Nandakumar’s daughter is involved please check

Another reason for manappuram underperformance compared to muthoot could be the promoter getting into trouble frequently (but acquitted). That’s when I reduced my stake in manappuram (got burnt once in yes Bank fiasco as both shareholder and depositor).

Muthoot last manging director died while falling down from his house one of the sons died by murder due to a brawl in the road

Thanks for your inputs. You are Right. Dr. Sumitha Nandan was appointed as ED, Hence, yes - we can say next generation there in board.

But as a minority shareholder - I am concerned if the Promoter Family cum management is serious in growing the company (and generating sustainable risk adjusted return) - if not better than the competition - then atleast at par with competition.

If not, why not to have a professional management - who have the fire in belly for growth.

For Ex: Aditya Birla Capital (ABC) - They brought in ex-ICICI ED to run the show and not some Birla family kid.

Manappuram & ABC - both NBFC - hence comparing.

Note: My thoughts are just to discover the reasons for continuous under-performance of Manappuram, and not to pin-point anything negative about an individual or group. Thanks.

Underperformance primary due to market sentiment and subdued gold growth now micro finance also under pressure and earlier some concerns about ethics overall good company at a fair price if management is honest

This has been a value trap and I have written about it previously. You cannot say that in past it has given this return so in future as well that should repeat. Well that can repeat in future but how far in future no one knows.

oke lots of pessimism back in the company… Enough for me to reenter this… Had exited on ED raids… they have come clean…

Disc: Invested 180

There was no substance in the ED raids. They were just perpetrated by some vested interest to tarnish the name of the company. Some local guy from the same village who had a grudge or maybe plain black mail. More than the regulatory actions what is worrying is if the company is run professionally. looks the the recent issue where an employee siphoned off more than 20Cr. Are systems in place to take care of these kinds of issues? As I see it the whole company is being run on Nandakumar, who is an honest man who built the company from scratch but who not young anymore. Though his daughter is brought on board, she needs to prove herself

Disc. Invested and did today as well

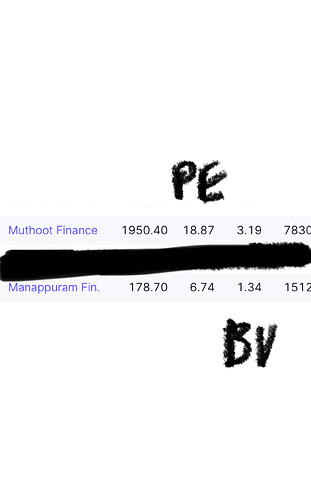

Pessimism tends to be quite strong in this stock. However, as long as the EPS and book value continue to grow while NPAs remain manageable, it’s not a major concern. The price can quickly adjust, often within just a week or a few trading sessions. Currently, it’s trading at about 1.3 times the book value and PE 6.7 , so I believe the downside risk is fairly limited at this point. It’s hard to catch the absolute bottom, but I feel this is near it

Results on 5th November

While Manappuram’s long track record in gold loan gives so much confidence I am not so sure about the other part of their portfolio. They have seen many cycles in gold loan but the problem is that now only about half of AUM is gold loan; a quarter of it is in MFI .I don’t know how to look at it but the signals are not so great.

A couple of days ago Manappuram was in news for this reason . Today it is about Asirvad . RBI has pointed out the usurious lending practices.

One instance of press coverage may not tell the standards set in lending practices, if any, but neither do such instances taken together gives one confidence in the direction they are taking.

While both Manappuram and Muthoot are known as gold lenders , for Muthoot more than 80% AUM is gold loan. This should be taken into account while comparing both.

Manappuram has historically been a highly volatile stock, which explains its lower valuation compared to Muthoot. The presence of Ashirvad Finance, a microfinance lender, has always been a concern. The true value and potential re-rating of Manappuram can only be realized after Ashirvad Finance is separately listed. Until then, the stock price is expected to remain volatile.

RBI cease and desist order on Ashirvad is very bad news for manappuram. Ashirvad is 25% of their loan book. Being short term loan, ashirvad loan book will run down at crazy speed. May lead to liquidity issue also

Looks like market had a news, that’s why stock fell 25% in last 1-2 months.

Let’s see how much impact it has tomorrow and this week

The RBI had previously stated that it removed the cap on the interest rates that could be charged, so it’s unclear why there is now sudden concern about high interest rates. Especially since the RBI had earlier indicated that there is no upper limit for interest rates

Why do you believe there will be liquidity issues since the loan recovery is feasible? Unlike the COVID situation, where job losses made loan repayment difficult, in this case, the RBI has imposed sanctions and requested a revision of their interest rate policy. While this may take some time, they should still recover over 95% of their money as usual.

For IIFL, a special audit was required before the restrictions could be lifted, involving a detailed review of processes. In contrast, for Ashirvad Microfinance, the RBI has requested the submission of proof of compliance, not a full audit. Ashirvad needs to review its processes, make necessary adjustments, and provide documentation like policy changes and revised procedures. I feel This approach is less complex, so the ban is likely to be lifted more quickly than in IIFL’s case.

I expect less than 1 month

what’s the difference between demerging Asirvad vs going the IPO route?

@maheshkumar I said ‘may’. it depends on time frame of restriction lifting. If it is 1 month like you mentioned, they may not gave liquidity issues. If it is prolonged one, then this will create such issues. In iifl case, due to this ban, even their housing finance entity faced difficulty in getting fresh loans from banks for certain time period.

Manappuram I feel will infuse capital, and given it survived the challenges of COVID-19, I believe it can withstand any current or future hurdles. Currently, it’s trading near its book value. Similar to IIFL, once the ban is lifted, the stock could experience a rapid increase. The most attractive aspect of Manappuram is its extremely low valuation

CLSA 200

Morgan Stanley 170

Jefferies : 167

Demerger:

- Splitting a company into two separate entities. Shareholders get shares in both companies.

- Shareholders keep their ownership in both the parent and new company.

- No new capital raised; focuses on restructuring.

IPO:

- Selling shares of a company to the public for the first time to raise capital.

- Existing shareholders may see their ownership percentage decrease as new shares are issued.

- Raises money from public investors for growth or debt repayment.