Median P/BV for 10, 5 and 3 years is about 2. Something to keep in mind.

Post Base building upside potential

Pivots again shifting away from gold; >15% RoE should be sustainable despite changing mix/yield strategy: Pivots again shifting away from gold; >15% RoE should be sustainable despite changing mix/yield strategy

reports coming up now about non gold segments and now started considering manappuram as diversified

This quarter gold didn’t show growth ,but non gold is firing all cylinders

When gold will start growing then it will be an extra effect

Future Growth in muthoot will be much lower than Manappuram given fast growing non gold portfolio of Manappuram and small base

Still muthoot valuations are twice the Manappuram

I feel either muthoot will halve from here or Manappuram will be 2x from here

Probability of later to happen looks more plausible

Gold loan is operationally very challenging business and this high competition Will likely fade slowly .

@maheshkumar The management prudently focuses on improving their balance sheet and diversifying their portfolio concentration risk. However, the risk of execution in microfinance business needs to be seen. Muthoot Capital Services burnt their fingers badly here. It’s a good case study. But the growth potential is immense.

The market is on wait and watch mode. Once the execution visibility comes in and they show traction. The stock might get re-rated. It’s a matter of time. The management needs to demonstrate that they can do this at scale without risking the quality of book in MFI segment.

Yes there are two things which market is watching closely

1)Can the competeitiors sustain the operational challenges of gold loan on long term .Many have tried in past and everytime everyone failed except muthoot and Manappuram .Gold loan on large scale long term is hard .Banks do it for short period and then they start losing the momentum .

- microfinance has huge potential and so far Manappuram is doing well

If Manappuram succeds in either(gold/non gold) than it will be a retating.

If grows in both gold ( gold growth and microfinace growth )then it will be a multi bagger given current lowest valuations

Please provide some insight on your point no. 1, it seems that we all can learn with your experience and learning in gold loan business.

Disclosure: bought third tranche @ 115.66

Why it is operationally challenging to operate gold loans in large scale?

Each and every bank from HDFC bank wants to increase the gold loan portfolio. If each bank takes a small share of manappuram / muthoot, will it be operationally very difficult?

Also, in rural areas, rural banks which gives agricultural loans offers more value for the gold at cheaper rates than Manappuram / Muthoot.

MFI has huge potential but from their numbers from last few quarters, they had GNPA of around 6.7%. Also, we don’t have any clear data on customer quality or ratings in this category.

@krishnan1159 Exactly. That’s why I mentioned it’s a risky business with high return potential. The borrower quality will be lower only. Only time will tell how the execution will happen.

The business model and the target customer are completely different. While you can secure a loan from Manappuram/Muthoot in few hours, same is not the case when you approach a Bank. As an investor, you have to recognize the associated risk and decide where to bet

Banks also started processing gold loans faster. It may not be done for all gold loans. But they have improved a lot in recent years. You can check the websites of leading banks as well. They have also started processing in few hours.

Regarding the target customers, as per the last quarterly report from manappuram finance, they are struggling to retain their high value customers. In past before few quarters, they have provided teaser loans to retain them. With rising interest rates and increase in cost of borrowing, they have stopped that and you could see the number of customers declining gradually.

Moats of gold loan finance companies are slowly eroding. They have high cost of borrowing when compared to banks, banks can provide more amount for the same amount of gold(LTV for banks is around 80% I guess) and banks have also started processing gold loans through online and reduced the processing times.

Again, only in the coming quarters we will know how they are going to perform. Manappuram is at better valuation and diversified when compared to Muthoot finance. In last conf call as well, they mentioned demand in rural areas have not picked up fully. We need to wait and watch.

Still more than half of gold loan is by local non nbfc/non-bank lenders

Loan gold competition happened in past also and reason it dosen’t last long are

- huge operational cost

- loss of focus after a time

- fatigue and service issue

- small ticket is not so attractive to banks

I get the valuations are cheap and the fear of competition from banks might be already priced in. But what I can’t understand is why the growth is not showing up even after 3 years of Covid. Because historically, this competition between banks and gold loan companies is a little bit cyclical. During slow times, banks aggressively pursue GLs. GL companies can’t compete due to higher rates but then in some time, banks go about their usual business and GL companies come back. Is it different this time around? From what I understand, the management of either of the GL companies is not really admitting to this bad growth.

