Hello everyone. My portfolio consists of two parts-

a) a long-term portfolio of quality growth companies for 10-15 years (core)

b) a short-/medium-term portfolio of companies with strong price-volume action along with fundamental catalysts for 6-12 months (satellite)

This thread is about the latter. In this part of my portfolio, the strategy is-

Technical charts on weekly and monthly candlesticks

Fundamental triggers like sector tailwinds, upcoming capacities, product launches, change in management etc.

(Slightly higher weightage given to technicals over fundamentals e.g. 60:40)

Cut all losses at 10% without exception (may re-enter if there is revival after hitting SL)

Trail the stop loss

Follow CANSLIM approach

Do scuttlebutt

Heavily influenced by Mark Minervini and William O’Neil

Cut losers and average up the winners

Stocks with thesis:

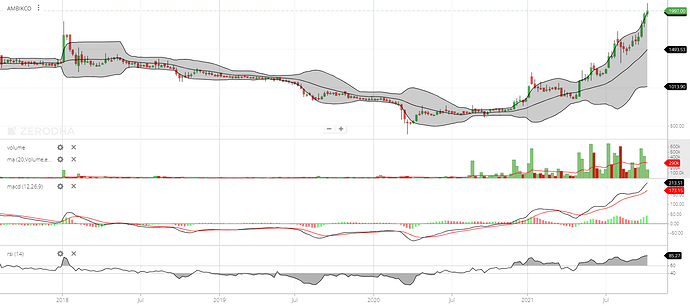

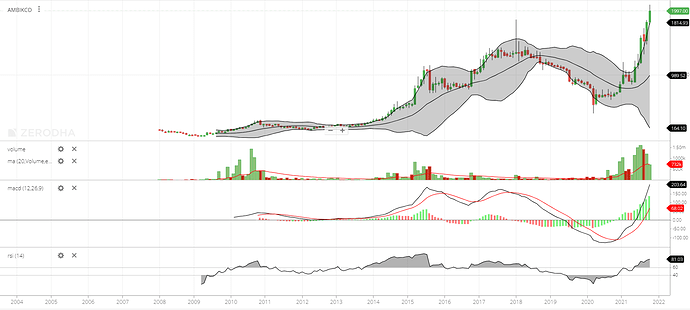

Ambika Cotton (CMP is ~ Rs 2024):

Price Volume Action on weekly chart-

and monthly chart-

Sector tailwinds (China+1)

Export oriented (out of ~ Rs 390 Cr turnover so far in FY22, ~ Rs 290 Cr was from exports i.e. ~ 74%) Debt free

Target of Rs 800 Cr revenue for FY22

Upto 28 Sept 2021, company had sales of Rs 390.25 Cr and Q1 FY22 sales was Rs 184.07 Cr hence Q2 turnover will be >= 206.18 Cr (390.25-184.07)

30K spindles capacity coming up (source for all numbers here is AGM)

Rise in cotton and cotton yarn prices

AGM Links-

Video Recording: 33rd Annual General Meeting of Ambika Cotton Mills Limited held on 29 Sep 2021 - YouTube

Transcript: Proceedings of the 33rd AGM of Ambika Cotton Mills – Ambika Cotton Mills Limited

