Ticker/Symbol: NSE: KOTHARIPET

As I begin this analysis, I’m reminded of one of the most important principles in investing: buying a simple, understandable business with strong management and a durable competitive advantage at a reasonable price. Kothari Petrochemicals, from all the data I’ve reviewed, seems to tick most of these boxes in several ways.

Summary

The first thing to notice is that Kothari Petrochemicals is involved in the production of Poly Iso Butylene (PIB). PIB is not something that needs much explanation or innovation — it’s an industrial commodity with consistent demand across a range of sectors. Think of it like a utility; demand for lubricants, sealants, adhesives, and other applications of PIB will persist, regardless of the latest technological trends.

Kothari Petrochemicals Ltd. (KPL), India’s largest producer of Polyisobutylene (PIB), stands at a pivotal point in its growth trajectory.

This business is predictable, not flashy, and necessary for industrial use. The end markets Kothari serves, such as automotive, construction, and other industrial applications, are stable, which provides a base for long-term growth. Importantly, Kothari is the largest manufacturer of PIB in India, giving it a significant scale advantage in a niche industry.

Business Overview:

Kothari Petrochemicals Ltd. (KPL), a subsidiary of HC Kothari Group, is India’s largest and most prominent producer of Polyisobutylene (PIB), an essential polymer used in a wide range of industrial applications such as lubricants, adhesives, sealants, and plastic additives.

Incorporated in 1990 and headquartered in Chennai, Kothari Petrochemicals has steadily grown into a niche player within the global petrochemical industry, supplying to markets across 20 countries including India, Europe, Japan, and Southeast Asia.

Market Leadership in Polyisobutylene (PIB)

KPL commands a dominant position in India’s PIB market with an installed capacity of 48,000 metric tonnes per annum (MTPA), making it the largest manufacturer of PIB in the country. The company focuses on producing Low Molecular Weight PIB, a product highly regarded for its versatility, stability, and application in high-performance industrial products.

KPL’s product portfolio includes a range of PIB grades such as KVIS-10 to KVIS-200 and PIB R-01, which are critical components in several key industries:

- Lubricants: Used in the formulation of motor oils and greases.

- Adhesives & Sealants: Enhances bonding in construction and automotive applications.

- Plastics & Rubber: Acts as a plasticizer in rubber compounds and polymers, improving their flexibility and durability.

Geographical Diversification

While the Indian market continues to drive 74% of KPL’s revenues, the company’s strategic focus on exports has contributed to 26% of its total revenue. Kothari has successfully penetrated international markets, particularly in Europe and Asia, where demand for PIB in automotive and packaging sectors remains robust. This geographical diversification acts as a buffer against domestic market volatility, ensuring stable revenue streams from multiple regions.

Strategic Partnerships and Procurement

KPL’s supply chain strength is underpinned by long-standing partnerships with industry giants like Chennai Petroleum Corporation Limited (CPCL) and Reliance Industries, which together supply 100% of the company’s raw materials. The company’s reliance on isobutylene, a crude-oil derivative sourced through efficient pipelines, provides a competitive edge in cost management and operational efficiency. KPL’s formula-based pricing mechanism for long-term contracts also shields the company from raw material price volatility, contributing to stable profit margins.

Product Innovation and Diversification

While PIB remains the company’s core product, Kothari Petrochemicals has strategically invested in research and development (R&D) to enhance its product portfolio and expand into higher-value derivatives of PIB. Recent innovations include the development of PIB grades for use in electric vehicle (EV) batteries and advanced packaging materials, positioning the company for growth in emerging sectors such as renewable energy and sustainable packaging.

Sustainability and ESG Initiatives

KPL is committed to sustainable manufacturing practices, with ongoing efforts to reduce its carbon footprint by implementing energy-efficient production processes. The company is also exploring the use of recycled feedstocks for PIB production, aligning with global trends toward environmentally friendly chemicals and circular economy models. These initiatives are designed to meet increasing regulatory demands while providing long-term value to stakeholders.

Management Insights and Governance

The company is managed by B.H. Kothari, part of the well-established Kothari Group, with decades of experience in petrochemicals. The promoter’s 70.98% stake in the company reflects strong confidence and alignment with long-term shareholder value creation. The board of directors is committed to sustainability, transparency, and corporate governance as seen in their annual disclosures and ESG reports.

