This is my first post on Valuepickr and i am new to investing world. I couldn’t find any topic related to KMC hospital so starting a new discussion please share your valuable thoughts and contra view will be appreciated.

Kauvery Hospital - erstwhile- KMC Specialty Hospital is located at Trichy.

KMC acquired Seahorse Hospital - a public limited company in the year 2008 & since then it has been functioning as KMC Speciality hospital - a 235 bed multispecialty facility.

It offers services in neurology, nephrology, obstetrics, gynecology, pediatrics, neonatology, cardiology, ENT, dental, orthopedics, joint replacement, liver transplant surgery, neurosurgery, plastic surgery, etc.

The hospital has 20 Doctors ,40 consultants and more than 600 nursing and supporting staff as per Dec 2021 Credit rating report. Which might have increased to a lot more.

It is a subsidiary of Kauvery group of hospitals which hold 75% stake in it.

The company is present in 5 locations with 7 hospitals and ~1500 beds.

The company has done >60’000 kidney dialysis and >10’000 heart surgeries until now and >2’000 Gastro, Neuro and Cancer procedures each along with Joint Replacements.

CAPEX:

The new maternal and child care hospital - it will incorporate the obstetrics and gynecology, and pediatrics and neonatology departments of the existing hospital.

It is almost complete and it will be operational from Jan/Feb 2024 as per inverstor relation personnel.

The new hospital was expected to commence operations in April 2023 but then it delayed to Oct 2023 and there was an increase from 150 beds to 190 beds with an increase in the total outlay from Rs. 85 Crs. to Rs. 141.80 Crs.

Now the operationalization of hospital is delayed to Feb 2024.

The project is being funded with Rs. 97.40 Crs. of the project loan as per Dec 2021 credit rating report.

As per latest AR – Term loan amount from SBI is 42.9 crore with payment of Principal quarterly and Interest monthly. Outstanding Instalment as on date March 31,2023 - 40 Quarters, with 9.45% interest rate.

Financials

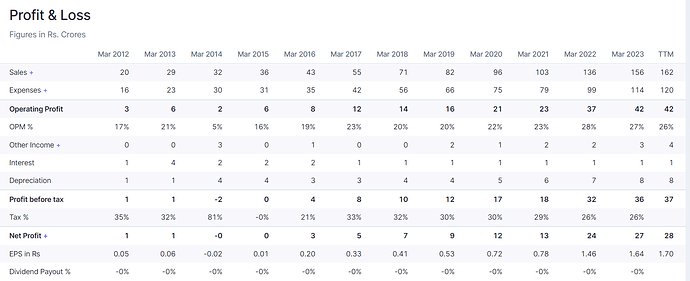

Yearly

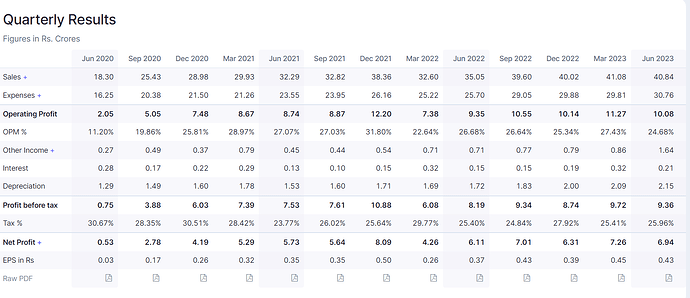

Quarterly

Stock Price: 85, P/E:50.2 Mcap: 1380 D/E: 0.39

Compounded Sales Growth

10 Years: 18%

5 Years: 17%

3 Years: 17%

TTM: 16%

Compounded Profit Growth

10 Years: 36%

5 Years: 32%

3 Years: 32%

TTM: 14%

Stock Price CAGR

10 Years: 48%

5 Years: 40%

3 Years: 61%

1 Year: 33%

Return on Equity

10 Years: 25%

5 Years: 27%

3 Years: 27%

Last Year: 27%

Investment Rationale:

Recession proof, Growing business and sustainable services for cash business.

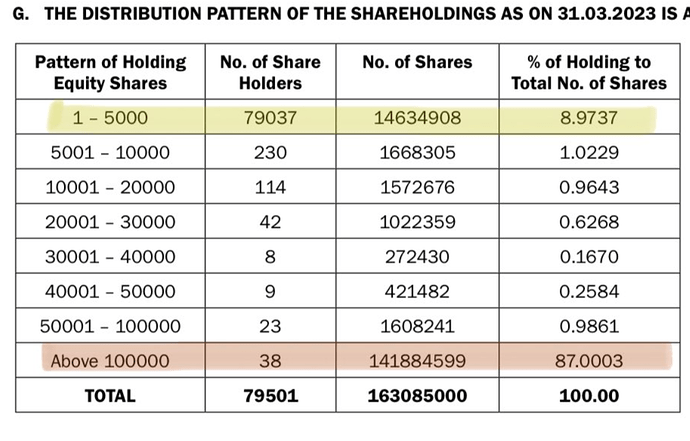

Promoter holding > 75% and Only 38 Shareholders have 87% of shareholding.

