Company Overview

The company is the largest producer of PIB compounds in the country & among the largest players across the globe.

About the industry

Polyisobutylene (PIB) is a Polymer made from Isobutylene. PIB is an inert polymer in nature but will react with other chemicals under certain conditions to give various derivatives to target specific end usages.

-

Dependence on an automobile: The fortunes of the industry are directly tied to the growth in AutoMobiles, as it is mainly used in/as a lubricant & two-stroke (2T) engine oil

-

Expected growth in the coming decade: owing to the applications in new industries like Adhesives, cosmetics, plastic masterbatch & rubber, and tire & sealants, the demand is expected to grow in the coming period.

-

The primary Raw material is some Crude derivative.

Polyisobutylene (PIB) is a Polymer made from a Hydrocarbon stream termed C4 in the industry. This is available in Refinery, Naphtha crackers, and MTBE crackers.

The availability of raw materials is a major concern for the industry, with some companies even shutting down their plants owing to the inability to get materials.

Competitive intensity: The industry is characterized by low competition owing to several players leaving due to the inability to get raw materials. There are negligible domestic producers in this space & the main competition is from imports (which have suffered post covid owing to higher freight costs.

About the company

The company is a part of the esteemed HC Kothari group of companies that have a presence across three industries ~ Sugar, petrochemicals & safe deposit lockers.

The company was earlier headed by the late Mr. Bhadrashyam Kohli who passed away in 2015, post which the promoter’s son ~Mr. Arjun. Kothari took over as MD at the age of only 24 years.

During FY15, the company was reeling with a poor demand scenario, difficulty in gaining a supply of raw materials as well as being highly dependent on the lubricant producers for demand, however, he has completely transformed the business in the past few years slowly & consistently.

Positives

- Strong market positioning- The company is the largest domestic producer of PIB catering to around 80% of the domestic market demand in the last 3 years (91% in FY23). This is owing to the Strong ENTRY BARRIERS wherein due to the scarcity of raw materials, several other players had to close their shops/ couldn’t produce the chemical. While the company owing to its strong relationships & investments in developing the pipeline with Chennai Petroleum (which also allows it to source material at lower costs due to proximity) & Reliance Industries, has helped in ensuring a consistent supply of materials making it a preferred & reputed supplier.

- Marque clientele: The company has a strong clientele comprising lubricant manufacturers and 2T lube-oil producers like Lubrizol India Limited, Hindustan Petroleum Corporation Limited (HPCL), Bharat Petroleum Corporation Limited (BPCL), and Indian Oil Corporation Limited (IOCL), etc, in the domestic market, and Infineum Singapore PTE Limited in the overseas market.

- Strong operational efficiency: The company owing to its constant focus on automation has been able to reduce its employee count as well as function the plants for more than 300 days consistently (350 days during the covid period!).

Its constant investments in its captive power plant, solar, waste heat recovery systems, & effluent water treatment have helped in controlling the power costs despite the high prices & volatility in the past few years.

Further, the company has not only run its plant consistently at utilization levels >90% but has also ensured zero fire/accidents since the start of its operation, which is a commendable feat for a chemical company.

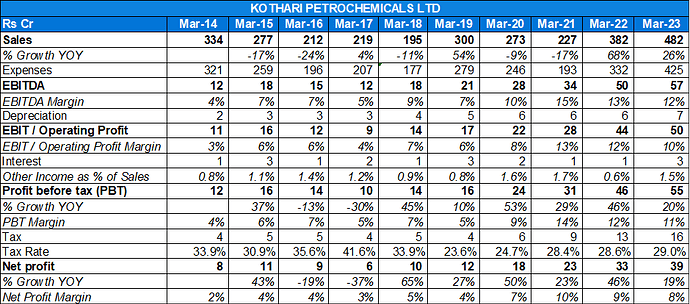

- Renewed growth prospects: The company after a slump in revenues till FY21 (partly contributed by the closure of LPG sales) has started showing strong growth owing to higher realizations as well as greater volumes due to 1) higher contributions from exports which rose by 140% in FY23 (25% of total revenues now), 2)increased domestic market share owing to non-feasible imports (with freights costs being high & supply chain issues post-covid), 3) Increased contribution from Non-lubricant industry like Adhesives,plastic-masterbatch among others which has diversified its revenue profile as well as giving a good growth opportunity.