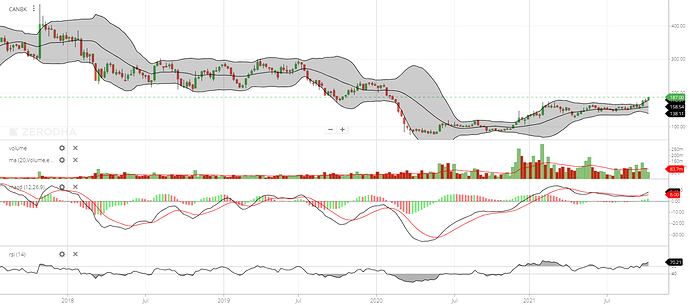

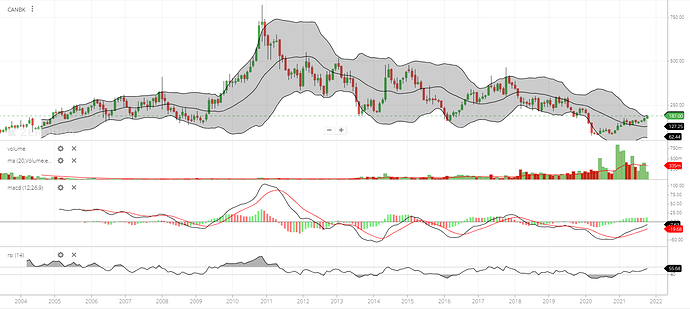

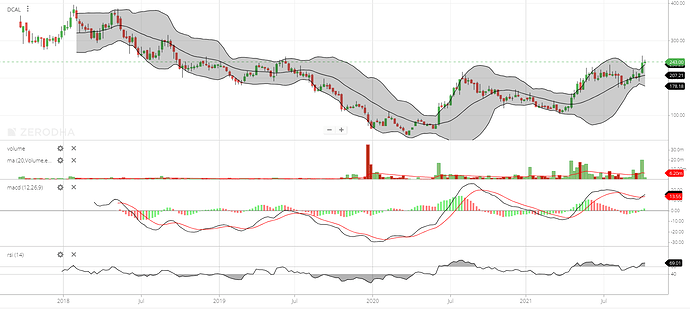

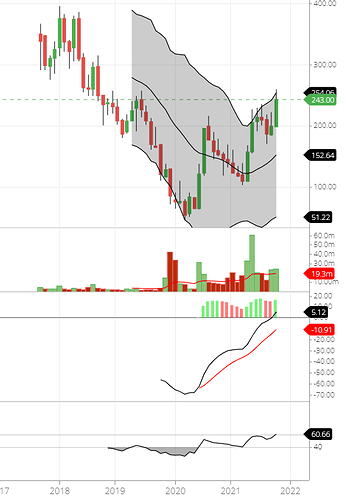

Canara Bank (CMP is ~ Rs 187):

Price Volume Action on weekly chart-

and monthly chart-

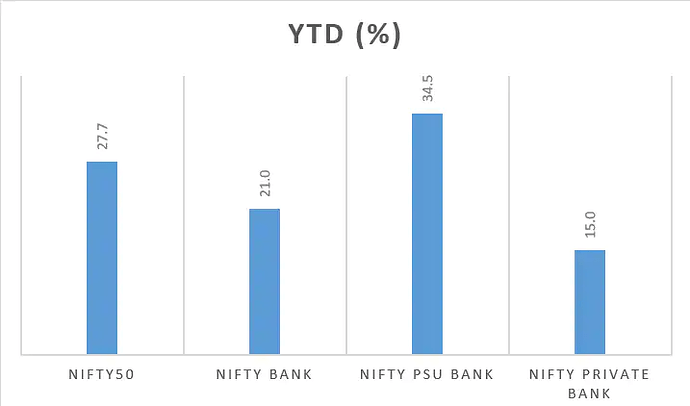

PSU banks have tailwinds: a) number of PSU banks has reduced from 27 in 2008 to 12 now b) all PSU banks have cumulatively made a pre-provision operating profit of ∼ Rs 9.8 Lakh Cr in last 6 years, and a cumulative provision of ∼ Rs 11.5 Lakh Cr in last 6 years, leading to a net loss of ∼ Rs 1.2 Lakh Cr (this shows the level of clean-up in PSU bank loan books)

Lenders will benefit in economic revival

Provision coverage ratio of 79.68% as on 31 Mar 21 (source), and further improved to 81.18% as on 30 Jun 21 (source)

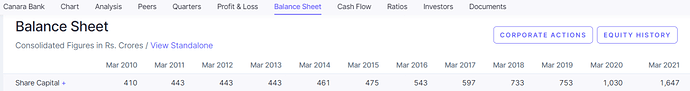

Raising of capital in Dec 2020 (source)

Major collateral is real estate, and real estate recovery may lead to provision write backs

Has major deposit gathering ability (people talk about CanFin Homes brand but what about the parent- Canara Bank?)

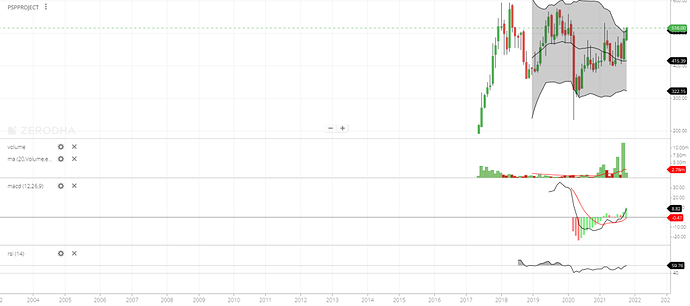

PSP Projects (CMP is ~ Rs 501):

Capex cycle recovery

Management has guided for revenue of 1600 to 1800 Cr for FY22 (source), whereas current market cap is 1846 Cr