Leadership Strategy: The management’s focus is on expanding globally while maintaining cost discipline. Their experience in managing cyclical downturns and commodity price volatility provides resilience in uncertain economic conditions.

Management’s decision to expand their capacity by 15-20% shows that they’re taking a long-term approach to growth. They’re not rushing into aggressive M&A or speculative ventures; instead, they’re investing in their core business — one they know well. This focus on operational improvements and incremental capacity expansion aligns with how I like to see businesses grow sustainably over time.

Industry Overview & Macro Context

The global petrochemical industry is projected to grow at a CAGR of 6-7% over the next five years, driven by rising demand from end-use industries such as automotive, packaging, and construction. The Indian petrochemical market is also seeing significant growth due to rising domestic consumption, government initiatives supporting industrialization, and increased foreign direct investment in the chemical sector.

Key Global Trends Impacting Petrochemicals

-

Shift Toward Sustainable Chemicals: With increasing pressure on environmental regulations, companies are focusing on producing more sustainable and environmentally friendly chemicals. This trend provides an opportunity for Kothari Petrochemicals to innovate its PIB product for greener applications.

-

Geopolitical Tensions: Global supply chain disruptions and geopolitical issues, especially involving major oil-producing nations, could impact the petrochemical industry’s supply chain and raw material pricing. However, Kothari’s domestic leadership helps buffer against such global fluctuations.

India’s Petrochemical Industry Outlook

India’s petrochemical market is expected to grow at a CAGR of 8% over the next five years, supported by rising domestic consumption, new industrial projects, and an increasing demand for plastics and polymers. Government initiatives like the Production Linked Incentive (PLI) scheme also support manufacturers by incentivizing domestic production.

-

Market Size: India’s overall petrochemical market is valued at ₹8 trillion.

-

Growth Factors: Rising middle-class income, increased industrialization, and new infrastructure projects.

Automotive and Precision Engineering Sector

Kothari Petrochemicals is well-positioned to benefit from the growing demand for PIB in the automotive industry, particularly in the production of high-performance lubricants. With the automotive sector undergoing a global transition to electric vehicles (EVs), the need for advanced lubricants and sealants is increasing. PIB’s use in these applications is expected to grow at a CAGR of 4-5% over the next five years.

Defense and Aerospace Expansion:

While Kothari Petrochemicals’ current exposure to the defense and aerospace industries is limited, these sectors present a promising growth avenue. PIB can be used in the production of specialized materials for aerospace lubricants and adhesives. The Make in India initiative, which promotes domestic manufacturing in defense, could provide new growth opportunities.

Macro Context

Given that 26% of Kothari’s revenue comes from exports, global trade dynamics and capital flows are critical to the company’s long-term success. Understanding macro trends like trade imbalances and capital flows is essential to analyzing any company.

In 2023, India’s trade deficit was approximately $268 billion. While this might seem negative at first glance, India’s exports of industrial chemicals have been growing. As countries like China and Europe undergo re-industrialization and recovery post-COVID, demand for specialty chemicals such as Poly Iso Butylene (PIB) remains robust. This has benefited Kothari, but how sustainable is this trend? Let’s see more on this

World View

-

China’s Economic Recovery: Although China is currently struggling with real estate debt and slow economic growth (expected at around 5% for 2024), its demand for raw materials is unlikely to decrease drastically. Infrastructure projects and automotive sectors in China continue to demand industrial lubricants and plastic additives.

-

European Inflationary Pressures: The European Central Bank (ECB) has raised interest rates to curb inflation, now at 4.3%. As Europe grapples with inflation, demand for industrial products may soften, affecting Kothari’s ability to grow its export revenues from the continent. However, the weaker Euro against the Rupee could temporarily benefit Kothari’s price competitiveness in Europe.

Commodity Pricing and Inflation’s Impact on Input Costs

Kothari relies on isobutylene, a crude-oil-derived material. The price of Brent crude has hovered around $85-$90 per barrel in 2023. This has a direct impact on Kothari’s raw material costs, and by extension, its profit margins.

- Brent Crude Analysis: In 2023, oil prices surged due to production cuts by OPEC+, aiming to keep supply tight. This limits the upside for Kothari’s margins, as they have long-term pricing contracts with their customers, limiting the extent to which they can pass on higher costs.