Part of a big group ( Kauvery ) - add to reputation.

Kauvery group also eyeing for ipo ( read somewhere not sure about source and how will it affect share price - senior members comments on this will be helpful)

Almost debt free : 39.87 Long term debt with 38.79 Cash Equivalents.

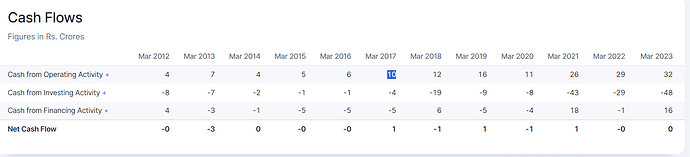

CFO increased from 10crores in 2017 to 32crores in 2023.

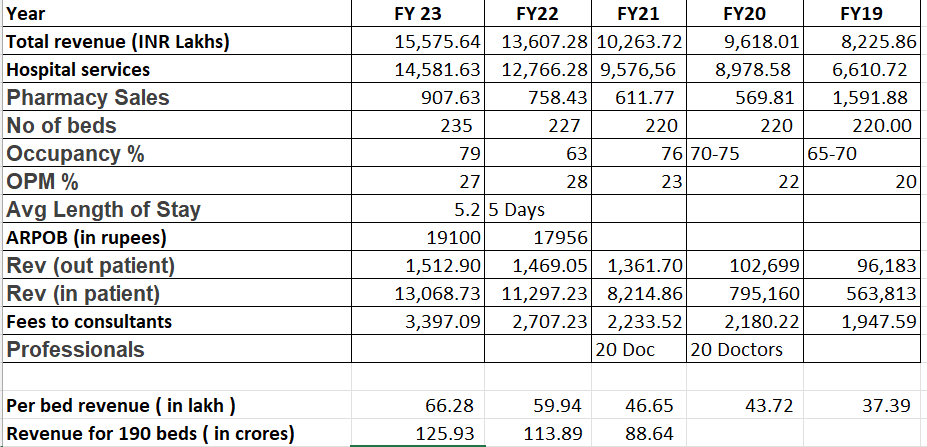

Occupancy %, increasing per year in FY 23 it was 79%.

ARPOB increasing from INR 17956 in FY22 to 19100 in FY23.

IMHO Maternity hospital will have more Average length of stay so revenue might be on higher side for 190 bed new hospital will add to bottom line.

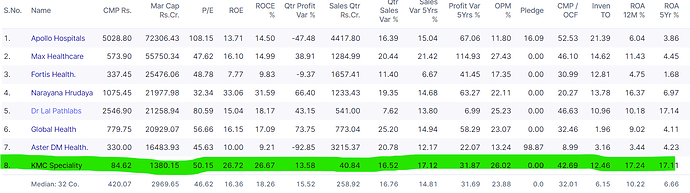

Best in industry ratios - only better ratios than kmcshil is of NH.

