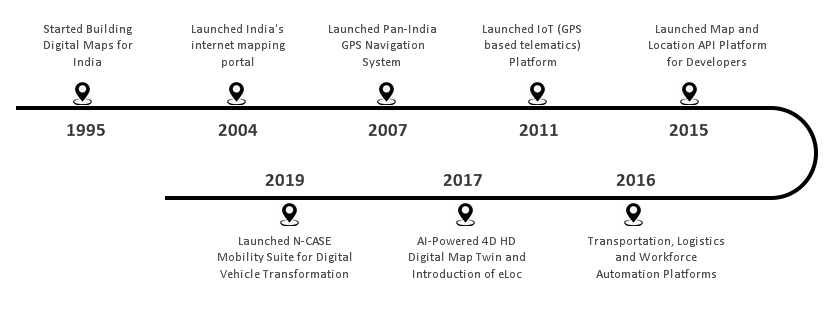

Started in 1995 with clients such as Coca-Cola, Cellular One, Motorola, Ericsson which are facing operational challenges in India on account of limited availability of accurate maps. They obtained contracts to create digital maps that contained specific company information such as bottlers’ territories or topographic features such as high ground suitable for cell towers.

In 2004, company launched its digital map portal. Fast forward to today, company has mapped 10.5 M unique destinations, 6.4 M km of road, ~ 7500 cities at street level, 80 at address level, 3D, 2D landmarks in 86+ diff cities which is being updated Daily.

Product Offerings

1. Navigation Assistant Device

- This is a navigation device embedded in dashboard of your 4W or 2W.

- These are 3-5 years contracts with automotive makers.

- Clients includes MG motors, Honda in 4W and Suzuki, TVS in 2W.

- Company claims to have 80% market share in this segment.

- They earn revenue per vehicle per year basis. Revenue will depend on no. of vehicle manufactured with MMI Navigation in a given year.

2. SaaS Products

(a) InTouch - IoT Platform & Telematics Platform

(Also, pitched as Digital Vehicle Twin)

- This is cloud platform with various use cases majorly related to mobility like

- Customizable Analytics Dashboard (Graphical representation of various parameter important to end user)

- Live Tracking of Vehicle (includes drones), Vehicle level information - Speed, Location, Altitude , IoT GPS device status

- Geo-fence Management : Geo-fencing is marking specific areas with geometrical figures (Polygon, Circle, etc) and tagging them as per business demand which will help in further location based analysis.

- Route Management - Creating Fastest, Shortest, Safest, Economical Routes, Adding Stops, Finding Nearby Locations, etc.

- Trip Management - Tracking a complete shipment / trip on several parameters

- Fleet Management - Organizing database of vehicles with important information like Maintenance.

- Vehicle Health Projections based on historical data, Alerts, Log Reports

- Clients include OLA, AVIS, FedEx, Safe Express, TCI, Mahindra Logistics, Ultratech

- Company also provide bespoke solutions as per business requirements

- ~ 10k Downloads in Google Play store with 3.4 / 5 Rating.

- Revenue Model - Subscription Based and as per Use Case

Vehicle Telematics : It includes GPS systems, onboard vehicle diagnostics, wireless telematics devices, and black box technologies to record and transmit vehicle data, such as speed, location, maintenance requirements and servicing, and cross-reference this data with the vehicle’s internal behavior.

(b) WorkMate

- This Product intended to help companies with managing their field staff, location analysis for their clients, assigning tasks and generating reports related to same data

- It’s also capable of working completely offline and gets automatically sync when back in internet connectivity

- Display and branding is customizable to client

- Clients includes PrintJet, Fullerton India, EMRI, Greenstarm SD Fine chem ltd.

- ~ 5k Downloads on Google Play store with 4/5 rating

- Pay as you go model - revenue based on licenses per user per month.

(c) mGIS Tool

- This is a visualization tool to perform analytics on geo-spatial data.

