 03.06.2020). Their shareholder letters are a delight to read (link). I have compiled my notes from the time of their listing in 1986 summarized in the three posts below (the pdf below contains my notes in a better formatting).

Notes.pdf (261.6 KB)

1986:

- IPO in December 1986

- Inducted on their board Prem Watsa and Stewart M. Kasen as directors

- Goal to grow at 20% with ROE > 20%

- Claims administration operation showed losses

1987:

- Share count increase led to lower increase in EPS compared to net profits

- ROE ~ 35%

- Brokerage operations: Bad results

- Contingent commissions business was good, however it’s hard to forecast how this will do in the future

- Owns 21.6% equity interest in Fairfax financial holdings

- Claims administration: Acquired Lindsey & Newsom Insurance Adjusters (Texas) to expand into international claims adjusting and claims management business

- Acquired 35% stake in Shand Morahan and Evanston Services using leverage ($12 mn) (specialty insurance company providing professional and product liability insurance), speaks highly of Joe Prochaska (CEO of the company)

- Added Edmund G. (Ned) Langhorne (turned around claims operation business) and Leslie A. (Les) Grandis (helped in two acquisitions and in taking company public)

1988:

- ROE ~ 31%

- Brokerage operations were good

- Severe price competition in transportation and animal mortality business

- Equity stake in Fairfax increased to 23%

- Diluted 650’000 shares at $16.25 (raising net after tax amount of $9.6 mn) at low PE multiples to increase investment in Shand/Evanston group.

- Increased borrowing to $15 mn

- Excess provisioning done in insurance underwriting business to be conservative

1989:

- ROE ~ 24%

- Brokerage operations : Acquired certain assets of Rhulen Agency using debt. Should double revenues

- Increased borrowings to $44.5 mn

- Claims administration: Continue investing in expansion of Lindsey & Newsom

- Underwriting: Essex Insurance and Markel American Insurance – combined ratio of 79%

1990:

- Underwriting: Combined ratio of 80%

- Acquired remaining shares of Shand/Evanston group (using debt) and divested Fairfax and Lindsey & Newson (claims administration) – had been continuously investing in Lindsey/Newson before.

- Focus has now become only on marketing and underwriting specialty insurance

- Increased long term borrowings to $127 mn

- Brokerage operations: Significant growth on back of previous acquisition of Rhulen

- Stock market declined

- Investment portfolio: $360 mn

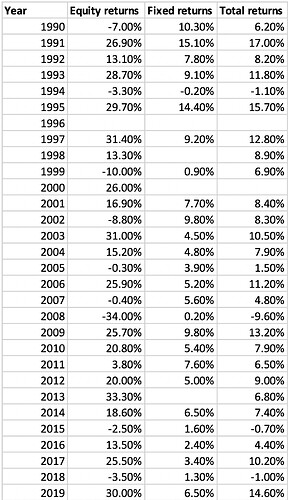

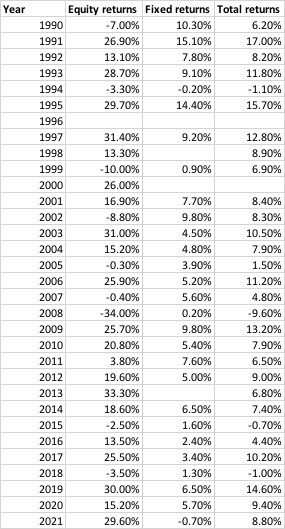

- Equity returns: (-7%), Fixed income returns: 10.3%, Overall: 6.2%

- As majority of revenues will be from underwriting activity, company will not seek to maintain 20% growth rate as future growth target to be prudent while writing risk