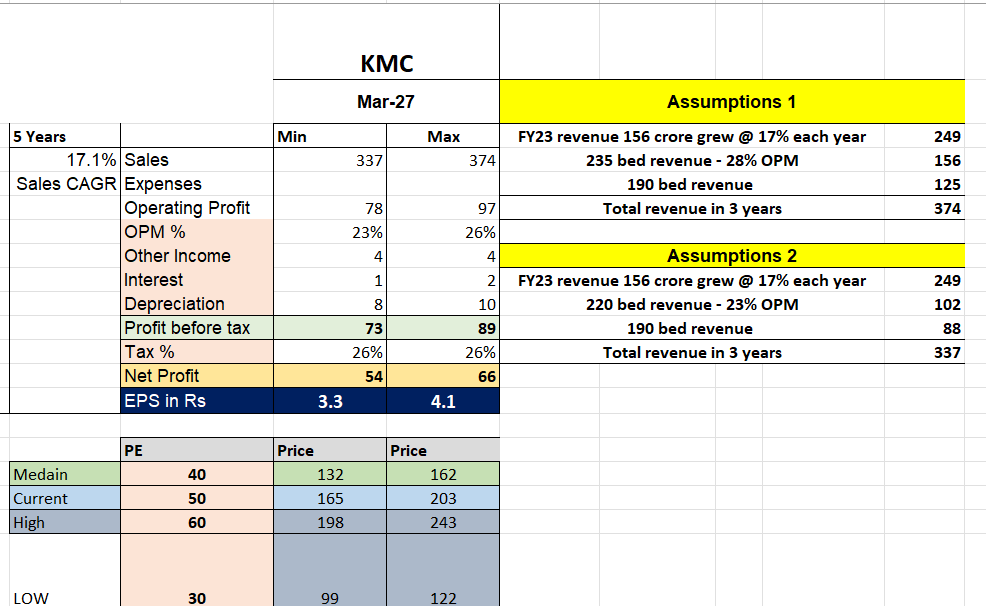

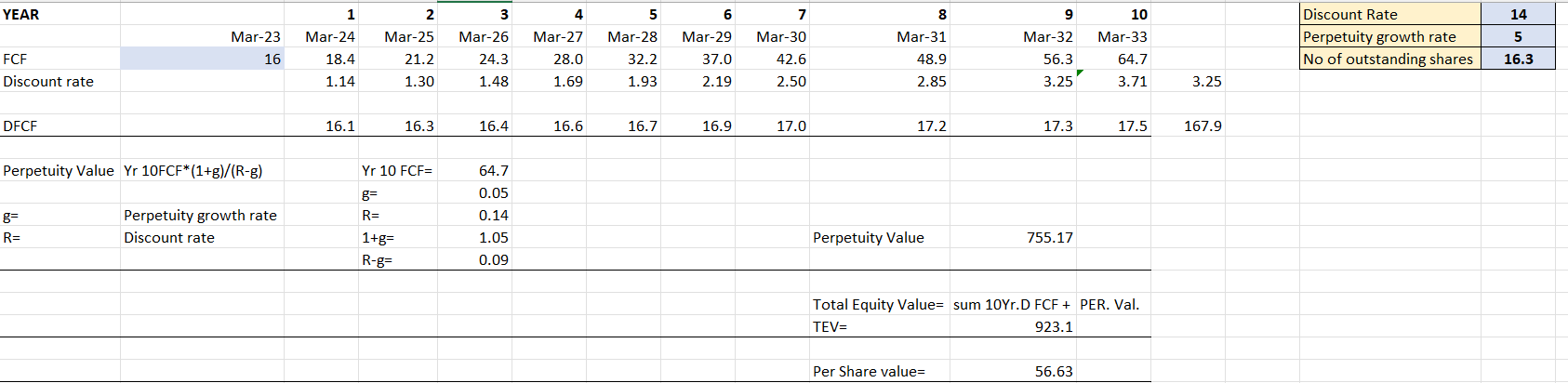

I also calculated target price after 3 year using previous data.

3 years CAGR from cmp of 85 at median PE(40) -

at 23OPM for 132 target - 15.9% , at 27% OPM for 162 target - 23.9% looks good to me.

This was my first time so i might be wrong.

Contra views are appreciated because i have position and i only see positives.

This not to be taken as an investment advice.

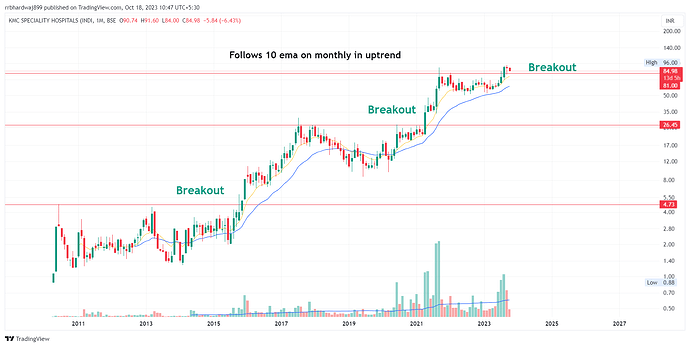

Technically

Monthly

Recently also break ATH in Monthly with volume.

-ve point is that next month candle red with high volume also.

if you look at stock history after breaking out in MTF never touched the breakout point again.

and breakout comes around 2-3month before or after capex i checked with Fixed assets in screener.

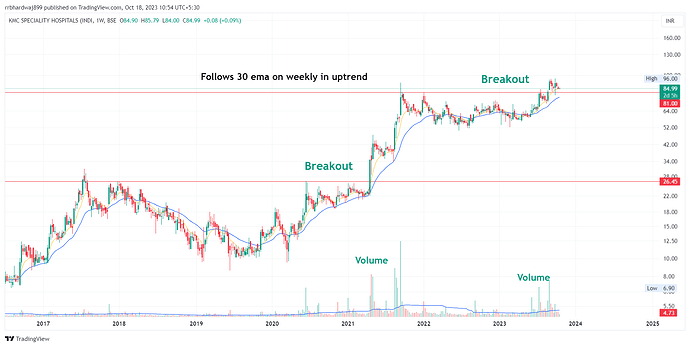

Weekly

Broke out of consolidation in weekly with high volume also.

Now retesting.

Follows 30 ema in weekly in uptrend.

same pattern observed in last breakout.

Negatives:

Capital intensive business.

Single hospital in Trichy only and upcoming hospital also in 300 meters vicinity.

High competition among other hospitals like Apollo and Maruti multispeciality.

Capex delayed 2 times already.

Disclaimer:

I already hold this one from lower price.

Not a Sebi registered and this one not a investment advice.

I just humbly want valuepickr community opinion because i couln’t find any negative about this one and not a lot of information available on internet about this.