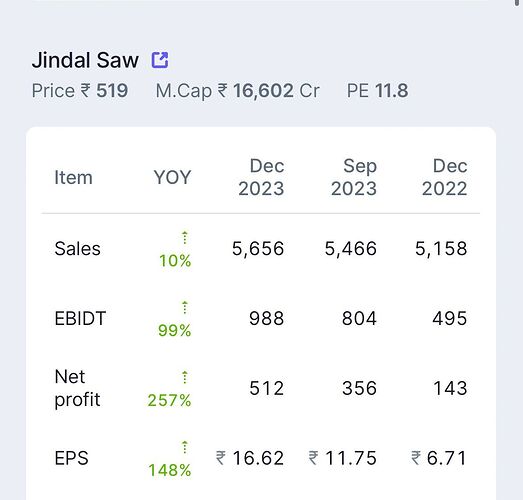

Jindal Saw, the flagship company of the PR Jindal group, major products are longitudinal submerged arc welded (LSAW) pipes, helical SAW (HSAW) pipes, ductile iron (DI) pipes and seamless pipes and pellets.

The Company’s revenue is well balanced among various products with no single product contributing more than 30 per cent of its revenue. Most of the products contribute between 10 per cent to 30 per cent of the total revenue, thus providing diversification to the cash flows and hedge against market volatility related to any single product.

Jindal Saw has a strong presence in the overseas market, with export contributing around 25 per cent to its top line. A larger portion of the exports are to Latin American countries and MENA region. Almost half of the Company’s revenues come from water supply and sanitation (WSS), which is growing rapidly in India and globally.

The Company’s exposure to the oil and gas sector accounts for only one third of the total revenue. Due to its diversified portfolio, the Company has been able to protect itself from the volatilities in one or more strategic business units. Jindal Saw’s client portfolio includes the government and the private sector, with a strong domestic and international presence across brands.

Analysts believe that the company shall be able to report healthy operating performance on the back of its relatively de-risked business model with the benefits of diversification in terms of both product segments and manufacturing locations, and competitive cost structure with captive availability of iron ore for its pellet plant. Furthermore, favourable industry tailwinds on the back of government’s push towards investment in water sector and renewed focus on investments in global oil and gas sector shall benefit the company in the medium term.

Credits - Business standard