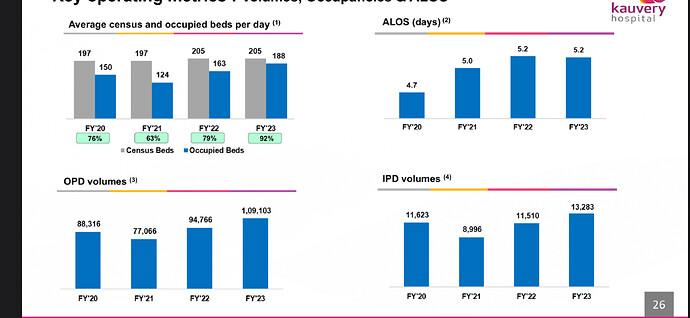

Results look great but I would be better to have more communication from management for example on the contribution from the new 200 bed maternity care unit. For now this is what we know from their investor presentation “Further, we are happy to announce the operationalization of its new facility of an additional 200 beds focused on providing Mother and Child Care services from January 29, 2024.”

This means we should have had 2 months of performance from this unit being included in FY2024 results.

Disc: Invested in 2024

Latest presentation out you can check data here

1 Like

Central bus stand going to move away from KMCSH. Chances are more on real estate price stagnation and drop in number of patients. I reduced my potion in KMCSH and increased in kovai medicals(at lower levels).

1 Like

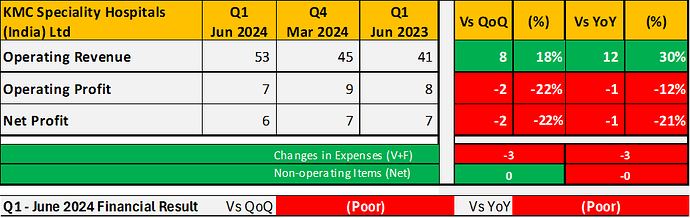

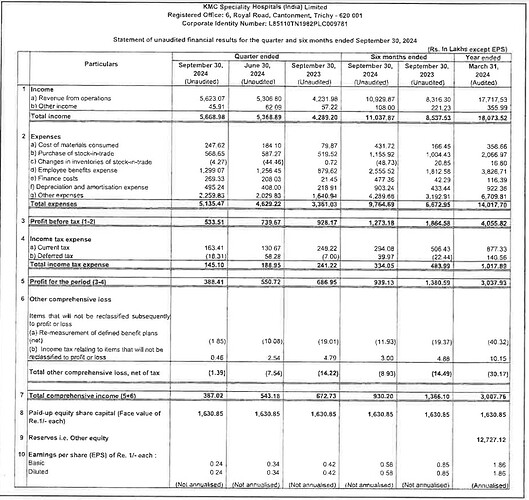

Poor result both QoQ and YoY

Source: x.com

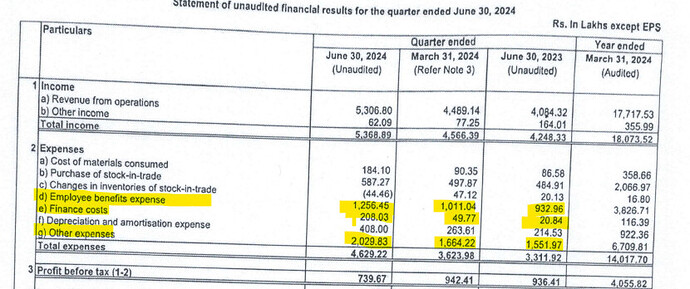

Any info on why the “other expenses” and “employee benefit expenses” have gone up so much?

Numbers seem to be quite bad.

New greenfield maternity hospital commissioned.

It’ll take some time to full revenue optimisation from this one.

Hospitals usually takes 1-2 years.

1 Like

That does make sense. But its a bit sad that management doesn’t put up any commentary on their new hospital’s progress.

Any idea why the other expenses are expanding at such a rate? Its gone up from 16 Cr last year quarter to 22 Cr. Seems quite strange.

My reading of KMC Speciality Hospitals

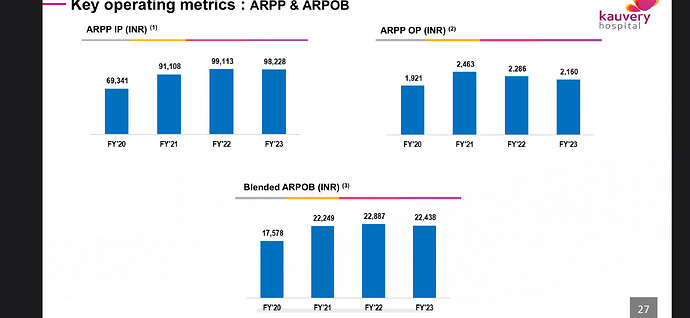

They have 2 facilities in Trichy: the original hospital and the new super-specialty pediatric facility. The revenue potential from the older facility seems to be capped, any revenue growth is likely to be tied to the pediatric hospital and expansion efforts, if any, within the listed entity.

Management’s focus, however, seems to be primarily on Sri Kauvery Medical Care (India) Limited, the non-listed entity. This entity already operates a network of 10+ hospitals with significant capacities and has plans to add 12-15 facilities. Most of the management attention is directed at the non-listed entity.

From a valuation standpoint, KMC Speciality Hospitals is fairly valued when looking at the EV/EBITDA ratio. In contrast Kovai Medical Centre & Hospital presents a stronger valuation by comparison. The major growth drivers for KMC Speciality Hospitals would likely be an increase in its hospital network within the listed entity or, as a less probable option, a reverse merger with the non-listed Sri Kauvery Medical Care. Given the actual ownership structure of the non-listed entity, which has significant political stakeholders, such a reverse merger seems unlikely.

1 Like