So do we have to send our questions/queries to the email id or do we send our details (Workplace/Org. name) and request our participation and ask the questions in the webinar itself?

@y21 You have to send your name, DP ID and Client ID. Of course, you can send your queries also. They have mentioned in the announcement made to stock exchange that this will be a detailed interaction. Hope they will come up with some guidance about future plans.

Okay okay.

Im gonna send a few questions/queries in the email and request for a spot in the webinar. Does anyone want to add any questions or something?

Ill be mainly asking what is their plan to use the enormous cash reserves that they have? (like a special dividend/buyback)

If not buyback/special dividend, they can easily use that cash to venture into something else other than Camphor or go further down into value chain and develop more camphor derivatives.

ill be adding a few more as i get the thought of them and will send them a mail by tomorrow/day after afternoon. Please let me know if anyone want to send a question through me or something like that.

Thanks!

Some of the questions in mind are:

-

Is the company already a producer of medicinal-quality camphor? Is it planning to do manufacturing of such a product? If so, what might be the markets and their size?

-

How much of the production is exported? To which countries? What might be the growth plans for this?

-

What are the plans to diversify into allied products such as maybe flavors and fragrances?

Will definitely add them to the list and update you on their response!

Stock split is planned to increase liquidity?

Yes i already mailed them this question.

I did not get a reply regarding the questions but they told me that they will send me a link to the webinar on monday 22nd.

Am not sure how Kanchi manage their Camphor prices when compared to market fluctuations.

Is this B2B or B2C customer oriented?

Do they have long term future contracts?

How much % of domestic share and % export share?

What is the current capacity utilization? - does that include new plant?

Disc : I hardly understand Camphor business however am planning to invest due to capex being done.

However the fact that there needs to be strong customer base for cycle to turn

Highlights of investor webinar held today. Other listened members may also add their points.

1.Expansion is completed. Commercial production started. Kanchi market share currently is 30%. Target to increase to 40%.

2.Revenue growth targeted is 20% for F.Y 2021-22 (I am not sure why management is so conservative when capacity is increased by 5 times from 100 mtpa to 500 mtpa)

3.Reason for higher OP margin in Q2 FY20-21 and Q3 FY20-21 is low holding cost of RM. However management has clearly mentioned that going forward, margins will come down due to higher RM prices and if imports scale up higher.

4.Plan to export more products to more countries.

5.Company planning to enter into IP grade camphor

6.SWOT analysis is underway for Flavour and Fragrance industry.

7.Cash reserves of 50+Cr will be utilised for land purchase for entering into chemical business.

8.New board members will be inducted, if required

9.Management not interested in B2C business.

10.As mentioned in last webinar, company sells only bulk camphor not branded camphor.

11.Issue of bonus shares/splitting of shares will be considered in due course.

12.Listing of shares in NSE will also be considered in due course.

13.Competition is tough now due to more new entrants in camphor market.

@reacharjunr thanks for posting, I did not attend the webinar, if you could clarify some points,

-

“Kanchi market share currently is 30%.” - I don’t get this… If Kanchi with 100mtpa has 30% market share, is the entire market 333mtpa?

-

“land purchase for entering into chemical business” - chemical business here means into the flavour and fragrance industry?

-

“Management not interested in B2C business” - Did they give any reasons for that?

@HarendraSingh22 I am trying to recollect the points from the webinar to answer your queries.

- Mr. Suresh Shah plainly said Kanchi’s share in camphor market is 30% and the plan is to increase it to 40% without giving much details. Without knowing the complete players in camphor market, I think it will be too early to say that entire market is 333mtpa. This is my view.

2.Yes, chemical business mentioned is flavour and fragrance industry.

- Reason is because of low margins and they don’t want to disturb their B2B customers.

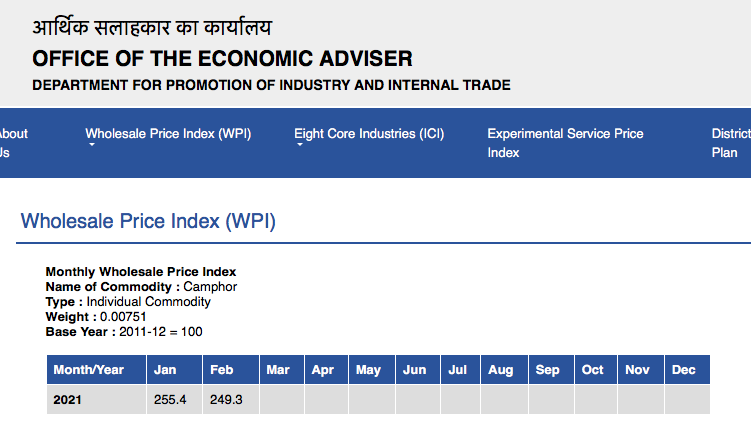

While there has been a price correction, it is only marginal ( approx 3 %)

Having said that, in the thread for mangalam organics, there was a long discussion on the correlation of camphor prices and it’s inverse relation with crude prices ( i.e High crude prices lead to more camphor supply ( in form of crude derivatives ) thus leading to camphor price correction.

Is my understanding correct or there is perhaps more than meets the eye?

[Disc] Invested in Mangalam organics but tracking Kanchi as well.

Regards,

Abhijit.

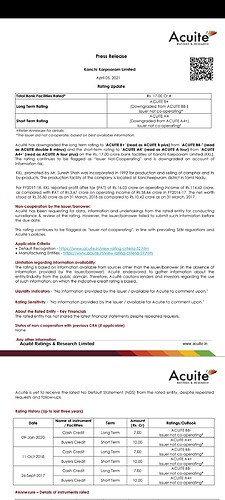

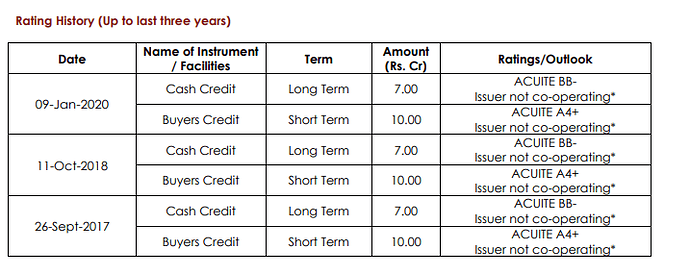

Another ratings downgrade report of Acuite Ratings and Research due to “Issuer not-cooperating”. I guess the company management should let the investors know the reason behind non-cooperation. It will remove the corporate governance risk which is present in minds of many.

Agree completely. This is red flag. Also several credit rating agencies has pointed out issuer not cooperating. Acute has repeatedly pointed out from 2017 as issuer not cooperating. This is not acceptable. Inspite of having good margins on their products, for long term interest of shareholders, management should clearly clarify this. Request all VP forum members in this group to write mail to CS of Kanchi in this regard.

Dr Vijay Malik has done analysis on this company.

The major takeaway, I took away was

- constant changing of credit rating agency.

- high cost of loan from promoters/directors.

- other related party transaction, which is concerning.

- Kanchi Karpooram has presented certain transactions in a manner, which do not seem to conform to prevalent accounting norms.

Thanks for sharing this. Seems like Mr.Market is aware of this and has discounted it. Q4 results is next trigger. Management has reiterated in the previous con calls that margins will fall due to fluctuation in RM prices. Need to closely watch this.