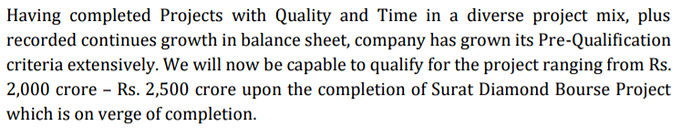

Post completion of Surat Diamond Bourse, company will qualify for larger projects

Strong order book as per AGM commentary

Dishman Carbogen Amcis (CMP is ~ Rs 2024):

Vitamin D opportunity

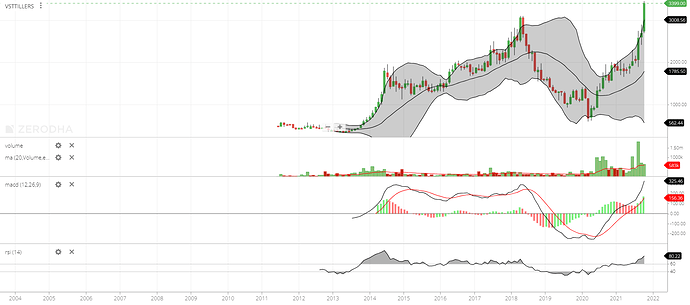

VST Tillers (CMP is ~ Rs 3400):

New product launches (27 HP tractor, 17 HP single cylinder tractor etc.)

1000 Cr revenue target for FY22

3000 Cr revenue target for FY25

Exports opportunity

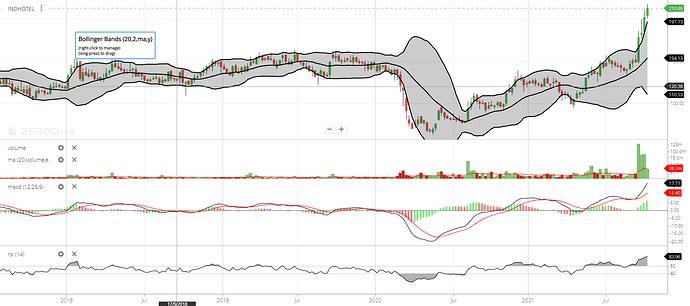

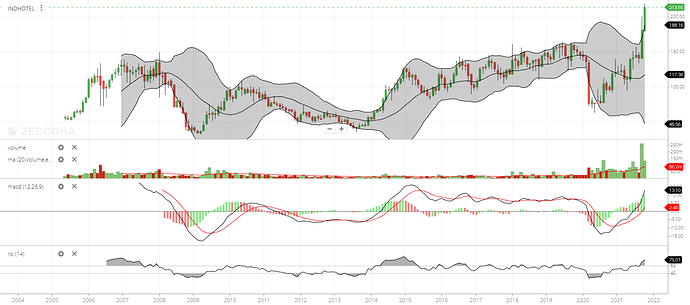

Indian Hotels (CMP is ~ Rs 214):

Covid situation revival can act as tailwind

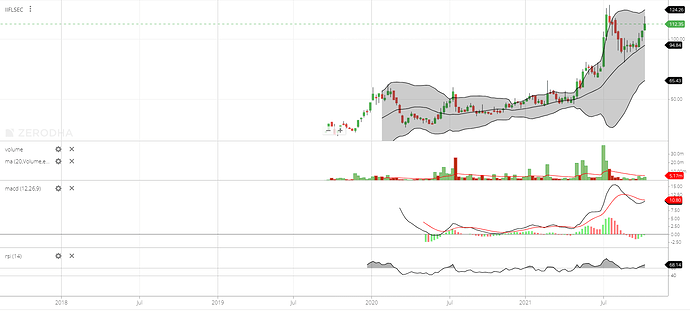

IIFL Securities (CMP is ~ Rs 112):

Beneficiary of retail investor participation

Allocation in these stocks is more-or-less equi-weight

Intended holding period is anywhere between 6 and 24 months (not fixed). Will post on this thread only when there is a portfolio update (e.g. exit/addition etc.) or to answer any questions. I have no rigid return expectation from the satellite portfolio; idea is to at least marginally outperform the core portfolio to justify the higher churn and related costs. Thank you. Looking forward to feedback/suggestions. Views invited.

Disclaimer: Any analysis posted should not be construed as investment advice. Any posted analysis is not a buy/sell/hold recommendation. I am not a SEBI registered investment advisor. Please consult your financial advisor before acting on any posted analysis. The author shall not be liable for any losses incurred by readers while acting on any posted analysis. The author has holdings (and hence a vested interest) in all companies posted and the analysis may be biased. This post is for educational purposes only.