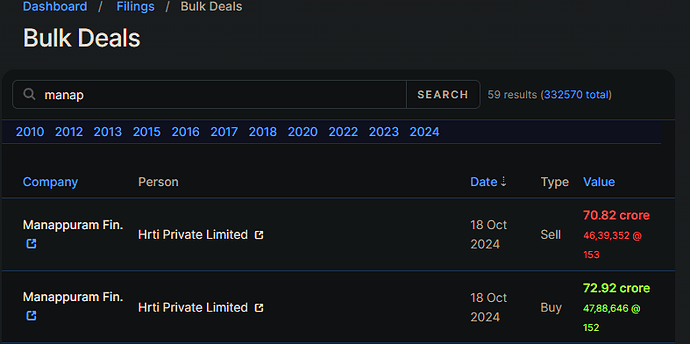

Manappuram stock is down 37.5% from its recent highs. Thanks to Reserve Bank of India’s (RBI’s) ban on Asirvad Microfinance.

Asirvad, which constitutes approximately 27% of Manappuram’s consolidated assets under management (AUM), has been barred from disbursing loans due to “material supervisory concerns”. This is not an isolated incident, neither for Manappuram nor for the microfinance industry. In 2019, the RBI imposed a penalty of ₹5 lakh on Manappuram and Muthoot Finance due to non-compliance with ownership verification protocols for gold jewellery used as collateral. More recently, in 2023, following an RBI inspection, Manappuram Finance faced a penalty of ₹42.78 lakh for failing to comply with directives on distributing surplus proceeds from auctions of pledged gold items back to borrowers.

However, the recent ban by RBI on Asirvad is by far the most damning. Here’s why.

In October 2023, Asirvad Microfinance filed its Draft Red Herring Prospectus (DHRP) with the Securities and Exchange Board of India (SEBI) as Manappuram aimed to list its microfinance subsidiary by September 2024. However, due to certain ‘observations’ from SEBI, the listing plans were initially delayed. Additionally, as financial stress within the microfinance sector became apparent throughout the year, proceeding with the listing under these conditions was deemed unviable.

According to a media report, there was a disconnect between the valuation demanded by the “promoter and what the market was willing to pay" to Asirvad Microfinance Ltd.

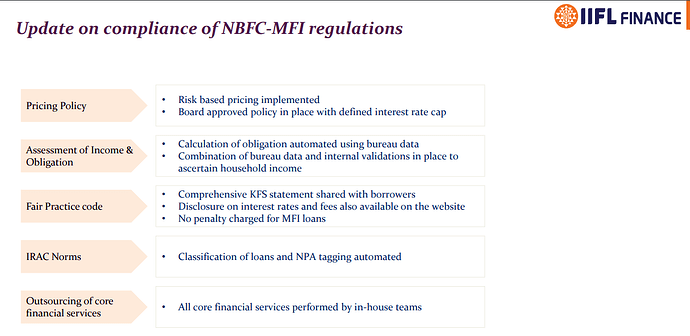

The listing was anticipated to result in ‘value unlocking.’ However, recent regulatory restrictions seem closer to ‘value destruction.’ Lending restrictions create a ripple effect, particularly affecting shorter tenure loans like those in the microfinance and gold sectors. A case in point is IIFL Finance, whose gold loan portfolio plummeted from ₹23,354 crore in FY24 to ₹10,979 crore in Q2FY25—a sharp decline of over 50%.

Microfinance institutions (MFIs) borrow on a short term basis to provide loans. The average loan tenure for MFI loans can be 12-24 months and average ticket size (ATS) is ₹30,000 – 50,000. In Q2FY24, Asirvad reported that it’s ATS was approximately ₹32,000, up from ₹27,000 in the previous year. Latest ATS data is not reported in Q1FY25 presentations.

Looming liquidity crunch

When lending is restricted, cash inflows from interest income slow down, while existing liabilities—such as interest payments to lenders and bondholders—persist. This situation can lead to a liquidity crunch, particularly in cases of asset-liability mismatch (ALM), where long-term loans are funded with cheaper, short-term borrowings. While it’s unclear if Asirvad faces an ALM mismatch, reduced interest inflow in the near term could still precipitate a liquidity squeeze.

