AZITHROMYCIN API is produced by Kopran

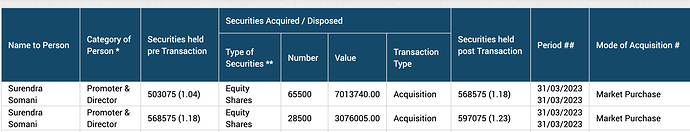

Some more of insider buying seen recently.

But not a significant amount.

If there if significant insider buying, then it will give some confidence to retail investors.

Till then tracking this one.

dr.vikas

That’s not buying. It’s transfer/inheritance of shares. I think she is wife of someone who passed away recently…Maybe Rajendra Somani who passed away in July last year?

Ohk. Thanks for clarifying.

Do they post any concall, tried searching in youtube couldn’t find any. Wanted to understand what is status of capex…

Unfortunately they don’t do concalls. Just occasional Investor presentations and yearly AR.

PLEASE do read credit reports for any extra information and the last resort is to write / call the company itself.

redgards,

dr.vikas

Do you know how much would they need to spend to get to the projected capacities?

To know the answers to the above, these are the options I guess

- Call the Investor Relations/company secretary and find the information.

- Go through the credit report by rating agencies and find the answers

- Last and best is to follow some industry experts on social media / do on-ground scuttlebutt if possible.

I was disappointed with Kopran as only in the Peak cycle they came up with the Investor Presentations and then nothing. Forget the con calls.

So in this scenario, the above options are only there to get the required information.

Regards,

dr.vikas

i have sent them email. lets see whether they respond or not.

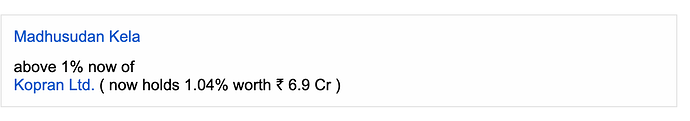

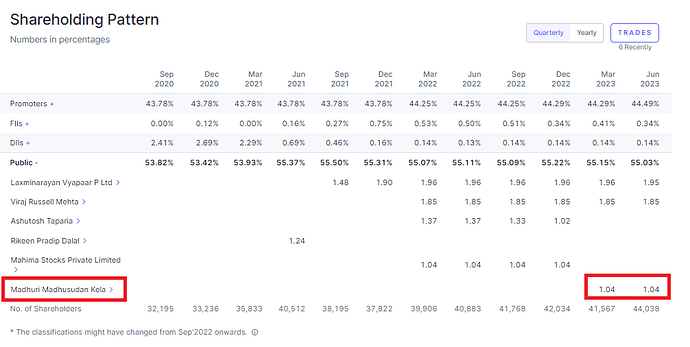

Sharing one interesting development.

The source is trendlyne.

Great to see Madhusudan Kela sir here.

Let’s see. How things pan out here.

I am not yet invested but may do after the results.

regards,

dr.vikas

@Pranshinv and Others - are you able get any more info on what can pan out for Kopran’s in FY24. What kind of number we can see? Its very unfortunate that management is not doing any concall or sharing any info on their growth plans.

Please try calling their Investor Relations and ask for all info you want to know.

The max that will happen is - they won’t give it. Then it’s better. One stock less to study!

Investor presentation-Kopran

KOPRAN -

Q4 and FY 24 results and concall highlights -

Q4 outcomes -

Revenues - 186 vs 158 cr, up 18 pc

EBITDA - 22 vs 12 cr, up 76 pc ( margins @ 12 vs 8 pc )

PAT - 19 vs 7 cr, up 168 pc

FY 24 outcomes -

Revenues - 615 vs 551 cr

EBITDA - 74 vs 52 cr ( margins @ 12 vs 9 pc )

PAT - 51 vs 27 cr

Total API sales @ 94 cr vs 76 cr YoY ( exports @ 50 pc )

Total formulations sales @ 89 cr vs 76 cr YoY ( all exports )

Company has a product basket of 26 commercialised APIs. Company is a major player in Carbapenems and is a leader in Atenolol. Other APIs made by the company include - Macrolides, Cephalosporins, Pregabalin. All API blocks are located at their plant @ MIDC Mahad, Maharashtra

Formulations plant located @ Khopoli, Maharashtra. It’s WHO compliant. Also approved by US FDA, EU GMP for non-sterile products

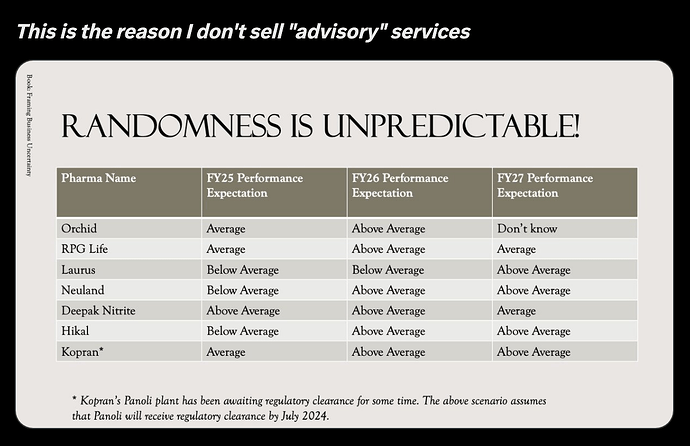

Company’s new API plant is ready @ Panoli

(Gujarat). Expected to start commercial production in Q3 FY 25

Company is guiding for 18 - 20 pc revenue growth without factoring in anything from the new Panoli plant. Also guiding for 100 cr EBITDA without the Panoli plant

Company’s gross margins stay in the band of 32-37 pc depending on competition from China, general demand scenario, RM prices etc

Company has submitted validation batches of Atenolol to the largest Atenolol ( anti-hypertensive ) - formulation player in US. Expect the commencement of commercial supplies in about 6 months from now. Also expect the commencement of supplies of Nitroxoline ( antibiotic ) into EU mkts wef June 24

Not looking at any major Capex for this FY. Next leg of Capex is expected at Panoli - ie addition of a new block, commencing sometime next FY. Capex for next 3-4 yrs shall only be brownfield - ie at existing facilities

Disc : hold a tracking position, looking out for margin expansion, biased, not SEBI registered