Hi guys

Will talk about concall, outlook and little bit of number crunching which I have tried

Concall Hilights

-

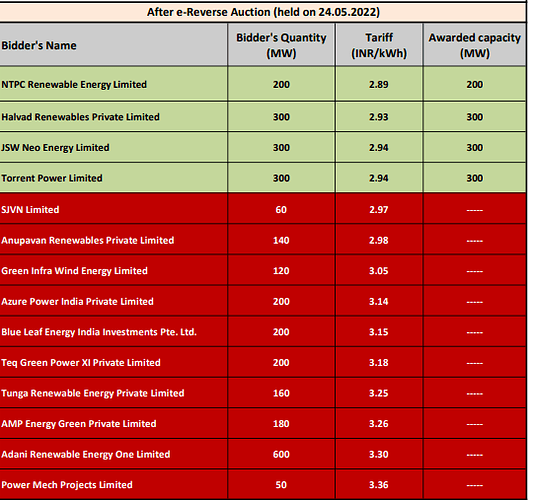

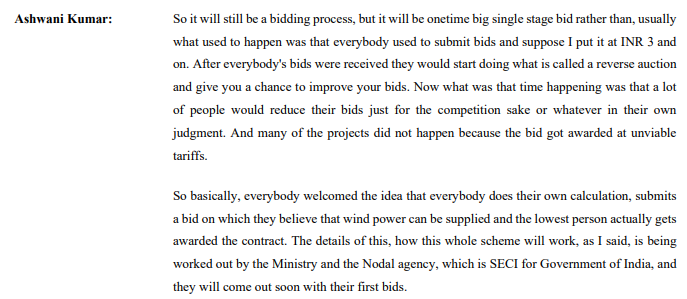

Going forward they will take order with good margins and will not want to build TOP line on the cost of bottom line. This option is available to them because of removing the Ereverse auction.

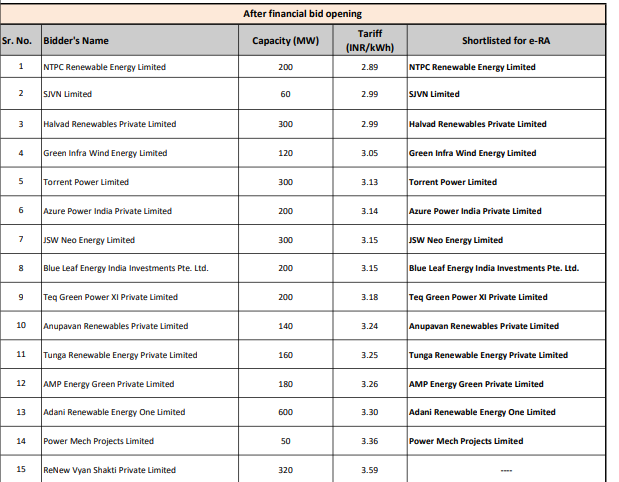

This is how bid is placed and after Ereverse it looks like this

Management Explanation

-

They have a positive book value of around 340cr this is almost of 600cr ++ jump than previous quarter (Don’t know how).

-

There is almost 3GW of back log from last year.

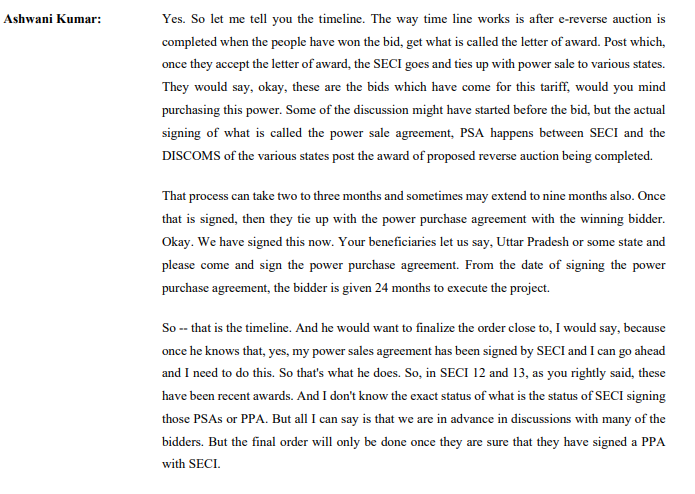

**WHY IS BACK LOG CREATED AND ENTIRE PROCESS

In short after signing PSA there is only 24months left to complete the project so developers don’t sign them until there is land availability or grid connection or if the price is not good.