But at the same time, I also believe if banks could take away the business of GL companies they would have done so 3 years back, or 5 years back, or 7 years back.

Also, not sure about this but I think 2point2 capital (which was a huge proponent of GL business, at least as per their past research blogs) has exited its Muthoot position (of nearly 9-10%).

Another perspective is that the target customer of GL’s is a particular segment of around 50k-5l, which has not seen a sharp recovery post covid. So as and when the recovery is more broad based we can see some growth.

Would love to know your views.

I think the bet should not be on gold loan anymore, as the management said, their focus is on creating a diversified NBFC. Therefore, we need to monitor other factors while assessing it

Muthoot is twice expensive than Manappuram

Manappuram has the advantage of diversification

Gold loan of Manappuram and muthoot is almost similar

So Manappuram has edge due to ashirawad and half the Price to book of muthoot

Manappuram is almost at book value (we are not giving any valuations to it’s brand, growth, dividend )

To me Manappuram is a significant rerating candidate , while muthoot will be a slow grower with 10-15% CAGR

Both are such a big brand and leaders from decades

@maheshkumar , Do check out the video below as well. Its a 3 part video gives a good insight into the business of gold financing companies.

GOLD LOAN

Manappuram Finance has been operating in the financial industry for several decades and has acquired expertise in the field of gold lending. While numerous players have attempted to enter this market in the past and achieved short-term success, they have not been able to sustain it over the long term. The primary reason for this is that banks tend to lose interest in the business after a while, particularly when they begin to issue large loans to infrastructure ,reality ,big business etc.Manappuram Finance is currently experiencing a difficult phase, but it is expected to bounce back to its typical valuation once this period passes. At present, the company’s valuations are quite low, and the margin of safety is high since it is trading at nearly book value. The situation that could potentially jeopardize the company’s book value or business model would be highly unlikely.

There is potential for increased demand for gold as a result of rising inflation, as well as the growth of emerging markets like China and India, which have traditionally been significant consumers of gold.

Manappuram Finance, Muthoot Finance, are popular in particularly in rural areas where gold is a common form of savings. Both companies have established a large network of branches across the country, making it easy for customers to avail gold loans.

The government of India has initiated several schemes and programs to promote rural development and improve the living standards of rural populations.

Rural sector remains an essential part of the Indian economy .

MFI

Microfinance institutions (MFIs) have also been playing a crucial role in providing credit to rural households. MFIs typically provide small loans to people who do not have access to formal banking services. These loans are often used for income-generating activities

However, there is still a long way to go to ensure that all rural households have access to credit and other financial services.

So there is huge scope for Ashirwad Microfinance also

MANAGEMENT

.Manappuram’s management has responded to tough times by diversifying its business, focusing on digitalization, optimizing costs, and maintaining a high quality of assets in its loan book. These strategies have helped the company to navigate challenging times

It has seen and overcome many challenges in past .Especially diversification strategy has helped the company to reduce its overall risk and improve its resilience to external shocks.

Nandakumar has been committed to maintaining a high standard of corporate governance and has been recognized for his ethical and transparent approach to business.

The following are some questions and answers about Manappuram Finance:

- Fundraising has not been an issue so far.

- The business model is flexible as they can change the interest rate to adjust returns.

- Competition will always be there and is mostly cyclical.

- Cross-selling products is possible.

- The company has a long track record of success.

- The management is clean and innovative. However, it’s mainly a one-man show, which poses a risk.But now they have come up with some succession plan

- Geopolitical risks exist.