- Some of the common metrics that could be tracked through this software like

- Customer Location Visualization

- Trade Area Analysis

- Advanced Arithmetic Operations involving Elevations and Altitudes on 3D maps

- Revenue Model - Subscription Based and as per Use Case

3. APIs / SDKs

API (Application Programmaing Interface) : In a nutshell, it is a piece of code that helps communication between two applications. So, if I need to insert a digital map or its related features in my personal app, I can use MapmyIndia API (Code) to get that data into my app and use it as per requirement.

SDK (Software Development Kit) : A kit or a package of tools, libraries, documentation, code samples, processes. Think of it as putting together a Squat Rack in your gym or that bed you bought from IKEA, you’ll need the base items, tools needed to put them together, assembly instructions and hence forth. An SDK might consists of several APIs and few other features around them.

All APIs / SDKs are subscription based freemium models and revenue depend on scale of client and number of transactions getting performed on application. There are several APIs / SDKs as below that company provides

- Search APIs

- Explore any address, location, place, Auto suggest, Nearby Places with Geo code or Reverse Geo code

- Real time Map Updates, Auto Scalable, eLoc (a unique 6 char digital address of a particular house level location)

- Apps includes McDonald’s, Yulu, PhonePe, Airtel

- Routing and Navigation APIs / SDKs

- Functions like Vehicle (Car, Bike, Truck, Pedestrian) Routing, Predictive ETA, Snap to Road, Turn-by-turn navigation, Drive range polygon (which will help in analysis of certain marked area)

- Client includes MG, Mahindra, Amazon, HDFC, TVS, Suzuki

- Intouch Platform APIs - APIs for Device details, Event Data, Drive Data, GeoFences, Alarms

- WorkMate APIs - APIs to get several data items from WorkMate App

- mGIS APIs - Map and Location APIs, widgets, plugins and tools for developers to build advanced location-based applications - map visualizations in 2D/3D, Geo coding, search, routing, Geo-spatial analysis, AI-powered image analysis and more.

- Global APIs - Map for 238 countries available

- Personalization SDK

- It helps build dynamic O2O (Online to offline) profiles for users or customers. This SDK help analyse profiles using algorithms to deliver personalized recommendations for products and services.

- This also tracks buying patterns and create localised marketing campaigns

- This has use cases in almost every major growing industry

4. IoT Products (Hardware Products)

- IoT Products include GPS products to track vehicles, drone trackers, asset trackers. Other than that they also provide Drone cameras and various set of sensors

- Map MyIndia’s Move App is used to track location, share location, Route summary and alert notifications

- Some of the clients using their IoT products include Safe Express, TCS, AVIS

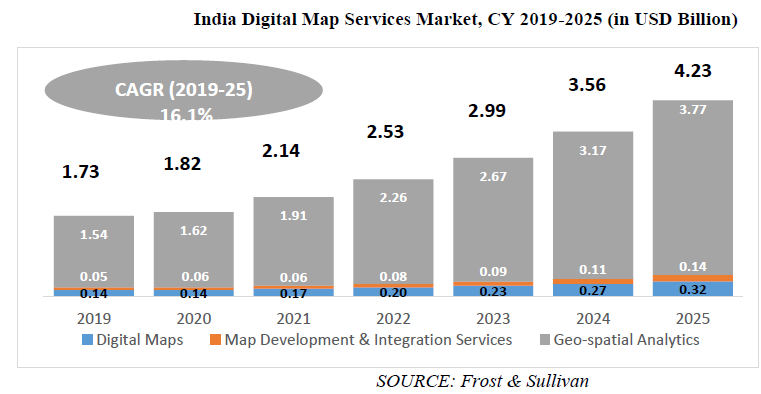

Industry Landscape and Competition

Regulation : Liberalization of Geo-spatial Sector

In Feb 2021, the Ministry of Science and Technology announced the deregulation of the Geo-spatial sector in India.

