Questionable Capital Allocation of late. Co’ has become a Fund Manager.

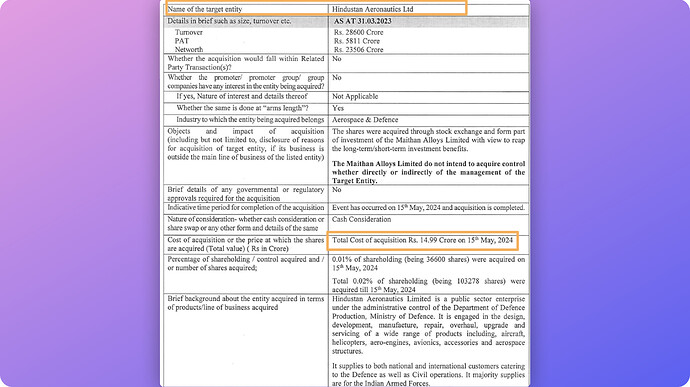

For Example : Co’ bought shares of HAL recently. It’s a small amount but, what’s their thought process here, it’s a little odd

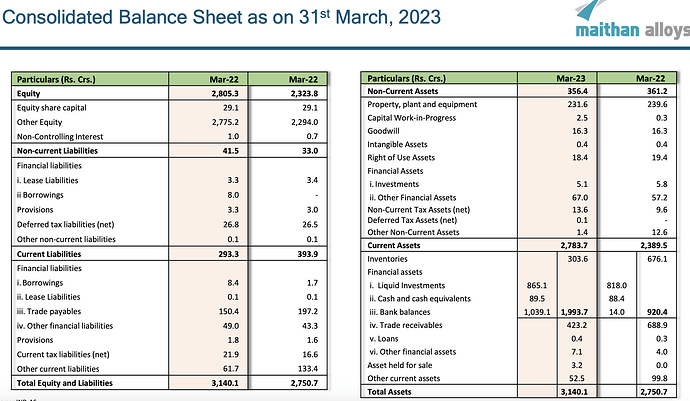

The co. has 1,788 Cr in investments, mostly in equities which they bought in the last few months. Full year revenue was 1729Cr. with a OPM of 7%. The margins are closer to the lowest margins the company has witnessed in last 10 years. They have switched on the furnace at Impex, which was turned off due to unviable operations. I guess the cycle must be turning, very low margins+starting the furnace. If I remove the investments from the m.cap (3300cr)…then the business which is debt free, is available at 1500 cr, thats P/S of 0.87 and could be a good investment idea.

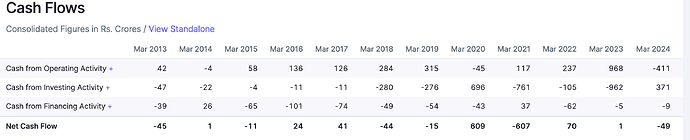

What I dont like is the mgmt’s unwillingness to distribute the cash to the shareholders. They have made massive equity investments which they should not have done, unwise capital allocation.

Disc: very small allocation, not an advise

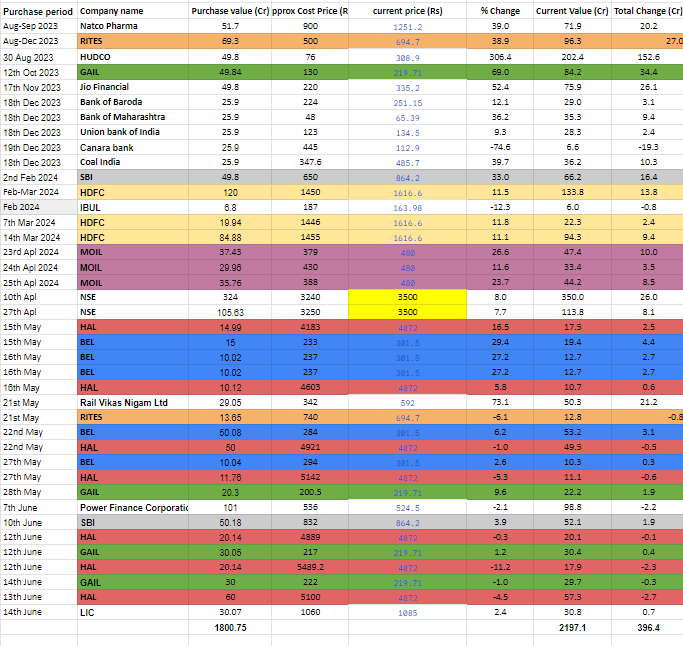

The biggest investment they have made is in NSE 425crs. They have got 13,25,000 shares at the Rs. 3,207 a share. I think unlisted share price of nse is more than rs 5000 a share, which means the company has already made unrealized gain of 50%+ on this investment. If the management can deliver returns in excess of 15-20% on the cash they hold on balance sheet, I think investors still benefit because ultimately book value keeps on expanding. Yes, I agree to an extent doing investments at peak margins and peak valuation is quite risky, especially in current scenario where PSUs are overowned. So, a negative.

