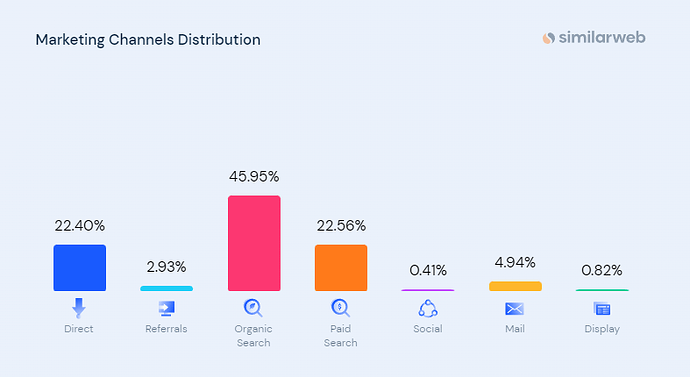

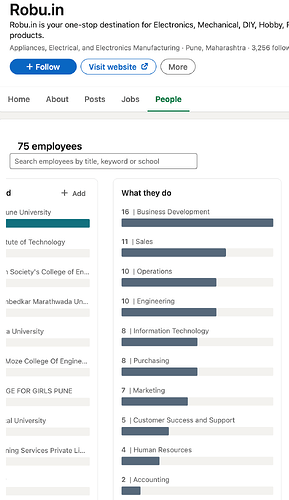

Macfos Limited is an e-commerce company that sells a wide range of electronic items through its website and mobile application, Robu.in. The Company has an extensive portfolio of 12,000+ electronic items including robotic parts, drone parts, E-bike parts, IoT & Wireless items, 3d printers & parts, DIY learning kits, development boards, Raspberry Pi (Single board computers& Peripherals), sensors, motors, motor drivers, pumps, batteries, chargers, electronic modules & displays and various other mechanical and electronic components. Further the company is also developing its own brand and developing certain products related to drone technology.

The company came out with IPO in February 2023, at price of Rs. 102. The IPO was offer for sale, i.e. promoters sold part of their shares. The IPO was highly oversubscribed. The stock is presently being traded at Rs. 270, commanding a market capitalization of Rs. 239 crores. Presently the stocks are available at a lot size of 1200 in SME exchange.

Promoters look humble and honest. They said in the investor meet,

“And the backstory of Robu is that, we are four friends first. We are all friends from engineering college, I can say. And before Robu, we have a failed business of doing chapati machines, 2011 to 2013. And that is where like we did one year in the industry, 2010 to 2011. And then we have this background of failed business. I’m just rushing through because I feel not the right venue. And because of that failed business background, we value every rupee that we spend. And that is how we started from scratch in 2014.”

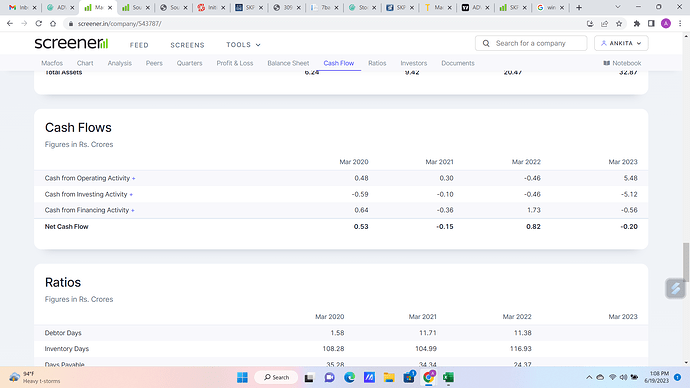

Financials:

Company had a good financials. The topline has gone up from 16 Crores to 80 Crores in 3 years with decent margin.

Valuation:

It is fundamentally am e-commerce platform. Most of such platforms are struggling to generate profit, this company is doing very well- both in terms of increasing the topline at good pace, with decent margins without infusion of external capital. Even in the IPO, the company did not issued any share. The management said,

“We didn’t raise any money or, thought of growing exponentially by not raising the money. So from day one, we are bootstrapped. And initially you don’t do like, for three, four years, we’re just like, I’ll say we were trying to make sure that our business fix and it does not fail. Because initially, initially it was really not that big of a picture in front of us. And later on, we were getting sufficient funds from the bank for our business growth. So there was a time when, we were growing sufficiently with the bank funds and never thought of raising the money and so on.”

The company is valued around 3 times sales and almost 30 times earning. Though not cheap on any standard, not very expensive as compared to other E-commerce companies.

Competitive Advantage:

Though the company is a mere e-commerce platform, the business cannot be easily replicated. Presently they have more than 12000 SKUs, for 80 crores topline. Thus, revenue per SKU is less than 1 lakh! Sheer number of SKUs required in this particular line of business gives a moat to the company. The management explains,

“But yes, I think it’s not just a trading business. It’s more than that. I think we are into a technology business. And we are selling a complete technical solution to our customers. So our customers really value, we keeping all the products that we know that they’ll require for a solution. So for example, if you want to make a drone, you don’t just require motors. You require 20-odd products which are compatible with each other. And then you have to keep those products in optimized stock to serve the customer at the right point in time. So that is a way beyond trading. That is not just buying a motor and selling a motor. We believe that we are a technical solution provider kind of in our business sense. And I think that helps because we are technical people and we know our customers requirements. And we act on that basis.”

The margin the company is commanding, over a prolonged period of time shows that the company has a decent advantage in the business.

The company is also supplying marquee clients like ONGC, M&M, Hindustan Aeronautics Ltd., Tata Power Solar Systems Ltd., Central Electronics Engineering Research Institute, Pilani, Wipro Enterprises Pvt. Ltd., Bharat Forge Ltd., Tata Communications Ltd., Schneider Electric India Private Limited.

B2B and B2C segment is almost equally divided. Operating margins are 23% in B2B segment, whereas it is 30% in B2C segment.

Scalability:

The business looks scalable because the company is operating in a growing segment. Further, it has only 12000 odd SKU presently, whereas leading global companies in the segment offer around 3Lakh SKUs. Further, brand development and new product development undertaken by the company will add to topline. The company has already created a new warehouse wherefrom 5X order can be served.

Investor presentaion-

8d7a67c7-228a-4df2-aebc-0505fb1c3a65.pdf (1.3 MB)

Reasons for Investing:

-

An E-commerce company available at reasonable price.

-

Decent growth prospect with good margin and good RoE.

-

Area of operation expanding.

-

Management is expecting OPM at around 15% and maintaining historical growth [which is upward of 50% p.a.]

Risk:

- Micro cap investment may result in loss of 100% capital.

- The company has to maintain huge inventory, which may become obsolete/cheap.

- The company is generating exceptionally high RoE, which may attract competitor or bigger players in the space.

- Lack of competitors in the listed space making it hard to compare.

[Disclosure: Invested]