- Inflation’s Impact: Globally, inflation in both the U.S. and Europe is still high, around 3-5%, and wage inflation is making labor more expensive. This increases the cost for Kothari’s global suppliers and could indirectly raise costs across the entire supply chain.

Kothari’s gross margins (around 16-17% in FY23) could be squeezed if oil prices rise further or if inflation continues unabated. The company would need to implement cost-saving measures in its manufacturing process or renegotiate contracts with its suppliers, such as Chennai Petroleum Corporation and Reliance Industries, which supply 70% of its raw material needs.

Global Trade Tensions and Currency Volatility

The global trade landscape has been increasingly marked by protectionist policies, tariff wars, and shifting geopolitical alliances. For Kothari, which exports a significant portion of its production, these dynamics present both opportunities and risks.

-

Geopolitical Tensions: Ongoing tensions between major global powers such as the USA and China could affect trade routes and impose new tariffs or regulatory barriers. These would directly impact Kothari’s ability to export competitively.

-

Currency Volatility: The Indian Rupee (INR) has experienced volatility against major currencies like the US Dollar (USD), Euro (EUR), and Yen (JPY). A strong Rupee could make Kothari’s exports more expensive, potentially reducing its competitiveness in international markets. On the flip side, a weak Rupee could boost export profitability.

-

The Indian Rupee has been relatively weak against the USD, trading around ₹83/USD recently. This could benefit Kothari’s exports in the short term, as their products would become cheaper in foreign markets.

-

The Euro and Yen have both experienced fluctuations due to the energy crisis in Europe and Japan’s weak economic recovery post-COVID.

The currency environment seems favorable for exports right now, but this is subject to rapid change due to geopolitical dynamics and central bank policies. Kothari must hedge its currency risk to maintain profitability in global markets. Moreover, the rising geopolitical uncertainty could disrupt supply chains and introduce new trade barriers, which might impact its ability to grow exports.

The Debt Cycle and Central Bank Policies

Examination of where we are in the debt cycle tells us a lot about where interest rates and economic growth are headed. For Kothari, whose raw materials are linked to commodity prices, understanding global monetary policies is critical.

- Interest Rates and Inflation: Central banks worldwide have been raising interest rates to combat inflation, leading to tighter monetary conditions. In the U.S., the Federal Reserve has consistently raised rates, while the Reserve Bank of India (RBI) has followed a similar path. Higher interest rates globally could slow economic growth, particularly in key markets like Europe and China, leading to lower demand for PIB products used in automobiles and packaging.

- Commodity Price Pressures: Kothari’s main raw material, isobutylene, is derived from crude oil. Given that oil prices have been volatile (hovering around $80-$90 per barrel), this adds a layer of unpredictability to Kothari’s input costs. Rising interest rates generally dampen demand for commodities, which could be beneficial if oil prices stabilize or fall.

Cyclicality of End Markets

Kothari Petrochemicals operates in cyclical industries, with its primary markets being automotive, rubber, plastics, and lubricants. These industries are highly sensitive to the global economic cycle and consumer demand

-

Automotive Sector: The automotive sector, in particular, is undergoing significant changes, driven by the shift towards electric vehicles (EVs). While Kothari’s products, particularly PIB, are used in lubricants, the demand for traditional lubricants may decline as EV adoption grows. EVs require different types of lubricants and fluids, meaning that Kothari may face lower demand from its existing automotive customers over time.

- The EV market is projected to grow at a CAGR of 22.5% globally between 2023 and 2028. This could reduce demand for traditional lubricants and PIB in the automotive sector.

-

Packaging Industry: Similarly, the plastic and packaging industry is facing disruptions due to the increasing global focus on sustainability and reducing plastic waste. This could impact demand for Kothari’s products used in plastic-based applications.

- Governments around the world are introducing regulations to reduce plastic waste. For example, the European Union has passed directives to reduce plastic packaging, which could affect Kothari’s long-term growth in this sector

Kothari needs to adapt its product portfolio to cater to the evolving automotive industry (specifically, the transition to EVs) and the shifting regulatory landscape for plastics. The company’s over-reliance on cyclical industries could make it vulnerable to demand shocks in the near future. Diversifying into sustainable alternatives and EV-related materials would be prudent.