This is visible from the doubling of capacity from 24,000 ~ 48,000 MTPA in the last 3 years, which is a big thing considering its capacity was constant at 24,000 MTPA between FY15-20.

- Strategic location Advantage: The company owing to its proximity to the port in the South-east as well as its supplier Chennai Petroleum, can save on freight costs as well as deliver products efficiently (in exports).

- Improvement in margins & ROE profile: The company owing to sourcing of higher quality IB content feedstock, has been able to reduce its costs (& increase quality) substantially owing to negligible waste generation (unreacted feedstock) & no-remnant LPG produced (by-product which had low margins). While at the same time, due to its improved competitive position, its ability to enter into formula-linked pricing mechanisms & higher commodity prices, the realizations have improved and remain stable leading to high margins & extraordinary ROE (30% in FY23) while maintaining a lean balance sheet (D/E~0.1).

- R&D aggression: The company has started heavily investing in its R&D from the erstwhile 50 lakhs Per annum to 2 Crs in FY23. The results are also visible in the form of the development of new chemicals like HR-PIB & High molecule weight polymers. The company also received a patent recently for a particular chemical which shows its R&D prowess.

Negatives

- Volatility in the commodity to hit realizations: The company’s sales have been boosted by higher realizations for its chemical which is highly correlated to LPG & Naphtha prices (which have risen sharply in the last 3 years). Thus any downward movement in the same can affect the sales numbers.

- The potentially low terminal value of the existing business segment- The company currently derives a major chunk of its revenues from Lubricants & two-stroke engine oils, which are expected to degrow after 5-10 years owing to the arrival of EVs. Thus dependence on this segment remains a huge risk that might not be visible in the current numbers & its ability to diversify in other segments will ultimately determine its fortunes.

- High client concentration risk: The company’s top 5 customers have historically contributed around 50-70% of total sales. Although, due to the addition of new clients (especially in exports), the company’s dependence is reducing which is visible from a decrease in the contribution of the top client (from 25% to 15% YoY), it remains a major risk.

- Availability to procure raw material: The company’s ability to source raw material can be a major risk in the future (which is currently a source of its moat!) as the company procures these from only 2 producers & it remains to be seen how it will procure in future given the projected increase in volumes.

- Increased working capital cycle: Owing to the company’s higher share of exports as well as supply chain issues, the working capital cycle has increased in the past 2 years which led to CFO/Net profit falling to around 60% in the last 2 years. Therefore, this needs to be tracked in the coming period.

- Potential competition from imports: The company’s domestic market share increased rapidly owing to supply chain issues created by covid which led to lower imports in India. However, the company does face competition from well-established international manufacturers, such as Daelim Corporation in Korea and an MNC in Singapore. It, therefore, remains critical to see how the company will utilize its higher capacity & if the domestic share is sustainable or not.

- Recent compensation hike for the Chairperson: Recently, The company passed a resolution to pay 1% of net profits as a commission to the chairperson~ Mrs.Nina Kothari. Earlier, she was eligible for only sitting fees (which indicates a lack of involvement in the daily operations as she held this post after the death of her husband) & got around 30-40 Lakhs of dividend income owing to her 10% direct stake. So, this sudden change in the remuneration policy looks like a red flag.

Management overview

- The management team is headed by Mr. Arjun Kotharti (MD & CEO)

- The company is an HC. Kothari Group company.

- The promoters have a healthy 71% stake ensuring skin in the game.

- The corporate governance standards have been decent with no major related party transactions except some 4 Crs paid to a group company as a professional service fee (the nature of this fee is still unclear to us).

- The management team is well experienced

- Management pay has also been reasonable given the size of the company

Capital Allocation

- The company has regularly given a dividend payout of around 15-20% in the past few years.

- Capex: The company has doubled its capacity in the last 3 years from 24,000 MTPA to 48,000 MTPA. While this is commendable, the company has also shown great restraint to do any major capex between FY15-20 where the capacity utilisations as well as the demand was low instead of focusing solely on showing higher volumes at lower realizations (which would have led to value destruction).

- The company has never indulged in any M&A activity.

The company has also regularly invested in R&D (2 Crs in FY23) which led to new product developments that de-risk its business profile (owing to high contribution from conventional PIB in the past)

In conclusion, the company’s strong & conservative Capital allocation policies have ensured an average ROE~20% in the past decade.