Jindal saw leads nifty metal index in the past 1 year.

Hello Everyone,

Warm Greetings,

I’m new here, actively reading the forum for a month now.

I have been tracking JINDALSAW for more than a month now, I prefer investing based on earnings numbers but as of my previous experiences, JINDALSAW is consolidating since publishing quite stronger earnings this time, I am somewhat assuming that the price was already corrected for upcoming numbers.

I cannot figure out where my considerations are going wrong, It would be great to hear on this from someone closely tracking stock itself or the industry will work as well.

Thank you.

Hi all,

Wanted to ask a basic question.Isnt this stock a value trap now?As far as my understanding goes peak earnings-peak profitability- and low PE is time to get out of the stock in cyclical business. Or is this a structural story? Would like comments from experts.

Hi,

No expert here but I do not completely agree with what you said, as you’re comparing the existing tailwinds to be the same as the previous ones, India has never been in the place it is today. The amount of capital/infra goods being consumed is at an all-time high and is expected to only grow with the economy due to how stranded we are when it comes to infra compared to other countries…so judging a steel stock only based on the traditional steel cycle metrics won’t work. Think out of the books…

Jan-2024

He is also part of the ruling party now, leaving the opposition right before the elections creating a favourable leadership of like-minded people.

Thanks a lot @Mohit_baid . Wanted to know that this is a structural story which it seems so. Was trying to find good low PE stocks and found Jindal Saw in screener. Should be a good starting point to dig deeper. Regards

With commodity stocks one needs to be be careful about their peak earning and margin performances as during that time valuations look attractive due to low p/e but that’s often followed by steep correction as commodity cycle reverses.

A good way to evaluate commodity stocks is to look at their historical price trend, valuations and margins. Generally such stocks have a continuous cycle of rerating and derating. If you time them right, you will make loads of money from rerating and expanding earnings and if you get caught on the reversal, derating and shrinking margins will require a long wait for recovery.

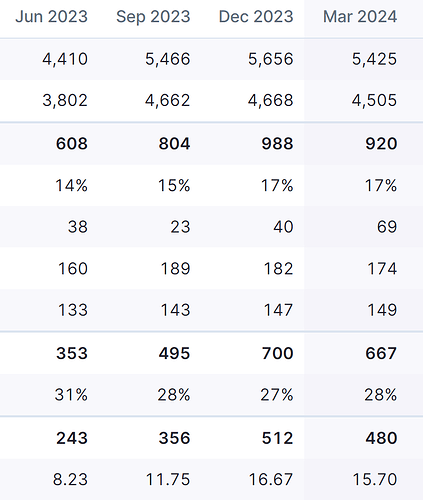

Jindal Saw seems to be nearing its peak earning (highest ever in its history) and margin (also highest ever) levels. P/E is also around it’s historical average. Stock has already given 6x move in last 1.5 years and still cheap because of last few tremendous quarters where earning growth has kept pace with price moves.

That said Jindal Saw is a good company and sector is enjoying a structural tailwind, which makes it interesting to see how much more juice is left in the stock. But I believe risk reward at this stage doesn’t look very favorable. After the last quarter which was fantastic, market didn’t celebrate and stock has settled around 450 level after touching 520.

No matter how good economic and market cycles appear, what goes up needs to come down (and vice-versa). Reversion to mean eventually catches up with every single sector and stock.

Disc- Invested from 110 level in 2021 and incrementally booking profits around 450 levels.

Hii,

Sorry to differ from you.

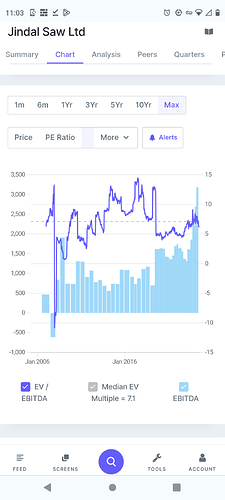

The more better Metrics to check for a cyclical sector such as steel sector, cement sector or telecommunication sector is EV/EBIDTA as they carry high debt in balance sheet and have high gestation period.I think Jindal saw story has just began as it is still trading below median EV multiple.Generally, It peaks up around 12-13.

