Overall macro trends in IT industry: -

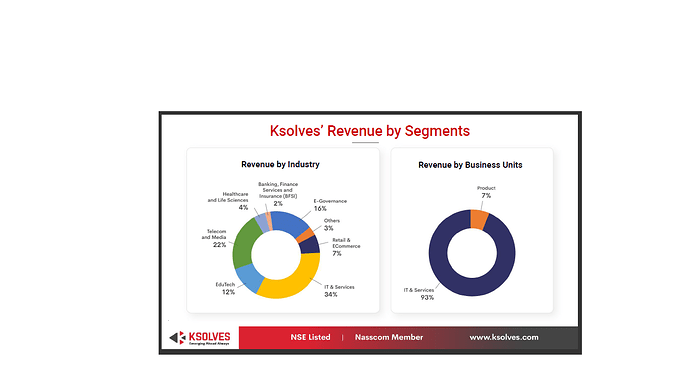

Software development firms offering IT services while transitioning from old technologies to new technologies/offerings such as Big Data, AI/ML, Blockchain, Cloud, Edge computing, IOT, SaaS/PaaS/IaaS, RPA, BPM etc. All of which come under one big umbrella of digitization.

As per Gartner, " Digitalization is the use of digital technologies to change a business model and provide new revenue and value-producing opportunities; it is the process of moving to a digital business."

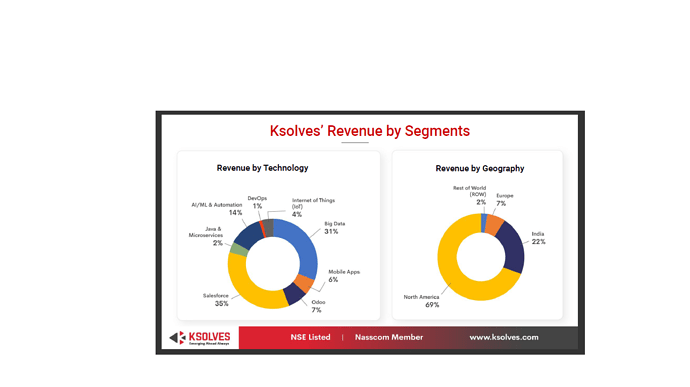

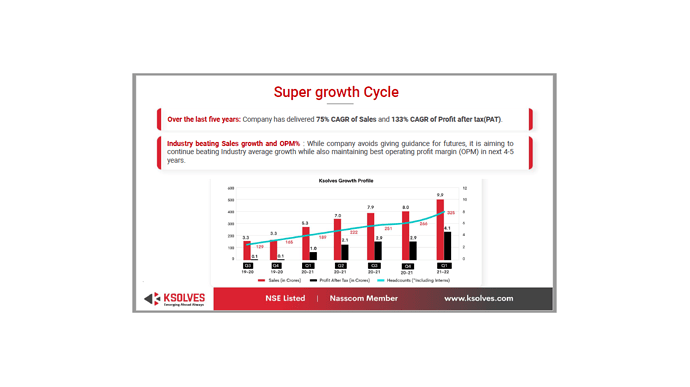

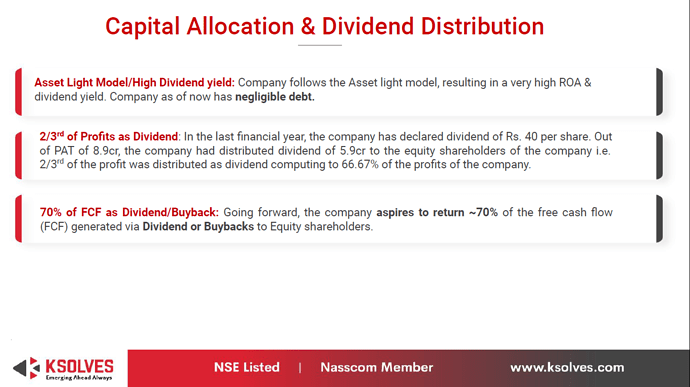

Traditionally, Indian pure play software services firms hold office spaces (real estate) on their books while MNC hold office spaces on lease basis that keeps them nimble. The advent of Covid

has only helped accelerate the trend towards being asset light if the transition from CAPEX to OPEX at customers end (due to cloud/saas) was not enough. While this transition in large IT firms will be a gradual shift, the hybrid model works best today for companies of all sizes.

Having said the above, there are companies today that truly operate with a global delivery model with no/very small office space (sales office). Needless to say that being asset light, helps companies command a higher OPM.

