To build my Investment Rationale, I am taking inspiration from “The Investment Checklist - the Art of in-depth Research” by Michael Shearn.

The first sector where I see good opportunities are in Auto Ancillary space, since we are in early phases of interest rate down-cycle and this sector has been picking up well in the last few years (Sales growth in L3Y for median 110 companies as per screener is 2X of L5Y (17% growth in last three years compared to 8.6% growth in last 5 years). There is a dormant thread on VP on Auto Ancillary for more info this sector.

My notes on this sector: [source: https://www.coinmen.com/wp-content/uploads/2021/09/Indian-Auto-Components-Sector_Overview-2020.pdf ]

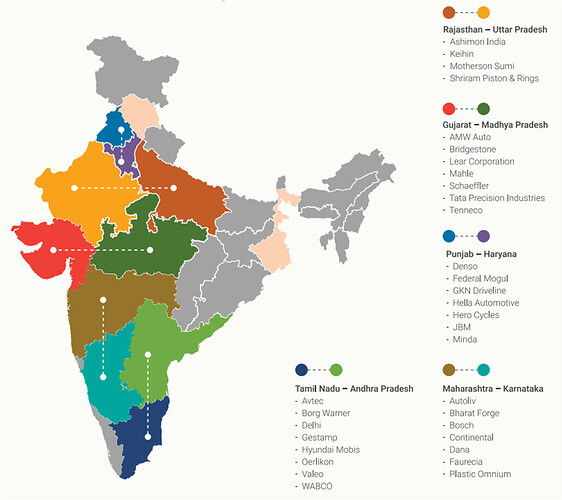

Automotive clusters are spread in North, West & South regions of India

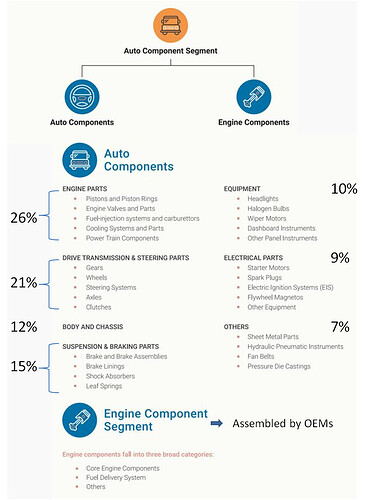

Auto components segments and their contribution to this sector

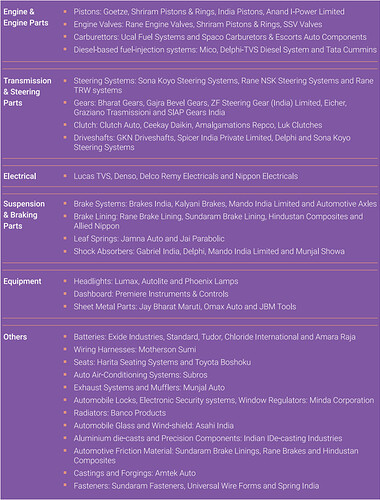

Key players in these component segments

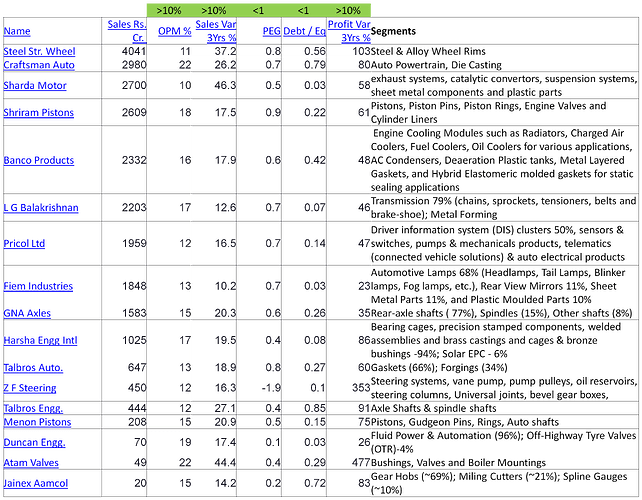

I have shortlisted companies based on below five threshold financial criteria:

- L3Y Sales Growth >10%

- L3Y Profit Growth >10%

- OPM >10%

- PEG < 1

- D/E < 1

Based on the above criteria, these are the shortlisted auto component/ancillary companies in descending order of revenue:

Next steps: further shortlisting based on other financial metrics and Pros & Cons of each to zero down on top 4-5 fundamentally good growing companies.

Refer the thread on Auto Ancillary for further shortlisting and analysis of shortlisted companies.