In the new Geo-spatial policy, there is no requirement to get approvals for the collection, preparation, storage and dissemination of Geo-spatial data and maps within India for Indian owned or controlled companies… It restricts foreign companies from doing granular level mapping - with a binding threshold of one meter in horizontal and three meter in vertical mapping making it difficult to create accurate maps for ADAS, HD, 3D, 360-degree street view, doing terrestrial survey and Indian territorial waters survey.

Since most of the foreign companies like TomTom and HERE use ADAS and HD tech for Navigation Maps, they’ll have to license the same through APIs from Indian Players.

Navigation Assistant Device and Mobility Related SaaS Products

Automobile Industry has been a major revenue contributor to map providers since last several years. This segment is consolidated among few players in particular region. MMI in India, TomTom and HERE Tech in UK and Map Box in US , has captured majority of the market.

This segment has been stagnant in last 2-3 years because of global automotive slowdown but is expected to pick back up in coming years as we are moving towards spectrum of autonomousity of vehicle, navigation system will become a integral part (both 4 and 2 wheeler).

After liberalization of Geo-spatial sector, we could see increased competition from other Indian Players getting aggressive in this space and we can also see some market share shift from foreign entities.

One of the recent news includes MG motors moved from TomTom to MMI in Aug 2021 in recently launched new models.

API / SDKs

As we discussed earlier, most of the application developers / companies prefer to include some functionalities of Location and Maps in their apps. APIs are highly preferred by companies to scale and grow their product quickly instead of re-inventing the whole wheel.

It is a fairly competitive space which leads API providers to spend on customer acquisitions through sales, getting interest of developers, free offerings upto a certain scale and at the same time, updating tech and investing in RnD.

Major competitors in this segment are Google Maps, TomTom, HERE Tech, Map Box, ESRI ArcGIS, Sales force Maps, Azure Maps, MapQuest

This segment is growing at a much faster pace, creating space for all competition to co-exist. With increasing penetration of internet and smartphones, growth will come from increasing use of location based apps, hence more transactions and increase in new applications using location based APIs.

The geo-spatial analytics space in India comprises of foreign players like ESRI, AutoDesk and Trimble. In addition to this, there are several other players like Rolta, RMSI, Infotech Enterprises.

Google : Elephant in the room

Spaces that google is present in this industry are as below :

Ad-sense - Google Maps earns majority of its revenue from Google’s Ad words and charges companies to advertise on google map app. For instance, if you search for Mumbai in Google Maps, it’ll show places, restaurants, cafe to visit.

APIs - Google Maps also provides APIs for different location based data and it’s pretty famous among developers however their prices are premium as comparison to other players and they also don’t provide HD, 3D Maps to doorstep level which might be a requirement for some e-commerce companies.

Navigation Assistant - Google stayed away from this segment until March 2017 when Google and Intel together with Volvo and Audi developed an Android Automotive Operating System (AAOS) combined with Google Automotive Services (GAS) which is a collection of applications and services like google maps, play, assistant, etc that OEMs can license and integrate into their in-vehicle infotainment systems. Volvo, Ford and GM are using AAOS with GAS.

In April 2019 Google opened up the APIs for developers to start developing applications for Android Automotive

Renault-Nissan-Mitsubishi alliance, one of the world’s top-selling automakers, has decided to go with Google’s Android operating system to run its dashboard information and entertainment features. A key reason cited previously by TomTom for Google’s contract wins was drivers’ desire to use a familiar, easy interface in their cars that is similar to the ones they are familiar with from their cell phones.

In September 2021, Honda announced that it would use Google’s Android Automotive OS in its cars starting in 2022.

Over the years, carmakers has been hesitant in giving full access of dashboard to Google due to data privacy concerns and willingness to own the branding for their dashboard. However, now with leading OEMs joining hands with google and well known superior quality product / brand of google, it will be the biggest risk for players in this segment like MMI, TomTom, HERE.

