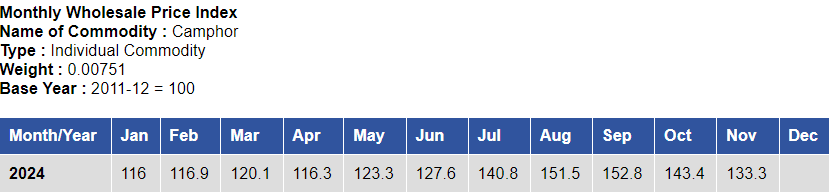

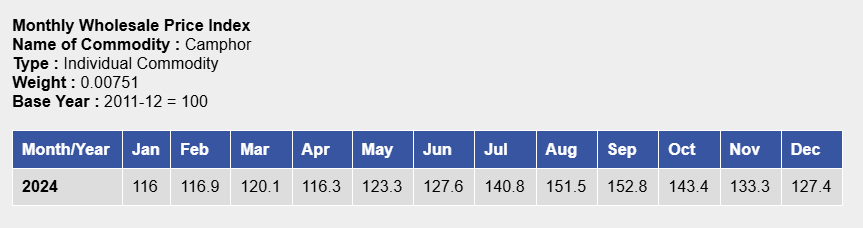

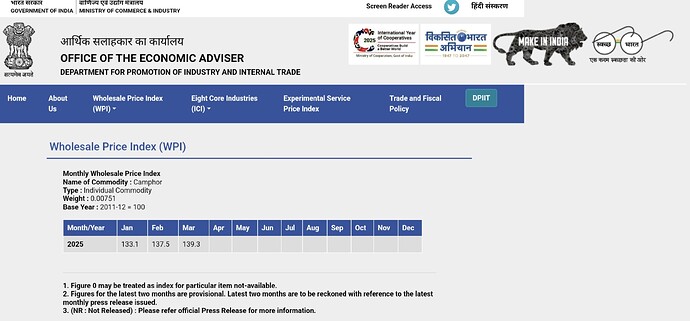

Post Diwali seasonal demand decline?

Can we compare with previous years to see if WPI reduces in October?

Is WPI price the reason share is declining? Doesn’t the share depend on retail sales? I could see their products in shelves of supermarkets. I don’t think people will stop using it so easily.

@sagar_sr Please share the source of this image

Hi @sudhakar,

I was trying to find out the profitability of the retail business. If you go to Page 49 of the Annual Report FY24, you will see that they have done a PAT of about 2 crores on a turnover of 160 crores. Please see the screenshot at the end. This is not great profitability. So I went back to the FY23 Annual Report to see what were these numbers in FY23. And this is what I found:

In FY23

Turnover: 100 crores

PAT: 0.3 crores

So in FY24 the revenue went up by 60% but the PAT went up by 600%. Let’s wait now for ARFY25 to see what are these numbers for FY25.

The annual report of Mangalam Brands Limited is available on the website of Mangalam Organics. Profits are subdued due to the substantial increase in Miscellaneous Expenses and Sales & Marketing Expenses.

Hello,

Do you have access to this article ?

Camphor prices continue upward trend so the B2B business should be doing well, reflected in standalone numbers going forward. Plus, B2C operated by subsidiary Mangalam Brands Limited is growing fast. While B2B tends to follow market cycles, B2C is the more sustainable story here.