The Indian Rupee’s depreciation against major currencies provides Kothari with an export advantage in the short term, improving its margins on international sales.

Current crude oil prices, hovering around $85 per barrel, help Kothari manage its input costs effectively, but this can quickly turn into a headwind if geopolitical tensions arise in oil-producing regions.

China’s Industrial Dumping: A Global Risk

China is known for its aggressive industrial policies, particularly its practice of dumping commodities and raw materials at artificially low prices in international markets. Dumping refers to the selling of products in foreign markets at a price lower than their domestic market price or cost of production, often subsidized by the Chinese government. This strategy can severely affect companies like Kothari Petrochemicals, which operate in industries vulnerable to price competition.

China is one of the largest producers of petrochemicals, and any move by China to dump petrochemical products globally would put downward pressure on prices. Given Kothari’s focus on Poly Iso Butylene (PIB) and related products, Chinese dumping could affect its export competitiveness. If China decides to flood the market with lower-cost substitutes for PIB, Kothari might face significant pricing pressure, both domestically and internationally. This could erode its profit margins and market share, especially in price-sensitive markets like Southeast Asia, where Chinese companies have a strong foothold.

Key Data:

- China’s production capacity for petrochemicals exceeds domestic demand, contributing to its reliance on exports. In 2021, China accounted for more than 40% of global petrochemical production.

- Several sectors, including plastics and synthetic rubbers, have seen Chinese dumping practices result in price collapses.

From a macro perspective, if global trade tensions worsen between India and China, it could affect Kothari’s ability to operate smoothly. Diversification into higher-value products or specialized markets where Chinese competition is less fierce might help mitigate this risk.

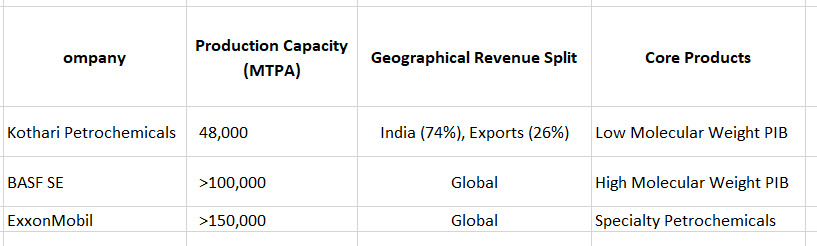

Sectoral Comparison

When comparing Kothari Petrochemicals with other key players in the global Polyisobutylene (PIB) market, it is important to highlight that Kothari is a major player within the Indian market, while on the global stage, it competes with several multinational corporations, including BASF, ExxonMobil, Daelim, TPC Group, and Lubrizol. These companies have far greater production capacities and diversified portfolios across various chemicals. For instance, BASF SE and ExxonMobil dominate the market with a strong foothold in high molecular weight PIB, used for more specialized industrial applications. Kothari’s niche focus on low-to-medium molecular weight PIB primarily used in lubricants, adhesives, and rubber products allows it to carve out a competitive space domestically and in select international markets.

However, Kothari’s ability to diversify its offerings beyond the Indian market is relatively limited compared to these global competitors who operate across regions like North America, Europe, and Asia-Pacific. The demand for PIB is set to grow globally, with projections indicating a compound annual growth rate (CAGR) of 5-6% from 2023-2030. This growth is driven by applications in automotive, packaging, and industrial lubricants. In this context, Kothari’s potential to expand its product range and geographical footprint will be key in maintaining competitiveness.

As of 2024, major global players in the market include:

- BASF SE (Germany)

- Braskem SA (Brazil)

- TPC Group (U.S.)

- The Lubrizol Corporation (U.S.)

- ExxonMobil Corporation (U.S.)