Financial Metrics

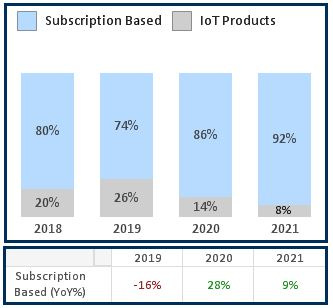

Overall Revenue Growth for company is flattish since 2018 but is expected to show high growth this year (31 % ▲ ) as per 1H22 Annualized numbers.

One of the reason for flattish performance is decline in IoT Products (GPS products) as they are mostly related to automotive industry which itself is facing strong headwinds from last few years and there is also a lot of local and foreign competition in hardware product market.

However, things get interesting when we look at segmental revenues below.

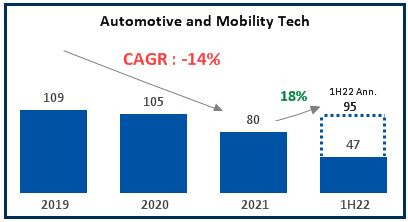

Another reason for overall revenue trend is Revenues from Automotive and Mobility (translates to Navigation Assistant, InTouch Platform and GPS products) has been declining rapidly majorly due to Slowdown in Automotive Industry. It has shown strong performance in 1H22 and expected to show high double digit growth in 2022.

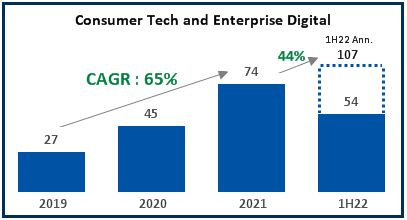

Even with sharp decline in Automotive Segment, Consumer and Enterprise Segment (translates to APIs, SDKs, Customized Solutions and Analytics) is growing at rapid pace on account of exponential rise in digital economy over the globe.

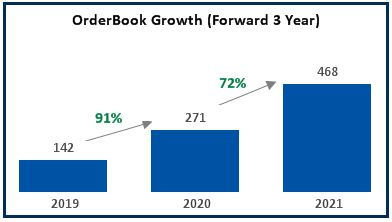

Orderbook, which is projected on the basis of current orders + expected volume growth of clients for the next 3 Years and is subject to change in future based on Indutry demand, hence should be considered with pinch of salt. That being said, numbers provided for Orderbook are growing at exponential pace and should translate to high growth in Revenues, if all went well.

“70% of orderbook is based on projections of volumes from OEMs. The volume projections are based on either the projections shared by OEMs or based on the historical usage trends amongst certain other parameters. Our customers may terminate contracts before completion, negotiate adverse terms of the contract or choose not to renew contracts, which could materially adversely affect our business, financial condition and results of operations”

Margins

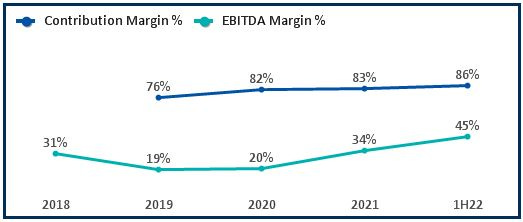

Variable cost in case of MMI are Software License Fee / Material Cost, Cloud Hosting Fee, Customer Customisation / Servicing.

Contribution margin has been increasing over the years mainly due to decline in Software License Fee and Customer Customization which generally relates to Automotive and Mobility Segment.

EBITDA Margins has also increased primarily because company has decreased non-permanent employees workforce and because of stable fixed cost and high contribution margin, EBITDA margins should be expected to increase in future with the rise in revenues.

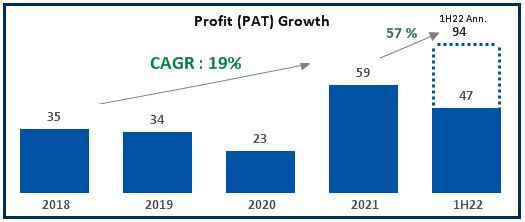

Profit After Tax has also shown double digit growth because of increase in margins and one time exceptional ‘other income’ in 2021 after selling some investments / mutual funds.