This scenario is why, just two days after RBI imposed restrictions on IIFL Finance, the company announced $200 million in liquidity support from Fairfax India, a prominent Canadian investment holding company.

In essence, about 25-27% of Manappuram’s consolidated loan book—equivalent to approximately ₹11,235 crore—is likely to shrink. This translates to a significant hit: a segment that accounted for 17.9% of Q1 FY25 profit and 20.8% of FY24 profit may contribute almost nothing to FY25 earnings.

It’s a bleak outlook. Small wonder that brokerage houses and analysts are now rushing to lower estimates and cut forecasts.

But what about the rest of the business? Is it still in good shape, or is the market overreacting, throwing out the baby with the bathwater? Let’s dig deeper.

The consolidated Manappuram finance book value as on Q1FY25 is ₹12,002 crore.

The standalone Manappuram finance houses - the legacy gold loan portfolio, the relatively newer vehicle finance, and micro, small & medium enterprise (MSME) segments. About 72% of this portfolio is made up of gold loans.

As of Q1 FY25, the book value of Asirvad Microfinance stood at ₹2,249 crore, implying that Manappuram’s net book value excluding Asirvad is around ₹9,753 crore. At the current market cap of ₹12,284 crore, Manappuram Finance (ex-Asirvad) trades at a price-to-book ratio of 1.25x, a key valuation metric for non-banking financial institutions (NBFCs) and banks.

This suggests that, even if Asirvad Microfinance were assigned a zero valuation, Manappuram’s gold portfolio, along with its relatively newer vehicle and MSME portfolios, appears reasonably valued.

But what if challenges extend to Manappuram Finance itself (ex- Asirvad)?

Core portfolio: Gold finance

Gold loans make up 70% of Manappuram Finance’s ex-Asirvad portfolio. While the legacy gold segment has grown at a modest compound annual growth rate (CAGR) of 6% since FY20, the actual gold tonnage held has decreased, indicating that growth has primarily come from an increase in average ticket size.

In an effort to modernise, the company introduced online gold loans (OGLs) in 2015, allowing customers to avail gold loans “anywhere in the world" against gold stored at Manappuram branches.

As of FY24, 57% of gold loans were through OGLs. Despite the limited growth and a potentially narrow strategy in this core segment, gross non-performing assets (GNPA) remains at a comfortable 1.9% for FY24. With a loan-to-value (LTV) ratio of 58%, indicating conservative lending, the risk of loss on the gold loan portfolio is minimal.

Vehicle & equipment finance

Vehicle finance has expanded swiftly, from ₹1,344 crore in FY20 to ₹4,110 crore in FY24, reflecting a CAGR of 25%. However, the GNPA rate stands at 3.6%, slightly above the norm for high-quality vehicle finance players.

Another potential concern is the portfolio’s limited track record. Since Manappuram’s vehicle finance portfolio has yet to experience a full credit cycle, it remains uncertain how these NPA figures will hold up long-term. With GNPA at 3.6%, the portfolio hovers at the lower end of asset quality standards.

MSME finance

Launched in FY20, Manappuram’s MSME finance segment has expanded rapidly from ₹260 crore in FY21 to ₹2,908 crore in FY24, achieving an impressive 83% CAGR, though from a small base.

However, this growth has been accompanied by a troubling rise in NPAs, which have escalated from 1.8% to 3.4% over the past four quarters. Compared to other listed peers in MSME financing, these NPA figures are the highest, raising concerns about asset quality in this segment.

Despite a consolidated price-to-book value of around 1.1x and an ex-Asirvad price-to-book ratio of 1.25x, along with a robust core business in gold finance and a standalone return-on-equity of 17% in Q1 FY25, we view Manappuram as a wait-and-watch story.

The underlying uncertainty surrounding nearly 30% of the ex-Asirvad portfolio—segments that are yet to ‘age’—casts a shadow over its otherwise promising metrics. Investors may want to tread cautiously, keeping a close eye on how these elements unfold in the coming quarters.