Krsnaa Diagnostics -

Q4 and FY 24 concall and results highlights -

Company’s operating infra -

148 CT / MRI centers, 1400 X-Ray machines - contributing to 57 pc of revenues

120 - Pathology Labs, 1900 collection centers - contributing to 43 pc of revenues

Present across 150 district locations across India ( in 17 states and UTs )

Company is now averaging 1.5 lakh CT / MRI scans / month and 5 lakh X-Ray scans per month

Company is the largest Radio - diagnostics company in Asia

Company is only into B2G segment ( catering only to Govt patients / Govt hospitals ). Currently having a bid win ratio of 75 pc. Company is present in most states except - Gujarat, Bihar, Jharkhand, WB, Telangana, Chattisgarh, Haryana, Kerala - among major states

FY 24 outcomes -

Sales - 619 vs 487 cr

EBITDA - 146 vs 124 cr ( margins @ 24 vs 25 pc )

PAT - 56 vs 62 cr ( margins @ 9 vs 13 pc )

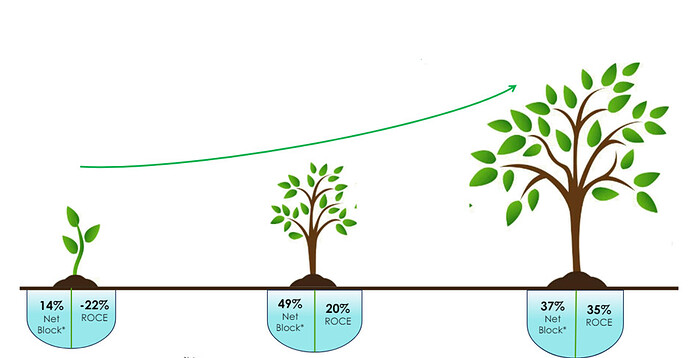

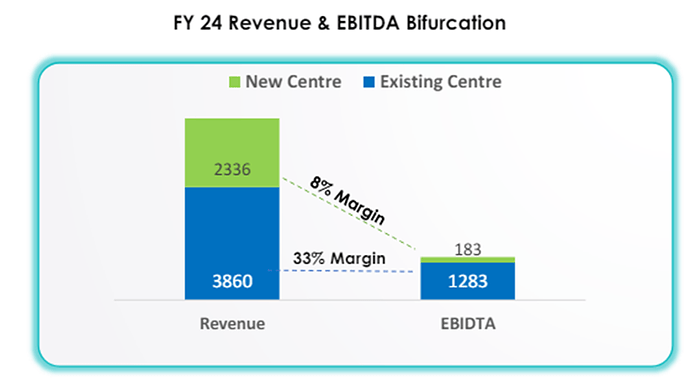

Revenues from old centers - 386 cr, EBITDA margins @ 33 pc

Revenues from new centers - 233 cr, EBITDA margins @ 8 pc ( as they scale up, there is massive scope for margin expansion )

Q4 outcomes -

Sales - 166 vs 158 cr

EBITDA - 44 vs 37 cr ( margins @ 26 vs 24 pc )

PAT - 18 vs 13 cr ( margins @ 11 vs 8 pc )

In last 12 months, company has put up 15 new CT/MRI centers and 25 new Pathology labs + 800 collection centers

Company is the process of setting up 22 new CT/MRI centers in Maharashtra + MP ( 17 + 05 )

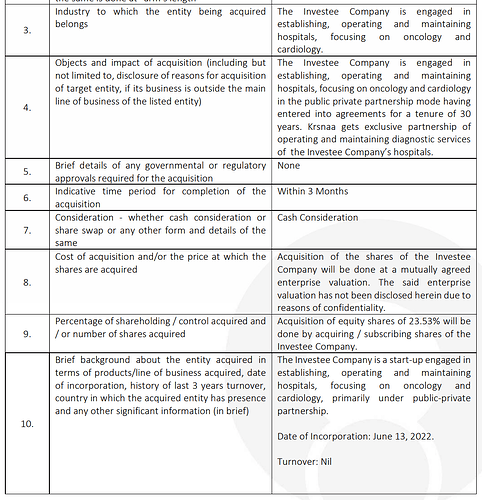

Company is now venturing into B2C segment. Company will leverage its existing infra for the same and will try and keep the pricing lower vs pure B2C players

Receivable days are currently @ 68 days ( excluding the recievables from HP which are elevated ). Increase in receivable days is also due to the 2024 general elections as a similar increase was witnessed during 2019 elections as well ( this is a key monitorable, hope it reduces towards the end of Q1 )

LY in July, Rajasthan Govt had arbitrarily cancelled the State’s health mission tender given to the company ( worth Rs 450 cr ). The matter is sub-judice and a verdict is expected shortly

Generally it takes about 3 yrs for a new center to mature and to start reporting healthy EBITDA margins. Company expects its centers in Punjab and Chandigarh to start turning around soon

Company looking at 25 pc kind of CAGR on Topline for next 2-3 yrs. Also expect the EBITDA margins to stabilise at around 25 pc

Expecting the receivables from Himachal Pradesh to start moderating towards the end of Q1 / beginning of Q2

Capex lined up for next FY @ 150 cr ( excluding Rajasthan )

Disc: initiated a tracking position, biased, not SEBI registered, not a buy/sell recommendation