Corporate Governance Concerns at Kitex Overstated? Business Expansion and Capex Plans May Offer Safety?

My views at the time of Investments around 2022

In recent times, there has been growing chatter surrounding corporate governance issues at Kitex Garments. While these concerns have raised some eyebrows, my own research into the company tells a different story. Having invested in Kitex, I believe their robust growth

trajectory far outweighs the governance challenges that have been highlighted over the years. From my perspective, the company’s ambitious expansion plans, backed by significant capital expenditure (Capex), paint a far more optimistic picture, offering long-term potential and a margin of safety for investors. A study

The primary corporate governance concerns raised by people regarding Kitex Garments revolve around three key points:

-

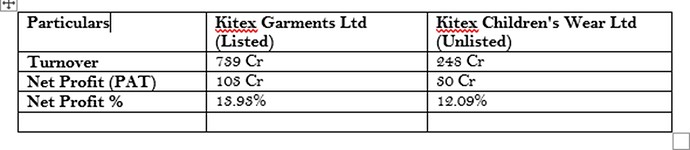

Kitex Garments Ltd (listed) and Kitex Childrenswear Ltd (unlisted) : Kitex Garments, the publicly listed entity, has a sister concern, Kitex Childrenswear Ltd, which is privately owned. Some critics argue that this relationship might raise questions about transparency and the fair allocation of resources between the two companies.

-

Sabu M. Jacob’s Political Involvement : Another issue frequently discussed is the involvement of Sabu M. Jacob, the Managing Director of Kitex, in launching a political party called

-

“Twenty20.” Some believe that his political ambitions could potentially distract from the company’s core business or create conflicts of interest.

-

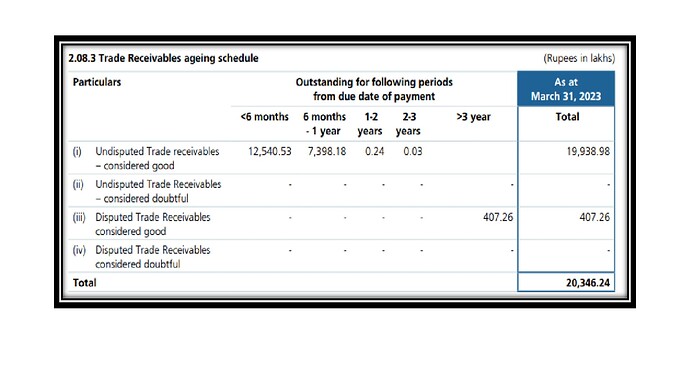

Concerns Over Trade Receivables : Lastly, there have been claims that Kitex might be

overstating its trade receivables or inflating its turnover. Skeptics argue that this could point to financial misrepresentation, raising doubts about the company’s true financial health.

Detailed views

- Kitex Garments Ltd (listed) and Kitex Childrenswear Ltd (unlisted) : Of course, I don’t know the reason behind company is maintaining 2 similar kind of entities.

I did analyze the financials of both for 2020 as part of my investment research.

Based on this analysis, I didn’t observe any significant discrepancies in profit margins between the listed and unlisted entities. With both companies showing similar profit percentages, is the****concern over this corporate structure truly warranted? The data suggests that both entities are operating efficiently, with no major profit booking anomalies between them.

- Sabu M. Jacob’s Political Involvement

Another point of concern for some is Sabu M. Jacob’s political involvement through his movement, “Twenty20.” In 2020, Kitex Garments spent ₹6.6 crore on CSR activities, while the company’s profit for the year was ₹103 crore. I am in a view this amount is not significant when compared to the profitability of the company.

From my personal experience, living near the company, I’ve witnessed Sabu’s commitment to public welfare initiatives over the years. One of the standout successes of his leadership in the Twenty20-led panchayat is the initiative to sell grocery items at highly discounted rates to the general public. It’s worth noting that this isn’t funded directly out of his pocket.