- The long-term sustainability is likely since people always need money. Additionally, 2/3 of gold loans are with the unorganized sector, leaving a huge scope for the organized sector to grow. A growth of 10% -20% is achievable in gold loans, and microfinance, housing, and vehicle loans combined

- The gold market is a dynamic process with ongoing changes in market share among banks, NBFCs, and other unorganized sectors.

- The brand value is good.

- The business is not easy to replicate.

- Consistent dividends are available.

- Gold prices are likely to go up gradually with inflation but are cyclical with an upward trajectory.

- Disruption by digital players is unlikely as gold storage is necessary. The company is also evolving its online process.

- The pricing is below book value, which is not bad.

- Diversification is ongoing. With diversification, operating leverage kicks in, which helps to bring down the operative cost combined with cross-selling, reducing the operational cost for individual portfolios.

- Although housing and vehicle loans are not high-yield businesses, the reduced operating cost combined with the gold loan branch’s presence can increase overall profits.

- Profits going down further is possible, but looks like all is priced in

- Market perception is poor so far

- The company has gone through many rough cycles and ongoing issues but has been steady in generating profits.

- Non-gold portfolio NPAs are cyclical. For example, Microfinance had a tough last two years, but the projected growth for the next couple of years is very strong, with 20-30% plus growth expected by industry players, which will take care of previous bad years in one go.

- Good lending practices have kept losses minimal

- Promoter buying in a tiny amount.

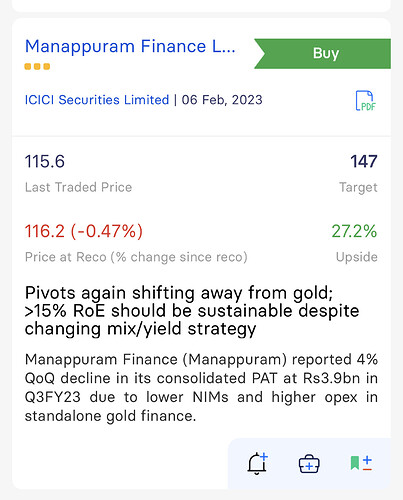

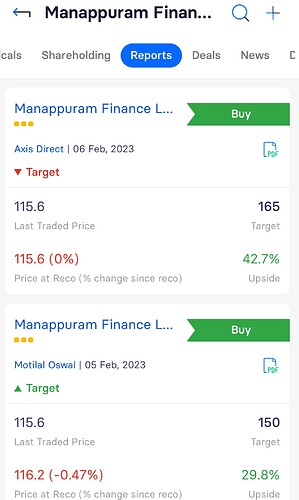

- Analyst views are mixed, depending on the market price. Some have exited, but most are buying.

- Ease of doing business is not easy.

- The ground is saturated, with new people still entering to get some pie, so profits are getting distributed.

- Banks’ main advantage is low-interest rates, which is good for long-term loans like housing. However, gold and microfinance are not their strong suits. Gold loans for banks comprise a minuscule percentage of their portfolio, while for NBFCs, it is a major portfolio. Since banks prefer to target it less aggressively, it remains a minuscule portfolio for them.

- NBFCs have a quick disbursal process, making them the kings of low-ticket size. Banks focus on high-ticket customers in all segments, including gold, housing, and vehicles. They don’t treat low-ticket customers same as high loan customers and most get lost in the crowd and big lines.

- The unorganized sector has high-interest rates but is connected to people with less exploring capabilities.

- The loan duration is short, so slight fluctuations in interest do not have much effect.

summary:In the short term, there can be multiple permutations and combinations in the market and it may take time to gain clarity on which companies will emerge as strong players and which ones will struggle. However, in the medium to long term, companies that are able to consistently grow at a rate of 10-20% will be successful. Strong companies are likely to emerge stronger, while weak players may not be able to sustain their position in the market in long term

Manappuram has witnessed loan gold competition in the past also , but the reason for its transient nature is manifold, including exorbitant operational expenses, waning attention over time, fatigue and service problems, and unattractive prospects for small loans among banks.

Seems like some banks are still lending at 90%. Interesting interview, worth a read

behind a paywall. Can you share the full interview here?