NSE shares are 4000/share right on the unlisted segment.

From what I have read, NSE prices are anywhere between 4500-5500 depending on the lot size at the moment. So definitely a big plus once NSE gets listed.

Mostly when a company starts investing in other companies through equity, and in turn increases its book value, markets tend to value them at a lower PB ratio. Look at all the holding companies, or companies which have substantial percentage of their cash in stocks, and you will find similar trend everywhere. The takeaway point in such cases is that company thinks of generating more returns through investment in equity in non related business rather than growing inorganically.

A better metric for such companies is Market capitalization to Sales ratio, which for Maithan has only increased over time.

Even if you assume 15% LTCG/STCG, the equity portfolio is about 2000Cr. I wont be surprised if the 450 Cr odd NSE portfolio will become 1000 Cr in a few years…

Plus in the next few years, there should be a few years where they can produce FCF of 400-500 Cr annually. Could get very interesting… if that happens,assuming the equity portion remains the same, the rest of the company could be going for a potenital MCap/FCF of 3 as of today. Should be an easy double from here, if that happens.

I was very positive on the company and used to think it is a great value buy…may be it still is…but what I didnt like was promoter’s intent to not return money to shareholders and instead invest money in equities. This was the biggest trigger for me to exit…I had a very small allocation but not any more.

Hi Gaurav,

Did you get any feedback from them on their equity investements and why they think its a better capital allocation strategy?

Because, I am not comfortable with them adding more PSU’s. Not sure, what is their plans and fall back strategy.

Will they plan to carry these investements for longer period ?

Disclosure: Invested.

Hi Santhavel

I am still awaiting their response. I had sent multiple reminders to their IR team but no one cared to reply or connect to the relevant person. I first invested post covid, exited around the peak in 2021-22

I entered again recently with a small position. But after this episode, I exited my position completely

In their past annual reports 5-6 years back, they mentioned conserving cash for future growth opportunities. It made sense as they were quite a small company but somehow I feel they have completely missed the bus, while other alloy companies expanded and are now reaping the fruits, they have not been able to acquire something big nor grow organically.

Some of the tailwinds boosting exchange stocks are expected to slow down as the government/SEBI explores ways to reduce the volume of FnO trades. This factor certainly contributed to the meteoric rise of BSE and, rub-off on NSE.

So only time will tell if this was most prudent decision on mgmt part or not.

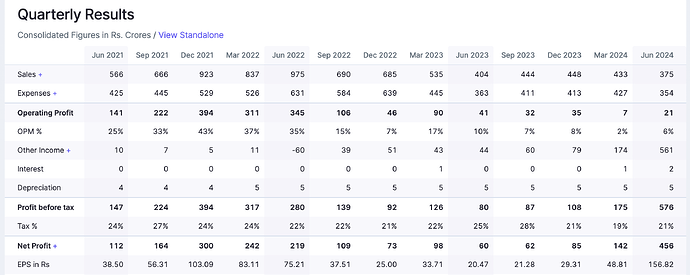

Operating Profits have halved with margins also contracting from 10% Jun’23 to 6% now.

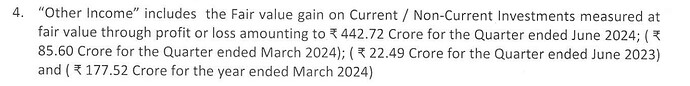

Wonder how is the other income component calculated. Fair Value means what? Current stock market prices may not be true reflection of the fair value…

anyways, the firm has shown a growth in other income from 44Cr Jun’23 to 442Cr Jun’24. 10 TIMES! They have been aggressively moving away from holding cash to being invested in stock market.

Wonder how much additional money they would have poured in equity markets to generate this additional 400Cr other income.

Any sources which confirm how much they have invested since March 2023?

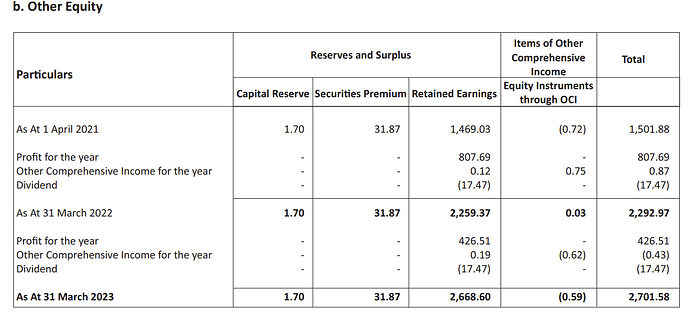

As per the balance sheet of March’23 they had almost 2000Cr in bank balance and their investments in Equity were 3112Cr as of March’24; could not get the balancesheet for half yearly Oct qtr end 2023

So this move from holding cash to equity has been beneficial to them so far… but yes its open to market gyrations… and if one were to invest in market only, why buy Maithan?