- JX Nippon Oil & Gas (Japan)

- Zhejiang Shunda New Material Co., Ltd. (China)

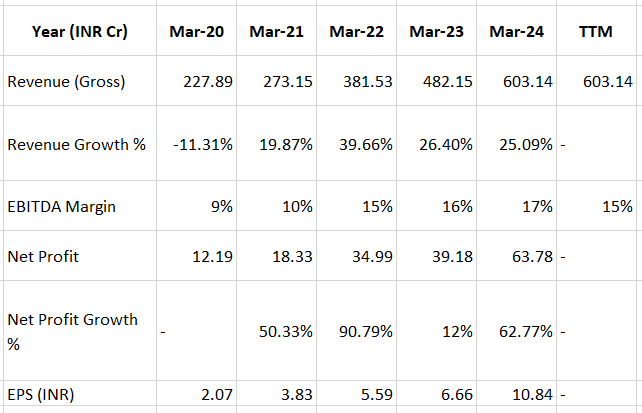

Financial Analysis & Fundamentals

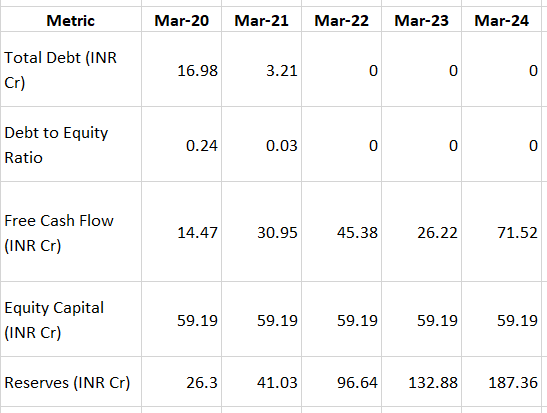

A key metric I would like to emphasize is management’s ability to allocate capital intelligently. This is one area where Kothari stands out. The company is debt-free, which is a massive plus.

“The best way to minimize risk is to avoid debt.” Kothari’s management has shown financial discipline by growing the business without leveraging the balance sheet. They have chosen to reinvest their profits into expanding production capacity and increasing their global market share.

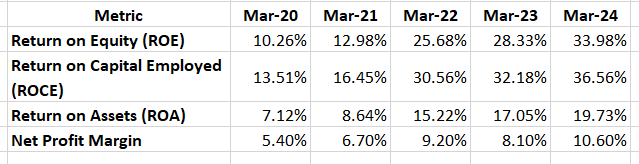

Financial strength is at the core of any long-term investment decision. I look for companies that generate healthy profits, produce strong cash flows, and use little or no debt. Kothari Petrochemicals excels in this regard:

- Return on Equity (ROE) is a remarkable 41%. This tells me that the business is highly profitable and management is using shareholders’ equity efficiently.

- Operating Margin of 16% is another indicator of a well-managed company. It shows that Kothari has pricing power in its market and the ability to control costs.

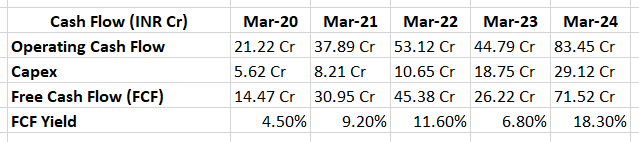

- Cash Flow Generation: Kothari’s ₹72 Cr in operating cash flow for FY2024 is a solid figure, and they are using this cash to fund growth without taking on debt.

These financial metrics show that Kothari is profitable, well-managed, and financially sound. This kind of financial health means the business can weather downturns without needing to resort to expensive financing.

Revenue & Profitability

- Revenue Growth: Kothari Petrochemicals’ revenues have grown at a robust CAGR of 25% over the past five years, driven by increasing demand for Polyisobutylene (PIB) and the company’s successful expansion into new geographies.

- Profitability: EBITDA margins have consistently improved from 9% in FY20 to 17% in FY24, indicating better operational efficiencies and pricing power.

Debt and Equity

-

Debt-Free Status: As of FY24, Kothari Petrochemicals is completely debt-free, allowing the company to allocate more resources toward capacity expansion and R&D initiatives.

-

Healthy Cash Flow Generation: The company’s free cash flows have seen significant growth, especially in FY24, due to enhanced profitability and disciplined capital expenditures.

