Kaynes Tech response to the exchanges.pdf (235.0 KB)

| Issue Raised by Kotak | What It Means in Simple Words | What Management Explained | My Judicious Investor View (Plain Truth) | Risk Level |

|---|---|---|---|---|

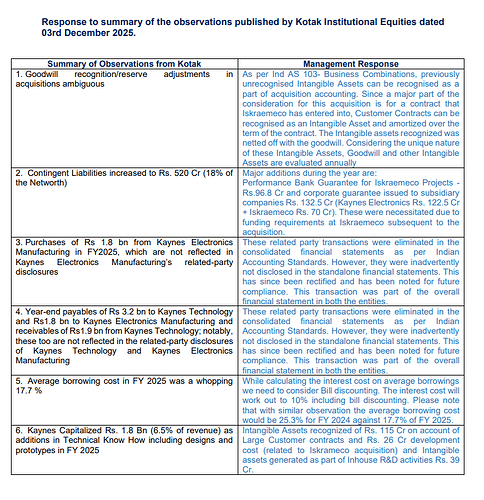

| 1. Goodwill & intangible asset accounting looks ambiguous | Kaynes changed how it recorded customer contracts after buying Iskraemeco. This affects reported profits. | They follow Indian accounting rules (Ind AS 103). Customer contracts were converted into “intangible assets” and written off slowly over time. These are reviewed yearly. | ||

| 2. Contingent liabilities jumped to ₹520 Cr (18% of net worth) | Kaynes has given large guarantees. If subsidiaries fail, Kaynes must pay. | Mostly bank guarantees and corporate guarantees needed to run Iskraemeco after acquisition. | ||

| 3. ₹180 Cr purchases from group company not disclosed properly | Kaynes bought goods from its own related entity but did not clearly disclose earlier. | These were removed at consolidated level but missed in standalone disclosure. Now corrected. | ||

| 4. ₹320 Cr payables + ₹190 Cr receivables between group companies not disclosed fully | Large money movement inside the group was not clearly visible to investors. | These were adjusted in consolidated numbers but missed in standalone disclosures earlier. Now rectified. | ||

| 5. Borrowing cost appeared very high at 17.7% | It looked like Kaynes was paying very expensive loan interest. | Actual effective cost is ~10% after bill discounting. The 17.7% was a computation mismatch. | ||

| 6. ₹180 Cr capitalized as technical know-how & prototypes | Instead of showing these as expenses (profit reducing), Kaynes treated them as assets (profit increasing). | Includes ₹115 Cr customer contracts, ₹26 Cr Iskraemeco development, ₹39 Cr in-house R&D assets. |

Auditors of Kaynes, KP Rao & Co will have a tough time explaining the related party disclosure errors. I don’t believe there is anything fundamentally wrong done by the company - this episode will likely act as an eye opener for the management/ audit committee to invest into good quality accounting professionals and appoint a high quality audit firm to ensure such mishaps are avoided in the future.

AJ

Disclosure: Recently added and may consider adding further during this decline. Consider my views as biased.

You have evaluated this as risk level - High. Fair point.

I understood from the management interaction that the corporate guarantees are provided to subsidiaries for them to participate in tenders or managing short term working capital loan. It’s not a structural debt but a controlled support to subsidiaries. For instance if you participate in any government tender you need to provide such corporate guarantees. It is a general practice opt by companies.

What do you make of it? Does it still look like a risk or general course of business.

Added recently, so my views are biased.

Yes, the company is bound to give corporate gurantee for their subsidiaries. Had the accounting error not crept into their filing, I would not mind these things. But the cockroaches are coming out. So this is a precautionery analysis in view of the recent issues that have crept into.

Kaynes Kotak.pdf (1.7 MB)

Kotak Flags Accounting and Cash Flow Red Flags at Kaynes”

Really impressed with this young guy. This is the first time I have seen one of his videos.