I just had a look at Maithan Alloy’s current valuation and it looks interesting. But I have a similiar doubt to Mayank’s post above - the company seems to have completely shifted strategies to become an equity holding company, mainly investing excess cash in PSU stocks. Also their disclosure is pretty poor - their latest Q1 2024/25 quarterly report doesn’t even have a balance sheet (the most basic of financial statements!). So, will wait and watch until the annual report is released. Hopefully will be clearer then.

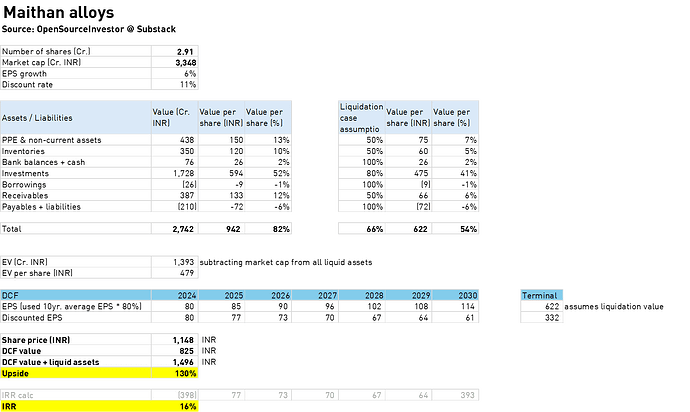

For now, I’ve based the below calculations on Q4 2023 quarterly report. If I use conservative estimates, the stock should provide ~16% IRR at these levels. However, I will wait for disclosures on the latest balance sheet and equity holdings before deciding to invest further.

Disc: invested; potentially biased

Cheers,

Sharad

OpenSourceInvestor

Companies are not required to furnish balance sheet on quarterly basis. Only on half yearly basis.

Hi All,

The NSEINDIA valuation of 440cr investment is now 3x from the purchase price of 3260 per share to 1900 (4:1) bonus shares so 880cr are in only for shares purchased.

The management is buying shares and doing fair value of investments through P&L leading to huge increase in EPS as seen in last qtr but market is not impressed as people want cash back if the company has no use of cash.

the problem seems to be high promoter share holding of 75% and relatives own some more so they care very less for ordinary shareholders, lack of institutional holding also does not help as no one is around to ask these folks, why they are paying dividend of Rs 6 net eps of Rs 400 per share.

I am investor since 2012 and have initially bought at Rs 60 per share, i am hugely disappointed as this share could have done wonders rather investing in Manufactuing they have ventured in to stock investing and no one in market is liking this the stock price is reflection of the same.

I hope management comes back to senses and give back the money in form of dividend and then we can decide which shares to buy ourselves unfortunately in India no one gives a damm about public shareholders specially well connected promoters.

Hi All,

I found a very interesting thing in Maithan alloy results.

It seems they have bought nseIndia shares as non-current investments along with some other shares.

Also, they are regularly buying and selling shares as they have both entries of purchase of current investments and sale proceeds from current investments.

Although I can find purchase intimation to stock exchange but missed seeing any information related to sale of securities.

Am I the only one finding this to be odd or others feel the same?

Disc: Invested and biased

I liked how you did the balance sheet valuation. So let’s say that the downside is protected this way to a certain extent.

However, may I ask on what is the EPS growth based on? And are these earnings of EPS coming from the operating side of the business or the investment side of the balance sheet? It would be great if you can share what assumption have you made for the operating side of the business to come to those earnings.

The operating side of the business has been pretty shi**y (this is not attack on you but the company). The mgt has failed to explain with any insightful details why the operating business has performed poorly, and what do they see going forward. It seems they are more interested in the exuberant stock market than in the operating business.

Ferro alloys has been under stress at industry level.

I follow Godavari Power. They have ferro alloys product line.

However, I would like management to communicate how do they expect business to evolve further. Will there (ever) be a growth capex for operating business?

Good thing is, at the very least, management is focussed on RoE/RoCE.

Disclosure: Not invested.

I have only 3 issues here:

- if the base business is not doing well, management needs to diversify in same line of business rather than becoming a stock market trader, we know the reason for the stock price is primarily due to this.

- if they have no business investment use case of cash return it as dividend

- when company is not rewarding shareholders either via dividend or share buyback or price appreciation, they should not increase management salary and profit share.

they own 75% directly and more by using close relatives as minority shareholder i have no hope from them to give me a fair deal.