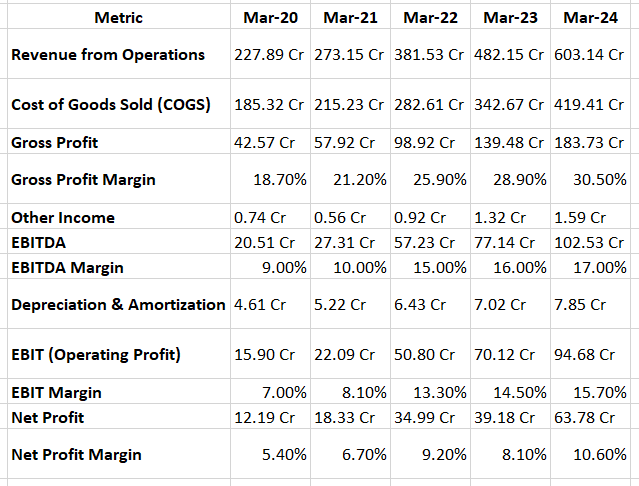

Income Statement Breakdown

-

Gross Profit Margin has improved from 18.7% in FY20 to 30.5% in FY24, indicating better operational efficiency and stronger pricing power.

-

EBITDA margins have increased steadily, suggesting that the company has been able to manage its fixed costs well and improve profitability.

-

Net Profit Margins jumped to 10.6% in FY24, a significant improvement from 5.4% in FY20, driven by both top-line growth and cost management

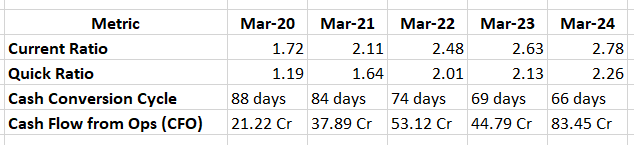

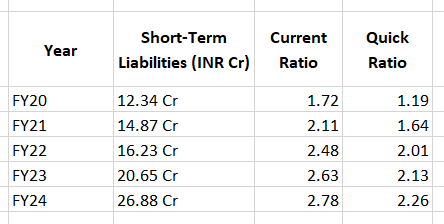

Liquidity Ratios

-

Current and Quick Ratios have improved over the years, indicating that the company has more than enough liquidity to meet its short-term obligations. A Current Ratio above 2.0 shows a strong liquidity position, while a Quick Ratio above 1.0 ensures that the company can cover its liabilities without relying on inventory sales.

-

Cash Conversion Cycle: The reduction in the cycle from 88 days in FY20 to 66 days in FY24 shows that the company is efficiently managing its receivables, inventory, and payables, resulting in improved liquidity.

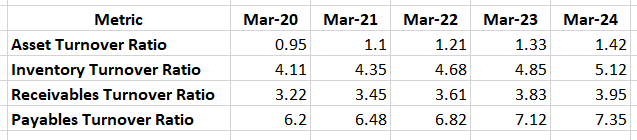

Efficiency Ratios

-

Asset Turnover: The Asset Turnover Ratio has improved from 0.95 in FY20 to 1.42 in FY24, reflecting better utilization of the company’s assets to generate revenue.

-

Inventory Management: The Inventory Turnover Ratio has steadily increased, indicating that Kothari Petrochemicals has improved its inventory management, with faster sales cycles and less inventory holding costs.

-

Receivables Turnover: An increasing Receivables Turnover Ratio indicates that the company is efficient at collecting receivables, contributing to improved cash flows.

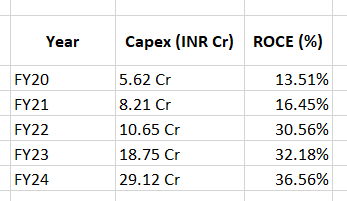

Return Ratios

- Return on Equity (ROE): The company’s ROE has jumped from 10.26% in FY20 to 33.98% in FY24, indicating a strong ability to generate profits from shareholders’ equity.

- Return on Capital Employed (ROCE): KPL’s ROCE of 36.56% in FY24 highlights the company’s efficient use of its capital to generate returns, a significant improvement from 13.51% in FY20.

- Return on Assets (ROA): The increase in ROA from 7.12% in FY20 to 19.73% in FY24 shows the company’s improved capability to generate earnings from its assets.

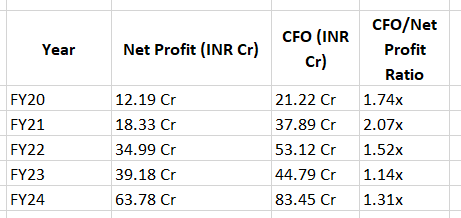

Cash Flow Analysis

- Operating Cash Flow has nearly quadrupled over five years, from INR 21.22 Cr in FY20 to INR 83.45 Cr in FY24, indicating stronger cash generation from core operations.