Ksolves seems to be just there offering services in software development and software products. Below in an excerpt from the annual report of FY21: -

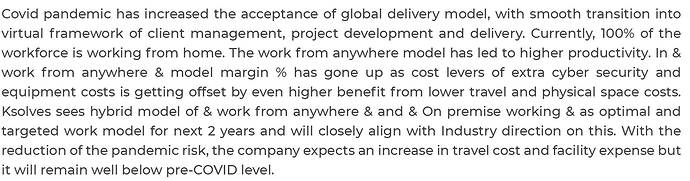

While, at one hand, the company has partnered with some of the most prominent and largely used software products across the globe such as Salesforce CRM, Magento, Drupal CMS and Odoo that helps stay relevant and garner a constant source of income, on the other hand, it has its own product “Dashboard Ninja” and a few other products/themes on its webstore and on Odoo store that have earned good traction globally. Moreover, the company has also partnered with some of the prominent online marketplaces to attract talent. Furthermore, the projects/services offered to clients seems solely on T&M basis.

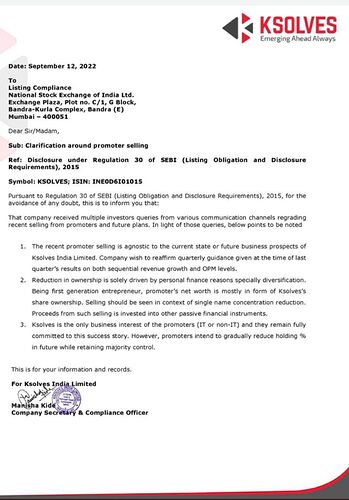

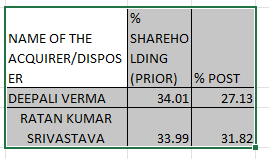

The main promoters of the company are Mr. Ratan Srivastava (around 15 years of IT experience) and Mrs. Deepali Verma (around 7 years of IT experience) with the board getting reconstituted in the last couple of years. The Chairman cum MD, Mr. Ratan seems to strive towards being industry relevant and nimble footed to the changing dynamics with underlying risk protection, which gets corroborated by the below details from the AR and investor presentation: -

Key risks: -

-

Client concentration - Top 5 clients contribute 45% of the revenue. Though the company claims 85% customer stickiness, loss of a single customer can cause a dent in revenue & earnings.

-

Intense competition - As with any other firm in the IT industry, this company is no different in terms of the intense competition faced. However, the opportunity size is equally huge, if not more, allowing multiple service vendors to co-exist.

-

Keeping pace with ever changing technology/digital solutions - To keep itself competitive, the firm has to constantly invest in personnel, training and development. It has to constantly keep abreast of the latest technologies and the developments therein (technology frameworks, tools etc) and effectively use them for its clients.

-

Forex risk - The company earns around 78 per cent of its revenue from outside India, predominantly from North America (69%), whereby it is exposed to foreign exchange-related risks.

-

Scalabilty of global delivery model – The company needs to mantain its edge over its competition as it grows leveraging the global delivery model (predominantly work from home with high dependence on software tools for communication, monitoring etc) that helps to offset a good portion of lease, infrastructure and business travel costs helping it maintain a higher OPM.

Corporate governance: -

No red flags so far except for some very low value loan transactions with the promoter and subisidary. The promoter, Mr. Ratan and Mrs. Deepali are related. The company is listed on NSE’s SME exchange and is aiming to get listed on the main board. It has earned the following accreditations from renowned institutions which increases its credibility in the global arena.

How the story unfolds and whether the management walks the talk is to be seen in the coming years.

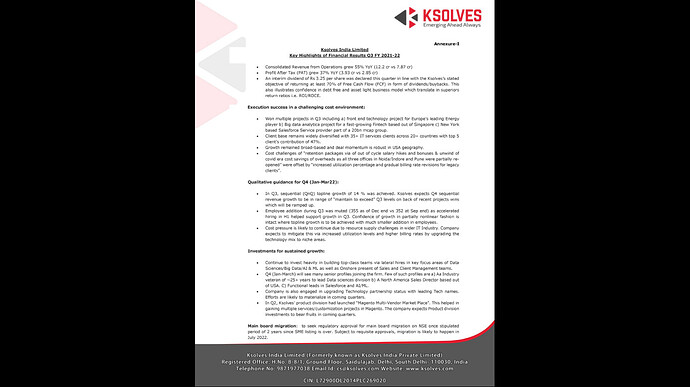

Q3 FY22 results out: -

P.S. This is not to be treated/construed as buy/sell recommendation. Please do your own due deligence.