“Uncle Ben keh gaye Peter Parker se

Aisa kalyug aayega

Joh payment expense karna chahiye tha

Usko accountant capitalise kar dega”

“Because with great use of Ind AS 38

Comes great management judgement” - Uncle Ben to Peter Parker (probably)

Please find my unsolicited two cents on the recent “mishap”

1. Goodwill & Intangible Asset Accounting

Intangible Asset as per Ind AS 38 (Intangible Assets) is defined as an identifiable, non-monetary asset without any physical substance. (Emphasis on Identifiable)

An asset is identifiable if and only if it can be sold separately OR it arises from a legal or regulatory contract.

As explained correctly by the management of Kaynes Tech, Ind AS 103 (Business Combination) very expressly allows entities to recognize previously unrecognized intangible asset if they meet the definition criteria during the acquisition.

Since Iskraemeco entered into contracts with customers (legal contracts, check), such contracts come under the definition of identifiability and hence the treatment of treating those contracts as Intangible Assets by Kaynes is in accordance with Ind AS 103 and Ind AS 38.

Conclusion: The treatment is perfectly fine, no worries.

2. Contingent Liabilities

Honestly, this is just a figure that the investors should track per se. Giving guarantees is like ordinary course of business but yeah giving a performance guarantee for a subsidiary which you recently acquired really does raise some eyebrows.

3. Related Party Disclosures

Since the management themselves admitted on lapse of disclosures, I have nothing to comment on.

4. Borrowing Costs

Explanation looked reasonable to me.

5. Technical Know-How

Now this is what caught my eye. Let me explain why. Our old friend Ind AS 38 tells us to divide expenditure incurred for self development of Intangible Assets into two phases:

- Research Phase

- Development Phase

All expenditure incurred in the Research Phase are to be treated as an actual expense (P&L debit). They cannot be capitalised, period. No exceptions.

Now the standard also tells us to expense off expenditure incurred in the development phase until the management is sure that inter alia “technical feasibility” of the product has been established.

Once technical feasibility has been established, all expenditure incurred thereafter are to be capitalised.

So refer to the last bullet point of the explanation. Kaynes capitalised Rs. 65 crores (26+39) of expense related to development costs. This is entirely management judgement.

What I mean to say is that it’s manipulative. If I want to increase profits, I will say Hey Technical feasibility of inhouse R&D has been established, let’s not expense off costs anymore. So this is a grey area. Because whether technical feasibility has been established or not depends entirely on the management

It could be a textbook example of costs that should have been expensed off but were capitalised, thereby artificially increasing current year’s profits.

Disc: Not invested

Moneylife article on the same.

Attractive Valuation | But What’s the Smart Way to Play It? Aakash Jha

Why is Promotor reducing the stack every quarter? Once it was 63% today its 53%

The video relates to the EMS secctor. Posting it here because the Kaynes imbroglio has forced us to refocus on this sector. May be even rethink.

Disclaimer: Invested in Kaynes and Syrma.

Thanks for sharing. I think EMS/OSAT/PCB is the only sector right now that is predictable in terms of growth. Next 2-3 years are very crucial in terms of execution. If Kaynes and Syrma are able to execute well, we can see some some very good returns.

Disclaimer: Invested in Kaynes and Syrma.

Interesting Q3 shareholder pattern changes noted.

Retail holding percentage up by ~8.75% in Q3

In absolute numbers, ~1.47 lakh new retail shareholders joined Kaynes

Institutional selling (DII sharp exit, FII continued trimming) driven by transparency concerns, lock-in expiry, and stock weakness led to retail absorbing shares, boosting their % ownership and account numbers.

There is a recent credit rating announcement for Kaynes Technology India Limited (KAYNES) from India Ratings and Research (Ind-Ra, a Fitch group agency).

Rating Assigned/Affirmed: IND A- (long-term) with Stable outlook, plus IND A1 (short-term).

-

This applies to bank loan facilities totaling ₹7,700 million (~₹770 crore).

-

Breakdown: Affirmed on existing facilities of ₹6,250 million + new/additional limits of ₹1,450 million.

This is a positive/credit-affirming development — it confirms Kaynes has a solid credit profile for its size/growth stage in the EMS sector, backed by strong fundamentals and growth visibility