- Free Cash Flow (FCF): The company has managed to generate significant FCF despite higher capital expenditures, which positions it well for future expansion without liquidity constraints.

- Capex: Capex has increased as KPL expands its production capacity. The focus on organic growth through internal cash flows further strengthens its financial flexibility.

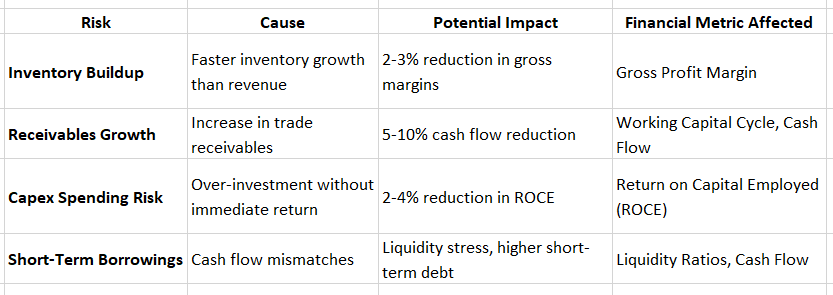

Red Flags & Anomalies

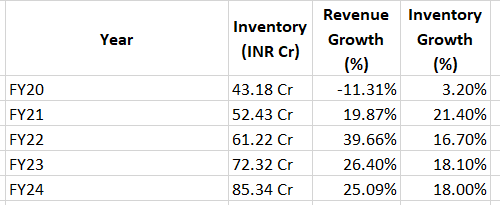

Inventory Buildup

Inventory Growth Rate: Over the last few years, KPL’s inventory has grown disproportionately compared to revenue growth. For instance, in FY23, inventory increased by 18%, whereas revenue grew by 25%. This disparity indicates that the company might be overstocking or facing issues with converting inventory into sales, which could be a sign of slowing demand or inefficiencies in inventory management.

- A higher-than-necessary inventory level could potentially lead to write-offs if the products become obsolete or unsellable, thus impacting future profitability.

Impact: If inventory growth outpaces revenue, excess inventory could lead to write-offs or discounted sales, reducing margins. Assuming an 18% inventory increase vs. 25% revenue growth, this could impact gross margins by 2-3% in the next fiscal year.

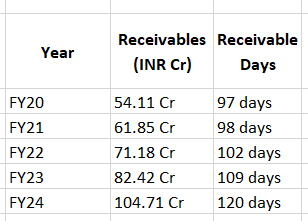

Receivables Management

Increase in Receivables: A significant increase in trade receivables has been observed in FY24, rising by 27%, faster than revenue growth. This suggests that the company is potentially offering more lenient credit terms to its customers, which could lead to cash flow issues if collection periods are extended or customers default.

- Analyzing receivable days shows that the collection period has been gradually increasing, a sign that working capital efficiency might be deteriorating. In FY24, receivable days stood at 120 days, up from 97 days in FY20.

Impact: Receivables increasing by 27% could lead to slower cash inflows, affecting liquidity. The rise in receivable days from 97 to 120 could extend the working capital cycle by up to 23 days, potentially reducing cash available for operations by 5-10%.

Capex Spending & Capital Allocation

- Rising Capex: Over the last two years, KPL has significantly ramped up its capital expenditure for capacity expansion. While this is expected to drive future growth, the rapid increase in capex could pose a risk if the expected returns on investment are not realized. In FY24, capex grew by 55%, from INR 18.75 Cr to 29.12 Cr.

- Return on Capital Employed (ROCE): Although ROCE has been increasing, the recent surge in capex without corresponding immediate returns raises questions about capital efficiency. If future demand fails to meet expectations, the return on investment may not justify the additional capital employed.

Impact: If the return on capex fails to materialize, the company’s ROCE could drop by 2-4% due to unproductive capital. With capex growing 55% YoY, a mismatch in revenue growth would result in over-investment, reducing future returns.

Short-Term Borrowings & Liquidity

- Short-Term Liabilities: Despite the company being largely debt-free on a long-term basis, there is a notable increase in short-term borrowings in FY23 and FY24, even though they remain minimal relative to total equity. This increase could indicate cash flow mismatches or working capital stress, despite overall profitability.