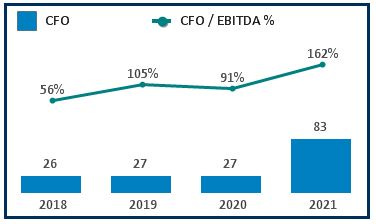

Company has been surviving since two decades, on the basis of healthy cash flow generation. Due to asset light nature of business, EBITDA generally flows almost completely to Profits, CFO and Free Cash Flow. CFO in 2021 looks optically high because of changes in Financial Assets / Liabilities which will probably revert back to mean in coming years.

Growth Opportunities

- Drone Industry

- Drone industry is rising over the globe with the increased use cases and improved technology. Drone helps in quick field surveys, Supplying Essentials, Sensor Equipped for defense purposes, Geographic mapping, Safety Inspections,Crop monitoring, shipping and delivery.

- Since GPS / GNSS (Global Navigation Satellite System) is a regulatory requirement for Drones, this could be a opportunity for MMI to strike deals at a nascent stage.

- Rise in Electric Vehicles and Semi Autonomous Vehicles

- As we move towards autonomous vehicle spectrum, Navigation Assistant will be required in most of the vehicles

- Since, Automobile industry has seen increase in volumes, we can expect it to reflect in MMI Revenues

- However, Google will remain a Challenge and need to have a keen eye how Google and other players are exploiting this market

- Licensing of Maps

- After the Geo-spatial liberalization in 2021, licensing of maps could appear as one of growth driver for MMI as Foreign Entities that provide HD and 3D Maps (TomTom and HERE Tech) will have to license map APIs from Indian Entities.

- This could also benefit them bagging deals with potential clients

- API revenue growth

- Major Growth is surely expected from the APIs / SDKs which will be driven by

- Increased traffic and transactions in existing clients like Paytm, PhonePe, Yulu

- Addition of new clients which is expected with increased internet penetration, new start-ups and advancement of technology.

- Major Growth is surely expected from the APIs / SDKs which will be driven by

Vulnerabilities and Risks

- Expansion of Google’s Android Automotive Operating System

- Google is continuously finding ways to make Maps as its next billion dollar business. It was clear in 2018 when google did exponential price hike in APIs and then entered into Automotive segment .

- Even though, currently main focus is in US and UK markets but it is a matter of time until google will try to capture the market in India.

- Low RnD Spend

- Considering its peers and being a tech company, RnD Spend is very low for MMI.

- This could limit their scalability and could end up losing clients. They have also lost clients in previous years.

- APIs/ SDK space is competitive.

- API/ SDK segment, though highly profitable is competitive and price sensitive.

- Switching Cost is moderate, Many companies have switched from using google map APIs to other providers after they’ve increased prices in 2018.

- Increase of Supply

- After new regulation, where Indian entities need no approvals for Map Data, new competition may arise from Indian players, hence challenging the economics of this industry

- Customer Concentration

- In the last three Financial Years, the number of customers that accounted for 80% of our revenue from operations were 17, 22 and 25 in Financial Years 2019, 2020 and 2021, respectively.

- Though company is moving towards diversifying the revenue pool, losing key clients is a big risk to subscription revenues.

- High Dependence on End User Industry

- A large chunk of revenue comes from Automotive sector, hence revenues can get impacted in case of draw down in industry.

[Disclaimer: Holding a tracking position in this company. I’m not a registered Investment or Financial Advisor. Any information in this article is from personal research and is not intended as, and shall not be understood or construed as , financial advice. It’s very important to do your own analysis and reviewing the facts before making any investment based on your own personal circumstances. Kindly seek professional advice before taking investment decision.]