Instead, he sources the goods directly from suppliers and passes the savings on to the public by eliminating the margins typically earned by intermediaries. Additionally, the local body under his leadership has efficiently collected taxes and curtailed corruption, enabling the funding of various charitable works.

From my observation, I haven’t seen any evidence that his company is heavily funding this movement. Instead, Twenty20 appears to operate largely on its own, driven by Sabu’s leadership and efficient management practices rather than relying on significant financial support from Kitex.

An investor’s primary concern should be whether the owner’s interests are fully diverted from the business. In Sabu M. Jacob’s case, I believe that’s not happening. From his public speeches, it’s clear that he has no intention of running for political office. Instead, he aims to support the public through his Twenty20 movement, which has been largely focused on welfare, not politics.

Additionally, his involvement in Kitex’s business operations has significantly increased over the past four years, reflecting his deep focus on expanding the company. A few key examples stand out:

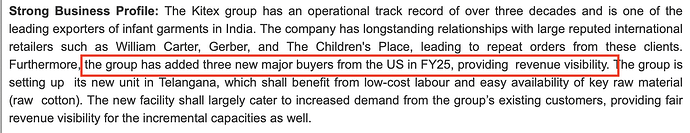

Business Expansion to Telangana : Sabu has strategically moved the company’s expansion plans from Kerala to Telangana, widely regarded as a business-friendly state. Kitex is scaling its production from 5 lakh to 20 lakh units of kidswear, transforming from the second-largest kidswear manufacturer to the largest in the world.

Government Subsidies and Incentives : The move to Telangana also brings considerable benefits, as the company has received several government subsidies. These include land subsidies, 75% interest subsidies on loans, concessions on state GST, and subsidies on water, ESI, and PF, which will significantly reduce costs and enhance profitability.

Given these moves, it’s evident that Sabu’s attention is firmly focused on Kitex’s growth. His leadership in both the business and public welfare realms suggests that investors should not be overly concerned about any distractions from his political movement. Instead, they should recognize his strategic vision and commitment to expanding the company.(My view).

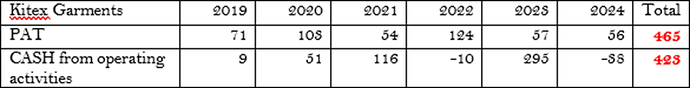

3. Concern over Company’s Trader Receivables -observed some concerns raised regarding Kitex inflating its profits by booking turnover through sales to its USA subsidiary. To investigate this, I analyzed their Profit After Tax (PAT) for the last seven years and compared it with their net cash flow from operations.

Based on the data, I don’t see any significant red flags suggesting profit manipulation, except for an investment in Kitex USA LLC, an associate company, amounting to ₹27 crore, which has impairment triggers but has not been written off in the books.

However, I don’t believe this sum poses a serious threat to the company’s existence or its ability to continue as a going concern. Additionally, a review of their trade receivables shows that they are within a reasonable range, further supporting the stability of their financial position.

Conclusion and Discliamer

I am an investor in this company and bought the shares in the ₹150-200 range, when the market cap was around ₹1,000 crore. My investment strategy was based on a value-plus-growth model.

At the time, I was convinced by the company’s decision to relocate from Kerala to Telangana

with plans for a 4x expansion, as well as Kitex Group’s successful track record over the last two decades. They’ve established several well-known brands like Sara Curry Powder, Scoobe Day, and Chakson Pressure Cookers, alongside their core garment business.

In my valuation, if the company can increase its total turnover to ₹4,000 crore with a 10% PAT margin (₹400 crore) and a target P/E ratio of 25, the expected market cap could exceed ₹10,000 crore.

Conclusion: I saw a significant business opportunity that far outweighed the few concerns raised.

Disclaimer: I was initially expecting a market cap of ₹5,000 crore, and it has now crossed ₹3,000 crore. And views expressed here are only for knowledge purpose.