- Liquidity Coverage: The current ratio and quick ratio indicate strong liquidity, but the sudden uptick in short-term liabilities could suggest underlying cash management issues.

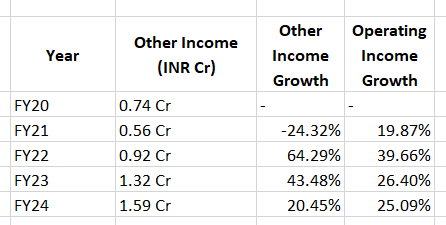

Other Income Growth vs Operating Income

- Over the past two fiscal years, there has been a disproportionate increase in other income compared to the core operating income. This could suggest that KPL is relying on non-core activities (such as interest, dividends, or one-off gains) to boost its bottom line

Cash Flow Statement: Inconsistencies

- The ratio of CFO to net profit has been declining, indicating that profits may not be fully converting to cash, a possible early warning sign of liquidity or operational inefficiencies.

In FY23, cash flow from operations (CFO) did not grow in line with the increase in net profit. While net profit grew by 62.77% in FY24, CFO grew by only 44%. This disparity could indicate issues with working capital management, particularly around receivables and inventory management, which are tying up cash.

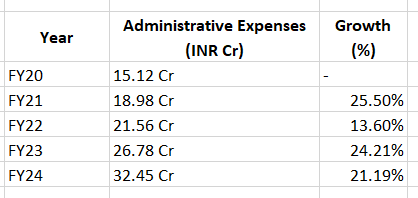

Rising Administrative Expenses

- Administrative Expenses have risen at a faster pace than revenue growth, particularly in FY23 and FY24. This raises questions about cost control measures and whether the company is scaling efficiently. If not addressed, these rising costs could erode profit margins in the future.

Risk Table

Future Revenue Projections

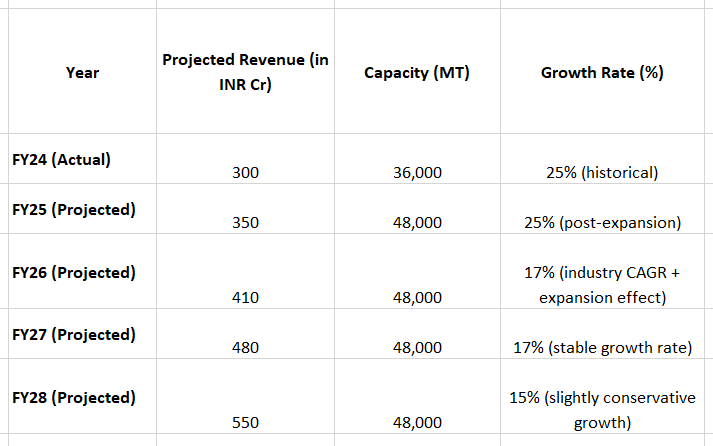

We will take into account the company’s historical growth rates, expected capacity expansion, and industry growth forecasts.

Key Assumptions for Revenue Projections:

- Historical Revenue Growth Rate: The company has been growing at an average rate of 25% over the past five years.

- Capacity Expansion: Kothari has expanded its Polyisobutylene (PIB) production capacity from 36,000 MT to 48,000 MT, an increase of 33%.

- Global PIB Market Growth: According to industry reports, the global PIB market is projected to grow at a CAGR of 5-6% from 2023 to 2030

- Domestic and Export Revenue Split: Kothari derives 26% of its revenue from exports and 74% from domestic sales.

FY24 Revenue: Based on recent financial reports and production data, Kothari’s revenue is estimated to be approximately INR 300 Cr.

FY25 Projections: With the full implementation of the increased capacity and continued strong demand for PIB, we estimate a revenue growth of 25%, which brings projected revenue to INR 350 Cr.

FY26-28 Projections: Post-expansion, we can expect a 17% CAGR, driven by both domestic demand and exports, along with a stable capacity. Growth could decelerate slightly in the later years as the expansion impact normalizes.

Revenue & Expenses

Past Earnings Growth

Debt to Equity History

Balance Sheet

CEO compensation

Earning & Revenue History

Ownership Breakdown

Top Shareholders

Price to Earnings Ration vs Industry

Fund Flow

Balance Sheet

Cash Flow

Quatery Result

Profti and Loss

Balance Sheet

Cash Flow

Ratios

Shareholding