Disclaimer:- Started Tracking,Not invested

I don’t think you are differing with me. EV/EBITDA multiple (just like P/E) currently looks low due to outstanding EBITDA performance company has delivered in the recent quarters.

If I’m not mistaken in the last quarter concall, management has guided for slightly lower EBITDA from current 18.2% as they said it’s not sustainable. .

So if EBITDA margins have peaked and start yielding you will have to look at valuation picture again as to how they are placed against historical median. From a quick back of envelope calculation, a 2% moderation in EBITDA margins will inflate EV/EBITDA multiple by 10%.

Point I was trying to make was that commodity stocks go through cycles of mean reversion (from top or bottom) and timing can be a critical factor. These are not your typical consistent compounders where you can hope to make decent returns from any point you enter.

Promoters said margin will settle down but won’t go below 15. Looking at the next 3 quarters they are going to beat the QoQ performance hands down with increased revenue and better margins. So PE will keep going down further. Plenty of juice left here if my thinking is correct.

Basically Jindal Saw is manufacturing steel pipes. So isn’t it fair to compare it with likes of JTL industries and Jai Balaji? Both of them trade at much higher valuation then Jindal Saw. What could be the reason?

you have to compare with Surya Roshni/ APL Apollo. REason for lower valuation is Debt of 4K+ cr . and Second is that this high sales and pat number is due to a one time 34% growth. If u remove that then the PE will rise to 20.

What one-time 34% growth are you talking about? Debt to Equity is still around 0.50 while Apl Apollo and Jai Balaji have a Debt to equity of around 0.30. Byways APL Apollo isn’t a fair comparison as it is in a league of its own manufacturing premium products mostly meant for end consumers, not businesses.

Jindal saw currently trades at a PE of 10 while Jai Balaji or JTL trade at 2x 3x of that. This huge gap isn’t sustainable either they come down or this goes up. I think a PE of around 15 is fair for a company like Jindal saw. Why not the same as the other two? Because it lacks the spiciness that the market likes, it’s just a healthy old-school business.

P/B

Jindal saw - 1.77

JTL - 4.70

Jai Balaji - 9.88

APL apollo - 13.1

We need to differentiate between valuations linked to earnings and P/E premium given by the market due to external factors. I think now that the latter has disappeared we’ll have to see how much valuations can be sustained by earnings which I feel will now moderate due to increasing competition (acknowledged by management in the last concall) and uncertainty over demand trajectory (both overseas and domestic).

I still maintain my previous position that all future prospects are priced in already into the counter and earning growth has peaked (which explains low p/e).

That said stock may still give decent return but I’m not comfortable with risk and reward.

Q1 FY2025 Concall Highlights:

Opening Remarks:

Revenue Growth 12% YoY.

PAT Growth 67% YoY.

Company continue to add value.

This year may be best ever. Will be 3 years in row.

EBIDTA to sales also moving up.

Debt is increased to lock in raw material prices, which are favorable.

11lac crores for infrastructure by govt. is music for us.

#Jindal Hunting Energy Services Limited:

In First quarter it self, capacity utilization is 85%. Profitable in Q1 it self.

Joint Venture may have some announcement, because order book is full for rest of the year and all boxes are ticked.

Oil Country Tubular Goods (OCTG) company wants to make India Atma Nirbhar.

# Sathavahana Ispat Limited:

Profitable. De-bottlenecking will increase capacity by 10 to 20% at least.

Creating special niche for small diameter which have high demand and high value.

Orderbook:

Oil & Gas is 30 to 35%. Water is 70%. Others is 5%.

UAE is only water facility, DI facility. Supply not only to middle east, all over world in 33 countries.

1.6 billion Dollars. 16 lac tons.

Saw pipe demand not squished. More then 5 lac Ton order for large diameter pipe.

Govt. of India come up with balance scheme, where state has to bring contribution. That makes projects are on track.

Export:

Export is 70%, which is sweet spot. Water pipes mostly in middle east. Oil and Gas is all over world.

CAPEX:

No plans yet. Conserving money.

Conclusion:

Many questions were not answered due to confidentiality and coemption etc.

Value addition projects are going on.

Valuations are lucrative at 12 PE.

As per management, FY2025 will be again best ever.

Financial Highlights:

D: Invested

Water should remain the highlight both in India and UAE.

Stock split in consideration.