- Last year on total installed capacity they had a market share of 42% (Big positive) current is 33%

OUTLOOK

-

8GW of order per year from central government is big positive. Management is saying that in next 3 to 6weeks there should be some update from here.

-

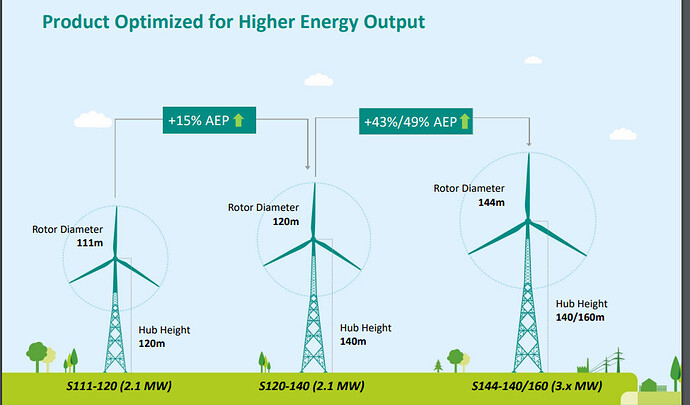

They have installed their first S144 this helps in reducing the LCOE

-

Their OEM business I am expecting to be flat or low single digit growth because after installation they provide 2years free warranty and only after this it comes to their OEM portfolio. Since the installation was low in FY21 I am not expecting lot of organic growth here.

-

The entire game is volumes here. If 8GW bids happen every year suzlon can get 2.5GW out of this then we have state bids and C&I also. In short demand is very strong we will have to see how much of this gets executed.

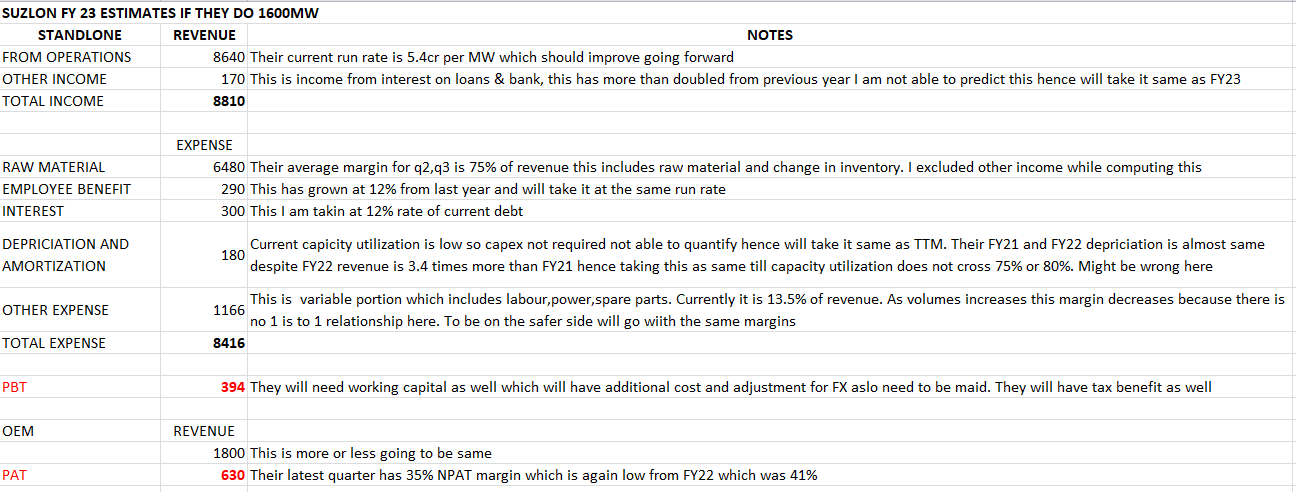

I have tried to calculate profit incase suzlon does 1.6GW next year. In my view there is a possibility of 0.80 to 1 rupee of EPS at those volumes.

Thankyou